原标题:与历史牛市相比,A股达到顶峰了吗?

概括

[ComparedwiththehistoricalbullmarkethaveAsharespeaked?InthemediumtermwiththeglobaleconomicrecoveryliquidityremaininglooseandthegradualimprovementofSino-USrelationsthisroundofA-sharemarkethasnotyetendedWiththereleaseofmarketsentimenttheriskofstructuralbubblescanberesolvedandthemarketisexpectedtousherinanacceleratedupwardphaseinthefuture

Summary

U.S. Treasury yields stabilized last week, global risk assets rebounded strongly, A shares gradually returned to the right track after the emotional venting of the first two trading days, boosted by unexpected financial data, Thursday and FridaymarketGeneral rise, all-week Wande all A, Shanghai Composite Index,Growth Enterprise Market IndexThey were down 2.43%, 1.40% and 4.01% respectively. From the perspective of the U.S. stock market, the Dow Jones and S&P 500 indexes surged 4.07% and 2.64% throughout the week. Both hit record highs during the intraday market, which also reflected that overseas markets’ feedback mechanisms for rising U.S. bond yields have become more rational. This also verifies what we said in the report “Worrying about inflation and trading recovery, “spring market” will return to the right track”, “With the continuous verification of economic recovery data, the improvement of profit expectations will increase market risk appetite and superimposecurrencyThe fulfilment of the authorities’ pledge to stabilize the currency will bring about valuation restoration, and the global market will also be out of a round of recovery.”

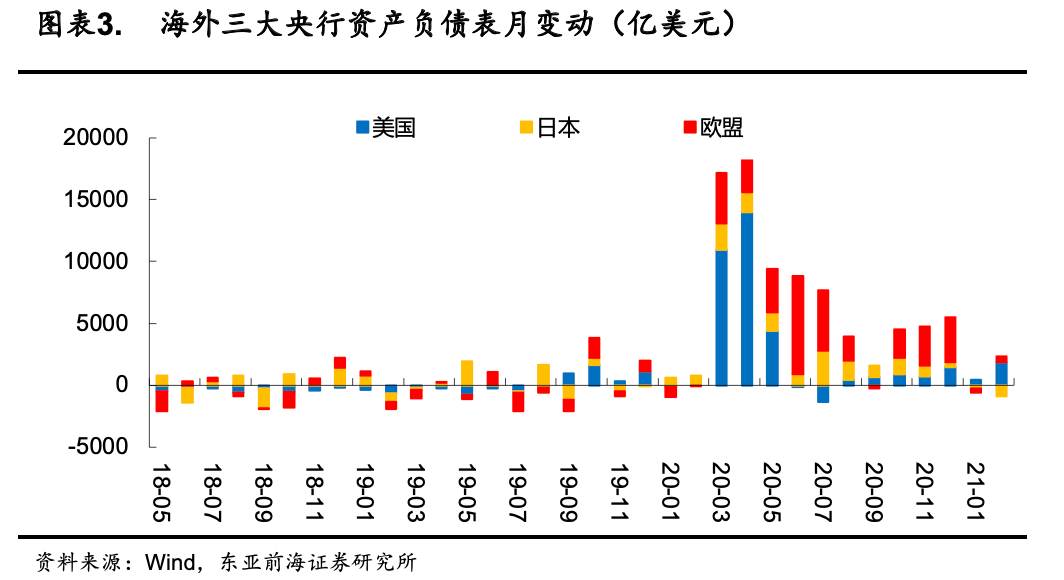

From the perspective of overseas markets, with the implementation of the 1.9 trillion fiscal stimulus, US consumer confidence has hit a new high since the epidemic. The improvement in economic data in the future is expected to continue. With the advancement of vaccination, although overseas epidemics have repeated themselves, the normalization of economic activities has increased The trend will not change.On the other hand, since February, the world’s major central banksBondThe scale of purchases has rebounded significantly from January, indicating that the monetary policies of major economies are still loose, and the market’s concerns about liquidity will gradually ease.

After the violent market turbulence last week, many investors are more confused about the mid-term trend of the market. Some investors believe that with the decline of the white horse leading stocks, the current bull market has come to an end.We have sorted out the market characteristics of the previous rounds of bull markets since 2005. The current market is still at a reasonable level whether it is from the comparison of major types of assets, the intrinsic investment value of the A-share market, and the overall market sentiment. With the release of market risks, we believe that the market is expected to usher in an accelerated upward phase.

In the medium term, with the global economic recovery, liquidity remaining loose, and the gradual improvement of Sino-US relations, this round of A-share market has not yet ended. With the release of market sentiment, the risk of structural bubbles has been resolved, and the market is expected to usher in an accelerated upward phase in the future.From a structural point of view, the current focus is on three investment leads.One clue is that the gradual implementation of the carbon neutral policy will bring continuous benefits to the cycle and energy.industryChain; the second clue is that after substantial adjustments in the previous period, the valuation is reasonable, and the industry is still improving; the third clue focuses on the spillover effect, mediumMarket valueThe second-tier leader is expected to achieve excess returns.In the medium term, we still pay attention to two main lines. One clue comes from the recovery of investment demand under the normalization of the global economy.manufacturingThe booming boom mainly includes construction machinery, electrical equipment, electronics, new energy, military industry, chemical industry, building materials, etc.; another clue comes from the consumption upgrade brought about by the release of domestic demand, mainly focusing on social services,food and drink, Light industry, medical beauty and other fine molecules track leaderenterprise.The theme focuses on digital currency, carbon neutrality and Hainanduty freeDistrict etc.

risk warning:Overseas stimulus fell short of expectations, the global epidemic exceeded expectations, and financial deleveraging accelerated.

text

1. The global market initiates recovery trading

U.S. Treasury yields stabilized last week, and global risk assets rebounded strongly. A-shares gradually returned to the right track after the emotional venting of the first two trading days. Boosted by unexpected financial data, the market rose on Thursday and Friday. All-weekly Wonderful A, Shanghai Stock Exchange Composite Index,Start a businessThe board index fell 2.43%, 1.40% and 4.01% respectively.We clearly pointed out in the report “Worrying about inflation and trading recovery, the “spring market” will return to the right track”: Driven by global economic data, overseas risk assets are graduallyinterest rate“Desensitization”, the domestic market will be back on track. In Tuesday’s report “Emotional release is nearing end, the market is expected to return to the right track” clearly pointed out that the market sentiment catharsis is coming to an end, and A-shares are expected to return to the right track. Verify our point of view.

Major central banks in the world have expanded their bond purchases.With the rapid increase in long-end yields, the central banks of major economies are stabilizingMarket liquidity, Have expanded the scale of asset purchases. On March 1, the Bank of Australia announced that it would double the scale of bond purchases and plan to purchase more than $3 billion in long-term bonds. On March 12, the European Central Bank discussed interest rates in March.meetingShanghai also promised to accelerate the pace of asset purchases to curb the rise in bond yields, althoughMidlandThe Chu did not announce a new asset purchase plan, but fromMidlandFrom the perspective of changes in the Reserve Bank’s balance sheet, the Fed’s expansion of its balance sheet in February was 185.1 billion yuan, far exceeding January’s 41.5 billion yuan, indicating that the Fed is still essentially investing liquidity to support the market.

2. The current market quotations of A shares have not yet finished

After the violent market turbulence last week, many investors are more confused about the mid-term trend of the market. Some investors believe that with the decline of the white horse leading stocks, the current bull market has come to an end.Here weReplayThe characteristics of the three rounds of bull market in the market since 2002 are compared with the current market for investors’ reference.

Judging from the gains of previous bull markets, the current market is still at a relatively moderate level.From the perspective of the past three bull markets, the bull market from June 2005 to October 2007 experienced a 28-month rise, with an increase of 568%. From October 2008 to August 2009, the market experienced a 10-month rise. The increase reached 136%. From December 2012 to June 2015, the market experienced a 30-month increase, with an increase of 274%. Since October 2018, the current bull market has experienced a 26-month rise in time, with an increase of only 62%.

Judging from the value of major asset allocation, A-shares are still more attractive than bonds.If A shares are regarded as a perpetual bond as a whole, the reciprocal of its valuation can be regarded as the implied annualized yield. From a historical point of view, when A shares peak in each round of bull market, their attractiveness relative to bonds is At a relatively high level, in October 2007, the implied rate of return on A-shares was 1.59%, which was higher than the 10-yearNational debt2.8 percentage points lower than 4.39%; in August 2009, the implied yield of A shares was 2.49%, 1.01 percentage points lower than the 3.50% of 10-year Treasury bonds; in May 2015, the implied yield of A shares was 1.21% , Which is 2.38 percentage points lower than the 3.60% of the 10-year Treasury bond.At present, the implied income of A shares is 3.60%, while the 10-yearTreasury bond yieldAt 3.29%, compared to bonds, A shares are still a better asset allocation option.

From the A share itselfValue indexLook, the current A shares are still in a safe area.From the perspective of valuation indicators, during the peak period of A-shares in 2007, PE and PB of all A-sharesMedianThey were 62 times and 6.8 times, respectively; during the peak period of A shares in 2009, the median PE and PB of all A shares were 41 times and 4.6 times respectively; during the peak of A shares in 2015, the median PE and PB of all A shares were respectively 82 times and 6.7 times; the current medians of PE and PB of all A shares are 27.8 times and 2.5 times, respectively, which are far lower than the market bubble period.

On the other hand, judging from the net breaking rate, the current market is still at a high level.In the past several rounds of market bull market, the net break rate will drop to about 0, but there are still about 10% of the market.the companyThe market value level of is lower than its book value, which also reflects that the current market still has investment value.

From a structural point of view, after some industry adjustments in the previous period, the valuation level has gradually fallen to a relatively reasonable level, and the risk of structural bubbles has also been resolved.

From the perspective of market trading sentiment, it is not currently at an overheating level.From a historical point of view, there will be a round in the latter part of the bull market.Low-priced stocksIn the market, under the background of the influx of marginal investors over the counter, low-priced stocks can often achieve excess returns. In the bull market in 2007, the proportion of low-priced stocks fell below 2%, and in the bull market in 2009, the proportion of low-priced stocks It fell to 2.3%. In the 2015 bull market, the proportion of low-priced stocks fell to 0%. At present, there are still more than 20% of stocks whose stock prices are below 5 yuan, which also reflects that the current over-the-counter fund sentiment is still at a relatively rational level.

The proportion of transactions between the two financial institutions reflects the low sentiment of leveraged funds on the market.From the perspective of on-the-spot fund sentiment, the total turnover of the two financial institutions has remained within a relatively stable range since 2016. From the perspective of the recent two financial transactions, the proportion is about 8%, which is also relatively stable since 19 years. Low level.

From the perspective of technical indicators, the current A-shares and ChiNext are at a relatively low level.Historically, at the end of a full-scale bull market, most stocks are often above their long-term trend line. In 2007, at the high point of the bull market, 91% of stocks were located in its MA60.Moving averageAbove, in 2009, the figure was 89%, and in 2015, the figure was 90%. Since 2018, this indicator has dropped to 25.5% of the previous year after reaching 74% in August 2020, until the festival. Only then did it rebound to the current 35.5%.

risk warning

Overseas stimulus fell short of expectations, the global epidemic exceeded expectations, and financial deleveraging accelerated.

(Source: Yi Bin Strategy Research)

(Editor in charge: DF358)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.