原标题:深圳主板,中小板今天合并,并澄清了开业前的六个主要问题!

概括

[ShenzhenMainBoardsmallandmedium-sizedboardtodaymergedsixmajorissuesbeforetheopeningofthefirstclarify!】TodaytheShenzhenStockExchangemainboardandthesmallandmedium-sizedboardformallymergedtoformanewmarketstructureconsistingofthemainboardandtheChiNextRegardingthe”twoboardmerger”theinterviewedinstitutionsgenerallybelievethatthesmallandmediumboardhaslongundertakentheIPOfinancingfunctionoftheShenzhenmainboardforalongtimewhichhasobvioustransitionalattributesandthismergerwillnothaveanabnormalimpactonthesecondarymarket

Today, the Shenzhen Stock Exchange’s main board and the small and medium-sized board formally merged to form a new market structure consisting of the main board and the ChiNext. Regarding the “two board merger”, the interviewed institutions generally believe that the small and medium board has long-term undertaking the IPO financing function of the Shenzhen main board, which has obvious transitional attributes, and this merger will not bring abnormal effects to the secondary market.

What does “two unifications and four unchanging” mean?

The overall arrangement for the merger of the two boards is “two unified, four unchanged”.

“Two unifications” refers to the unification of the business rules of the main board and the small and medium-sized boards, and the unified operation and supervision mode.

“Four unchanged” refers to the unchanged issuance and listing conditions after the merger, the investor threshold remains the same, the trading mechanism remains the same, and the securities code and abbreviation remain unchanged.

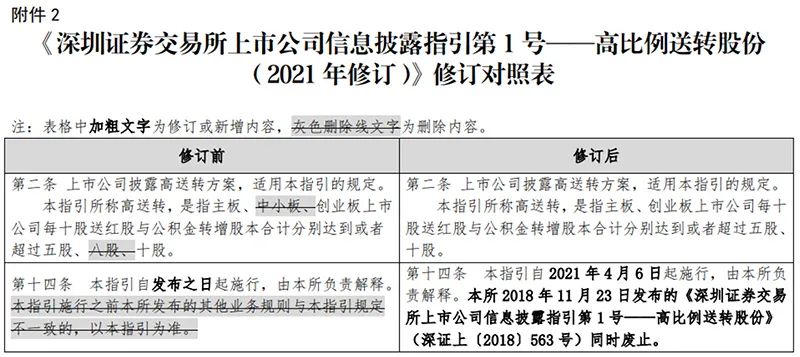

What are the integrations of regulatory rules?

In the process of integrating business rules for the merger of the two boards, the Shenzhen Stock ExchangeMargin tradingSeven rules including transaction implementation rules and guidelines for high-end transfers have been adaptively revised, and two notices have been abolished, mainly involving the deletion of relevant expressions on the small and medium-sized boards, unification of the definition of high-end transfers, adjustment of relevant trading indicators to calculate benchmark indexes, and cancellation of continuous supervisory commissioners System and so on. The above adjustment arrangements will take effect when the merger of the two boards is implemented on April 6.

What are the adjustments starting today?

The Shenzhen Stock Exchange reminded that the following adjustments will take effect on April 6th:

First, regarding the types of securities. The securities category of the original small and medium-sized board listed company was changed to “Main Board A shares”, and the securities code and securities abbreviations remained unchanged.

Second, regarding the securities code interval. The stock code interval of the original small and medium board “002001-004999” is used by the main board, and the A-share code interval of the Shenzhen main board is adjusted to “000001-004999”.

Third, regarding index adjustments. The name adjustments of the original SME Board Index, SME Board Composite Index, and SME Board 300 Index will take effect from the formal implementation of the merger. There will be no substantial changes to the index compilation method, and no sample adjustments are involved, so the actual impact is very small.

Fourth, on the market display. There is no longer a small and medium board stock area for front-end interfaces such as trading and market display.

What is the scale of the new deep motherboard?

As of April 2, there were 468 listed companies on the Shenzhen Main Board, with a total market value of about 10 trillion yuan; there were 1,004 listed companies on the small and medium-sized board, with a total market value of 13.4 trillion yuan. After the merger of the two boards, the number of Shenzhen main board companies accounted for about 35% of the total number of A-share listed companies; the total market value of the Shenzhen main board exceeded 23 trillion yuan, accounting for about 30% of the A-share market.

Will the company’s valuation change?

In this regard, research institutions generally believe that the impact will not be significant.

“From the overall grossinterest rateHejinginterest rateIn terms of level, revenue and profit growth, many indicators of the original SME board and the Shenzhen main board are very close. Said Sun Jinju, assistant to the president of Kaiyuan Securities and director of the research institute.

Although the main board and the original small and medium board P/E ratios have certain differences, the valuation differences between the two are mainly due to structural differences such as industry types. Therefore, the valuation after the merger will not fluctuate significantly. Even for different companies in the same sector, due to factors such as company size, industry type, profitability, growth characteristics, and investor expectations, it is normal for companies to have certain differences in valuation levels.

Open source securities statistics show that before the merger of the two boards, in terms of price-to-earnings ratios, the average PE (TTM) of the Shenzhen main board, small and medium-sized board, and GEM companies were 27.4, 33.3, and 58 times, respectively, and the median was 20.7, 26.6, and 38.4 times, respectively. . In terms of price-to-book ratio, the average PB of the Shenzhen main board, small and medium-sized board, and GEM companies are 2.2, 3.2, and 5 times, and the median is 1.7, 2.4, and 3.4 times, respectively.

“Valuation levels of various sectors vary greatly, mainly due to the different types and structures of listed companies in different sectors, rather than the naturally different valuation premiums of the sectors themselves. Therefore, after the merger of the small and medium-sized board and the Shenzhen main board, the difference in valuation of listed companies is not the same. There will be obvious convergence because of this.” Sun Jinju thinks.

Will the pace of market release be accelerated?

Qianhai Open SourcefundExecutive General Manager Yang Delong said: “After the merger of the two boards, the issuance and listing conditions remain unchanged. There will be no new listing channels for companies, and no changes to the issuance rhythm. It will not cause market expansion or speed up the issuance rhythm, which will have a greater impact on the overall stock market. small.”

In addition, in the view of some research institutions, the original SME board was operated under the main board system. Therefore, there is no fundamental difference between the SME board and the Shenzhen Main Board. In terms of many fundamental indicators, there is no clear boundary between the small and medium board and the main board, so that this merger will not bring major fluctuations.

Related reports:

The Shenzhen Stock Exchange Main Board and the Small and Medium-Sized Board Merged to Deepen the Reform of the Stock Market and Make Another Strike

The merger of the small and medium-sized boards on the main board of Shenzhen Stock Exchange will not cause significant fluctuations in valuation

Shenzhen Stock Exchange’s main board small and medium-sized board today has a clearer merger market pattern

The merger of the Shenzhen main board and the small and medium-sized board will affect the geometry

(Source: Shanghai Securities News)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.