原标题:措手不及! 碳中和完全受到了打击,与7个关联的恶魔股票的股东突然宣布减少持股量! 如果您正在追赶,恐慌了吗?

概括

[Caughtoffguard!CarbonneutralityiscompletelyonfireShareholdersof7-linkeddemonstockssuddenlyannouncedtheirreductions!Panicifyouarechasingtherise?】Thestockpricehasnotbeenstunnedforthreeyearsanditbrokeout7consecutiveboardsSeeingthestockpriceofHuayinPowersoaredshareholdersfinallycouldn’tsitstillandplannedtoreducetheirholdings(ChinaFundNews)

The stock price has not been stunned for three years, and it broke out 7 consecutive boards.WatchingHuayin PowerThe stock price skyrocketed,shareholderFinally couldn’t sit still, and planned to reduce holdings.

Seven LinksHuayin PowerShareholders intend to reduce their holdings

In the evening of March 16,Huayin PowerreleaseannouncementSaid,the companyOn March 16, 2021, it received the “Notice on Reduction of Shares in Datang Huayin Power Co., Ltd.” issued by Xiangtou Holdings, a shareholder of the company holding more than 5% of the shares.

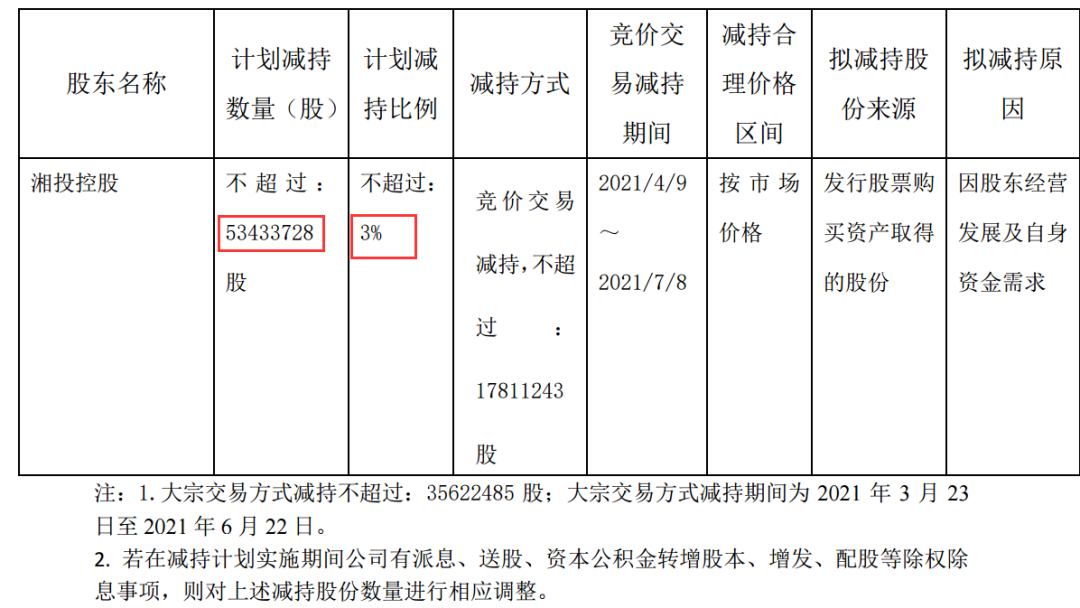

The company’s non-largest shareholder Xiangtou Holding with more than 5% of the company plans to reduce its holdings of the company’s shares by no more than 53.43 million shares from April 9, 2021 to July 8, 2021, and the planned reduction ratio will not exceed 3%. The reason is “due to the shareholders’ business development and their own capital needs”.

At present, Xiangtou Holdings is the third largest shareholder of Huayin Power, holding 209 million shares, accounting for 11.73% of the company’s total share capital, which was acquired by the company in 2015 by issuing stocks to purchase assets.

If calculated based on the latest closing price of Huayin Power at 5.85 yuan per share, the market value of Xiangtou Holding’s top grid reduction will reach 313 million yuan.

Public information shows that Huayin Power is mainly engaged in thermal power generation business, and also operates hydropower, wind power and power sales businesses. It is the largest thermal power generation in Hunan Province.enterprise。

The industry in which Huayin Power is located is not a hot industry.PerformanceThe scale is not very eye-catching among the ranks of A-share listed companies.Moreover, Huayin Power’s operating conditions are poor and its liabilities are high. The third quarter report of 2020 shows that Huayin Power’s asset-liability ratio is 83.73%.Power IndustryRanked fifth in China. As a result, the share price of Huayin Power has fallen continuously in the past three years.

Recently, Huayin Power broke out suddenly. On March 16th, Huayin Power opened lower in early trading and fell by nearly 7 points to the final big reversal to seal the daily limit. The amplitude exceeded 17 points in a day, and the stock price hit a new high in nearly 4 years.

So far, Huayin Power has pulled 7 daily limit in 7 trading days, of which the second board is the ground board, which has completely activated its equity. During the 7-link period, the company’s cumulative price increase has reached 94.35%, and the total market value has soared by about 5.055 billion yuan.

Although during the continuous stock price limit period, Huayin Power successively issued announcements on abnormal stock trading fluctuations and risk warnings on March 9, March 10 and March 12, which still could not stop the company’s stock price limit.

In fact, the official launch of this wave of Huayin Power’s market was the first trading day after the Spring Festival, and it rose by more than 5% on that day. Afterwards, it started to accelerate on March 8 after moving upwards in small steps. As of March 16, it closed 7 daily daily limits. From the beginning of the market on February 18, the company’s stock price has risen 1.5 times so far.

Became the hottest concept stock of “carbon neutrality” due to participation in the Exhibit Stock Exchange

Behind the skyrocketing stock price, the news of the Shenzhen Emissions Rights Exchange through capital increase and share expansion nine years ago became a direct catalyst.

On the evening of March 10, Huayin Power issued an announcement on abnormal stock trading fluctuations, stating that recently, relevant media reported that the company is the sixth largest shareholder of Shenzhen Emissions Exchange Co., Ltd. (with a shareholding ratio of 7.5%). “And other market hotspots.

The company participated in Shenzhen Emissions Exchange Co., Ltd. through capital increase and share expansion in 2012, with an investment of 22.5 million yuan and a shareholding ratio of 7.5%.

Of which received in 2019DividendsThe amount of 33,800 yuan, the amount of dividends in 2019 accounted for the company’s 2019Net profit0.13% of the total; in 2020, the dividend amount of 88,200 yuan will be received.The company’s main power generation business, and related dividend pairscompany achievementsThe impact is limited.

The company’s official website shows that the Shenzhen Emission Rights Exchange was established in 2010 as a comprehensive environmental rights trading institution and low-carbon financial service platform that promotes energy conservation and emission reduction through a market mechanism. It is the most influential exchange in the field of green, low-carbon and environmental protection in China. Brand. Currently, the Pai Stock Exchange has 7 shareholders and 3 of its central enterprises. Datang Huayin Power Co., Ltd. is one of them.

It is precisely because of the concept of “carbon neutrality” on the A-share market that has triggered market associations, Huayin Power has become the most powerful stock recently.

The annual dividend is less than 100,000 yuan, but the market value has increased by nearly 5.1 billion yuan, which shows the market’s enthusiasm for the theme of “carbon neutrality”.

The 9th Central Finance and Economics Committee held on the afternoon of March 15meeting, To study the basic ideas and main measures for promoting the healthy development of the platform economy and achieving carbon peak and carbon neutrality.

The central government stated that achieving carbon peaking and carbon neutrality is a broad and profound economic and social systemic change. Carbon peaking and carbon neutrality must be incorporated into the overall layout of ecological civilization construction, and the strength to grasp iron will be shown as expected. To achieve the goal of peaking carbon by 2030 and carbon neutral by 2060.

This means that carbon neutrality will be an important goal for my country in the next 40 years. During the “14th Five-Year Plan” period, the implementation of the carbon neutrality goal will be even more important. This is equivalent to adding fuel to the fire for the carbon neutral concept plate that has been hot for a while.

On March 16, with the strong leader, it greatly stimulated the strengthening of environmental protection, UHV, smart grid, photovoltaic construction, waste sorting and other sub-sectors. At least dozens of carbon-neutral stocks in multiple sectors have shown a daily limit trend.

Many well-known hot money have appeared one after another

Standing on the strongest point of carbon neutrality, many hot funds have taken turns appearing behind the strong share price of Huayin Power.LonghubangData show that since last week, Huayin Power has been on the Dragon and Tiger list five times.

On March 16, Huayin Power was listed as a security with a cumulative deviation of 20% in three consecutive trading days and a security with a daily amplitude of 15%.

The total net sales of nearly 20 million yuan in the five full days before the transaction.Buy seats, top hot moneyHuatai SecuritiesRongchao Business Center, Yitian Road, Shenzhen, bought RMB 25,153,800. Among the sales attendance, the four major business departments were all bought yesterday.

Among them, the well-known hot money Ningbo Sangtian Road sold 23,243,500 yuan, located in the second seat of the sale. The hot money was located in the second seat of the previous day.In addition, where the leader of the chapter isHaitong SecuritiesShanghai Jianguo West Road bought 16.2042 million yuan.

The data of Huayin Power’s after-hours ranking on March 12 showed that there were also many hot money among the top five trading seats, including well-known hot money.Haitong SecuritiesNanjing Guangzhou Road, Huatai Wuxi Liangqing Road, etc. The total net sales of nearly 20 million yuan in the five full days before the transaction. Among them, Oriental Shanghai Pudong New Area Yuanshen Road bought 38.55 million yuan, ranking the first place; Huatai Wuxi Liangqing Road sold 40 million yuan, ranking the second place.

On March 9, Dongguan and Beijing were excluded from Huayin Power’s Dragon and Tiger List.Branch officeExcept for one institution, the rest are all hot money. Among them, the hot money Huatai Wuxi Liangqing Road bought 36.43 million yuan, ranking first; the hot money Huatai headquarters bought 18.63 million yuan and sold 21.43 million yuan at the same time; the hot money Caitong Hangzhou Shangtang Road bought 30.97 million yuan and sold 32.63 million yuan at the same time , The signs of hype are obvious.

Despite the unabated market enthusiasm, returning to the fundamentals, the data shows that from 2017 to 2019, Huayin Power’s deduction for non-return to parentNet profitHave been inLossstatus.

In addition, the company’s dynamic P/E ratio is relatively high. According to the data published on the website of China Securities Index Co., Ltd.,Power IndustryThe price-earnings ratio is 16.84 times, as of the close of March 16, 2021,Company dynamicsThe price-earnings ratio is 94.89 times.

Pay attention to the performance after the expected rise

In the short-term, the current concept of carbon neutrality is still strong, and the agency recommends that for equity assets, attention should be paid to the performance of the expected rise.

China SecuritiesSecurities pointed out that from my country’s energy structure andindustryFrom a structural point of view, the development of new energy is the first driving force to reduce carbon emissions. The proportion of clean energy will increase from less than 10% to more than 70%.In the medium and long term, photovoltaic and wind energyIndustry chain, New energy automobile industry chain and cleaning equipment industry are the biggest beneficiaries.

At this stage, industries with high energy consumption and large carbon dioxide emissions in my country include cyclical industries such as steel, building materials, nonferrous metals, chemicals, and papermaking. The short-term tactical investment strategy is to allocate high-quality production targets in these industries. On the other hand, in the configuration of environmental protection industries, environmental protection companies with technologies to reduce energy consumption and emissions of industrial enterprises also benefit first.

Tianfeng SecuritiesFixed income headquarterscreditSenior research departmentAnalystYu Tingting believes that from the perspective of taking the initiative to attack, under the anticipation of carbon peaks in the near future, both steel prices and stock prices will rise to a certain extent.Valuation adjustmentLater, we will enter the period when policy expectations are fulfilled, and the next step is performance fulfillment, but from the perspective of the overall plan, the benefits for superior steel companies are relatively certain.

However, she also emphasized that from the perspective of passive adjustment, the stock market rose sharply in the previous period, but the steel sector did not rebound significantly, and the safety margin was high. Under the situation of relatively high valuations of the other sectors, the relative allocation value of the steel sector has increased. Carbon peaks may act as a fuse.

Kaiyuan Securities stated that the theme of “carbon neutrality” has the following three ways to benefit: First, from the perspective of the priority of policy promotion, focus on the transformation and substitution of energy structure andIndustrial structureTransformation.

Secondly, promote the R&D and application of green consumption and carbon capture and storage technologies; finally, the trial implementation of the carbon emission trading system and the corresponding supporting carbon monitoring standards are indispensable system construction throughout the entire carbon neutralization process.

(Article source: ChinafundNewspaper)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.