原标题:北向基金连续三天购买了185亿股A股,但要提防这一信号! (附加股)

概括

[Northboundfundshavebought185billionAsharesfor3consecutivedaysbutbewareofthissignal!(Attachedstock)OnApril14ththemaininflowofnorthboundfundswasinearlytradingTherewasanetinflowof74billionyuanintheintradaymarketAfter2pmthefundsflowedoutslightlyandtherewasanoutflowofabout17billionyuaninthelasthourFinancialmanagementsaidthatthisshowsthatafterthenorthboundfundssuccessfully”buythebottom”partofthefundscashedinprofitswhenthemarketrebounded(21stCenturyBusinessHerald)

On April 14, the three major A-share stock indexes collectively closed up.Shanghai IndexRose 0.06% to recover 3400 points,Shenzhen Component IndexUp 1.55%,Growth Enterprise Market IndexIt rose more than 2% to 2.24%.Tourist Hotel、Commercial Department Store、Chemical fiber industryWaiting for the sector to lead the gains.

According to 21 investment through intelligent monitoring, on April 14, the northbound fund bought 5.731 billion yuan, of whichShanghai Stock ConnectNet purchase of 1.541 billion yuan,Shenzhen Stock ConnectNet purchases were 4.191 billion yuan.

Northbound funds have been mobilized for 3 consecutive days, with a cumulative net purchase of 18.506 billion yuan, of which 8.377 billion yuan was purchased for Shanghai Stock Connect and 10.129 billion yuan was purchased for Shenzhen Stock Connect.

It is worth noting that on April 14th, the main inflow of northbound funds was in the early trading.Net inflow7.4 billion yuan. The funds flowed out slightly after 2 pm, and about 1.7 billion yuan flowed out in the last hour.Financial managementSaid that this shows that after the northbound funds successfully “buy the bottom”, some of the funds cashed in profits when the market rebounded.

OverweightElectronic component

UnderweightTransmission and Distribution Electric

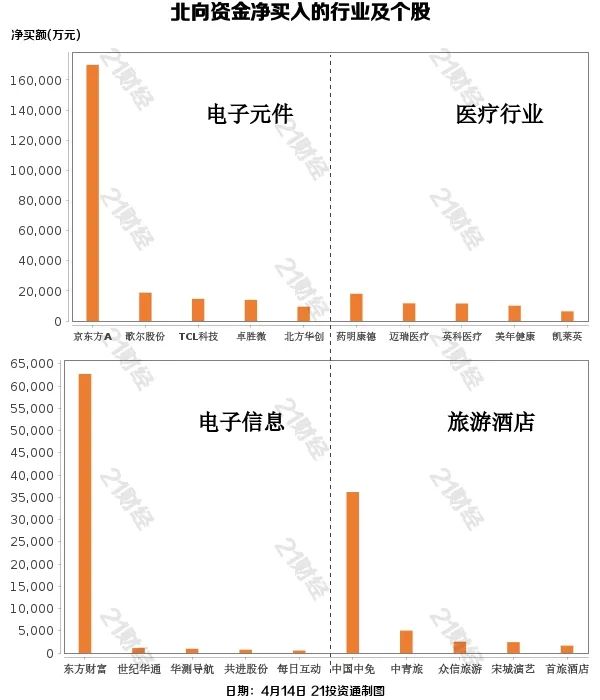

From the point of view of the net purchase amount, Northbound funds increased their holdings in 42 industries, of whichElectronic componentRanked first, with a net purchase amount of 1.717 billion yuan, followed byMedical industry, A net purchase of 738 million yuan.

Northbound funds reduced its holdings in 18 industries, of whichTransmission and Distribution ElectricThe most, net sales amounted to 509 million yuan, followed byMaterial industry, A net sale of 433 million yuan.

Net buyBOE A1.700 billion yuan

Net saleLongi shares880 million yuan

In terms of individual stocks, northbound funds are net purchasesBOE A(000725.SZ)、Oriental wealth(300059.SZ)、Industrial Bank(601166.SH)、BYD(002594.SZ)、Ganfeng Lithium(002460.SZ) is at the top.

among them,BOE AWas net purchased 1.70 billion yuan,Oriental wealthWas net bought 627 million yuan,Industrial BankWas net bought 466 million yuan,BYDWas net bought 432 million yuan,Ganfeng LithiumIt was net bought 402 million yuan.

Net sale of northbound fundsLongi shares(601012.SH)、Wuliangye(000858.SZ)、Sungrow(300274.SZ)、COSCO SHIPPING(601919.SH)、Hengli Hydraulic(601100.SH) is at the top.

among them,Longi sharesWas net sold 880 million yuan,WuliangyeWas net sold 702 million yuan,SungrowWas net sold 333 million yuan,COSCO SHIPPINGWas net sold for 287 million yuan,Hengli HydraulicWas net sold 234 million yuan.

(Source: 21st Century Business Herald)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.