概括

[WhichoneofHillhouseCapitalandTigerFundspeculatesinChina’sconceptstocksmorepowerfully?】TigerandHillhousehavebecomethetwomostpopularPEcompaniesRegardingthespeculationofChinesestocksTigerandHillhousehavemanysimilaroperations:forexampleShigekuraJDcomPinduoduoandAliincreasedtheirpositionsonJDcomandPinduoduoaftertheoutbreakandsuccessivelyreducedtheirholdingsofnewenergyautostocksinthefourthquarterHoweveraftercarefulanalysisthetwostylesareobviouslydifferentForexampleHillhousepreferstodobandoperationswhileTigertendstoholditforalongtime;HillhousecoversawiderrangeandTiger’sholdingsareconcentratedintheelectronicsthatheisfamiliarwithBusinesseducationstreamingmediaandotherfields

Tiger and Hillhouse have become the two PEs that are most likely to speculate on China’s stocks.

Tiger GlobalfundEarned more than 10 billion U.S. dollars in 2020,Jingdong、PinduoduoThe two stocks have earned Tiger 4.2 billion; Hillhouse Capital’s position in US stocks has reached 12.6 billion US dollars by the end of 2020, and China Concept Stocks has brought about US$4.5 billion in gains to Hillhouse last year.

Regarding the speculation of Chinese stocks, Tiger and Hillhouse have many similar operations: for example, heavy warehouses.Jingdong、PinduoduoAnd Ali, increase positions after the outbreakJingdong、Pinduoduo, In the fourth quarter successively reduced holdings of new energy auto stocks, etc.; but careful analysis shows that the styles of the two are obviously different. For example, Hillhouse prefers to do band operations, but Tiger prefers long-term holding; Hillhouse covers more Wide, Tiger’s holdings are concentrated in the e-commerce, education, streaming media and other fields that he is familiar with…

Let me emphasize that the purpose of this article is to summarize the characteristics of Hillhouse and Tiger stocks, not to define the entire investment strategy of the two PEs. Hillhouse’s asset management scale is nearly US$80 billion, and the US stock position accounts for only 1/7 of the asset portfolio. Although Tiger has greatly increased the proportion of US stocks in the asset portfolio in 2020, it entered the private equity stage and held it for a long time after the company went public. Yes, it is the secret of the Tiger Global Fund’s prosperity since its establishment 17 years ago.

Hillhouse, Tiger, who is the most likely to speculate in China’s stocks of PE

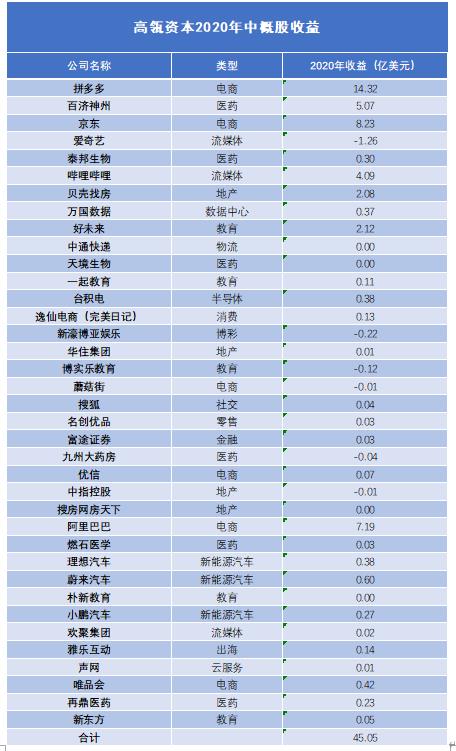

First, let’s review the earnings of Hillhouse and Tiger in China’s stocks in 2020.

Let’s look at Hillhouse first, as shown in the table above,Hillhouse Capital successively held 37 Chinese concept stocks in 2020, with a total annual income of approximately US$4.5 billion.

In Hillhouse’s portfolio, the top five stocks with the highest returns are Pinduoduo, JD.com,Alibaba,BeiGenewithBilibili, The annual revenue was 1.432 billion U.S. dollars, 823 million U.S. dollars, 719 million U.S. dollars, 507 million U.S. dollars and 409 million U.S. dollars.

Look at the tiger again, as shown in the table above,In 2020, Tiger successively held 25 Chinese concept stocks, with a total annual income of US$4.8 billion, accounting for 46% of the total income of the Tiger Global Fund in 2020 (approximately US$10.4 billion).

In Tiger’s portfolio of Chinese concept stock positions, JD.com, Pinduoduo,AlibabaThe highest earnings, the total earnings of the three stocks combined is as high as 4.71 billion US dollars, accounting for 99% of all China’s concept stock earnings in 2020.

At first glance, whether it is income or position, Hillhouse and Tiger have many similarities, but analyzing the investment behavior behind the two, it can be found that Hillhouse and Tiger have obvious differences in the speculation of Chinese stocks.

The first is the difference in stock selection

Tiger’s choice of China’s concept stocks is basically a continuation of its PE sector investment strategy. As shown in the figure above, as of the fourth quarter of 2020, Tiger’s concept stock positions accounted for about 25% of its U.S. stock positions. The three Chinese e-commerce giants Jingdong, Pinduoduo,AlibabaHas a position of more than 1 billion U.S. dollars, of which JD.com’s stock position is as high as 4.5 billion U.S. dollars, which is the highest stock held by Tiger Fund, accounting for 11.6% of all Tiger’s U.S. stock positions.

In addition to e-commerce, the areas where tigers invest the most are education (6) and streaming media (5). In addition, tigers in industries such as data centers and new energy vehicles, which are more popular in 2020, will also participate.

In contrast, Hillhouse has a wider range of research. As of Q4 2020, Hillhouse’s concept stock positions totaled US$7.13 billion, accounting for about 57% of Hillhouse’s total US stock positions, of which Pinduoduo,BeiGene, JD.com’s three stocks hold more than US$1 billion.

From the perspective of industry classification, e-commerce is also Hillhouse’s favorite industry. In addition to the three giants of JD, Alibaba, and Pinduoduo, Hillhouse also holdsmushroom Street、Vipshop(Cleared),UxinIsometric e-commerce. In addition, medicine is also a key industry for Hillhouse. In 2020, Hillhouse has successively invested in 6 Chinese concept stock pharmaceutical companies. In addition to Chinese concept stocks, Hillhouse also invested in nearly 30 European and American medical and health companies in 2020.

In addition to the focused e-commerce, medical, and education industries, there are also many other popular Chinese concept stocks. From station B,Futu Securities、Universal Data、MINISO、SoundnetToshellLooking for a room,HuazhuGroup and the three new automakers, the most popular China concept stocks in 2020, except for the end of the yearBaiduNothing else was missed.

Another performance of Hillhouse’s strong stock selection ability is its ability to avoid pits. In 2020, the two largest stocks of concept stocks are Ruixing and Eggshell. These two stocks were also popular Chinese concept stocks before, but Hillhouse is perfect. Avoid.Except becauseIQIYIThe position lost about 100 million U.S. dollars, Hillhouse’s speculation in China’s stocks in 2020 almost did not lose much money.

The second point is the difference in buying strategy.

Tiger rarely buys China’s concept stocks in the secondary market, and most of its positions are investments completed during the private placement stage. The only exception is e-commerce. In 2020, Tiger will only buy shares of JD.com, Ali and Pinduoduo in the secondary market. The e-commerce industry is also the area that Tiger is most familiar with. Whether it is investing in Dangdang Excellence in the early years or investing in JD to become famous, China’s e-commerce can be said to be the dragon’s door to the top PE.

Hillhouse also obtained top-level PE tickets through JD.com’s case, but speculation in Chinese stocks is not limited to e-commerce. Hillhouse has bought at least 14 Chinese concept stocks in the secondary market in 2020. Perfect Diary,Universal Data、Futu Securities、Wei LaiAutomobiles, these popular Chinese concept stocks in 2020, have all bought in the secondary market, and have also participated as cornerstone investors.Ideal carwithshellHouse hunter”Make a new”。

Another thing worth mentioning is the investment in station B. The stock price of station B has taken off after the New Year’s Eve party in 2019. Hillhouse is not an early investor in station B. It will not start to increase its holdings of station B until Q4 of 2020. Public information There is no news about the introduction of Hillhouse investment in Station B, which means that Hillhouse has a high probability of buying B station stocks in the secondary market.

In Q4 of 2018, 2 million shares were bought, and 1.3 million, 4.5 million and 4.8 million shares were bought in the first three quarters of 2019. Hillhouse’s total holding cost was less than US$180 million, but it made nearly US$650 million, and the return was as high as 260 %, more than most of the VCs who have staked in Station B.

The third point is the difference in investment style.

Tiger’s investment style in China’s concept stocks is relatively stable. For JD, Pinduoduo, Alibaba,New Oriental、Good futureRegardless of whether Tiger is increasing or reducing its holdings of these stocks, the magnitude of each time is not large.For example, in 2020Q1, the proportion of JD’s holdings will be reduced by about 4%, the proportion of holdings in 2020Q2 will be about 2%, and there will be Q4 reductionsNew Oriental, The proportion does not exceed 15%.

Hillhouse likes band operation and even “All in” at every turn. For example, JD.com, Q2 Hillhouse first reduced its holdings by 30%, Q3 directly increased its holdings by 100%, and then reduced its holdings by nearly 20% in Q4. The operations are not only frequent, and the proportion of holdings and holdings reduced every quarter far exceeds that of Tigers. In the fourth quarter of last year, Hillhouse directly liquidated the stocks of Future, Xiaopeng, and Ideal for new car-building forces that were at a high point. Hillhouse cleared a total of 13 Chinese concept stocks in 2020, of which 5 stocks were purchased during the year.

Finally, there is a particularly interesting phenomenon, that is, forIQIYIDifferent treatment with Alibaba’s two stocks.

AliheIQIYIBoth Tiger and Hillhouse are heavily stocked. In early 2020, Hillhouse held nearly 2 million shares of Alibaba (valued at approximately US$400 million) and 12 million shares of iQiyi (valued at approximately US$400 million), respectively, held by Tiger. 3.5 million shares of Alibaba (approximately US$700 million) and 1 million shares of iQiyi (approximately US$21 million).

Both companies ran into trouble in 2020. At the beginning of the year, iQiyi was attacked by a short-selling agency, and then it was reported that it was investigated by sec; Alibaba was in trouble at the end of the year because of the domestic antitrust investigation and the failed listing of Ant.

Tiger liquidated iQiyi’s stock in Q2, but never reduced its holdings of Ali’s stock, and even led to a decrease in the income of Ali’s stock by about 300 million U.S. dollars in Q4 in 2020; Hillhouse was decisive in the matter of Ali. Q4 directly liquidated Alibaba stock, but did not “abandon” iQiyi, and only reduced its holdings of about 8 million shares in Q3 and Q4, which is about 1/6 of the shareholding.

Facing the same crisis and facing different companies, Tiger and Hillhouse made two diametrically opposite operations, and the things behind them deserve our careful consideration.

Cheng is also Jingdong, how much is Jingdong

Finally, let’s talk about Tiger and Hillhouse’s investment in JD.com.

Hillhouse and LaoTiger CapitalIt is because JD.com became famous in the first battle, and it became one of the top PEs in the world. Tiger, which launched the first phase of private equity fund raising in 2003, completed a total of approximately US$6 billion in fundraising in the following 11 years. After JD.com went public in 2014, Tiger completed nearly US$18 billion in fundraising in 7 years. 3 times in 11 years.

The same is true for Hillhouse. When Zhang Lei founded Hillhouse Capital in 2005, he only got $20 million in seeds provided by David Swenson and others. Hillhouse’s fundraising was accelerated after JD’s listing in 2014, and the scale of asset management by 2020 It has exceeded 500 billion yuan (approximately 76 billion U.S. dollars).

Let’s review the investment of Tiger and Hillhouse in JD before going public.

Hillhouse invested in JD’s Series C financing in 2010. According to media reports, the total investment was US$300 million, of which US$65 million wasConvertible bondWay to invest. This part of the convertible bonds was converted into 86 million ordinary shares in 2012. Together with the 230 million C-series preferred shares obtained in the C round, Hillhouse held a total of 319 million ordinary shares (equivalent to 159 million ADS) after listing on JD.com. .

Tiger Lai invested in JD.com several times between 2010 and 2012. In 2012, it invested US$75 million in JD.com. According to the prospectus, Tiger held 445 million shares of JD.com (equivalent to 222 million ADS). However, after the JD.com listing, Tiger allocated most of its stock to LP, and as of the end of 2014, only 5 million shares belonged to the Tiger Fund.

As shown in the figure above, Hillhouse still held 152 million shares of JD.com at the end of 2014. In 2015, Hillhouse began to slowly reduce its holdings of JD.com. Among them, it reduced its holdings by approximately 30 million shares in 2015 and made a profit of more than US$800 million. Hillhouse further accelerated its shareholding reduction in 2016. By Q2 of 2018, it had reduced its holdings to approximately 21 million shares, with a profit of approximately US$3.4 billion during the period. At this time, Hillhouse’s investment in JD.com had already achieved a return of nearly US$5 billion.

In 2018, due to the impact of Liu Qiangdong’s Mingzhou incident, JD’s stock price began to enter a long period of stagnation. At this time, Hillhouse also slowed down its reduction of holdings. In 2019, it also bought a small amount of JD’s stock in two quarters.

By the beginning of 2020, Hillhouse’s JD stocks fell to 12 million shares, with a total market value of approximately US$420 million.And because the epidemic has acceleratedPerformanceAfter recovery, JD.com’s stock price soared in 2020. Hillhouse also invested more than US$500 million to buy JD stocks in Q2 of 2020. In the end, Hillhouse will earn approximately US$800 million on JD’s stock in 2020.

Tiger, on the other hand, is the opposite of JD’s operations. After the listing, Tiger allocated most of its shares to LP, and at the end of 2014 there were only 5 million shares left. However, Tiger began to increase its holdings in JD.com. In 2015, in Q1 and Q2, Tiger invested nearly US$2 billion and bought 16 million and 50 million shares of JD.com through its funds.

In the following years, Tiger reduced its holdings of JD stocks at a very slow rate. By 2018Q2, its holdings fell to 40 million shares, a reduction of about 40% (Hillhouse has reduced its holdings by nearly 90% during the same period), and in the Mingzhou incident in 2018 After that, Tiger chose to further increase its holdings in JD.com, and bought nearly 16 million shares of JD.com at a consideration of approximately US$500 million in the next two quarters.

By the beginning of 2020, Tiger holds 53 million shares of JD.com. In this year, JD.com, whose stock price has more than doubled, has earned nearly US$2.8 billion for Tiger.

When JD.com was listed, Hillhouse’s return was about US$3 billion based on the issue price. After that, through long-term holdings, Hillhouse made an additional US$2.5 billion on JD.com; Tiger gave LPs worth US$4.2 billion after being listed on JD.com. Stocks (calculated according to the issue price), after 7 years of speculation in JD stocks, Tiger himself made another 3.1 billion US dollars.

(Source: Touzhong.com)

(Editor in charge: DF532)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.