原标题:五年内实现28亿的巨额利润! 姚振华削减了他的800亿市值的房地产巨头,宝能的A股“购物车”已经调整了吗? (附上最新的股权清单)

概括

[5yearstomakeabigprofitof28billion!HasYaoZhenhuareducedhis80billionmarketcapitalizationrealestategiantBaoneng’sA-share”shoppingcart”hasbeenadjusted?】AccordingtostatisticsBaonenghasbeeninvestingextensivelyinA-sharelistedcompaniesinrecentyearsbutitsA-share”shoppingcart”seemstohaveundergonemajoradjustmentscomparedtoafewyearsagoYesofcoursesomenewfaceshaveappearedinthe”shoppingcart”(SecuritiesTimesNetwork)

Previously in A sharesmarketThe Baoneng system, which has been stunned, attracts againinvestmentThe gaze of the viewer.

This time it’s because it plans to reduce its holdings for many years.Overseas Chinese Town APart of the stock.

Baoneng’s shares in this part of Overseas Chinese A City have floated in the billions.

According to the datastatistics, Baoneng is still investing extensively in A-share listings in recent yearsthe companyEquity, but its A-share “shopping cart” seems to have undergone a major adjustment compared to a few years ago, and it has greatly reduced its holdings of the stocks of some companies with heavy positions in the past. Of course, some new faces have appeared in the “shopping cart.

Earn 2.8 billion in 5 years!The Baoneng Department is going to reduce its holding of OCT

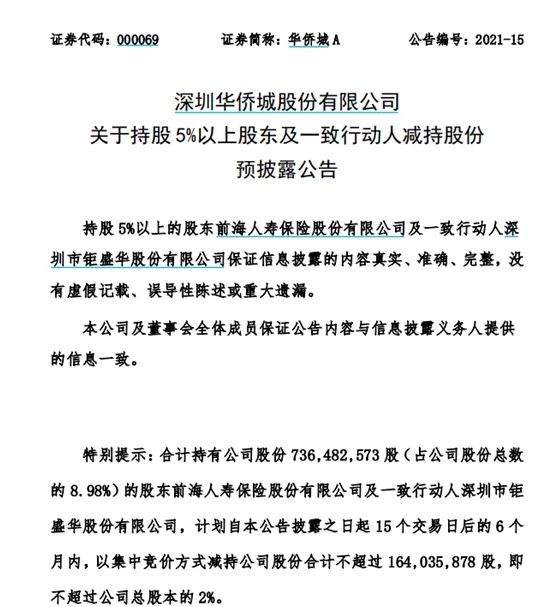

Overseas Chinese Town A(000069.SZ) Released on the evening of March 19announcementShows that a total of 736,482,573 shares of the company are held (accounting for 8.98% of the total company shares)shareholderQianhai Life Insurance and Shenzhen Jushenghua, a person acting in concert, plan to reduce the company’s shares.

In terms of the reduction method and the amount of reduction, the aboveshareholderThe plan is to use centralized bidding to reduce the total shareholding of the company by no more than 164,035,878 shares, that is, no more thanTotal equityOf 2%.

Market data display,Overseas Chinese Town AThe current stock price is 9.70 yuan. If estimated based on the current stock price of OCT A and the upper limit of the above-mentioned reduction, the maximum amount of reduction will reach 1.591 billion yuan, which is close to 1.6 billion yuan.

According to the data, the people behind Qianhai Life and JushenghuaActual controlAll are Yao Zhenhua. As of March 19, 2021, Qianhai Life and its concerted person Ju Shenghua together hold approximately 736 million shares of OCT A, accounting for 8.98% of the company’s total share capital.

It is worth noting that for the source of the proposed reduction of shares, the announcement stated that it originated from the non-publicly issued shares of OCT A subscribed by the above shareholders in 2015.

According to the data, at the end of 2015, OCT A issued non-public shares to 3 targets including OCT Group, Qianhai Life Insurance and Jushenghua.priceAt 6.81 yuan per share, Qianhai Life and Jushenghua subscribed for about 705 million shares in total, costing a total of 4.8 billion yuan.

Market data shows that after the completion of the above-mentioned non-public offering, since 2016, theReal estate stocksSimilarly, the overall performance of OCT A’s share price is tepid, but it has risen continuously since February this year, and the highest has risen to nearly 10 yuan.Based on the current share price of RMB 9.7, the shares subscribed by Qianhai Life Insurance and JushenghuaMarket valueHas increased to 6.837 billion yuan.

In addition, as OCT A has carried out many times during the periodcashDividends, Calculated according to the number of shares held, the accumulated cash received during Qianhai Life and JushenghuaDividendsNearly 800 million yuan. After considering this factor, Qianhai Life Insurance and Jushenghua had actually subscribed for shares of approximately 2.8 billion yuan during the non-public development of OCT A in 2015.

Why did Baoneng reduce its holdings this time?

According to the announcement, Qianhai Life Insurance and Jushenghua said it was necessary for their own business development.

From the current stock price, the above-mentioned shareholders of Baoneng Group are in a state of floating profit, and cashing out is also profitable from an economic point of view.

On the other hand, the target of this plan to be reduced, OCT A, in recent yearsOperatingOverall it is relatively stable.

According to data, OCT A is a leading listed company in the tourism real estate industry under OCT Group. It has developed a number of well-known projects and theme parks across the country, including Shenzhen East OCT, Shenzhen Happy Valley, Shenzhen Splendid China, Shenzhen Window of the World, Changsha World Window, Shanghai Overseas Chinese Town, etc., especially Shenzhen has a considerable reputation.

From a fundamental point of view, OCT A in recent yearsPerformanceThe overall steady growth will be affected by the epidemic in 2020. In the first three quarters of 2020, the company achieved revenue of 33.394 billion yuan,Year-on-yearIncreased by 11.83%, realizing return to motherNet profit5.248 billion yuan, a year-on-year decrease of 12.50%.

The information recently disclosed by OCT A shows that in February 2021, OCT A will achievecontractThe sales area is 283,600 square meters, and the contracted sales amount is 5.791 billion yuan. From January to February 2021, the company has realized a total of 597,700 square meters of contracted sales area, and the contracted sales amount is 12.238 billion yuan.

Back to Baoneng. In the real estate of the year,InsuranceIn addition, the tentacles of the Baoneng Department have extended to many fields such as automobiles and fresh food in recent years, and the demand for funds for related projects is not small.

Baoneng’s “A-share shopping cart” shrinks OR adjustment?

The Baoneng department has never been in the limelight in the A-share market, and its investment in the equity of listed companies has always been generous. The battle for equity and control of Vanke in the Baowan War a few years ago attracted the attention of countless people.

On July 7, 2016, when the Baowan War was in full swing, the reporter made some statistics on the stock “shopping cart” of the Baoneng Department. Statistics at that time showed that the Baoneng Department, including Vanke, had at least won 9 listed companies have more than 5% of the shares, and the market value has exceeded 70 billion yuan.According to the shareholding ratio at that time, Baoneng Group already held 1/4 of Vanke’s shares, 26.36% of CSG (including A and B shares), and 24.92% of shares.Zhongju High-tech, 19.58% China Jinyang, 15%Shaoneng shares, 14.65%Nanning Department Store, 9.89% OCT A, 6.72%Hefei Department Store, And 5.02%Star power。

In fact, this may only be part of the Baoneng Group’s shareholding landscape at the time, as the shareholding ratio of less than 5% is not included in the statistics.

According to the reporter’s current statistics, Qianhai Life Insurance and Jushenghua controlled by Baoneng are still present in the top ten shareholders or top ten shareholders of more than 20 A-share listed companies.Tradable shareholdersCompared with a few years ago, Baoneng’s “A-share shopping cart” has changed a lot, and some new faces have appeared on the list.

However, in addition to the reduction of OCT A plan, the Baoneng Department also reduced its holdings before.Dong EjiaoAnd many companies.

The largest reduction in Baoneng’s holdings may be due to its reduction in Vanke. Baoneng, which previously held a large number of Vanke shares, is no longer seen among the top ten shareholders of Vanke.

(Source: Securities Times Net)

(Editor in charge: DF358)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.