原标题:贾跃亭刚刚被终身禁止! 欺诈方法特别糟糕,并且金融欺诈已经暴露了10年! 这些承诺都是谎言…

概括

[JiaYuetingwasbannedforlife!Fraudulentmethodsareparticularlybadfinancialfraudhasbeenexposedin10years!】AccordingtothedetailsdisclosedintheprohibitiondecisionJiaYuetinghasrepeatedlyviolatedhispromisesTheoriginal26billionyuanofshareholdingreductionloantothelistedcompany’spromiseonly630millionyuanremainedonLeTVandtherestwenttoJiaYueting’scontrolaccountNotonlythatLeTVmademultipleloansfromJiaYuetingallofwhichwerefrequentlywithdrawn(BrokerChina)

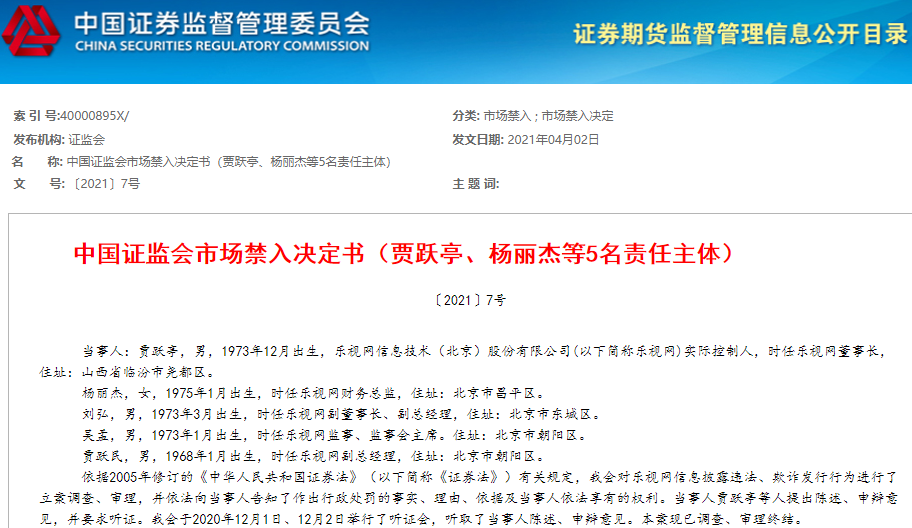

Following a fine of 240 million yuan, Jia Yueting was banned from the market for life by the China Securities Regulatory Commission!

On April 13th, the China Securities Regulatory Commission issued the market ban decision of five responsible entities including Jia Yueting and Yang Lijie. Because of LeTV’s financial fraud for ten consecutive years, the then chairman Jia Yueting and CFO Yang Lijie were promoting the above issuance of LeTV and the related issues involved. The organization, planning, leadership, and implementation of financial fraud have played a role in financial fraud. In the financial fraud, particularly bad methods such as concealing and fabricating important facts have been adopted. The fraudulent amount is huge, and the issuance application documents submitted and disclosed are not diligent and conscientious. Sign and ensure that the information disclosed is true, accurate, and complete. The illegal circumstances are particularly serious. He is the person in charge who is directly responsible for the fraudulent issuance of LeTV. The China Securities Regulatory Commission decided to take measures to ban Jia Yueting and Yang Lijie from entering the securities market for life.

According to the details disclosed in the prohibition decision, Jia Yueting has repeatedly violated his promises. Only 630 million yuan of the original pledge of 2.6 billion yuan to lend to listed companies was left on LeTV, and the rest went to Jia Yueting’s control account. Not only that, LeTV made multiple loans from Jia Yueting, all of which were frequently withdrawn.

Jia Yueting directed LeTV to falsify financial affairs for ten years, with a huge amount of bad methods

After investigation by the China Securities Regulatory Commission, LeTV reported financial fraud from 2007 to 2016, and the documents submitted and disclosed for the initial public offering and listing (hereinafter referred to as IPO) and the 2010-2016 annual report contained false records.

Specifically, in 2007, LeTV’s inflated revenue was 9.3995 million yuan, and the inflated profit was 8.7023 million yuan (the inflated profit accounted for 59.27% of the total disclosed profit for the current period, the same below); in 2008, the inflated revenue was 46.155 million yuan, and the inflated profit 43.082 million yuan (136.00%); in 2009, the inflated income was 93,757,600 yuan, and the inflated profit was 88,831,800 yuan (186.22%); in 2010, the inflated revenue was 99.618 million yuan, and the inflated profit was 94.434 million yuan (126.19%); in 2011 The inflated income was 69,376,500 yuan, and the inflated profit was 65,291,300 yuan (39.75%); in 2012, the inflated revenue was 89,653,300 yuan, and the inflated profit was 84.451 million yuan (37.04%); the inflated revenue in 2013 was 19,989,700 yuan, and the inflated profit 193,939,900 yuan (78.49%); 2014 inflated revenue of 351,941,900 yuan, inflated cost of 5.9038 million yuan, inflated profit of 342.7038 million yuan (470.11%); in 2015, inflated revenue of 399,223,900 yuan, and inflated cost of 9,434,400 yuan , The inflated profit was 382,951,800 yuan (516.32%); in 2016, the inflated revenue was 512,470,000 yuan, the inflated cost was 30,851,500 yuan, and the inflated profit was 432,763,300 yuan (-131.66%).

From the perspective of operating methods, at the initial issuance stage, LeTV used fictitious business and false payment collection.PerformanceIn order to meet the listing and issuance conditions, it is mainly through the fictitious business of the company actually controlled by Jia Yueting, and through the control of Jia YuetingbankAccounts construct false fund circulation methods to inflate performance. The companies involved include Beijing Yirongtong Investment Consulting Co., Ltd., Beijing Tonglian Xinda Technology Co., Ltd., Wanglian Wanmeng Technology Co., Ltd., Tianjin Shitong Tianyu Technology Co., Ltd., and Nanjing Xinmoke Technology Co., Ltd. These companies are all companies actually controlled by Jia Yueting.

At the same time, LeTV also fictionalized its business with a third-party company and controlled it through Jia Yueting.bankThe way the account constructs a false capital cycle inflates performance. In the real business dealings with customers, the performance is inflated by means of impersonating the money back.

After LeTV’s online market, financial fraud became more frequent.

After LeTV’s online market in 2010, in addition to using its own funds to circulate and collude to “pass through” fictitious business income, it also used forgerycontract, Continue to inflate performance by not actually implementing the framework contract or unilaterally confirming the swap contract.

The specific operation method is to confirm the revenue of the fictitious advertising business, and in the case of no fund return, the accounts receivable will be kept in the account for a long time, which will inflate business revenue and profits. Subsequent use of intangible assets to offset all or part of the accounts receivable, correspondingly inflated costs and profits.

Continue to conduct business with third-party companies through fiction and control through Jia YuetingbankThe way the account constructs a false capital cycle inflates performance. The revenue was confirmed through the fictitious business of a third-party company, and at the same time, the bank account controlled by Jia Yueting was used to construct a part of the false capital cycle and the long-term account receivable method to inflate performance. Recognizing business revenue and inflating performance by signing an advertisement swap framework contract or a fictitious advertisement swap contract that has not been actually executed with the customer Use advertising swap contracts to inflate performance by accounting for revenue only or inflating revenue but not cost.

The aforementioned 10 consecutive years of inflated performance by LeTV has resulted in false records in its IPO prospectus and annual report from 2010 to 2016, which it submitted and disclosed, and constituted an illegal act of information disclosure as described in the Securities Law. An investigation by the China Securities Regulatory Commission showed that Jia Yueting, then chairman of LeTV.com, was fully responsible for LeTV’s work, organized, made decisions, and directed LeTV and related personnel to participate in fraud. He did not diligently perform his duties, and signed the relevant issuance documents and periodic reports and guaranteed the disclosures. The information is true, accurate, and complete; Yang Lijie, the then chief financial officer, directly organized and implemented financial frauds without diligence, and signed the relevant issuance documents and periodic reports to ensure that the information disclosed is true, accurate, and complete.

In the financial fraud, the above two people used particularly bad methods such as concealing and fabricating important facts. The fraud amount was huge and lasted for a long time. They played the role of organization, planning, leadership, and implementation. The illegal circumstances were particularly serious and they were the directly responsible managers. ; Liu Hong, the director in charge of the advertising business at the time, organized and implemented the company to cooperate with “accounting” and other related financial frauds, and signed the issuance documents and periodic reports involved in the case, and ensured that the information disclosed is true, accurate and complete. During the period involved Has been servingExecutives, Played a larger organizational role in LeTV’s financial fraud, failed to perform diligently, and had serious violations of the law, and belonged to other persons responsible for the above-mentioned violations; the then supervisor Wu Meng contacted relevant companies according to the arrangements of Jia Yueting, Yang Lijie and others , Establishing a company, keeping the official seal, organizing the implementation of relevant “account transfer” and other acts, directly participating in the above illegal acts, failing to diligently perform their duties, signing the confirmation opinions of the relevant periodic reports and ensuring that the information disclosed is true, accurate and complete, on LeTV. The financial fraud played a major role, and the violations were more serious and belonged to other directly responsible persons; the other directors, supervisors, and senior executives at the time were Zhao Kai, Tan Shu, Ji Xiaoqing, Zhang Minhui, Zhu Ning, Cao Bin, etc., Failure to diligently perform their duties, sign on the confirmation opinions of the relevant periodic reports and ensure that the information disclosed is true, accurate and complete, and belong to other directly responsible persons. As the actual controller of LeTV, Jia Yueting instructed relevant personnel to engage in the above-mentioned illegal acts, which constituted the illegal acts described in the Securities Law.

In addition, LeTV has not disclosed related-party transactions as required, nor has it disclosed guarantees for companies such as LeTV Holdings. LeTV’s then chairman Jia Yueting did not diligently perform his duties. He was the person in charge who was directly responsible for LeTV’s failure to disclose related party transaction violations and failure to disclose external guarantees. Wu Meng, then chairman of the board of supervisors, signed on behalf of 4 of the 7 related parties. , Knowing of the related transaction, Zhao Kai, then secretary of the board of directors, directly participated in matters related to external guarantees and was responsible for the company’s information disclosure work. He failed to diligently and did his duty. As a result, LeTV did not disclose the above-mentioned matters and was the other person directly responsible for the above-mentioned illegal acts.

Jia Yueting reduced his holdings by 2.6 billion yuan and failed to fulfill his loan commitments

Jia Yueting reduced LeTV’s shares in two in 2015. Before the reduction, Jia Yueting held 8,180,84729 shares, accounting for 44.21% of the total share capital. And promised to lend all its income to the company as working capital. LeTV can withdraw and use it according to the needs of liquidity within the specified period. The loan period will not be less than 60 months, and no interest will be charged. LeTV’s 2015 annual report and 2016 annual report disclosed the fulfillment of the commitment to lend the reduced funds to listed companies, saying that Jia Yueting had complied with the loan commitment during the reporting period.

However, this is not the case. Jia Yueting received 2.6 billion yuan of after-tax income from the reduction of holdings and transferred it to LeTV. Then, in a short period of time, most of the funds were transferred in batches to Jia Yueting, Jia Moufang, Jia Yuemin, LeTV Holdings, etc. Bank account of listed company system.CombingCash flowBackwards, Jia Yueting’s reduction of 2.6 billion yuan of funds only 630 million yuan remained in LeTV, and the rest went to Jia Yueting’s control account.

Not only that, from June 15, 2015 to May 10, 2017, LeTV made multiple loans from Jia Yueting, but they were frequently withdrawn and failed to fulfill their commitments.

Jia Yueting only temporarily lent part of the reduced holdings funds to the listed company for use, and then withdrew the relevant borrowings, violating the holdings reduction and borrowing commitments.The “Special Disclosure on the Implementation of Commitments” issued by LeTV.comannouncement》(2015-083) and the performance of the commitments disclosed in the 2015 annual report and 2016 annual report are inconsistent with the actual situation. There are false records. Jia Moufang’s actual performance of the commitments is not listed in the “Company’s actual control” in the 2015 annual report and 2016 annual report. people,shareholder, Related parties, acquirers, companies and other commitments that have been fulfilled by the relevant parties during the reporting period and have not yet been fulfilled as of the end of the reporting period, and there are major omissions. The CSRC believes that the above actions constitute the provisions of the Securities Law Information disclosure violations. The then chairman Jia Yueting violated his promise and directly instructed relevant personnel to withdraw his and Jia Moufang’s loans without diligence and due diligence. He was the person in charge who was directly responsible for the false records and major omissions in the relevant disclosure documents of LeTV. As the actual controller of LeTV, Jia Yueting instructs relevant personnel to engage in the above-mentioned illegal acts, which constitutes an illegal act of the Securities Law.

The China Securities Regulatory Commission identified LeTV as a fraudulent issuance

As the Securities Regulatory Commission found out the implementation of LeTV’s financial fraud, it determined that LeTV did not meet the issuance conditions and defrauded the issuance approval by deception, which constituted an illegal act of fraudulent issuance as described in the Securities Law.

The then chairman Jia Yueting and chief financial officer Yang Lijie played an organizing, planning, leading, and implementing role in promoting the above-mentioned issuance of LeTV and the financial frauds involved. In the financial fraud, they adopted particularly bad methods such as concealing and fabricating important facts. , The amount of fraud was huge, and he did not diligently perform his duties, signed the submitted and disclosed issuance application documents and ensured that the information disclosed was true, accurate, and complete. The illegal circumstances were particularly serious, and he was the person in charge who was directly responsible for the fraudulent issuance of LeTV. The then supervisor Wu Meng and the deputy general manager Jia Yuemin directly participated in the relevant financial frauds, did not diligently perform their duties, signed the issuance application documents and ensured that the information disclosed is true, accurate and complete, and played a greater role in the fraudulent issuance. Illegal circumstances More serious. Liu Hong, the director at the time, did not diligently perform his duties, signed the issuance application documents and ensured that the information disclosed is true, accurate, and complete. He is the other person directly responsible for the fraudulent issuance of LeTV. According to the aforementioned facts about LeTV’s financial fraud, Jia Yueting, as the actual controller of LeTV, instigated relevant personnel to engage in the above financial fraud, which led to the company’s application for non-public issuance declaration for the three years from 2012 to 2014 and from January to June 2015. There are serious false records in the financial data of the first period, which constitutes an illegal act described in the Securities Law.

Jia Yueting applied for a lighter punishment, and the China Securities Regulatory Commission issued a huge fine

Jia Yueting put forward multiple defense opinions:

First, regarding IPO application documents and annual reports from 2010 to 2016, there is insufficient evidence to determine that its organization, decision-making, directing LeTV and related personnel involved in fraud, concealing and fabricating important facts and other means are insufficient.

The second is LeTV’s commitment to investors in Leshi Sports’ A+ and B rounds of financingRepurchaseObligation, in essence, is performance gambling. It does not have the subordination and complementarity of guarantee. It is not a guarantee in law. If the repurchase clause has been disclosed as a component of the financing transaction, LeTV does not need to perform an external guarantee. Review procedures and disclosure obligations, and this clause is a hidden clause, relevant personnel did not find that it was negligent at best.

The third is that even if there are problems with the description of the share reduction commitment in the relevant announcement, it is a minor flaw, and it is not enough to be deemed illegal for information disclosure.

Fourth, the defendant did not instruct to engage in illegal information disclosure and fraudulent issuance based on the identity of the actual controller. In summary, Jia Yueting believes that he should be given a lighter and mitigated punishment.

The China Securities Regulatory Commission responded that during LeTV’s 10 consecutive years of financial fraud, Jia Yueting was the chairman and actual controller of LeTV. He was fully responsible for the company’s business management. Other responsible persons and multiple witnesses all pointed to Jia Yueting’s organization and direct participation in the implementation. Involving matters related to financial fraud, evidence from various parties in the case also proves that the relevant matters are all part of financial fraud. Jia Yueting is in the highest leadership position at LeTV. His main performance is organization, decision-making, and command. For specific fraud business, it may be direct and specific organization, decision-making, and command, or general organization, decision-making, and command. It does not need to be specific to every fraudulent business. Based on this, the China Securities Regulatory Commission determined that its organization, decision-making, and command of LeTV’s financial fraud were not inappropriate. The evidence in the case proves that in the financial fraud of LeTV, a large number of methods of concealing and fabricating important facts such as fictitious capital circulation, fictitious business, and fictitious recording of amounts were used. The amount involved is huge. The completion of these matters is obviously inseparable from decision-making and command and related matters. For the specific organization and implementation of business and financial matters, the China Securities Regulatory Commission is not inappropriate in its determination. In the illegal and fraudulent issuance of information disclosure in this case, in addition to being the chairman of LeTV, Jia Yueting failed to fulfill his duty of diligence and due diligence, as the actual controller, he exceeded the chairman’s scope of duties and performance procedures, violated the requirements of corporate governance norms, and used actual control People’s control over the company instructs relevant personnel to implement financial fraud, fraudulent issuance, and evasion of borrowing from LeTV.com, resulting in illegal information disclosure by listed companies.

The China Securities Regulatory Commission believes that Jia Yueting’s behavior in this case is that on the one hand he failed to perform the duties and procedural requirements of the chairman of the board, and failed to fulfill the duties of the chairman of the board of directors at the company level. On the other hand, he used the position and role of the actual controller to control his own will. The lower organization instructs a small number of people to complete the related matters involved in the case, and many matters are directly for the benefit of the actual controller, such as financial fraud at the IPO stage, violation of loan commitments, etc., and at the same time, it is the actual controller and largest shareholder of LeTV. The financial report of the company after listing is also highly related to its interests. Although it is done by one person, Jia Yueting’s performance of his duties as the chairman of the board is independent of the instigation behavior of the actual controller. While the China Securities Regulatory Commission will punish Jia Yueting as the chairman of the board for non-diligence and due diligence in accordance with the directly responsible person in charge, there is nothing wrong with penalizing him as the actual controller for instigation. In summary, Jia Yueting’s defense is not accepted.

In the end, the China Securities Regulatory Commission decided to impose a total fine of 240.6 million yuan on LeTV, a total fine of 241.2 million yuan on Jia Yueting, a total fine of 600,000 yuan on Yang Lijie, and a fine of 50,000 to 400,000 yuan on other responsible persons. At the same time, Jia Yueting and Yang Lijie have adopted lifelong security market bans, and other responsible persons have corresponding bans.

Related reports:

Heavy! Jia Yueting fined 240 million yuan for 10 years of LeTV fraud!Zeng insisted that the IPO was 100% without fraud

Deceived for ten years! IPO, refinancing, LeTV fined 240 million yuan, Jia Yueting fined 241 million yuan

The cost of returning home will increase again! Who pays Jia Yueting’s fine of 241 million yuan for 10 years of fraudulent use of LeTV? Where did the money go?

(Article Source:BrokerageChina)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.