原标题:私募股权巨头朱雀(Suzaku)入股! 隆基正式进入氢能源市场。 光伏行业将面临什么变化?

概括

[PrivateequitygiantSuzakubecomesashareholder!WhatchangeswillLongifacewhenitofficiallyentersthehydrogenphotovoltaicindustry?】OnApril5theindustrialandcommercialregistrationsystemshowedthatXi’anLongjiHydrogenTechnologyCoLtdwassuccessfullyregisteredonMarch312021TheshareholderswereXi’anLongjiGreenEnergyVentureCapitalManagementCoLtdandShanghaiZhuqueyingPrivateEquityInvestmentFundPartnership(Limited)Partnership)LONGifounderLiZhenguopersonallyservedaschairmanandgeneralmanagerItmarksthe400billionphotovoltaicleader-Longjiofficiallyenteredthehydrogenenergymarket(21stCenturyBusinessHerald)

On April 5, the industrial and commercial registration system showed that Xi’an Longji Hydrogen Energy Technology Co., Ltd. was successfully registered on March 31, 2021.shareholderInvested in Xi’an Longji Green Energy Venture Capital Management Co., Ltd. and Shanghai Zhuqueying Private EquityfundPartnership (Limited Partnership), LONGi founder Li Zhenguo personally served as chairman and general manager. It marks the 400 billion photovoltaic leader-Longji officially entered the hydrogen energy market.

Ups and downs in stock prices

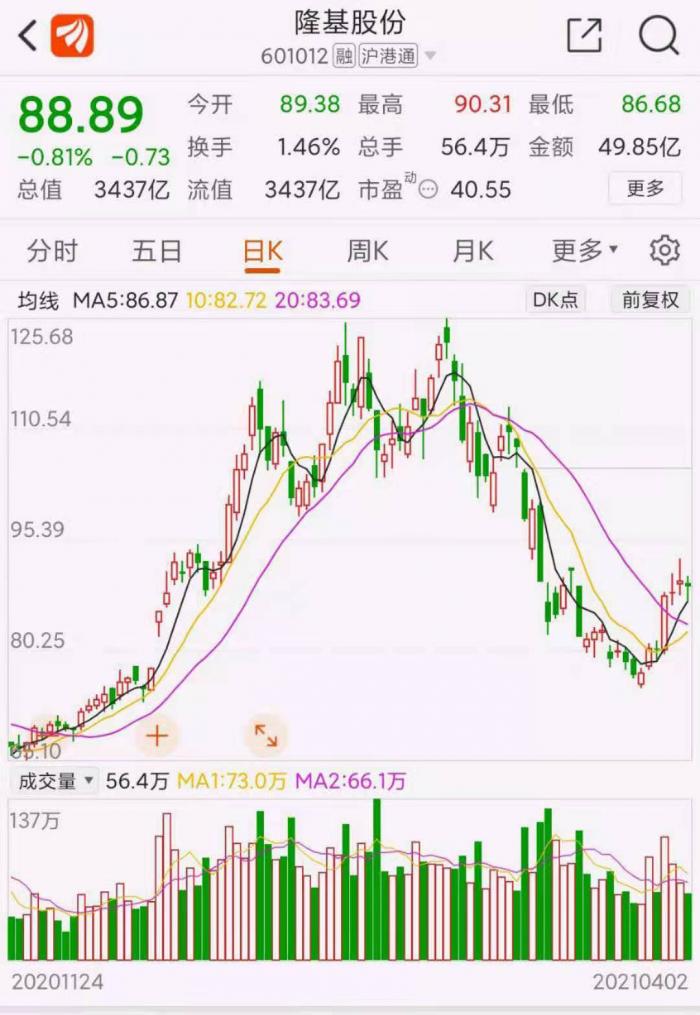

In the past year,Longji sharesBecome a “bull stock” in the photovoltaic sector and even the entire A-share market. The cumulative increase of nearly 275% throughout the year gave this company the title of “Photovoltaic Moutai”.

December 20, 2020Longji sharesannouncement, Li Chun’an, a shareholder of the company holding more than 5% of the shares, intends to transfer his 6% of the company’s shares to Hillhouse Capital through an agreement transfer. The transfer price per share for this transaction is 70 yuan. The total consideration for this transaction is 15.841 billion yuan.After Hillhouse Capital became a shareholderLongji sharesThe total market value once exceeded 440 billion yuan, and the stock price continued to rise. On February 18 this year, LONGi’s stock hit the highest price in the range of 125.68 yuan per share, which was 477.8% higher than the company’s low share price in 2020.

Later, it ushered in the weakness of institutional holdings, and Longji shares, the leader of the photovoltaic sector, once fell to a limit. Since February 18, the company’s stock has fallen rapidly. In less than a month, the stock price has fallen by more than 35%, and there have been two lower limits during the period.

The latest closing price showed that Longi’s share price was 88.89 yuan, down 0.81% from the previous trading day.

Even the “carbon peak and carbon neutral” work was written into the 2021 “Government Work Report”, the major good news has not suppressed the momentum of the decline in stock prices.

Raw materials are in short supply

On the other hand, at the end of last year, the price of silicon, an important material for photovoltaics, rose sharply. Entering 2021, photovoltaic giants will continue to rush to purchase upstream materials. Longji shares performed most positively.

In fact, ensuring the supply of upstream materials has become the top priority for leading photovoltaic companies since 2021. According to the statistics of 21st Century Business Herald reporters, since this year, including Longji shares,Zhonghuan、Oriental Risen、Chint ElectricSigned purchases of polysilicon, photovoltaic glass and silicon wafers with relevant partnerscontract。

The rise in the price of silicon materials has brought many challenges to Longji.

Prior to this, Longi shares were caught in a layoff storm. Subsequently, it responded that the production line was deployed mainly because of the impact of the staged supply of upstream raw and auxiliary materials. In this regard,CITIC SecuritiesIt was predicted that the short-term and medium-term supply of silicon materials would be limited, and the release of production capacity would be slow. In 2021 and 2022, silicon materials will be in short supply.

On March 29, Longi said on the interactive platform that the recent increase in the price of silicon materials in the industry has caused the cost of the downstream industry chain to rise, and most companies in the industry have digested it by raising product prices. It will take a certain time for customers to accept changes in the price of the industry chain. . In the short term, it is time to test each company’s comprehensive capabilities, which is conducive to the improvement of the concentration of leading companies. In the long run, the entire supply chain will return to the stage of dynamic equilibrium, and there is a lot of room for industry demand.

“Photovoltaic + Hydrogen Energy”

In fact, Longi’s entry into Hydrogen Energy is not accidental.

Held in Beijing on March 16, Jiang Dongyu, general manager of Longji’s Strategic Management Center, pointed out in a keynote speech at the “Sixth China Energy Development and Innovation Forum” that in the future, the demand for hydrogen energy will be very substantial, and green hydrogen will promote the photovoltaic industry. Rapid growth.

As the cleanest energy source in the world, hydrogen has the characteristics of high combustion calorific value.gasoline3 times that of alcohol, 3.9 times that of alcohol, and 4.5 times that of coke. Among the many “photovoltaic +” models, “photovoltaic + hydrogen energy” is generally optimistic.

Jiang Dongyu pointed out that replacing oil and natural gas energy with clean photovoltaic power and hydrogen will significantly reduce carbon dioxide emissions. “Currently, about 70% of the world’s greenhouse gases come from traditional fossil fuels, and the IEA predicts that global energy demand will increase by 54% in 2050,” he said. In order to limit global warming in this century to below 1.5°C, the IPCC line proposed The consumption of low-carbon and zero-carbon energy needs to be increased. As zero-carbon power and clean energy power carriers, photovoltaics and hydrogen can play a huge role in reducing CO2 emissions.

“The future demand for hydrogen energy is considerable, and green hydrogen will promote the rapid growth of the photovoltaic industry.” Jiang Dongyu pointed out that by 2050, global hydrogen demand will reach 600 million tons/year to 800 million tons/year. According to this expectation, the next 30 years In 2015, the global annual increase in hydrogen production capacity was about 25 million tons, which will bring about 900 GW of new photovoltaic installed capacity annually, thus forming a trillion-level market.

To further promote the development of the photovoltaic industry, Jiang Dongyu suggested that the goal of high clean energy should continue to drive carbon peak carbon neutrality; make full use of hydropower and other regulating resources to speed up the flexible transformation of coal power; support photovoltaic and other green power to produce hydrogen, and encourage green hydrogen Coupling with multiple industries; guiding the domestic traditional energy industry to actively plan for strategic transformation; introducing a carbon tax in a timely manner, and the tax rate can be low first, then high, and gradually strengthened.

Related reports:

What is the answer to Longi’s chess-playing with the “dual-carbon” solution?

Longi officially enters the hydrogen energy market: founder Li Zhenguo personally leads the team

(Source: 21st Century Business Herald)

(Editor in charge: DF142)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.