原始标题:[Xingzheng Macro]非农业的强劲恢复,美联储的态度何时会改变? ——3月对美国非农业数据的评论

概括

[IndustrySecuritiesMacroUSMarchnon-agriculturaldatacomment:Whenwillthenon-agriculturalstrongrepairoftheFed’sattitudechange?】TheUSjobmarketcontinueditsrapidrecoveryinMarchNon-agriculturalemploymentincreasedby916000thehighestvaluein7consecutivemonthsTherapiddeclineoftheepidemichasstimulatedrapidemploymentgrowthintheserviceindustryTheemploymentgrowthofhotelleisureandeducationandhealthisthehighestwith280000and100000respectivelyTheconstructionindustryhasbenefitedfromthehotrealestatemarketandtheweakeningofthecoldweatherandemploymenthasincreasedby110000Theperformanceisequallyeye-catchingInadditiontherapidrepairoftheserviceindustryhasledtorapidimprovementintheemploymentofpeoplewithlowacademicqualificationsTheunemploymentrateofpeoplewithahighschooleducationandbelowfellby19percentagepointsto82%and21%duringthepeakperioddroppedsharply

Investment points

Event: After the seasonal adjustment in March 2021, the number of non-agricultural employment in the United States increased by 916,000, far exceeding the expected increase of 660,000; the unemployment rate was 6%, the same as expected. Our views on this are as follows:

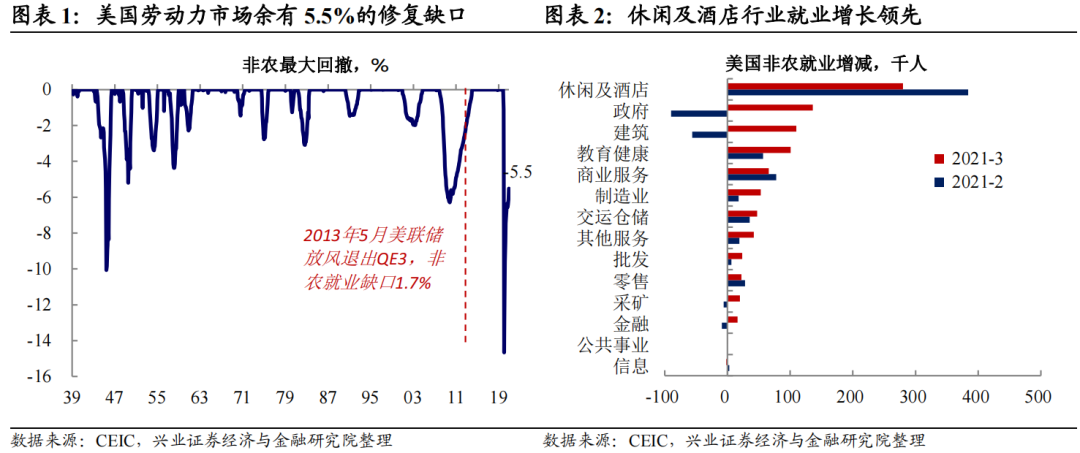

Non-agricultural growth in March far exceeded expectations, and the recovery of the service industry entered the “fast lane”.The US job market continued its rapid recovery in March. Non-agricultural employment increased by 916,000, the highest value in 7 consecutive months. The rapid decline of the epidemic has stimulated rapid employment growth in the service industry. The employment growth of hotel leisure and education and health is the highest, with 280,000 and 100,000 respectively. The construction industry has benefited from the hot real estate market and the weakening of the cold weather, and employment has increased by 110,000. , The performance is equally eye-catching. In addition, the rapid restoration of the service industry has led to rapid improvement in the employment of people with low academic qualifications. The unemployment rate of people with a high school education and below has dropped by 1.9 percentage points to 8.2%, and the 21% in the peak period has dropped sharply.

Although hourly wages have declined slightly, it may be due to the return of low-income groups.Average hourly wages fell 0.1% month-on-month in March. In terms of different industries, wages in the construction and education and health industries, which are among the top job restoration industries, have declined. The return of low-income groups may have caused a certain degree of drag on hourly wages. However, employment and hourly wages in the hotel and leisure industry have both kept rising month-on-month, indicating that the service industry job market is still showing a trend of both supply and demand.

Looking forward, there is still a lot of room for employment in the service industry to “fill in the pit”, and strong restoration is expected to continue.From the perspective of the recovery gap, the recovery gap in the US service industry is still relatively large. Compared with February 2020, the current leisure and hotel industry still has an 18.5% recovery gap, corresponding to about 3.13 million people. This part of employment demand is directly related to residents’ out-of-home activities, and high-frequency data shows that recent US economic activity is still picking up rapidly, pointing to the recovery of employment in the service industry or will continue to maintain a relatively high slope.

Strong non-agricultural stimulus to US debtinterest rateWith the US dollar index going up, high-value assets are still under pressure.After the release of non-agricultural data in March, the yield on the US 10-year Treasury bond rose rapidly by 4 bp to 1.72%, the 5-year Treasury bond rose by 7 bp to 0.98%, and the U.S. dollar index rose 0.2% to 93.1.Looking back, U.S. debtinterest rateThere is still room for upside. At the same time, the fundamental pattern of “the US is strong and Europe is weak” may support the US dollar index to continue to rise. As a result, the high-value technology stocks and commodity markets of US stocks may continue to be under pressure (see “European epidemic triggered market turbulence, future Market Outlook”).

The Fed’s policy goals return to basic goals, and the timing of the closure of the employment gap is worthy of attention.We are reporting “MidlandThe SLR can’t be stored, how will the market interpret” mentioned that due to the guarantee of market liquidity, the fiscal “surplus” is abundant, and in the short termMidlandThe Central Bank’s attention to the financial market may decline, and the policy goal will return to two basic goals-securing employment and stabilizing inflation. From the perspective of employment restoration, refer to the Fed’s effort to reduce the third round of QE in May 2013. At that time, the job market gap was about 1.7%, while the current job market gap is still 5.5%. The time when the subsequent gap closes is worthy of attention. .

Risk warning: fluctuations in overseas financial markets exceeded expectations; vaccine advancement fell short of expectations.

Risk warning: fluctuations in overseas financial markets exceeded expectations; vaccine advancement fell short of expectations.

(Source: Wang Han on Macro)

(Editor in charge: DF064)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.