原标题:美国国债收益率上升和下降,未来会有多少驱动力和上升空间?

概括

[USTreasuryyieldshaverisenandfallenhowmuchdrivingforceandupwardspacearethere?】InthegeneraldirectionwecontinuetobebullishonUSTreasuryyields;inthefuture2%isthekeyresistancelevelfor10-yearUSTreasuryyieldsbeforeraisinginterestratesFortrendtraderstherecentpullbackinUSbondyieldsprovidesanexcellentopportunitytore-enterthemarket(CMEGroup)

U.S. Treasury is the rare asset out of trend in the financial market this year. The 10-year US Treasury has rebounded from 0.93% at the beginning of the year to a high of 1.74%, and is currently fluctuating around 1.6%. In this position, how do you view the follow-up space and drive of long-term US debt?

Space: 2% may be 10-year US debtinterest rateUpper limit

To judge how much room there is for 10-year U.S. Treasury yields to rise, it needs to be measured by the level of U.S. Treasuries’ maturity spreads.Considering this yearMidlandThe Reserve Bank will not have any real interest rate hikes, and the probability that the 2-year US Treasury will remain near the current 0.15%. This means that the change in the 10-year to 2-year maturity spread mainly depends on the change in the 10-year U.S. Treasury.

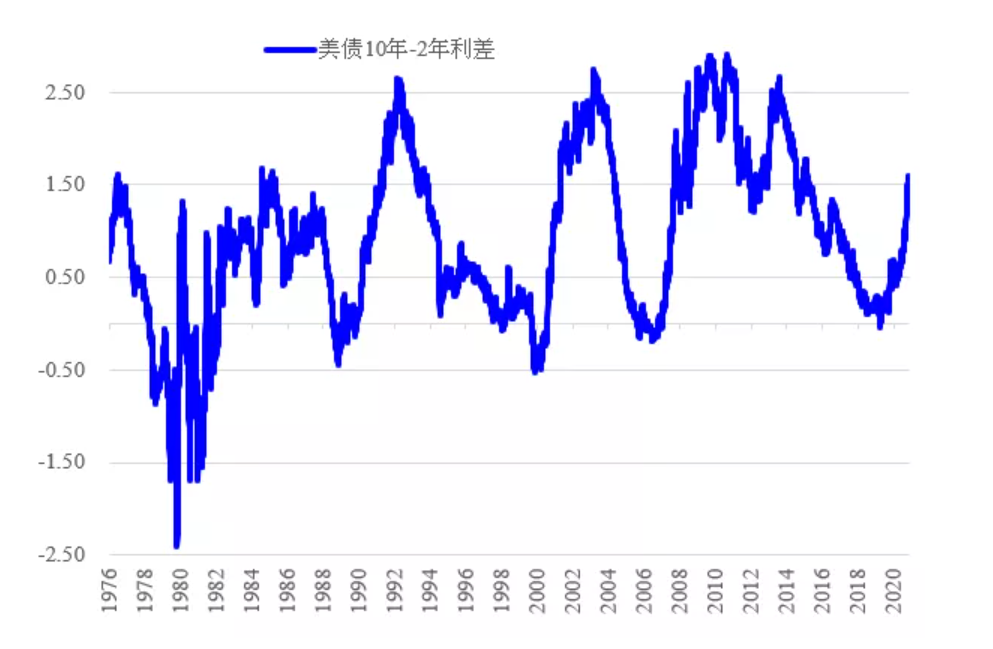

The 10-year to 2-year U.S. bond maturity spread is an indicator that characterizes the steepness of the U.S. bond curve, and it also reflects how the market assesses the medium and long-term growth momentum of the U.S. economy. We have seen that historically, the US debt maturity spread has entered the bearish steep upper limit of the spread during the economic recovery phase, mainly fluctuating in the range of 1.5%-2.5%. The current spread is around 1.5%.

How much room there is for the next 10-year U.S. Treasury bonds depends on how the market evaluates the medium-term growth of the US economy in this round. (Note that it is medium-term, not short-term)

If we think that after skipping the short-term growth disturbance brought about by the epidemic, the medium-term growth of the US economy is still at a growth rate of 2%, then the bearishness of this round of US debt is steep and the width of the maturity spread, we cannot be too optimistic. . 2% may be the upper limit of the maturity spread, which is the reason why the market currently judges the 2% upper limit of 10-year U.S. Treasuries.

Drive: U.S. debtinterest rateThe upward drive may weaken in the second half of the year

From the perspective of the 10-year U.S. debt drive, although the U.S. bond yield is the U.S. bond interest rate, it is highly relevant and sensitive to the global manufacturing boom. This has something to do with the pricing anchor of U.S. debt as the global risk-free interest rate. In other words, when the global manufacturing industry is booming, the global demand for U.S. debt will decrease, and vice versa.

Therefore, when judging the long-term drivers of U.S. debt, we will pay more attention to the global manufacturing situation. Judging from the changes in the short-end interest rates of the global mainstream countries that we track with the same spread, and the leading guidance on the global manufacturing boom, the current round of global manufacturing boom may peak in the third quarter. This also means that, from the perspective of driving, the upward driving of U.S. bond interest rates will gradually weaken in the second half of the year over time.

Technical: 10-year U.S. Treasury yields slow down

From the technical picture, the 10-year U.S. Treasury yield is currently in a very clear upward trend channel, but the rising speed has slowed down significantly, fluctuating between 1.6% and 1.8% in the past month.

If it can break through 1.8% in the future, the next key resistance level is the integer 2%, which is also the monthly downtrend line resistance.

In addition to the fundamental factors mentioned above, the continuous increase in U.S. bond issuance is also a key variable supporting the upward growth of yields from the supply and demand level. Through the CME Treasury Watch tool, we can obtain the issuance scale of US Treasury bonds with specific maturities in the table below, and analyze the trend of US Treasury yields from the perspective of supply and demand.

CME Treasury Watch is provided by CME Group, which aggregates multiple data sets, including U.S. Treasury yields, U.S. Treasury auctions and issuances,MidlandReserve balance sheet data, core market interest rates, etc., to better analyze the factors that affect the U.S. bond market.

This free tool sorts the data into 3 related columns. The leftmost column contains important market data and is updated dynamicallyMidlandThe balance sheet data released by the Reserve Bank. This column also includes information on the Federal Open Market Committee (FOMC) target interest rate and probability of FedWatch, another analytical tool of CME Group. The middle column tracks and plots recent, historical, and predicted U.S. bond auction scales in the form of charts and tables. In the rightmost column, you can view important US economic events and links to other related debt issuance information. The content is dynamically updated.

CME TreasuryWatch can be accessed from the English website of CME Group.

COT holdings and changes in the term structure of interest rates:

Since the beginning of the year, the structure of U.S. Treasury holdings has also undergone significant changes. The specific manifestation is that the overall net long position of asset management institutions has been reduced, while the leveragefundThe overall net short position is closed. In other words, the liquidation of long positions by asset management institutions is the main driver of this round of U.S. bond yields.

At the same time, let’s take a closer look at the year-to-date position changes of various maturities. The 20-year period has the most significant change, followed by the 10-year period, which is in line with the year-to-date yield curve changes. The selling pressure of U.S. bonds is mainly concentrated in the 20-year period.

Outlook of the FOMC meeting on April 28

We expect the Fed to keep the benchmark interest rate unchanged.However, in the face of the recently announced indicators of economic data that tend to overheat, the Fed will have to face increasingly strongcurrencyThe policy margin tightened expectations and was forced to adjust his wording.

Recent speeches by some Fed officials have already revealed clues. For example, Powell mentioned in an interview with “60 Minutes” that benefiting from vaccination and financial support, the US economy will grow faster; St. Louis Federal Reserve President Brad said that 75% of vaccines The vaccination rate will be one of the prerequisites for the Fed to discuss the reduction of bond purchase plans.

It is expected that these wording changes will eventually be reflected in the expected pricing of reduced bond purchases and interest rate hikes, and will provide certain support to the yields of U.S. Treasuries.

in conclusion

In the general direction, we continue to be bullish on U.S. Treasury yields; in the future, 2% is a key resistance level for 10-year U.S. Treasury yields before raising interest rates. For trend traders, the recent pullback in U.S. bond yields provides an excellent opportunity to re-enter the market.

(Article source: CME Group)

(Editor in charge: DF537)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.