原标题:很大! 负责“城市礼品贷款”的人员将被追究责任。 遍布世界的“公墓贷款”如何结束?

概括

[It’sbig!Howtoendthe”cemeteryloan”wherethepersoninchargeofthe”CityGiftLoan”isaccountable?】Infactinadditionto”beautifulgiftloans”variousexoticloanproductssuchas”cemeteryloans””second-childloans”and”marriageloans”haveemergedinanendlessstreaminrecentyearsThesefancyloansfullofgimmicksinsteadofusheringintheexpectedenthusiasmhaveattractedanxiouscriticismsreflectingthecompetitionandurgencyofmajorbanksinconsumerloans(InternationalFinanceNews)

inBank of JiujiangAfter the “California Loan” incident triggered a heated discussion on the Internet, the supervisory intervention was involved in the investigation. At present, the bank has dealt with relevant personnel, and the directly responsible persons and department heads have been held accountable.

In fact, in addition to “gift loans”, various exotic loans such as “cemetery loans”, “second-child loans”, and “marriage loans” in recent yearsproductEmerge in endlessly.These fancy loans full of gimmicks, instead of ushering in the anticipated enthusiasm, have evoked anxious and anxious criticisms.bankCompetition and urgency on consumer loans.

The controversy over the “City Gift Loan” was not settled, and the “Graveyard Loan” followed one after another.

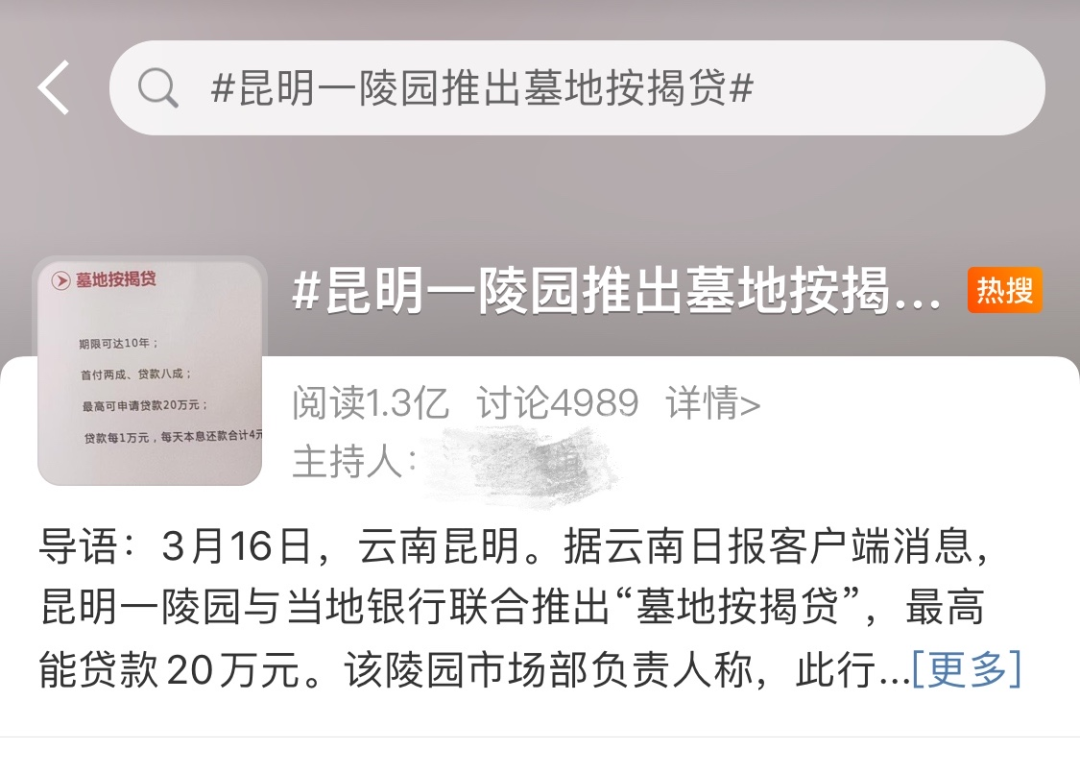

Recently, it was reported that a cemetery in Kunming and abankCooperation to jointly launch the “cemetery mortgage business”.Subsequently, #昆明一陵园launched the cemetery mortgage loan# onWeiboHot search in the same city.

《International financeThe reporter found that the “cemetery loan” product is not limited to Yunnan. There are also other funeral service providers in many places that claim to bebankProvided in cooperation, involving Bank of China, ICBC, and TailongbusinessBank etc.

In addition to the “exotic loans” such as “second-child loans” and “marriage loans” introduced by banks in various regions before, many netizens lamented that “consumer loans have been broken by “playing”.”

So, under the controversy, why are banks still keen to launch all kinds of “wonderful loans”?

“Graveyard loan” business triggered controversy

On March 17, according to media reports, at the Qingming Festival press conference held in Kunming Jinlong Ruyi Garden, the relevant person in charge of Kunming Jinlong Ruyi Garden stated that the garden and Yunnan Xishan Beiyin Village Bank jointly launched the “cemetery mortgage loan” finance For service projects, the project can be loaned up to 200,000 yuan.

The sales manager of the cemetery introduced,Cemetery averagepriceThe price is around 40,000 yuan, and the slightly higher price is 70 to 80,000 yuan. Mortgage loan period of cemetery can be up to 10 years; the first negative is 20%, the loan is 80%; for every 10,000 yuan of loan, the total daily repayment of principal and interest is 4 yuan.The cemetery negotiated with the bank that the lender should be a child and would not lend to the elderly.

Once the news was fermented, it caused countless netizens to complain. Some netizens sighed, “It’s too miserable to repay the mortgage if you are alive, and repay the cemetery if you die!”

Topic hot search screenshots

In response to this news, a reporter from “International Finance News” called Kunming Jinlong Ruyi Garden, and the relevant person responded: “It is true that it is nowWeiboThere is a lot of news on the above, but in fact we have not formally cooperated with the bank, and this business has not been formally implemented. “

The person stated that, frankly speaking, the “cemetery loan” itself is a notice and is unilateral.Creativity, If the formal cooperation will be announced.

An account manager of Yunnan Xishan Beiyin Rural Bank told relevant media, “This product has been suspended and will not be launched in the future.”

However, the “International Finance News” reporter noticed that the “cemetery loan” product is not limited to Yunnan. There are also many other funeral service providers who claim to cooperate with banks to provide it.

The reporter found that the “Tomb Baby” loan service provided by a funeral service center called “Yikong.com” is applicable to all commercial cemeteries in Shanghai and surrounding areas, and is suitable for people who are temporarily stressed and willing to repay. The application needs to see and copy the ID card, the client’s income and financial resources, and fill in the application form for the tomb. Generally, the loan can be released within 2 to 3 working days.

“At present, our service has been suspended for one year. We are undergoing rectification and reorganization, and we will open it again in four or five months.” Tomb Baby staff told the “International Finance News” reporter that they have been doing “cemetery loans” for some years, and their main business is Do funeral services, but also do third-party guarantees, contact the bank through Tomb Baby to apply for a loan. “There is no way to ask the bank directly, but you can try.”

The specific details of the service are still on the official website. A total of three banks provide loans, namelyBank of China、Construction BankTyronecommercial Bank.Assuming a loan of 100,000 yuan, each bank monthlycreditCard repayments were 8708 yuan, 8683 yuan, and 8800 yuan.ToBank of ChinaExamples of solutions provided, 0 down payment below 100,000 yuan, 30% down payment above 100,000 yuan, 4% annualinterest rateUp.

In addition, one-stop funeral service provider Xiaoci Technology also offers to buy tombs in installments. The official website said that through Xiaoci Technology to buy tombs, they can obtain the right to apply for bank cemetery installment loans, and their professional account managers will help to apply.ICBC、Construction BankwithChina Merchants BankAll loans can be applied for. There is no limit to the household registration of the applicant, and it is necessary to purchase the cemetery’s ID card and copy, financial proof, etc.

The customer manager of the Shanghai Baoshan Sub-branch of Tyrone Bank told the “International Finance” reporter that this may be a cooperation between certain sub-branches and the platform, not the business of the whole bank. The essence is consumer loans, or it is not recommended that customers go through an intermediary. Offline banks apply for consumer loans. “I have never heard of this cemetery loan and cooperation platform.”

The person responsible for “California” has been suspended

Before the “cemetery loan”, the “beautiful gift loan” also caused controversy.

March 16, a copyBank of JiujiangThe promotional poster of “California Loan” went viral in the circle of friends.The online poster shows that the maximum loan amount for this “beautiful gift loan” is 300,000 yuan, and the maximum loan amount is one year.interest rateAs low as 4.9%.It is worth noting that one of the application conditions is that the couple must be administrativeBusiness unitRegular employees; loan purposes are wedding trips, car purchases, home appliances, jewelry, etc.

Bank of JiujiangAfter the “California Loan” incident triggered a heated discussion on the Internet, it attracted great attention from the local regulatory authorities.

On March 19, the local regulatory authority disclosed the latest investigation results. It is reported that the Jiujiang Municipal Party Committee and Government of Jiangxi Province established a joint investigation team.After investigation, “California Loan” is a copywriting design by a staff member of the retail bank management headquarters of Jiujiang Bank on the basis of “pocket money” consumer loans for newly married customers.

At around 8:30 on March 16, without the approval of the relevant procedures of Jiujiang Bank, this staff member sent the copy that was still in the design stage to the WeChat Moments. Subsequently, other employees of the department forwarded it on WeChat Moments, and then withdrew all the copy at around 11:30 am on March 16.

After verification, although Jiujiang Bank’s business system is not related to “color gift loans”product information, And there is no relevant credit balance,However, without product compliance review and other procedures, it was issued privately by internal employees, exposing Jiujiang Bank’s lack of compliance awareness and inadequate internal control management.

The joint investigation team ordered Jiujiang Bank to deal with relevant personnel and apologized for the adverse effects caused by this matter. At present, Jiujiang Bank has dealt with relevant personnel, and the directly responsible persons and department heads have been held accountable.

On the evening of March 18, Jiujiang BankWeiboA statement of apology said that at present, the directly responsible person has been suspended from work, the department head has been given demerit penalties, and relevant forwarders have been criticized and educated. “In response to the exposed compliance awareness and internal control management problems, Jiujiang Bank will deeply reflect, draw inferences from one another, and continue to strictly investigate and rectify, strengthen compliance awareness, continuously improve internal control management, and standardize financial marketing behavior. We urge all sectors of society to continue to monitor “.

“City gift loans and cemetery loans are marketing gimmicks. They are essentially ordinary consumer loans that change the soup without changing the medicine. The loaned funds need to be used for consumption. Applicants also have age, work and other related restrictions, which are incompatible with past consumer loan products. There is not much difference.” Su Xiaorui, a consumer finance expert, bluntly told a reporter from International Finance News.

Consumer loan

In fact, in addition to “beautiful gift loans” and “cemetery loans,” banks have also introduced “second-child loans” and “marriage loans” and other exotic loans.

In 2016,Bank of Nanjing、Bank of Jiangsu、ABCWedding with Nanjingthe companyMarriage Music launched “Marriage Loan”.Happy through marriageBank of NanjingFor newlyweds who apply for a marriage loan, the maximum amount is 300,000 yuan, the fastest one day is the loan, and the marriage expenses are paid in installmentspayment, It can be divided into 36 phases at most.

In 2015,Postal Savings Bank, China Post Consumer Finance Co., Ltd. joins hands with household consumptionenterpriseReleased “Second Child Loan”.“As long as a parent-child photo + birth certificate” can be loaned up to 200,000 yuan,Online and offlineAnyone can apply, and the funds can be released on the same day, and the monthly handling fee is about 0.75%.

Postal Savings BankClaim that in order to satisfy different customerspersonalityThe product quota ranges from a minimum of 1,000 yuan to a maximum of 200,000 yuan, and the product period is free to choose from 3 to 36 periods.

These fancy loans full of gimmicks, instead of ushering in the expected enthusiasm, have attracted anxious criticisms, reflecting the competition and sense of urgency among major banks in consumer loans.

“Banks intend to compete for consumer application scenarios. In terms of personal consumption loan scenarios, some have already been occupied, such as mortgages and car loans.” According to the financial commentator Ma Yuan, it is now even on some e-commerce websites. Buy an old mobile phone, you can “white bar”, and some are interest-free. Therefore, banks are looking for consumer application scenarios to make loans bigger, and various names have come out.

The reporter noted that on February 20 this year, the China Banking and Insurance Regulatory Commission issued the “Regarding Further Regulation of Commercial Banks”the InternetThe “Notice on Loan Business” (hereinafter referred to as the “Notice”) has stricter requirements for cross-regional operations.“Local corporate banks that carry out Internet loan business shall serve local customers and shall not carry out Internet loan business across jurisdictions of registration.”

Insiders pointed out that forSmall and medium banksIn short, this means that the market and breakthroughs for loan issuance are narrower, and its own risk control and data levels are relatively weaker, so it needs moreborrowMachine looking for gimmicks.

Jin Tian, a senior researcher at the Institute of Digital Economy, Zhongnan University of Economics and Law, said that from the current policy orientation, “do not use consumptionCreditThe idea of “as a means of stimulating consumption” has become increasingly clear, indicating that the supervisory authorities have realized the name of fake consumption scenes, the actual countermeasures of excessive consumption and excessive borrowing.Real economy, Financial risks and the negative effects of social stability. We hope that financial institutions andPractitionersIt must be taken seriously.

Related reports:

“California” is completely cold!The bank involved apologized to the person directly responsible for suspension and punishment

Jiujiang Bank responded to “California Loan”: the person directly responsible has been suspended

CCTV criticized!Jiujiang Bank apologizes for “California Loan” but it is not an isolated case

Pushing lottery gift loans suspected of fraud? There is also a cemetery loan! Local banks “invest in medical care in a hurry”

(Source: International Finance News)

(Editor in charge: DF150)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.