原标题:惊呆了! 百亿私募也购买了公开募股。 Yang Dong和其他产品的收入是多少?

概括

[Stunned!WhatistheincomeoftensofbillionsofprivateplacementstobuypublicplacementssuchasYangDong’sproducts?】In2020publicfundswillbehotandtensofbillionsofprivateequitywillalsobuypublicfunds!Withthedisclosureofthefund’sannualreportthefundmanagerwassurprisedtofindthatmanytensofbillionsofprivateequityincludingNingquanAssetsYingshuiInvestmentLinyuanInvestmentandYonganGuofuareactuallybuyingpublicfundsThesetensofbillionsofprivateplacementsarerelativelywell-knowninthemarketandhavestronginvestmentcapabilitiesWhydotheybuypublicplacements?Let’stakealookatthefund(ChinaFundNews)

Public Offering in 2020fundHot, tens of billions of private placements also buy public placements!

With the completion of the fund’s annual report, the fund manager was surprised to find that Ningquan Assets, Yingshui Investment, Linyuan Investment, Yongan Guofu and many other tens of billions of private equity are actually buying public funds. These tens of billions of private placements are relatively well-known in the market and have strong investment capabilities. Why do they buy public placements? Let’s take a look at the fund.

Why Ningquan Assets Purchased Public OfferingLOF?

Yang Dong, the head of ten billion private equity Ningquan Assets, used to serve as the general manager of Xingquan Fund. In 2007, the stock market 6,000 points persuaded investors to redeem the fund. In 2015, the stock market was high and publicly shouted risks, urging everyone to buy funds cautiously. Conscience of the industry”. Yang Dong founded Ningquan Assets by “Ben Private Equity” in 2018, and his style has always been very stable.

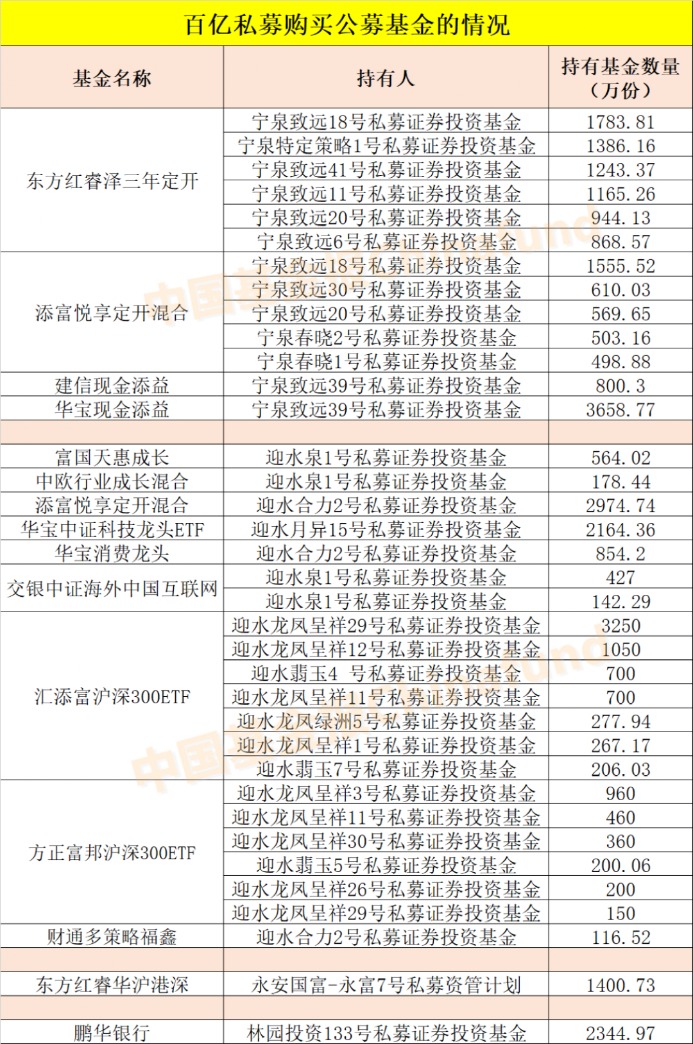

The recently disclosed fund annual report shows that among the top ten holders of Oriental Red Ruize’s three-year fixed A (LOF), 6 private equity funds under Ningquan Assets have appeared, holding a total of 73,313 million shares. It accounts for 6.65% of the total market share. Among them, Ningquan Zhiyuan No. 18, Ningquan Specific Strategy No. 1, Ningquan Zhiyuan No. 41, and Ningquan Zhiyuan No. 11 private equity products have bought more than 10 million shares of Dongfanghong Ruize.

In fact, as early as the 2020 semi-annual report was disclosed, Ningquan Assets firmly held the fund. The latest annual report shows that there is also a private equity subsidiary of Ningbo Wankun Investment’s Wankun Oriental Dianyu Index Enhancing No. 1, which also holds 9,789,100 copies of Dongfanghong Ruize, accounting for 0.88% of the total listing.

Dongfanghong Ruize is a three-year fixed fund, managed by Sun Wei, senior fund manager of Dongfanghong Asset Management. It was established on January 31, 2018. After three years, it has a cumulative net value of 1.91 as of April 2, 2021. yuan. The fund was listed in October 2018, until the first closed period expires in 2021, and will be open for subscription and redemption on February 1.

At the same time, Ningquan Assets also holds Tianfuyue Enjoy Fixed-opening Hybrid (LOF), which is more popular with private equity. The annual report of the fund shows that its top ten on-market share holders have 5 funds under Ningquan Assets. , Holding a total of 37,372,400 shares, accounting for 17.10% of the total market share; among them, Ningquan Zhiyuan No. 18 holds more than 15 million shares.

Another tens of billions of private equity fund Yingshui Heli No. 2 holds 29,747,400 shares of the fund, accounting for 13.62% of the total listed shares. There is also a private equity company, Command No. 201, which holds 10,731,500 shares of the fund, accounting for 4.91% of the total listed shares.

Tianfuyue enjoy fixed-open mixed fund was established on January 31, 2019, byChina Universal FundManager Zhao Pengfei, who is known as a “stock picker”, has a relatively stable style. As of April 2, the fund’s return rate has reached 45.27% since its establishment. Tianfu Yuexiang was listed in July 2019, and the closed period is two years. It will open for redemption on February 1 this year.

In addition, the funds of Ningquan Assets also hold several Huabao Cash Tianyi and CCB Cash Tianyi.Monetary Fund. The fund manager found that compared with the half-year of 2020, Ningquan Assets has already withdrawn from the list of the top ten LOF holders at the end of 2020, such as CEIBS Hengli, Yinhua Ming’s Multiple Strategy, and Oriental Hongruixi.

About why Ningquan Assets buys public offering fund products? Some insiders analyzed that the high probability should be to grasp the low-risk on-court profit opportunities.

An insider in Shanghai’s private equity industry said that observing its holdings, the main purchases are LOF funds with discounts on the market, and they are all products of outstanding fund managers who are good at active management and value investment. “The products have a two- to three-year closed period. Arbitrage through some LOF funds with large on-site and off-market price differences, the premise is to have a sufficient understanding of the fund manager and believe that he has the ability to make the fund back, and the net worth will continue to hit new highs in the future.”

He also said that last year the A-share market experienced events such as the epidemic and fluctuated greatly. When the market sentiment was weak, the discount rate of the funds on the market was often higher. Buy at this time and sell when the market sentiment recovers.Fund equityIncreases and discounts converge, the income will be better. And some funds with closed periods tend to continue to narrow the discount rate when their maturity date approaches. For example, several funds bought by Yang Dong have their maturity dates at the beginning of this year.

Another private equity investor told the fund that they had participated in the arbitrage of a product managed by a well-known fund manager. The fund had a discount of 10 points on the market, and they continued to buy at 5 or 6 points. Low-risk investment opportunities in China are also very attractive.

Yingshui Investment aggressively bought multiple listed funds

In the market withMake a newThe well-known new tens of billions of private equity investment, seem to prefer to buy public fund products. From the annual report of the fund, it can be seen that they have bought the stocks LOF managed by many star fund managers such as Fortune Tianhui Select Growth and China Europe Industry Growth. , Also bought HuitianfuCSI 300ETF, Fortune China Securities Technology Leading ETF, Founder Fubon CSI 300 ETF and many other ETFs, as well as Fortune China Securities Consumer Leading, Bank of Communications China Securities Overseas China Internet and other passive index LOFs.

According to the fund’s annual report, Yingshuiquan No. 1 Private Equity by Yingshui Investment ManagementStock investmentThe fund is the largest holder of Wells Fargo Tianhui Growth (LOF), holding 5.6402 million shares, accounting for 0.92% of the total listed shares.

The fund manager of Fortune Tianhui Growth isWells Fargo FundSenior veteran Zhu Shaoxing, the fund is recognized by the market as a bull base, with a return rate of 65.57% in the past year and 87.93% in the past three years. Judging from its heavy stocks, includingZhifei Bio、Yili shares、Kweichow Moutai、SF Holdings、Ping An of China、Wuliangye、National Porcelain Materials、Bank of Ningbo、Gree Electric、Luxshare Precision。

Yingshui Investment also boughtChina Europe FundThe Sino-European Industry Growth Mix (LOF) managed by Wang Pei, a star fund manager and good at growth investment, Yingshuiquan No. 1 Private Equity Securities Investment Fund holds 1,784,400 shares, accounting for 3.30% of the total listed shares, making it the largest holder.

Judging from the fund’s performance, the China-Europe industry has achieved a yield of 53.91% in the past year and a yield of 105.52% in the past three years. The top ten positions includeLongji shares、Mango Super Medium、Wuliangye、Midea Group、SF Holdings、Wanhua ChemicalWait.

In addition, Yingshui Investment also bought some passive index funds, including ETFs, most likely to grasp the trending opportunities in related industries and sectors.

For example, Yingshui Investment bought two wide bases, its 7 private equity funds bought a total of 64,511,400 shares of China Universal CSI 300 ETF, and six funds held a total of 23,300,600 shares of Founder Fubon CSI 300 ETF.

Yingshui Investment also bought a number of passive index funds in the industry. For example, it holds 21,643,600 leading ETFs of Fortune China Securities Technology and 8.542 million for leading consumption of Fortune.In addition, Yingshui Investment also bought the Bank of Communications and China Securities Overseas China Internet Index (LOF). The fund’s main positions are the Internet giants listed in the US and Hong Kong stocks, such as the newly disclosed positions, includingTencent Holdings、Pinduoduo、Alibaba, Meituan,Jingdong、Baidu、NetEase、Bilibili、Good future、shell。

Yongan Guofu sticks to Dongfanghong Ruihua

Lin Yuan buybankLOF

Yongan Guofu, a tens of billions private equity firm that specializes in multi-strategy investments, has always been in love with Dongfang Hongruihua Shanghai, Hong Kong and Shenzhen (LOF). In the first half of 2017, the private equity asset management plan of Yongfu No. 7 appeared among the top ten holders of the fund for the first time. . By the end of 2020, it still holds 14,073 million copies, accounting for 8.55% of the total market share, making it the largest holder.

Dongfanghong Ruihua Shanghai, Hong Kong and Shenzhen was established in August 2016, with a return rate of 181.61% since its establishment, and a return rate of 55.71% in the past year; the fund was previously managed by star fund manager Lin Peng and won the active equity fund year in 2017 champion.

Lin Yuan Investment, which is at the helm of the “private stock god” Lin Yuan, will hold Penghua Zhongzheng at the end of 2020bankIndex (LOF), Linyuan Investment No. 133 Private Securities Investment Fund holds 23,449,700 shares, accounting for 1.12% of the total listed shares.

Actually, Lin Yuan had expressed his disapproval beforebankStocks, banks, and real estate must resolutely avoid. So why did he buy bank LOF? The fund manager once interviewed Lin Yuan. He responded to this. He is not optimistic about bank stocks for a long time, and the risk is very high. But this time I bought it from a special company account, I didn’t pay much attention to it, and the amount was not large. Stock trading is very flexible. Optimistic or not optimistic is relative. If there is a short-term arbitrage, the opportunity to bend over to pick up money will also participate.

Some insiders reminded that most of the tens of billions of private equity purchases are listed funds, mainly for arbitrage, seizing industry investment opportunities, etc., and it is the data at the end of the fourth quarter of last year. Investors should not copy their homework at will.

(Source: China Fund News)

(Editor in charge: DF506)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.