原标题:特斯拉Q1的交付量是“魏小立”的4倍,谁能在高压下突破?

概括

[Tesla’sQ1deliveryvolumeis4timesthatof”WeiXiaoli”Whocanbreakthroughunderhighpressure?】OntheeveningofApril2Tesla(TSLAUS)announceditscarproductionandsalesforthefirstquarterof2021DatashowsthatfromJanuarytoMarchthisyearTesladeliveredatotalof184800electricvehiclesexceedingthe173000previouslypredictedbyWallStreet;itproducedmorethan180000electricvehiclesallModel3andModelY(RedStarCapitalBureau)

In the evening of April 2,Tesla(TSLA.US) announced its auto production and sales for the first quarter of 2021. The data shows that from January to March this year,TeslaA total of 184,800 electric vehicles were delivered, exceeding the 173,000 previously generally predicted by Wall Street; more than 180,000 electric vehicles were produced, all Model 3 and Model Y.

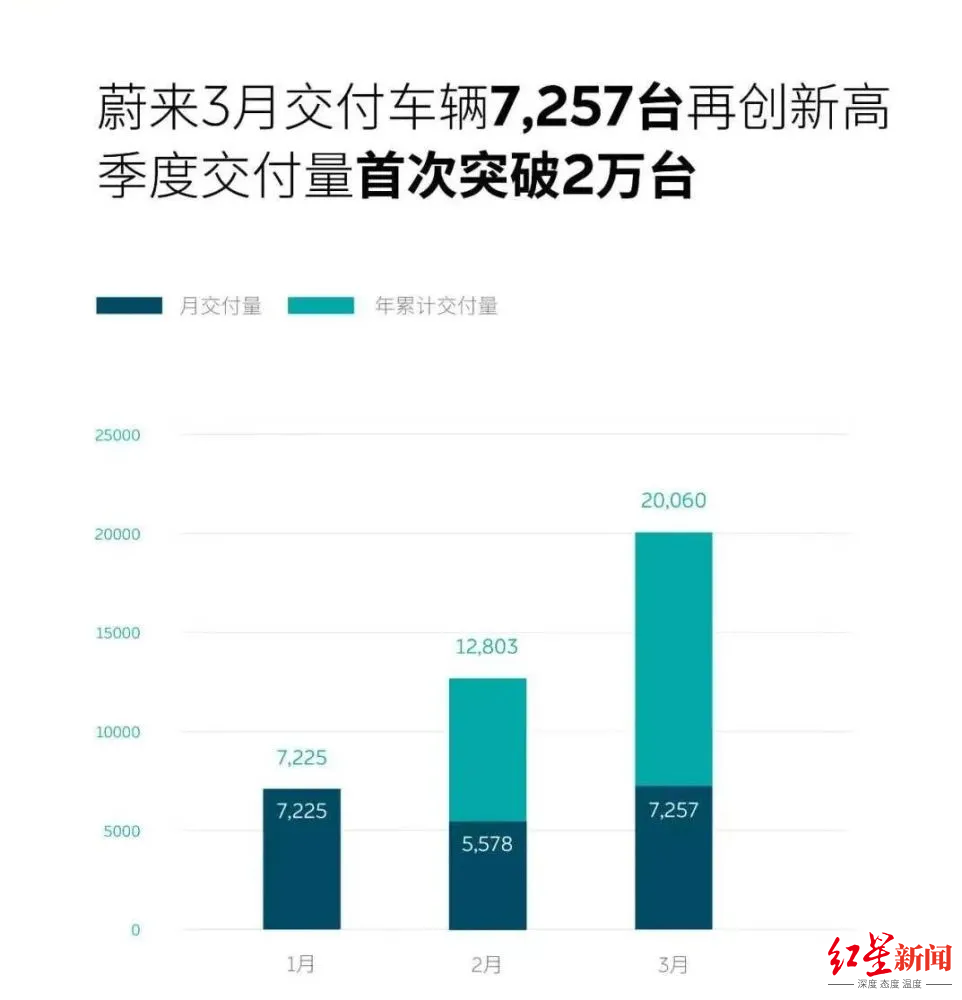

Earlier,Wei Lai(NIO.US), Ideal (LI.US), and Xiaopeng (XPEV.US) have also announced their first quarter delivery results.Wei LaiThe best performance, more than 20,000 vehicles, the ideal Xiaopeng is not far, the growth rate of the three companies has reached more than 300%, and the results are outstanding.

But even so, the delivery volume of the three new forces in the first quarter was not as good asTeslaA quarter. Jia Xinguang, a member of the Expert Committee of the China Automobile Dealers Association, said in an interview with the Red Star Capital Bureau: “The real battlefield for new energy has not yet arrived, and the three new forces are not Tesla’s opponents.”

Tesla delivered 184,800 vehicles

99% are Model 3 and Model Y

On the evening of April 2, Tesla announced its car production and sales for the first quarter of 2021. Data shows that from January to March this year, Tesla delivered a total of 184,800 electric vehicles, exceeding the previous Wall Street consensus forecast of 173,000. Sales increased by 109% year-on-year, setting a new delivery high.

Among them, Model 3 and Model Y accounted for 99% of deliveries. According to Tesla’s official website, if you book Model Y now, you will have to wait until after June at least to pick up the car. The deliveries of Model S and Model X were 2020, accounting for only about 1% of the total delivery in the first quarter, a sharp drop of 89% from the previous quarter.

In addition, the Red Star Capital Bureau noted that Tesla produced more than 180,000 electric vehicles in the first quarter, all of which were Model 3 and Model Y, while the production of high-end models Model S and Model X was zero. In response, Tesla responded that the reason why it did not produce any Model S and Model X models in the first quarter was that new equipment was being installed and tested during the quarter to produce updated versions of high-end models. It is currently in the early stages of production capacity increase. stage.

In the first quarter of this year, Tesla experienced a series of impacts such as the fire at the Fremont factory in California, the short-term closure of the factory caused by the shortage of global automotive chips, the impact of the new crown epidemic on port capacity, and the price increase of some models at home and abroad. The delivery capacity remains confident.

“Tesla delivered about 500,000 vehicles last year, and this year’s plan should be 800,000-850,000 vehicles. I think this goal should be achievable.”

Jia Xinguang, a member of the Expert Committee of the China Automobile Dealers Association, told Red Star Capital Bureau: “Tesla’s market value is so high because it fulfills its promises better. Last year it almost completed 500,000 vehicles (the actual difference is 400). This year, Shanghai The production capacity of the factory is increased, and the Texas factory may be built, coupled with the high probability that Tesla will launch new models, it should be no problem to complete the production capacity of 850,000 vehicles.”

At the same time, Jia Xinguang talked about the reason for Tesla’s frequent price cuts, in addition to the official call of “cost reduction, to benefit consumers”, it is also an act of lowering prices in exchange for market share to impact sales. The recent increase in the prices of domestic Model Y and foreign Model 3 may indeed indicate that Tesla has encountered a shortage of chips.

According to China Business News, Li Shaohua, deputy secretary-general of the China Association of Automobile Manufacturers, said that in the short term, the shortage of automotive chips is a problem of the imbalance of market supply and demand. In the short term, it cannot be adjusted by non-market means. It is expected that the supply and demand of automotive chips will be imbalanced. Will continue until the third quarter of this year.

Wei LaiSales are rising, ideals fall behind

At the beginning of April, the three new forces of Weilai, Xiaopeng, and Ideal also handed in their answers for the first quarter delivery.

The largest delivery volume was Weilai Automobile, which delivered 2,060 vehicles in the first quarter, a year-on-year increase of 423%;Xiaopeng MotorsRanked second, but with the fastest year-on-year growth rate, with a delivery volume of 13,340 vehicles, a year-on-year increase of 487%;Ideal carSales growth lags behind, with 12,579 deliveries, a year-on-year increase of 334.4%.

It’s worth noting that just a week before Weilai announced its March delivery data, Weilai had a suddenannouncementSaid that due to the shortage of chips, production was temporarily suspended for 5 working days, and the delivery forecast for the first quarter was also lowered, from the previous 20,000 to 25,000 to 19,500.

The performance of the three new forces may be better reflecting the problem by extending the timeline a little longer. In March 2020, Weilai, Xiaopeng, and Ideal provided delivery data of 1533, 1055, and 1447 respectively. This is the closest delivery volume of the three companies within a year. A year later, by March 2021, this number has become 7,257, 5102, 4900.

NIO’s delivery in March 2021

Xiaopeng’s delivery in March 2021

Ideal ONE delivery volume in March 2021

Why did Weilai’s delivery volume begin to surge within a year, Xiaopeng’s growth rate is extremely fast, and the ideal is falling behind? This may be inseparable from the production capacity of car companies and the positioning of models.

The data shows that of the 7,257 deliveries of NIO in March, 1,529 were ES8, 3152 ES6, and 2,576 EC6.Xiaopeng MotorsThere are also two cars, the P7 delivered 2,855 and the G3 delivered 2,247. There is only one ideal ON, and 4,900 vehicles were delivered in March.

In other words, the ideal ONE is the best-selling model in terms of the model itself, but it is hard to beat the four. The single product structure makes Ideal suffer a lot from the total delivery volume.Obviously Ideal is also aware of this problem. The fourth quarter of 2020 was more than a month ago.PerformanceAt the conference call, CEO Li Xiang made a clear statement: “Starting from 2022,Ideal carAt least two new products will be released to the market every year, and pure electric products will be delivered in 2023. The price range will also be expanded from the current 300,000 to 350,000 to 150,000 to 500,000. “

In contrast, the pricing of the three models of Weilai ranges from RMB 558,000 for the ES8 to RMB 368,000 for the EC6. This range is just in the blank range of major competitors. In the field of pure electric vehicles, Xiaopeng focuses on the market below 250,000. Tesla’s “moving” Model 3 and Mode Y are in the range of 250,000 to 350,000, and “high-end line” Model S and Model X are in the range of 700,000 to 1 million. . In this way, 400-700 thousand “luxuryThe price range of “Introduction to Cars” is just vacated for NIO to play.

The new energy war has not yet arrived?

18.48 vs. 4.59, this is the comparison data between Tesla and the sum of the deliveries of the three new powers. In other words, in the first quarter, Weilai Xiaopeng’s ideal delivery volume was less than a quarter of Tesla’s.

In addition, in the battle of new energy car companies,BYD(002594.SZ) also have to be mentioned.

The Red Star Capital Bureau learned that in March this yearBYDThe sales of new energy vehicles reached 23,000, even surpassing the sales of Weilai Automobile in one quarter. But in terms of topical heat,BYDThe frequency of hot search is obviously much lower than that of Tesla.

For quite some time, the three new forces maintained this strange and ambiguous relationship with Tesla. They wanted to compete with Tesla but did not want to be compared with Tesla. Weilai CEO Li Bin once said that Tesla is not an opponent of Weilai, “Tesla wants to be a new energy public, and what Weilai wants to do is the BBA high-end market.”

Jia Xinguang believes that Tesla’s future opponent may indeed be Volkswagen, but not because Tesla and Weilai “do not eat in the same bowl”, but because the real electric vehicle market war has not yet begun, and these traditional car companies Instead, the giants may be bigger opponents.

“Now we are in a time of changes in the electric vehicle market.” Jia Xinguang analyzed, “The first is the change of policy subsidies, from subsidy decline to the change of guiding market competition; secondly, large enterprises, including traditional enterprises and technology giants, are turning to electric vehicles. Cars increase the level of competition in the industry. Again, product changes. Tesla’s success has driven market confidence. Large companies, including Tesla, are now engaged in dedicated platformization, and even design different products for the high-end and low-end markets. Platform; Finally, the development of battery technology. Batteries are the ceiling of electric vehicles. If semi-solid batteries land in the next two years, the cost of lithium iron phosphate batteries will inevitably be further reduced, and market competition will become more severe.”

The Red Star Capital Bureau learned that the Volkswagen ID.4 series products have been officially launched in March and will be unveiled at the Shanghai International Auto Show in April. At that time, there may be more new energy models from traditional car companies on the stage. On the eve of the market situation, are new energy car companies jointly seizing the fuel vehicle market, or are traditional car companies turning their heads and entering the new energy blue ocean cannibalize the market? It is foreseeable that the war is imminent.

(Source: Red Star Capital Bureau)

(Editor in charge: DF062)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.