概括

[JustafterthedayaftertomorrowtheShenzhenStockExchangemainboardandthesmallandmedium-sizedboardwillmerge:Whatistheimpact?】KaiyuanSecuritiesreleasedanin-depthresearchreportonthemergerofthemainboardandthesmallandmedium-sizedboardThereportpointedoutthatalthoughtheactualimpactofthemergeroninvestorsislimitedithasimportanthistoricalsignificancefortheconstructionofmycountry’scapitalmarketAfterthemergertheIPOfunctionoftheShenzhenStockExchangeMainBoardwillberestoredandthecompetitivenessoftheShenzhenStockExchangeMainBoard+ChiNextBoardisexpectedtobesignificantlystrengthenedwhichwillformadislocationcompetitionwiththeShanghaiStockExchangeMainBoard+ScienceandTechnologyInnovationBoardstructurewhichwillhelptoformamoreefficientandclearerstructureAmulti-levelcapitalmarketsystemInadditionafterthemergeroftheShenzhenStockExchangemainboardandthesmallandmedium-sizedboardtheregistrationsystemwillbefullyrolledoutandonlytheShanghaiandShenzhenmainboardwillremainwhichwillalsomakeadvancepreparationsforthesubsequentfullimplementationoftheregistrationsystemforstockissuance(OpenSourceSecurities)

On March 31, the Shenzhen Stock Exchange announced that, with the approval of the China Securities Regulatory Commission, the Shenzhen Stock Exchange will formally implement the merger of the main board and the small and medium-sized board on April 6.

Open Source Securities releases depth on the merger of the main board and the small and medium-sized boardresearch reportAccording to the report, although the actual impact of this merger on investors is limited, it has important historical significance for the construction of my country’s capital market.

After the merger, the IPO function of the Shenzhen Stock Exchange Main Board will be restored, and the competitiveness of the Shenzhen Stock Exchange Main Board + ChiNext Board is expected to be significantly strengthened, which will form a dislocation competition with the Shanghai Stock Exchange Main Board + Science and Technology Innovation Board structure, which will help to form a more efficient and clearer structure. A multi-level capital market system.In addition, after the merger of the Shenzhen Stock Exchange main board and the small and medium-sized board, the registration system will be fully rolled out and only the Shanghai and Shenzhen main board will remain, which will also make advance preparations for the subsequent full implementation of the registration system for stock issuance.

Summary

Established for the transition to the ChiNext, the small and medium-sized board will undertake the long-term IPO financing function of the Shenzhen Main Board

The original intention of the establishment of the SME board was to achieve a smooth transition from the Shenzhen Stock Exchange Main Board to the ChiNext Board. Since it is set up within the main board of the Shenzhen Stock Exchange and operates under the framework of the main board system, it is not fundamentally different from the main board of the Shenzhen Stock Exchange. Instead, it undertakes the IPO financing function of the Shenzhen main board and the function of serving some large enterprises. As of the end of March 2021, the number of listed companies on the small and medium-sized board has reached 1,005, and the cumulative amount of IPO funds raised has reached 674.572 billion yuan, corresponding to the current total market value of 13.41 trillion yuan.The years of development of small and medium-sized boards have also given birth to many large market capitalization companies, among whichHikvisionThe total market value has exceeded 500 billion yuan. In addition, although the small and medium board is positioned to serve small and medium-sized enterprises, the GEM listing standards are more inclusive and the efficiency of IPOs after the registration system reform is higher. The financing service function for small and medium-sized enterprises is even stronger than that of the small and medium-sized enterprises. In this context, the merger of the Shenzhen Stock Exchange main board and the small and medium-sized board is a matter of course.

From a fundamental perspective, the transitional attributes of the small and medium-sized boards are equally clear, and many indicators are blurred with the main board of the Shenzhen Stock Exchange.

From a fundamental perspective, the Main Board is mainly geared towards mature companies, while the ChiNext Board serves growth-oriented innovative and entrepreneurial companies. Therefore, Main Board listed companies tend to be larger in size and have relatively stable profitability, but their growth rate is slower. Relatively small, but with better profitability and higher growth. The performance of listed companies on the SME board is between the Shenzhen Main Board and the ChiNext, and the transitional attributes are equally clear. In addition, in many fundamental indicators, the boundary between the small and medium board and the main board is blurred. As of March 31, 2021, the average market value of the Shenzhen Stock Exchange Main Board/Small and Medium-Sized Board/GEM listed companies was 209.7/130.3/107.2 billion yuan, and the median value was 62.7/47.8/432 billion yuan, respectively. In terms of revenue and profit scale, the Shenzhen main board is also significantly larger than the small and medium-sized board and the ChiNext. In terms of profitability, the ChiNext is clearly superior. The small and medium-sized board is between the ChiNext and the Shenzhen Main Board but is very close to the Shenzhen Main Board. In 2019, the gross of Shenzhen main board/small and medium board/GEM companiesinterest rateThe average is 24.7%/24.2%/28.2%, the median is 21.8%/26.2%/33.8%, and the netinterest rateThe average is 5.8%/4.6%/4.8%, and the median is 5.1%/6.5%/9.6%, respectively. In terms of growth, the difference between the Shenzhen Main Board and the SME Board is also lower than that of the ChiNext.2017-2019 of Shenzhen Main Board/Small and Medium-Sized Board/GEM companiesOperating incomeThe average CAGR was 10.4%/11.3%/13.8%, and the median was 5.8%/6.7%/14.3%, respectively.Net profitThe average CAGR was 10.8%/12.2%/19.4%, and the median was 7.6%/8.8%/14.7%.

The small and medium-sized board withdrew from the historical stage, and the multi-level capital market system will be more efficient under the dislocation competition

In addition to the gradual blurring of the boundary between the SME board and the Shenzhen main board, the vigorous development of the ChiNext has also gradually diminished the significance of the SME board as a transitional board.In this context, the Shenzhen Stock Exchange on March 31, 2021announcement, The main board of the Shenzhen Stock Exchange and the small and medium-sized board will formally implement the merger on April 6. Although the actual impact of this merger on investors is limited, it has important historical significance for the construction of my country’s capital market. After the merger, the IPO function of the Shenzhen Stock Exchange Main Board will be restored, and the competitiveness of the Shenzhen Stock Exchange Main Board + ChiNext Board is expected to be significantly strengthened, which will form a dislocation competition with the Shanghai Stock Exchange Main Board + Science and Technology Innovation Board structure, which will help to form a more efficient and clearer structure. A multi-level capital market system. In addition, after the merger of the Shenzhen Stock Exchange main board and the small and medium-sized board, the registration system will be fully rolled out and only the Shanghai and Shenzhen main board will remain, which will also make advance preparations for the subsequent full implementation of the registration system for stock issuance.

Risk warning: risk of policy changes, etc.

1. Established for the transition to the ChiNext, the small and medium-sized board will undertake the long-term IPO financing function of the Shenzhen Main Board

The original intention of the establishment of the SME Board (hereinafter referred to as the SME Board) is to achieve a smooth transition from the Shenzhen Stock Exchange Main Board to the ChiNext Board. Since it is set up inside the main board of the Shenzhen Stock Exchange and operates under the framework of the main board system, there is no fundamental difference between the small and medium-sized board and the main board of the Shenzhen Stock Exchange. In addition, although the small and medium board is positioned to serve small and medium-sized enterprises, the listing standards of the GEM are more inclusive and the efficiency of IPO under the registration system is higher. The function of financing for small and medium-sized enterprises is also stronger than that of the small and medium-sized board. In this context, the merger of the Shenzhen Stock Exchange main board and the small and medium-sized board will be a matter of course.

1.1. There is no fundamental difference between the small and medium-sized board and the main board of the Shenzhen Stock Exchange, and long-term undertaking of the IPO financing function of the main board of the Shenzhen Stock Exchange

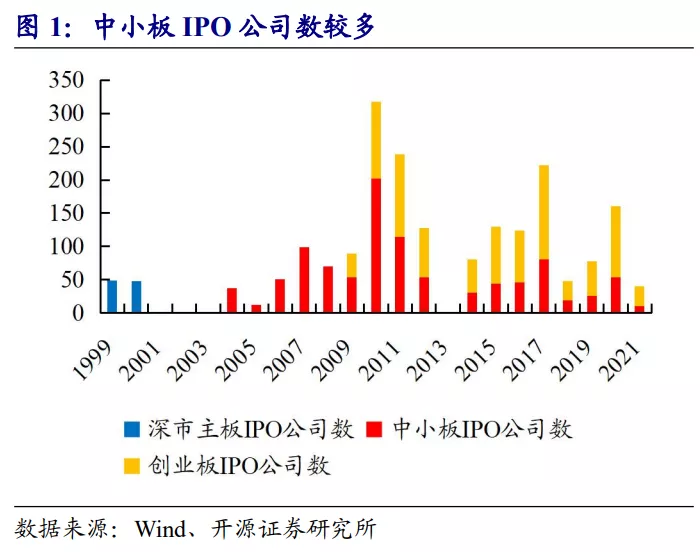

The SME board (hereinafter referred to as the SME board) has no fundamental difference in the operating system from the Shenzhen Stock Exchange Main Board. In fact, it has undertaken the IPO financing function of the Shenzhen Stock Exchange Main Board and some of the functions of serving large enterprises.In order to strengthen the capital market’s ability to provide financing services to small and medium-sized enterprises, the Shenzhen Stock Exchange began preparations for the establishment of the Growth Enterprise Market as early as 1999, and for this reason, suspended the Shenzhen Stock Exchange’s main board IPO in October 2000. However, due to historical constraints such as the insufficient development of the capital market, the launch of the ChiNext was once shelved, and the Shenzhen Stock Exchange turned to adopt a more prudent “step by step” strategy. Step by step” is the first step. Therefore, the establishment of the small and medium board has a transitional nature from the beginning. In order to better control reform risks, the small and medium board is set up inside the main board of the Shenzhen Stock Exchange, operates under the framework of the main board system, and keeps pace with the main board in terms of the company’s IPO standards. Therefore, there is no fundamental difference between the SME board and the Shenzhen main board at the beginning of its establishment. For a long time, the small and medium board has in fact undertaken most of the IPO financing functions of the Shenzhen main board. As of the end of March 2021, the number of listed companies on the small and medium board has reached 1,005, corresponding to a total market value of 13.41 trillion yuan. The number of listed companies and the total market value are 2.19 times and 1.35 times that of the Shenzhen main board, respectively. Since the opening of the market in 2004, the small and medium-sized board has achieved a total of 674.572 billion yuan in IPO funds. In addition, although the small and medium-sized board is positioned to serve small and medium-sized enterprises, in practice, the years of development of the small and medium-sized board have also bred many large market value companies.Among the top 10 companies with the largest market capitalization on the Shenzhen Stock Exchange Main Board and SME Board, 4 of them are from the SME Board.HikvisionThe total market value has exceeded 500 billion yuan.

1.2. The Growth Enterprise Market is more inclusive, and the financing service function for SMEs is better than that of SMEs

After the reform of the registration system, the ChiNext is more inclusive and more efficient in IPOs, and outperforms the small and medium-sized enterprises in terms of financing services for SMEs.From the perspective of sector positioning, the small and medium board aims to provide financing channels and development platforms for small and medium-sized enterprises with outstanding main businesses and growth potential. After the reform of the registration system, the ChiNext has thoroughly implemented the innovation-driven development strategy and adapted to the development relying more on innovation, The general trend of creation and creativity, mainly serving growth-oriented innovative and entrepreneurial enterprises, supporting traditional industries and new technologies,New industry, Deep integration of new business formats and new models. Although the two developments are misaligned in positioning, from the perspective of IPO standards, ChiNext is more tolerant than SMEs. Especially after the registration system reform, ChiNext’s IPO financing efficiency has been greatly improved, and its ability to provide financing services to SMEs has actually been improved. Stronger than small and medium board.

2. Fundamental perspective: the transitional attributes of small and medium-sized boards are distinct, and many indicators have blurred boundaries with the main board of Shenzhen Stock Exchange

From a fundamental perspective, the Main Board is mainly geared towards mature companies, while the ChiNext Board serves growth-oriented innovative and entrepreneurial companies. Therefore, Main Board listed companies tend to be larger in size and have relatively stable profitability, but their growth rate is slower. Relatively small, but with better profitability and higher growth. The performance of listed companies on the SME board is between the Shenzhen Main Board and the ChiNext, and the transitional attributes are equally clear. In addition, in many fundamental indicators, the boundary between the small and medium board and the main board is blurred.

2.1. Industry structure: ChiNext is concentrated in innovative industries, and small and medium-sized boards are in a transitional stage

Under the leadership of different positioning, the industry distribution of listed companies in each sector has distinct characteristics. The top five industries on the GEM are machinery and equipment, computers, electronics, chemicals, and pharmaceuticals and biology, accounting for 14.9%, 13.3%, 10.7%, 10.2%, and 9.8%, respectively, accounting for 58.9% of the total. The industry distribution is highly concentrated in High-growth emerging industries.The distribution of the Shenzhen main board industry is relatively scattered, with the top five industries accounting for 42.5% in total, followed byreal estate, Chemical industry,Public utilities, Medical biology and automobile, accounting for 10.7%, 9.2%, 8.5%, 8.5% and 5.7% respectively. The industry attributes are relatively traditional. In contrast, the industry attributes and concentration of the small and medium board are between the Shenzhen Stock Exchange and the ChiNext. The top five industries are chemical, mechanical equipment, electronics, medical and biological and electrical equipment, accounting for 10.4%, 9.5%, 9.0%, 7.7% and 6.4%, the total accounted for 42.8%.

2.2. Volume: The market value, revenue and profit of the small and medium-sized board are between the Shenzhen main board and the ChiNext

As of March 31, 2021 (the same below), the average market capitalization of Shenzhen Main Board/Small and Medium-Sized Board/GEM listed companies is 209.7/130.3/107.2 billion yuan, and the median is 62.7/47.8/432 billion yuan, respectively. The overall market value of companies on the Shenzhen Main Board is higher, while the GEM has a highly concentrated market value distribution. 75% of the companies have a scale of less than 10 billion yuan. The market value and distribution concentration of the small and medium-sized boards are somewhere in between.

The average operating income of Shenzhen main board/small and medium-sized board/GEM companies in 2019 was 139.9/52.4/19.9 billion yuan, and the median was 35.8/20.9/900 million yuan, respectively. Since the Shenzhen Main Board did not have a positioning distinction when it was first established, it contains the widest types of listed companies and therefore has the widest distribution of operating income, while the distribution of operating income of small and medium-sized and ChiNext companies is relatively concentrated, especially for the vast majority of ChiNext. The company’s operating income is less than 2 billion yuan. In terms of net profit, the average net profit of Shenzhen Stock Exchange Main Board/Small and Medium-Sized Enterprise Board/GEM companies in 2019 was 8.1/2.4/0.9 billion yuan, and the median was 1.9/1.2/80 million yuan. Overall, the revenue and profit volume of the Shenzhen Main Board is significantly higher than that of the SME Board, and the SME Board is significantly higher than that of the ChiNext.

2.3 Profitability: The overall gross profit margin and net profit margin of the small and medium-sized board are close to those of the main board of the Shenzhen Stock Exchange

In terms of gross profit margin, in 2019, the average gross profit margin of Shenzhen Main Board/Small and Medium-Sized Enterprise Board/GEM companies was 24.7%/24.2%/28.2%, and the median was 21.8%/26.2%/33.8%, respectively. In terms of net interest rate, the average net interest rate of Shenzhen Main Board/Small and Medium-Sized Enterprise Board/GEM companies in 2019 was 5.8%/4.6%/4.8%, and the median value was 5.1%/6.5%/9.6%, respectively. In terms of specific distribution, the overall profitability of the ChiNext is obviously superior. The small and medium-sized board is between the ChiNext and the Shenzhen Main Board but is very close to the Shenzhen Main Board.

2.4. Growth: The growth rate of SME board revenue and profit is close to that of Shenzhen’s main board

The average CAGR of 2017-2019 operating income of Shenzhen Main Board/Small and Medium-Sized Board/GEM companies was 10.4%/11.3%/13.8%, and the median was 5.8%/6.7%/14.3%, respectively. In terms of profit compound growth rate, the average CAGR of 2017-2019 net profit of the Shenzhen Main Board/Small and Medium-sized Board/GEM companies was 10.8%/12.2%/19.4%, and the median value was 7.6%/8.8%/14.7%, respectively. . The growth rate of the ChiNext is significantly higher than that of the Shenzhen Main Board and the Small and Medium-sized Stock Market, and the revenue and profit growth of the latter two are relatively close.

2.5. Valuation: Different corporate structures make the valuation level of the small and medium-sized board higher than that of the main board of the Shenzhen Stock Exchange

In terms of price-earnings ratios, the average PE (TTM) of the Shenzhen main board/small and medium-sized board/GEM companies were 27.4/33.3/58.0 times, and the median was 20.7/26.6/38.4 times. In terms of price-to-book ratio, the average PB of Shenzhen main board/small and medium-sized board/GEM companies were 2.2/3.2/5.0 times, and the median was 1.7/2.4/3.4 times. The valuation level of each sector is quite different, mainly due to the different types of listed companies in different sectors, rather than the naturally different valuation premiums of the sectors themselves. Therefore, after the merger of the small and medium board and the main board of the Shenzhen Stock Exchange, the valuation level of listed companies will not converge significantly.

3. Small and medium-sized boards withdraw from the stage of history, and the multi-level capital market system will be more efficient under dislocation competition

3.1. The Growth Enterprise Market is booming, and the significance of the small and medium-sized board as a transitional sector continues to fade

Since the official opening of the market in 2009, the Growth Enterprise Market has been booming. As of 2020, the total number of companies listed on the ChiNext will reach 892, corresponding to a total market value of 10.94 trillion yuan. At the same time, the registration system has been successfully implemented on the Growth Enterprise Market and has received good market feedback. In general, the ChiNext has mature service functions such as corporate financing and pricing, and the significance of the small and medium-sized board as a transitional board is gradually diminishing.

3.2. The small and medium-sized boards have succeeded in retreating, and the multi-level capital market system will be more efficient under the dislocation competition

On March 31, 2021, the Shenzhen Stock Exchange announced that with the approval of the China Securities Regulatory Commission, the main board of the Shenzhen Stock Exchange and the small and medium-sized board will formally merge on April 6. The merger will follow the overall principle of “two unifications and four unchanges”, that is, unified business rules and unified operation and supervision mode, maintaining the issuance and listing conditions unchanged, the investor threshold, the trading mechanism, the securities code and The abbreviation remains unchanged, and only a few differentiated rules such as market products and technical systems are adjusted. It is expected that the actual impact of the merger of the Shenzhen Stock Exchange Main Board and SME Board on investors will be very limited, but it has important historical significance for the construction of my country’s capital market.

For the Shenzhen Stock Exchange, the merger of the SME board and the Shenzhen Stock Exchange is a natural choice for market development. After that, the Shenzhen Stock Exchange will form a market structure with the main board and the ChiNext board as the main body, with a simpler structure, more distinctive features, and clearer positioning. Better provide financing services for different types of enterprises at different stages of development. From a higher level, the total market value of the three major sectors of the Shenzhen Stock Exchange is about 33 trillion yuan, while the total market value of the two major sectors of the Shanghai Stock Exchange has reached 50 trillion yuan. After the merger of the SME board and the Shenzhen Stock Exchange Main Board, the IPO financing function of the Shenzhen Stock Exchange Main Board will in fact be restored. The market structure of the Shenzhen Stock Exchange Main Board + ChiNext Board will form a dislocation competition with the structure of the Shanghai Stock Exchange Main Board + Science and Technology Innovation Board, which will help form a more Efficient and clear multi-level capital market system. In addition, after the merger of the Shenzhen Stock Exchange main board and the small and medium-sized board, the registration system will be fully rolled out and only the Shanghai and Shenzhen main board will remain, which will also make advance preparations for the subsequent full implementation of the registration system for stock issuance.

4. Risk warning

Related policy changes risk, etc.

Related reports:

Over 20 trillion events! The Shenzhen Stock Exchange announced that the main board and the small and medium-sized board will formally merge from this day!Understand everything

Shenzhen Stock Exchange Main Board and SME Board will merge next Tuesday! How big is the impact of the simultaneous implementation of the four major adjustments and seven rules?

Ying Jianzhong: Will the small and medium board merge to the main board bring big market?

Shenzhen Stock Exchange Main Board and SME Board Merger Countdown Expert: Or lay the foundation for a comprehensive registration system

The merger of the SME board on the main board of the Shenzhen Stock Exchange and the implementation of the registration system in the whole market are two different things

(Article source: Kaiyuan Securities)

(Editor in charge: DF506)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.