原标题:携程在这里! 首次公开募股的第一天,保证金超额购买了3倍,募集资金可能超过100亿! 美国股市接连下跌。 有多少想象空间?

概括

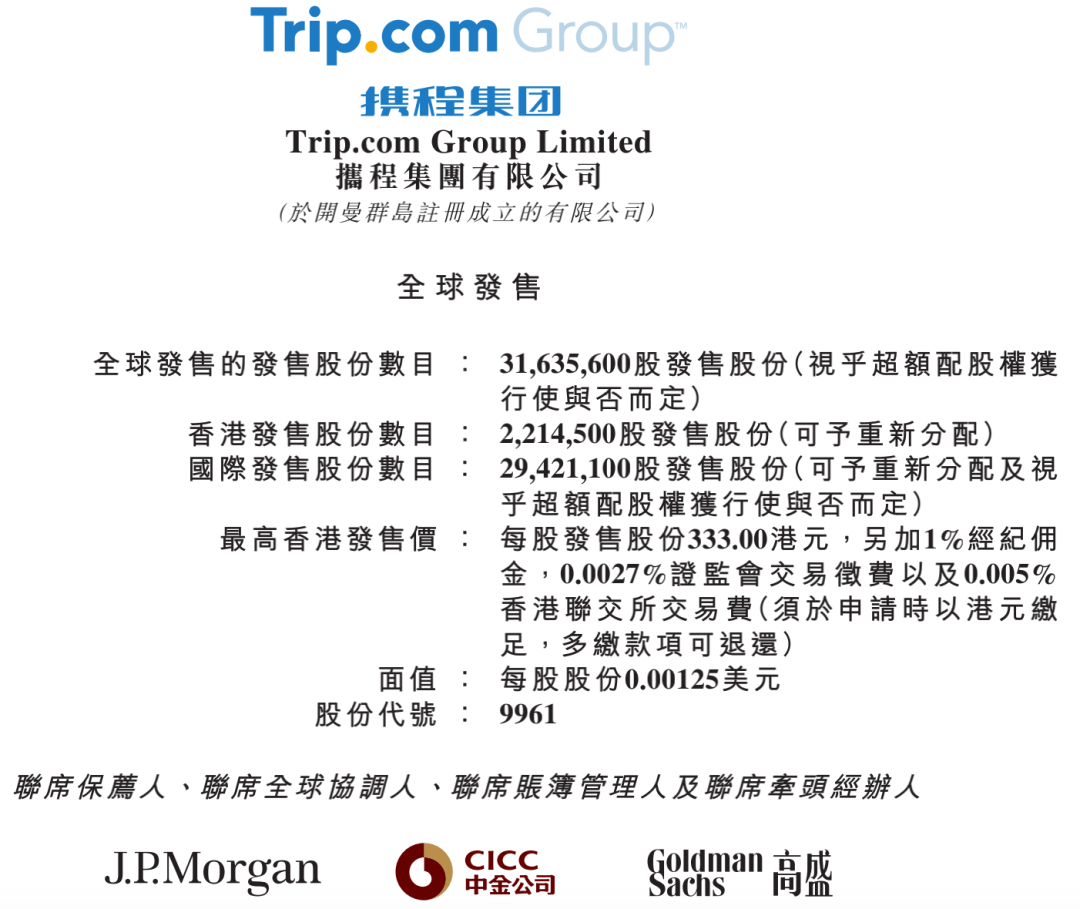

[Ctripishere!MarginoverbuyingonthefirstdayoftheIPOraises3timesormorethan10billion!USstockshavefallensuccessivelyHowmuchroomisthereforimagination?】OnApril8thCtripofficiallylaunchedtheHongKongstockIPOsubscriptionatapriceof333HongKongdollarspershareBasedontheglobalofferingof31635600sharestheinitialfundraisingisexpectedtobe105billionHongKongdollarsCtrip’sIPOperiodisfromApril8toApril13withJPMorganChaseCICCandGoldmanSachsactingasjointsponsorsjointglobalcoordinatorsjointbookrunnersandjointleadmanagers(BrokerChina)

FollowingBaidu, After station B,CtripIt is also quick to fight for the second listing of Hong Kong stocks.

April 8,CtripThe Hong Kong stock IPO subscription is officially launched. The offer price is 333 Hong Kong dollars per share. Based on the global offering of 31,635,600 shares, the initial fundraising is expected to be 10.5 billion Hong Kong dollars.CtripThe offer period is from April 8th to April 13th, fromJPMorgan、CICC、Goldman SachsServed as joint sponsor, joint global coordinator, joint bookrunner and joint lead manager.

However, at the same time that the IPO was launched, Ctrip’s US stock price has not risen but fallen for many consecutive days. On the evening of April 8th, Ctrip’s US stocks fluctuated and declined all the way after the opening, and once fell to 37.97 US dollars, a decline of 2.16%. Although there was a rebound afterwards, as of about 11 o’clock Beijing time, its US stock price was reported to be US$38.42, a decrease of 1%, and its market value also shrank to about US$23 billion, or about RMB 150 billion.

3 times excess margin on the first day of IPO

On April 8th, Ctrip officially launched the Hong Kong IPO IPO subscription, the offer price is 333 Hong Kong dollars per share, 50 shares per lot. According to the plan, Ctrip’s global offering of 31,635,600 shares, of which 29,421,100 international offering shares, and 2,214,500 public offering shares.

according toJieli trading treasureAccording to data, as of 18:52 pm on April 8, the total subscription of Ctrip’s margin subscription has reached HK$3.043 billion, which is equivalent to 3.13 times overbuying.

Judging from the data alone, Ctrip’s first-day subscription performance is not very popular. In the investor community, some analysts believe that the current oligopoly effect of Ctrip has not yet been highlighted. The OTA industry is a three-legged situation where Meituan, Alibaba, and Ctrip. In addition, Ctrip’s revenue in 2020 will also drop a lot from the peak in 2019. It is judged that the current valuation is not Have greater appeal.

Ctrip in the United States in December 2003NasdaqThe listing is one of the earlier Chinese concept stocks that went public in the United States. It owns four major brands: Ctrip.com, Qunar.com, Skyscanner, and Trip, as well as Lvping.com, Honghu Yiyou, Yongan, and Yiyou. According to the Analysys report, Ctrip has been the largest online travel platform in China in the past ten years based on GMV (website transaction value) statistics, and has ranked first in the global online travel industry for three consecutive years from 2018 to 2020.

In fact, as early as the end of 2019, Ctrip reported that it was planning a secondary listing in Hong Kong stocks. Ctrip CEO Sun Jie also responded to the Hong Kong stock IPO rumors through the media in October 2020, saying that if it is beneficial to the company, Ctrip will consider it. However, the sudden new crown epidemic caused a major impact on Ctrip’s business, and the listing matter has only now been officially revealed to the public.

The prospectus documents show that the funds raised by Ctrip’s return to Hong Kong for its secondary listing will be mainly used for three purposes:

The first is to provide funds for expanding Ctrip’s one-stop travel services and improving user experience;

The second is to invest in technology to consolidate Ctrip’s leading market position in the field of products and services and improve operating efficiency;

The third is for general corporate purposes.

Epidemic hit last year’s total income halved

As a tourism company that bears the brunt of the new crown epidemic, Ctrip 2020PerformanceSuffered a huge impact.

According to the prospectus, Ctrip’s total revenue in 2020 was 18.3 billion yuan, compared with 35.7 billion yuan in 2019, a year-on-year decrease of 49%, and a net loss of 3.3 billion yuan was recorded. This is mainly due to the restrictions on domestic and international travel caused by the new crown epidemic, resulting in the convenience of users to cancel reservations and refund requirements, resulting in huge incremental costs and expenses, and investment losses recognized by the equity method.

However, Ctrip emphasized that although the duration and development of the epidemic are difficult to predict, compared with the first two quarters of 2020, its performance in the third and fourth quarters of 2020 has improved overall (in terms of revenue and grossinterest rateAnd other key financial indicators), and turned losses into profits.Net profit(Benefit from China’s control of the new crown virus epidemic since the third quarter of 2020).

It is reported that as social and economic activities in China gradually return to normal from the new crown virus epidemic, people’s demand for short-distance travel, local travel, domestic boutique and high-end accommodation experience is gradually emerging. Ctrip has launched targeted new products for this purpose, and Achieve a strong recovery in domestic travel business.

According to data, as of the end of 2020, the number of Ctrip’s event ecosystem partners in destinations has increased by about 25% year-on-year. In the fourth quarter of 2020, the total amount of hotel merchandise transactions in Ctrip’s province increased by more than 20% compared with the same period in 2019, and the number of scenic spots and event bookings increased More than 100%.

On March 29, Ctrip held a press conference,Ctrip GroupCo-founder and chairman of the board of directors Liang Jianzhang announced the “tourism marketing hub” strategy, planning to use a planet number as a carrier to aggregate the three core sectors of traffic, content, and commodities, aiming to create new transaction scenarios, through content conversion and marketing empowerment It can create incremental revenue for the pan-tourism industry and help industry partners to manage their own private domain traffic.

Its CEO Sun Jie emphasized that although the global epidemic situation is still not to be underestimated, the global vaccination volume has increased rapidly since the end of last year and has so far exceeded 300 million doses. According to the forecast of China Tourism Academy, the inbound and outbound tourism market is expected to start in an orderly manner in the second half of the year. At that time, Ctrip will continue to compete in the international market with the content-based experience accumulated in the domestic market and form a unique competitive advantage.

U.S. stocks have fallen continuously recently

However, under the good news of the launch of the Hong Kong stock IPO, Ctrip’s US stock price did not rise as expected.

On the evening of April 8, Ctrip’s U.S. stock market fluctuated and fell all the way after the market opened. It once fell to US$37.97, a decline of 2.16%. Although there was a subsequent rebound, as of about 11 p.m. Beijing time, its U.S. stock price was reported to be US$38.42, a decrease of 1%, and its market value also shrank to about US$23 billion, or about RMB 150 billion.

Prior to this, Ctrip’s stock price had fallen for two consecutive days. Even on April 6, when it passed the Hong Kong stock hearing, the US stock price rose slightly by 1.23% to close at $40.18. As of the close on April 7, Ctrip’s US stocks closed at US$38.81, a decrease of 3.41%, and this price has fallen by about 14% compared to the high of US$45.19 on March 17.

In fact, perhaps due to the performance recovery, Ctrip’s U.S. stock price has risen all the way since early February, from 31.15 US dollars to a maximum of 45.19 US dollars, but in mid-March, it was accompanied by a collective correction in the Chinese concept stock market, and recently it was around 40 US dollars. Shock.

In this regard, some analysts pointed out that Ctrip’s attempt to achieve valuation revaluation through the secondary listing of Hong Kong stocks still needs to solve four major issues:

The first is industry competition. Fliggy and Meituan have developed strong momentum in recent years. Relying on the advantages of Alibaba’s traffic and local life service platforms, they competed fiercely with Ctrip from different levels to continuously seize market share.

Second, the domestic and foreign tourism industry has been hit hard by the epidemic, and it will take time for a full recovery.

Third, previous related complaints about big data acquaintance have also affected the brand reputation and user reputation to a certain extent.

Fourth, the company currently lags behind in its rejuvenation layout, and its follow-up development still needs to be further strengthened.

Related reports:

Ctrip will sell 31.6 million shares in the Hong Kong IPO and will be listed on the Hong Kong Stock Exchange on April 19

Countdown to Ctrip’s second listing! But recently it’s a little bit “cold” to fight a new race

(Article Source:BrokerageChina)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.