原标题:刚刚! 证券监督管理委员会发行了1,300亿经纪人,并处以巨额罚款:将该业务暂停12个月!

概括

[TheChinaSecuritiesRegulatoryCommissionissued130billionbrokeragesandwasheavilyfined:Suspendthisbusinessfor12months!】TheChinaSecuritiesRegulatoryCommissionannouncedthatrecentlytheChinaSecuritiesRegulatoryCommissionissuedadministrativeactionstoHaitongSecuritiesandHaitongAssetManagementforprudentialoperationsfailuretoeffectivelycontrolandpreventrisksandlackofcomplianceriskcontrolmanagementduringthedevelopmentofinvestmentconsultingandprivateassetmanagementbusinessesbyHaitongSecuritiesandHaitongAssetManagementPriornoticeofregulatorymeasures(ChinaFundNews)

Over 130 billionMarket valueLargeBrokerage, Business violations were subject to measures taken by the regulatory authorities.

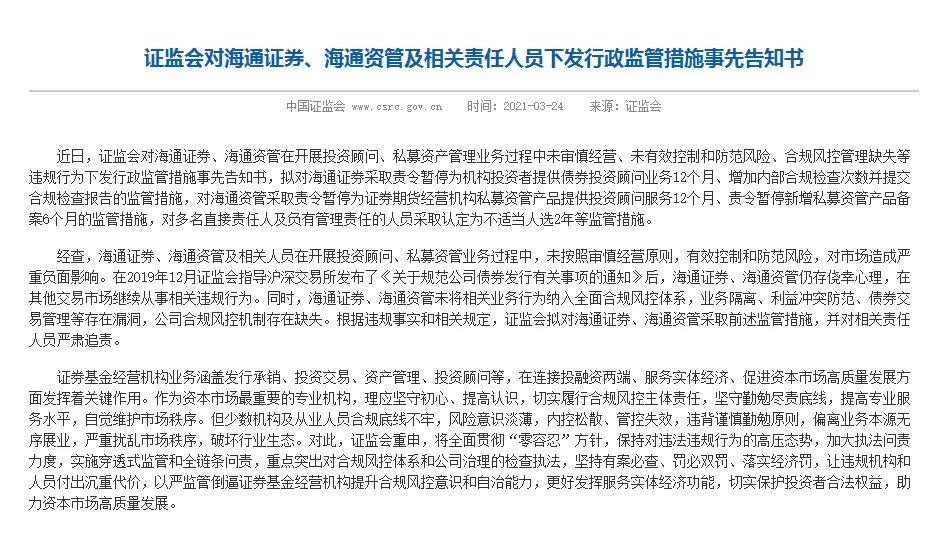

Securities Regulatory CommissionHaitong Securities, Haitong Asset Management plans to take measures: suspend a certain business for 12 months

On the evening of March 24, the Securities Regulatory CommissionHaitong Securities, Haitong Asset Management issued an advance notice of administrative supervision measures because of their violations.

Securities Regulatory Commissionannouncement, Recently, the Securities Regulatory CommissionHaitong Securities, Haitong Asset Management is developinginvestmentFailing to operate cautiously or failing in the process of consulting and private equity asset managementEffective controlIn addition to preventing risks, lack of compliance and risk control management and other violations, an advance notice of administrative supervision measures will be issued.

QuasiHaitong SecuritiesTake an order to suspend the provision ofBondInvestment advisory business for 12 months, increase the number of internal compliance inspections and submit compliance inspectionsreportRegulatory measures, and ordered Haitong Asset Management to suspend its securitiesfuturesPrivate equity management of operating institutionsproductProvide investment advisorsserviceFor 12 months, order to suspend the 6-month regulatory measures for the filing of new private equity management products, and take regulatory measures such as identifying as inappropriate candidates for two years on multiple directly responsible persons and those with management responsibilities.

The China Securities Regulatory Commission stated that after investigation,Haitong Securities, Haitong Asset Management and related personnel did not follow the principle of prudent operation to effectively control and prevent risks in the process of conducting investment consulting and private equity management businesses.marketCause serious negative effects.In December 2019, the China Securities Regulatory Commission guided the Shanghai and Shenzhen Stock Exchanges to issue thethe companyAfter the Notice on Matters Related to Bond Issuance,Haitong Securities, Haitong Asset Management still has a fluke mentality and continues to engage in related violations in other trading markets.At the same time, Haitong Securities and Haitong Asset Management failed to incorporate relevant business behaviors into the comprehensive compliance risk control system.conflictThere are loopholes in prevention, bond transaction management, etc., and the company’s compliance risk control mechanism is lacking. Based on the facts of violations and relevant regulations, the China Securities Regulatory Commission intends to take the aforementioned regulatory measures against Haitong Securities and Haitong Asset Management, and hold responsible persons seriously accountable.

Involving hundreds of billions of state-owned enterprise bonds, Haitong Securities was investigated before!

On the evening of November 18, 2020, due to suspicion of providing assistance for Yongcheng Coal Power’s illegal issuance of bonds, etc.,Bank of ChinaThe Inter-Market Dealers Association (hereinafter referred to as the Association of Dealers) announced the launch of a self-discipline investigation of Haitong Securities and its related subsidiaries. At this time, it has only been six days since the Association launched a self-discipline investigation of relevant institutions such as Yongcheng Coal and Electricity. Haitong Securities also issued an announcement at that time.

The Dealers’ Association said that recently, the association has challenged Yongcheng Coal and Electricity Holdings GroupLimited companyCarried out a self-discipline investigation.Based on the clues obtained from the investigation and combined with relevant market transaction information, it was discovered that Haitong Securities and its related subsidiaries were suspected of providing assistance to the issuer in issuing bonds in violation of regulations, as well as suspectedMarket manipulationAnd other violations, involvingbankbetweenBond MarketNon-financialenterpriseDebt FinancingTools and Exchange MarketCorporate bonds。

As of the third quarter of 2020, Yongcheng Coal Power’s total assets were 172.65 billion yuan, total liabilities were 134.395 billion yuan, and the debt-to-asset ratio reached 77.84%.

On the evening of January 8 this year, the official website of the Association of Dealers issued four self-discipline information in a row, addressing Haitong Securities and its subsidiaries Haitong Asset Management, Haitong Futures, and DonghaifundBe warned, order these four companies to carry out comprehensive and in-depth rectification of the problems exposed in this incident, and report the violations of the above-mentioned companies to the Chinese peoplebank、China Securities Regulatory Commission。

(Source: China Fund News)

(Editor in charge: DF380)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.