原始标题:上市20多年后,新浪正式私有化! 曹国伟:别当“乾郎”,只当“新浪”!

概括

[Sinaofficiallyprivatizedaftermorethan20yearsoflisting!CaoGuowei:Don’tbe”Qianlang”only”Sina”!】OnMarch23Sinaofficiallyannouncedthecompletionofprivatizationandwillchangeitsnameto”SinaGroupHoldingsCoLtd”whichmeansthatasthefirstbatchofChineseInternetlistedcompaniesthatwerelistedonNasdaqin2000theyalsosaidgoodbyeUSstockmarket

March 23,SinaOfficially announced the completion of privatization and will be renamed “SinaGroup Holdings Limitedthe company“, which means that as the year 2000, it will landNasdaqThe first batch of Chinathe InternetListed companies have also bid farewell to US stocksmarket。

at the same time,SinaChairman Cao Guowei issued an internal letter to all employees. He said that the privatization of Sina is not the end of an era, but a new structure to better open up the future. “After privatization, the original Sina portal business, which is dominated by Sina Mobile, will beWeiboBusinesses are more closely integrated, and vertical businesses such as Sina Finance, Sina Finance and Sina Sports will develop more independently.At the same time, Sina will increaseinvestmentSpeed upM&ATo achieve diversified business development. “

The market is generally concerned about what capital operations will be available after privatization? Sina did not respond to a reporter from Securities Times·e Company.

However, some insiders believe that Sina will return to A-shares or listing on Hong Kong stocks. “The benefits of the capital market and the leverage of funds are obvious. Sina’s return to A-shares or the listing of Hong Kong stocks are all feasible paths. With the continuous development of A-shares and Hong Kong stocks and a more inclusive listing system, it is foreseeable that there will be more Chinese companies are returning from U.S. stocks.” U.S. stocks seniorlawyerSean is inacceptE company reporter said in an interview.

Start the privatization process

In fact, as the first batch of Chinese Internet companies that have been listed on the US stock market for more than 20 years, Sina’s privatization is expected to augur in 2019.

In June 2019, Sina announced that it had reached a subscription agreement with Cao Guowei. After the transaction was completed, Cao Guowei became Sina University.shareholder, Accounting for 16.02%. At that time, the market generally believed that Cao Guowei’s behavior was undoubtedly to hold the initiative, and perhaps it would be able to reduce the resistance to decision-making for future privatization.

On July 6, 2020, Sina releasedannouncementClaimed that the company received from Chairman and CEO Cao GuoweiHolding companyNew Wave’s non-binding privatization offer establishes a price of $41 per sharepriceAcquire all the issued shares of the company that it does not already own by means of cash. At the same time, New Wave also stated that it is only interested in the outstanding shares of Sina that the buyer does not hold, and has no intention of selling the company to any third party.

According to the disclosure at that time, the company’s board of directors has established a special board of directors consisting of independent directors Zhang Songyi, Zhang Yichen and Wang Yan.CommitteeTo evaluate and review this privatization offer. Affected by this news, Sina is sought after by funds in the secondary market.On the same day, Sina US stocks jumped 8% at the opening, and finally closed by more than 10%.Market valueAbout 2.651 billion US dollars.

On September 28, 2020, Sina finalized the privatization price, which means that Sina is one step closer to privatization.

At that time, Sina’s latest announcement showed that New Wave MMXV planned to acquire all Sina’s issued shares at a price of US$43.3 per share in cash.Common stock, The transaction valued Sina at US$2.59 billion. The price was an 8% premium to the stock price at the time, and was an increase of approximately 5.6% from the $41 per common share originally proposed in the New Wave “privatization” proposal in July.

The funds for the transaction were collected by New Wave fromMinsheng BankCommitment obtainedTerm loan, And the combination of Cao Guowei and New Wave’s cash investment.A committee composed of independent directors of the Sina Board of Directors has unanimously passed the privatization plan and resolved to recommend shareholders to voteAuthorizationAnd approve the plan. Sina expects that this transaction will be completed in the first quarter of 2021.

Now, with the completion of the company’s privatization process, Sina will officially withdraw from the US stocksNasdaqMarket and became a company led by Sina Chairman Cao Guowei and Sina’s managementJoint controlPrivateenterprise。

Cao Guowei issued an internal letter

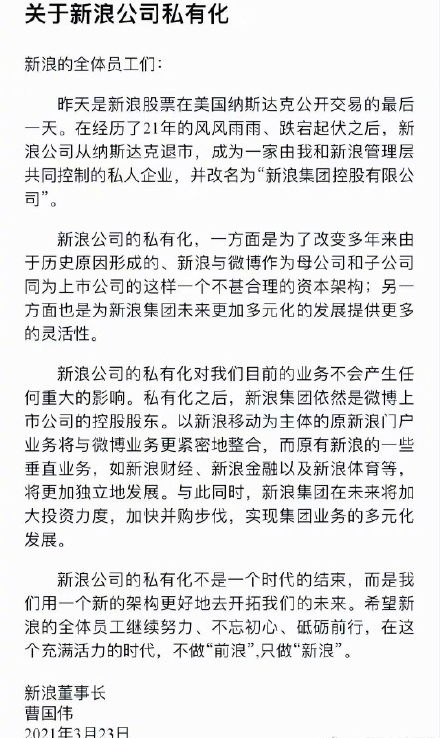

Cao Guowei said in Sina’s internal letter that yesterday was Sina’s stock in the United StatesNasdaqThe last day of public trading. After 21 years of ups and downs,Sina CorporationDelisted from Nasdaq and became a private company jointly controlled by Sina and I, and renamed “Sina Group Holdings Limited.”

Sina’s privatization is, on the one hand, to change theWeiboSuch an unreasonable capital structure in which the parent company and subsidiary are both listed companies; on the other hand, it also provides more flexibility for the more diversified development of Sina Group in the future.

The privatization of Sina will not have any significant impact on our current business.After privatization, Sina Group is stillWeiboListed companyControlling shareholder. The original Sina portal business, which is dominated by Sina Mobile, will be more closely integrated with the Weibo business, while some of the original Sina’s vertical businesses, such as Sina Finance, Sina Finance and Sina Sports, will develop more independently.At the same time, Sina Group will increase investment in the future and accelerateM&ATo achieve the diversified development of the group’s business.

The privatization of Sina is not the end of an era, but we use a new structure to better open up our future. I hope that all employees of Sina will continue to work hard, not forget their original aspirations, and forge ahead. In this dynamic era, we will not be a “front wave” but only a “Sina”.

(Source: e company official micro)

(Editor in charge: DF358)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.