原标题:取消五粮液的限制性股票(三年内增长了11倍)将造就一群亿万富翁

概括

[Wuliangye’s(000858SZ)employeeshareholdingplanlock-upperiodexpiresandwillsoonbeunlockednextMondayApril19thInthepastthreeyearsWuliangye’ssharepricehasrisen11timesWhatiscertainisthatbenefitingfromtheemployeestockownershipplanabout2400employeesofWuliangyewillcollectivelyreceiveasuper”bigredenvelope”and23coredistributorswillcollectivelybecomebillionaires(Readcreation)

Next Monday, April 19,Wuliangye(000858, SZ) The employee stock ownership plan has expired and will be unlocked soon. Locked for three years,WuliangyeThe stock price has risen 11 times. To be sure, benefiting from the employee stock ownership plan,WuliangyeAbout 2,400 employees will collectively receive super “big red envelopes”, and 23 core distributors will collectively become billionaires.

Up 11 times, will this batch of newly rich men sell it? How will Wuliangye’s stock price perform? Will it become the next white horse stock to plummet?

Stock ownership plan becomes wealth plan

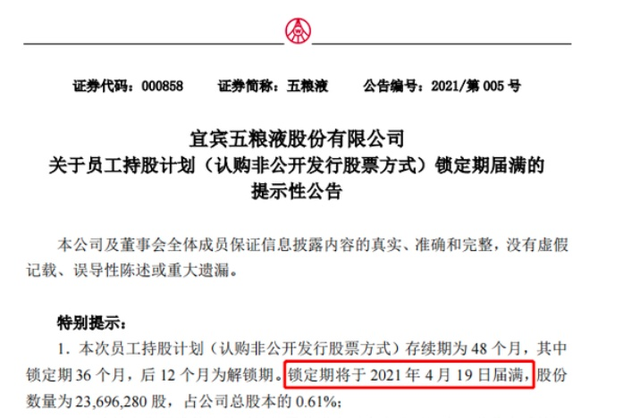

In the evening of April 15, Wuliangyeannouncement, The lock-up period of the employee stock ownership plan will expire on April 19, the number of shares is 23,696,300 shares, accounting for 0.61% of the company’s total share capital. The employee shareholding plan was obtained in April 2018 by subscribing for non-public offering of shares, at a price of 21.64 yuan per share.

The reporter checked the announcement and found that on April 19, 2018, Wuliangye issued 85,641,300 shares in a non-public offering at a price of 21.64 yuan per share.Issuance object isGuotai JunanAsset Management Plan, Junxiang Wuliangye No. 1, Taikang Asset ManagementInsuranceCapital and enterprise annuity plan,Huaan FundThere are no more than 10 investors, such as Kailian Ai Rui, and the stocks are restricted for 36 months.

among them,”Guotai JunanThe “asset management plan” was established and managed by Guojun Asset Management. It was funded and fully subscribed by Wuliangye Phase 1 Employee Stock Ownership Plan. The Employee Stock Ownership Plan held 23,696,300 shares, accounting for 0.61% of the company’s total share capital. Participated in the employee stock ownership plan. Including company directors, supervisors, senior managers, and more than 2,400 ordinary employees.

The “Junxiang Wuliangye No. 1” was subscribed by 23 outstanding distributors and related personnel of Wuliangye, and the number of subscribed shares was 19.414 million shares, accounting for 0.5% of the company’s total share capital.

As of the close on April 16, Wuliangye’s share price was 261.80 yuan per share.After three yearsDividendsLater, the cost of holding shares was less than 20 yuan. This means that the shareholding of the above 2,400 employees has increased by 11 times in three years, and the floating profit per lot is about 24,000 yuan. Based on an average of 99,873 shares per person, the floating profit per capita exceeds 2.36 million yuan.

As for the 23 outstanding distributors, all of them will become billionaires due to the large number of individual holdings.

The few employees who gave up the purchase at that time probably regretted it.

How much impact will unlocking the shares have on the company?

100 shares made a profit of 23,400 yuan, which is very profitable, and the current overall valuation of the liquor sector is on the high side. Investors are likely to sell it. Will Wuliangye be the next white horse stock to plummet?

Insiders believe that the proportion of unlocked shares is small and will not have a major impact on the stock price.

On April 20, 2018, Wuliangye’s non-public offering of shares was listed on the Shenzhen Stock Exchange. The duration of this employee stock ownership plan (subscription of non-public shares) is 48 months, of which the lock-up period is 36 months, and the next 12 months is the unlock period.

What does the 12-month unlock period mean? It turns out that unlocking and holding down are two concepts.According to the regulations of the Shenzhen Stock Exchange, listed companiesRestricted sharesThe unlocking of the copies must go through the procedures of submitting an application to the China Securities Depository and Clearing Corporation and the Shenzhen Stock Exchange, and issuing relevant announcements.

According to the “Shenzhen Stock Exchange listed companyshareholderAnd the relevant provisions of the “Implementation Rules for the Reduction of Shareholding by Directors, Supervisors and Senior Management (Revised in 2017)” 50% of the non-public offering of shares.

According to this calculation, even if all 50% of the unlocked shares flow into the market, they only account for about 0.3% of the total share capital. According to industry insiders, the reduction of shares, which account for about 0.3% of the total share capital, is a small proportion and will not have a major impact on the stock price.

However, some investors believe that although the proportion of employees unlocked is small, the stock market value of 85.64 million yuan is 22.4 billion yuan. Except for the portion of employee shares, most of them are held by institutions, and they will also be unlocked. In addition, in the face of the upcoming employee stock ownership plan, from the perspective of market investment psychology, Wuliangye’s stock price is under pressure.May drive the liquor sector is not optimistic, investors are still avoiding the liquor sector in the near future and prefer “drinking”fundAs well.

Many friends in the stock bar group believe that Wuliangye’s share price will fall due to this. 【Click to enter Wuliangye】

PerformanceGood institutions are optimistic about the company’s future

Wuliangye released its 2020 main performance data forecast on January 7. The company achieved revenue of approximately 57.2 billion yuan last year, an increase of about 14% over the same period of the previous year; realized net profit of approximately 19.9 billion yuan, an increase of 14% over the same period last year. about.

According to the feedback at the Spring Sugar and Wine Fair this year, the market wholesale price stands above 1,000 yuan, and the market retail price of 1,399 yuan per bottle also allows Wuliangye distributors to have considerable profits.

Tianfeng SecuritiesResearch reportIt is believed that since 2020, Wuliangye has adopted “traditional volume reduction and group purchase increment” as the main line of channel adjustments, with a more refined delivery rhythm, and the proportion of group purchase channels that continue to increase. It is expected to increase from 20% to 30% in 2021. At the same time, the company accelerates the digital transformation of marketing, introduces a mode of controlling disk and profit sharing, and effectively supervises market operations. Maintain a 6-month buy rating. The target price is 292.80 yuan.

Cinda Securities Research Report believes that according toCompany AnnouncementIt is disclosed that in 2020, the company is expected to achieve total operating income of about 57.2 billion yuan, a year-on-year increase of about 14%, and return to the parentNet profit Around 19.9 billion yuan, a year-on-year increase of about 14%, achieving the double-digit growth target at the beginning of the year, and successfully ending the 13th Five-Year Plan. Looking back on 2020, the company’s “three losses and three supplements” work policy in response to the epidemic has accelerated the progress of Wuliangye’s digital transformation, whether it is the launch of the “Wuliang Cloud Store” or the launch of the “digital liquor certificate”. Industry benchmarking meaning. The creation of enterprise-level group purchases made up for losses in traditional channels and provided effective support for the company’s control of goods and prices. We expect the EPS in 2020-2022 to be 5.13, 6.16 and 7.27 yuan, respectively, with a “buy” rating for the first time.

inAnalystBehind the “buy” ratings given to Wuliangye, Wuliangye continues to create good returns for investors. Statistics show that since its listing, Wuliangye has distributed a total of 39.6 billion yuan in dividends. In the past three years, Wuliangye has distributed as much as 20.2 billion yuan, with a dividend rate of about 50%. Investors have received generous returns.

(Source: Reading Chuang)

(Editor in charge: DF142)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.