原标题:重! 宝能是减少其持有的800亿房地产巨头1.6亿股股份的最新举措! 发生了将近30亿的浮动利润,发生了什么?

概括

[Baoneng’slatestaction!Reduceholdingsof160millionsharesof80billionrealestategiants!Whathappenedtothenearly3billionfloatingprofit?】Themovementof”BaonengSeries”inthefinancialmarkethasattractedspecialattentionfromthemarketOntheeveningofMarch19OverseasChineseTownA(000069)announcedthatshareholdersQianhaiLifeInsuranceCoLtdandShenzhenJushenghuaCoLtdapersonactinginconcertplantoreducetheirholdingsbynomorethan2%ofthecompany’stotalsharecapitalTheannualreportdisclosedbyDongEjiao(000423)onthesamedayalsoshowedthatinthefourthquarteroflastyearQianhaiLifeInsuranceCoLtdreduceditsholdingsof6444900shares(OfficialWeiboofeCompany)

The movement of the “Baoneng Series” in the financial market has received particular attention from the market.

In the evening of March 19,Overseas Chinese Town A(000069)announcementSaid,shareholderQianhai LifeInsuranceLimited sharesthe companyAnd the person acting in concert, Shenzhen Jushenghua Co., Ltd., plans to reduce its holdings by no more than 2% of the company’s total share capital.Dong Ejiao(000423) The annual report disclosed on the same day also showed that in the fourth quarter of last year, Qianhai LifeInsuranceCo., Ltd. reduced its holdings of 6,444,900 shares.

Floating profit is about 2.8 billion yuan

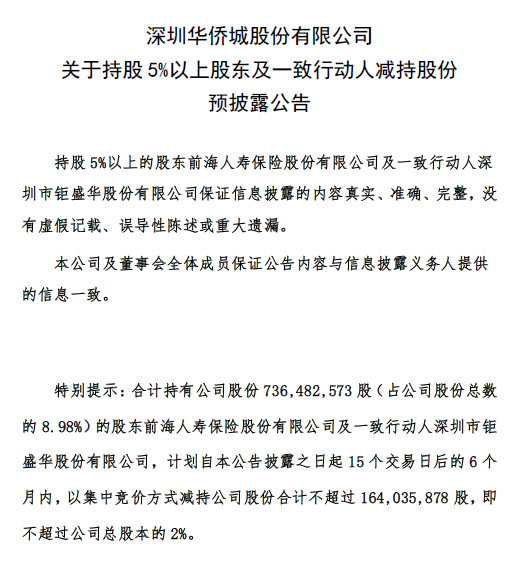

Overseas Chinese Town AAccording to the announcement, at present, Qianhai Life Insurance under the Baoneng Department and Jushenghua, a person acting in concert, hold a total of 736 million shares of the company. The two plan to concentrate within 6 months after 15 trading days from the date of the announcement. The total shareholding of the company’s shares reduced by way of bidding does not exceed 164 million, that is, no more than 2% of the company’s total share capital.

Qianhai Life and concerted action people are prosperous, stationedOverseas Chinese Town AIt needs to go back 5 years ago.

In January 2016, OCT A completed the non-public offering. This timeAdditional issuanceAccording to the additional issuance price of RMB 6.81 per share, Qianhai Life has subscribed for 587 million shares in cash, and Jushenghua has subscribed for 117 million shares in cash. The two subscribed for a total of 704 million shares, accounting for 8.59% of the total share capital. The lock-up period is 36 months. Became the second largest shareholder of OCT A.

In addition to participating in additional issuance, Qianhai Life also increased its holdings of OCT A through the secondary market. According to the 2016 quarterly report, Qianhai Life Insurance held a total of 642 million OCT A shares, accounting for 7.82% of the total share capital. The latest disclosure shows that as of March 10, 2021, Qianhai Life holds 619 million OCT A shares, accounting for 7.55% of the total share capital.

As of March 10, 2021, Qianhai Life and its concerted person Ju Shenghua held a total of 736 million OCT A shares, accounting for 8.98% of the total share capital.

On March 19, 2021, OCT A closed at 9.7 yuan per share. If the cost of the shares held is estimated based on the initial price of 6.81 yuan per share, Qianhai Life and the concerted person Ju Shenghua has a floating profit of approximately 2.128 billion yuan in the past five years.

In addition, since 2016, OCT A has conducted 4 timesDividends, A total of 10.06 yuan per 10 shares will be distributed.This also means that Qianhai Life, which holds 736 million shares, and Ju Shenghua, a person acting in concert, also received nearly 740 million yuan.Dividends. Therefore, during the five years of holding OCT A, Qianhai Life and its concerted person, Ju Shenghua, have a floating profit of approximately 2.828 billion yuan.

At the beginning of the period, Qianhai Life and concerted action person Ju Shenghua participated in more than 5 billion yuan of funds. Five years in exchange for 2.8 billion yuan of income, the overall floating profit is about 56%, and the average annual yield is about 11.2%.

Why reduce holdings

Listed company is importantShareholder reduction, Either because the prospects of listed companies are dim, or because of their own reasons for reducing shareholders.

From the perspective of OCT A, the company uses “Chinese cultureindustry“Leader, leader of China’s new urbanization, and model of China’s global tourism” as the strategyPositioning, The current main business consists of cultural tourism business,real estateIt consists of two major areas, including Shenzhen Window of the World, Happy Valley, OCT East and other well-known attractions, which are often used by Internet celebrities to check in.

Under the new crown epidemic, the tourism industry has become the hardest hit area of the epidemic. Affected by the epidemic, OCT APerformancePoor performance in 2020. The third quarterly report for 2020 shows that as of the end of September 2020, the company achievedNet profitFor 5.248 billion yuan,Year-on-yearDecrease by 12.5%.In 2016-2019, since Qianhai Life and its concerted parties participated in the issuance, OCT A’sNet profitThe increase was 48.44%, 25.47%, 22.36% and 16.69% respectively.

Against this background, OCT A’s share price has performed poorly. For the whole year of 2020, the company’s share price has fallen slightly by about 5%. In 2020, when institutions embrace core assets, OCT A’s share price performance must be difficult to satisfy investors.

However, entering 2021, with the new progress in epidemic control, the cultural tourism industry has been favored by institutions again, and they have given a “buy” rating. The main reason is that “retaliatory consumption after the epidemic supports the rapid recovery of tourists, and the valuation will be restored. “The secondary market shows that the company’s share price has continued to strengthen since 2021, and has risen by nearly 40% so far, which is significantly stronger than the broader market.

From Baoneng’s perspective, after the Yao brothers’ “separation” has attracted attention, they have recently been troubled by rumors of large-scale layoffs.

According to media reports in February this year,Baoneng GroupLarge-scale layoffs start with Baoneng City Development and Baoneng Logistics.Among them, Baoneng Logistics already has a number ofExecutivesResignation also includes President Wu Haofeng. All industrial projects for which Baoneng Logistics has not received project loans have been suspended.

However, on February 24, in response to the large-scale layoffs of Baoneng circulating on the Internet, the suspension of year-end bonuses, and the suspension of paymentSocial securityIn response to other information, Baoneng Group stated that the information was not true. He said that optimizing and upgrading the organizational structure is a routine operation and management measure of Baoneng Group.

Regarding the reasons for the reduction of OCT A, the announcement stated that it was mainly due to the needs of its own business development, and the source of the reduction of shares was the subscription of the company’s 2015 non-public offering.

Virtual and real

Since 2014, Baoneng has used the two major capital platforms of Shenzhen Jushenghua Company and Qianhai Life Insurance to enter and exit the A-share market frequently, except forVanke A, And nearly 30 A-share listed companies have been involved. among them,CSG A、Shaoneng shares、Zhongju High-tech、Nanning Department Store, Baoneng Department still occupies the largest shareholder; at the same time, it is also OCT A,Hefei Department StoreThe second largest shareholder.

However, the radical Baoneng Department has also been controversial. After being attacked by Wang Shi and boycotted by Dong Mingzhu, the Baoneng Department made investments in multiple industries. However, various signs show that the Baoneng Department’s journey to “getting out of the virtual to the real” is not smooth.

In the “Baoneng Department” hugebusinessIn the Empire, the real estate sector is one of the core business sectors. Yao Zhenhua, the head of the Baoneng department, once set a sales target for Baoneng Real Estate to exceed 100 billion yuan in 2021 and reach 200 billion yuan in 2022.Market valueThe promise of up to 700 billion yuan and net profit exceeding 40 billion yuan.

But the reality is that Baoneng real estate sales are not ideal in the industry. According to the data disclosed by Crane, from 2018 to 2020, Baoneng Group’s full-caliber sales were 6.66 billion, 8.48 billion, and 10.91 billion, ranking outside the 100. The lack of scale means that Baoneng Real Estate has huge difficulties in listing.

Yao Zhenhua made a high-profile announcement in 2017 to enter the field of new energy vehicles, and proposed that “it will take 10-15 years to build Baoneng Automobile into an automobile group with strong competitiveness and international influence.”

Since then, Baoneng Group smashed real money and started the “car building” movement, and withborrowIts new energy vehicle business has successively signed cooperation agreements with local governments to establish new energy vehicle industrial parks in Hangzhou, Kunming, Guangzhou, Xi’an Xixian New District and Kunshan.

According to previous field visits by the media, Baoneng Group has successively built 4 new energy vehicle and parts production bases in Hangzhou, Kunming, Guangzhou and Xixian New District of Shaanxi, with a total investment of more than 200 billion yuan. Tens of thousands of acres. On December 21, 2017, BaoEnergy acquired a 51% stake in Qoros Auto with 1.6 billion yuan and became the largest shareholder of Qoros. However, the overall construction progress of the above-mentioned new energy vehicle industrial park project of Baoneng Group is slow.

Advance and retreat

In fact, in addition to the upcoming sale of OCT A, the Baoneng Department behind the layoffs is shrinking.

On the evening of March 19, 2021, well-known Chinese medicineenterprise, A century-old brand——Don Ejiao(000423) The disclosed 2020 annual report shows that during the fourth quarter of last year, Qianhai LifeInsuranceCo., Ltd. reduced its holdings of 6,444,900 shares.The third quarterly report for 2020 shows that Qianhailife insuranceThe company also reduced its holdings by 8.6 million shares.Previously, Qianhai Life had heldDong Ejiao27.244 million shares, accounting for 4.17% of the company’s total share capital. In other words, Qianhai Life has reduced its holdings by more than 70% compared with the beginning of the period.

According to the statistics of e company, in the third quarter of 2020, among the rivals of Qianhai LifeHuahai Pharmaceutical、China Animal Husbandry、Zhongshi Technology、Tianma Technology、Yongxin Optics、Jerry sharesOther companies have all reduced holdings of varying amounts, and the number of companies that have been reduced has increased significantly compared with the second quarter. In the same period,Changan Automobile、Yuntu Holdings, Suken Longfa,China Life InsuranceQianhai Life Insurance was added to the company’s top ten floating shareholders list.

(Source: e company official micro)

(Editor in charge: DF078)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.