原标题:100元意外伤害保险费,95元代理费是多少? 新的监管措施说不!

概括

[100yuanaccidentinsurancepremium95yuanistheagencyfee?Thenewregulatorymeasuressayno!】Aconsumerboughtanaccidentinsuranceproductwithapremiumof100yuanbut95yuanisactuallyahandlingfeefortheintermediaryagency?ThisapparentlyunreasonablehighhandlingfeewillcometoanendTheChinaBankingandInsuranceRegulatoryCommissionhasissuedthe”MeasuresfortheSupervisionofAccidentalInjuryInsuranceBusiness(DraftforComment)”tovariousinsurancecompanieswhichisthefirsttimetouniformlyregulatetheaccidentinsurancebusinessofpropertyandlifeinsurancecompanies(ShanghaiSecuritiesNews)

Consumers bought an accident insurance product with a premium of 100 yuan, but 95 yuan is actually a handling fee for intermediaries? This apparently unreasonable high handling fee will come to an end.

A reporter from Shanghai Securities News learned that the China Banking and Insurance Regulatory Commission hasInsuranceThe company issued the “Accidental InjuryInsuranceBusiness Supervision Measures (Consultation Draft)” (hereinafter referred to as the “Consultation Draft”), for the first time in a unified standard for the accident insurance business of property and life insurance companies. In response to various market ailments such as high fees and high prices, the “Draft for Solicitation of Comments” imposes strict requirements in terms of actuarial requirements, retrospective management, and negative lists.

Good for consumers:

Products with inflated prices should “force price cuts”

Relatively speaking, accident insurance has low premiums and high leverage.Common peopleIndispensable protection products in response to various unexpected risks, and consumers should also prioritize configurationInsuranceproduct.

However, this kind of foundation should be handed inInsurance Products, The actual compensation to consumers is not high. According to industry insiders, most of the accident insurance premiums paid by consumers are not used to settle claims for consumers, but are used for the sales expenses of various online platforms and intermediary channels. This is turning the cart before the horse and in disguised form harming the rights and interests of consumers. .

The “Draft for Comment” has to say no to this market status! A clear “compulsory price reduction” mechanism for overpriced accident insurance products. The “Draft for Comments” shows that insurance companies should make pricing adjustments based on the product’s comprehensive loss ratio. For short-term accident insurance products with annual cumulative scale premium income exceeding 1 million yuan, the average comprehensive loss ratio after reinsurance in the past three years is low. At 50%, insurance companies should adjust their pricing in a timely manner and continue to track the status of product claims. Products after pricing adjustments should be resubmitted for approval or filing in accordance with relevant requirements.

In other words, after the implementation of the new regulations, insurance companies must retrospectively conduct accident insurance operations. If the three-year average comprehensive compensation ratio is less than 50%, they must reduce prices. This can not only guide insurance companies to increase the accident insurance payout ratio, but also force insurance companies to develop more high-priced products for sale.

What if there are still insurance companies committing crimes? Discontinued!

The “Draft for Comments” clarified that for short-term accident insurance products with premium income of more than 2 million yuan for three consecutive years and a comprehensive loss ratio of less than 30%, insurance companies should stop the sale in time and report to the China Banking and Insurance Regulatory Commission within 10 working days after the suspension. Submit a report stating the reasons for discontinuation of use, relevant measures for follow-up services, etc.

Fight against unjust enrichment of middlemen:

Set the upper limit of the pre-determined premium rate

Accompanying the low loss ratio is the problem of high handling fees. Due to the simple product form and the lack of differentiation and competitiveness, insurance companies often engage in vicious competition in handling fees when selling accident insurance.

“Some aviation accident insurance charges more than 95% of the online platform’s handling fee, and some auto intermediary channels also charge more than 50% of the accident insurance handling fee. That is to say, if consumers spend 100 yuan on aviation accident insurance, 95 of them may be It is obviously unreasonable that the online platform has made a profit. These intermediary channels and online platforms are improperly profitable.” The above-mentioned industry insiders said frankly.

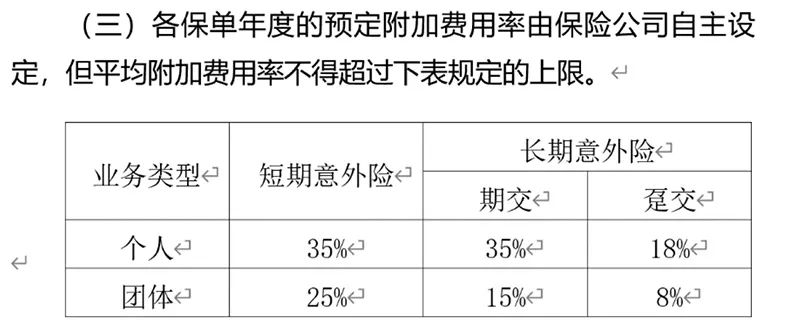

In this regard, the “Draft for Comment” has been constrained by clarifying the upper limit of the predetermined additional expense rate for each policy year. Taking personal business as an example, the upper limit of the average surcharge rate for short-term accident insurance shall not exceed 35%, for long-term accident insurance, the regular delivery product shall not exceed 35%, and the batch product shall not exceed 18%.

At the same time, when an insurance company submits an accident insurance product for review, if the maximum intermediary expense rate exceeds the upper limit of the average additional expense rate by more than 10%, a written explanatory material signed by the general manager of the company must be provided, including but not limited to the reasonableness of the intermediary expense rate level Analysis etc.

Set up the form of the negative list for the first time

11 “prohibited” behaviors must not be touched

It is understood that the previous accident insurance business related requirements were scattered in various specifications of property and life insurance companies, and there were differences in reserve management, and there was a lack of unified institutional arrangements. This “Draft for Comment” is the first time that the insurance industry has sorted out and integrated the accident insurance business of a property and life insurance company, and formulated a unified system and norms.

Industry insiders believe that this will help eradicate the long-standing abnormally high expense ratios, low payout ratios, and vicious competition in the accident insurance market, regulate accident insurance operations, and protect the legitimate rights and interests of accident insurance consumers. For some chronic diseases that have disrupted the market for a long time, the “Draft for Solicitation of Comments” also for the first time in the form of a negative list draws out 11 “prohibited” behaviors for insurance companies.

According to industry insiders, in addition to issuing the “Draft for Comments”, accident insurance has a number of supporting reforms on the way. Including the compilation of the accident insurance rate table and the formulation of the “grey list” of accident insurance anti-fraud, all are in the process of progress.

Related reports:

The China Banking Regulatory Commission unified the accident insurance business of property and life insurance companies for the first time

China Banking and Insurance Regulatory Commission solicits opinions on the supervision measures for accidental injury insurance business

(Source: Shanghai Securities News)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.