原标题:茅台爆发重大新闻,数万亿巨人增加了头寸! 中信证券“举手”大喊:3000元的目标价维持不变! 任泽平大声讲话!

概括

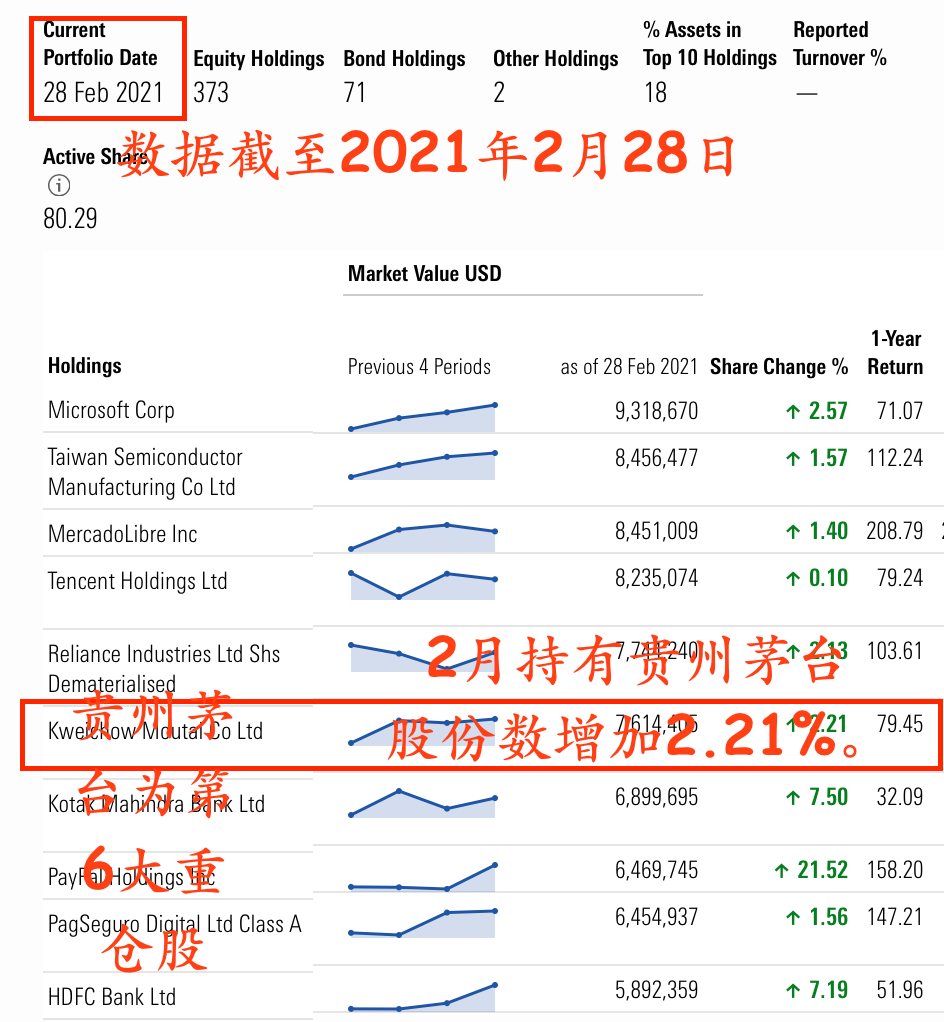

[Moutaibrokethebignewstrillionsofgiantsincreasedtheirpositions!CITICSecurities”raisedarms”chanted:Thetargetpriceof3000yuanremainsunchanged!】TheA-share“DinghaiShenzhen”KweichowMoutaihasfallenby20%aftertheholidayWheninvestorshesitatetoleaveorstayforeigninvestorshavequietlyincreasedtheirpositionsAccordingtoChinaSecuritiesasofFebruary28globalholdingsMoutai’slargestfund-NewWorldFundundertheCapitalGroup’ssharesinKweichowMoutaiincreasedby221%(ChinaFundNews)

A-share “Dinghai Shenzhen”Kweichow MoutaiAfter the holiday, it has fallen by 20%. When investors hesitate to go or stay, foreign investment has quietlyAdd warehouseUp…

According to the China Securities Journal, as of February 28, the world holds the most Moutaifund—Under the Capital GroupNew worldFund heldKweichow MoutaiThe shares increased by 2.21%.

According to the fund manager’s inquiry, as of the end of December 2020, the fund had reduced some of its holdingsKweichow Moutai. At that time, Kweichow Moutai became the fund’s fourth largest stock with a market value of 1 billion US dollars.

Although foreign investors have increased their positions in Kweichow Moutai, as of March 12, northbound funds have sold Kweichow Moutai for 9 consecutive weeks, and the market value of their holdings in Moutai has been reduced by about 12 billion yuan. Recently, despite a small rebound in institutional heavy stocks, Kweichow Moutai was still net sold 1.143 billion yuan by northbound funds, becoming the only stock that sold more than 1 billion yuan last week.

So now should we sell Moutai taking advantage of the rebound, or should we increase our position on dips?Let’s take a lookAnalystWhat do they say?

CITIC Securities: Can still rise by 48%

March 14,CITIC SecuritiesreleaseResearch reportSaid to maintain Kweichow Moutai’s target price of 3,000 yuan in the next year,WuliangyeThe one-year target price is 320 yuan.

According to the latest closing price on March 12, Kweichow Moutai closed at 2026 yuan. If you want to rise to 3,000 yuan, there is still 48% room for growth;

Compared to the current stock price of 264 yuan,WuliangyeThe stock price also needs to rise 21%.

CITIC SecuritiesIt is believed that in the near future, Moutai has successively increased the ex-factory prices of non-standard wines & series wines: first, the price of series wines increased by 10-20%; secondly, the total distribution of custom wines (ex-factory prices generally above 1500 yuan) increased the prices by 50-100 %; Chinese zodiac wine (1299 yuan increased to 1999 yuan) increased by 50%+; boutique Moutai (2299 yuan increased to 2699 yuan) increased by 15-20%, the above non-standard is expected to account forthe company8%-10% of the total plan of Moutai.Therefore, it is estimated that the income of the thickening company in 2021 will be about 5-7%, which will be attributed to the motherNet profitAbout 7-9%, the company’s revenue is expected to increase by nearly 15% in 2021, and it will be returned to the parentNet profitThe same increase of 15-20%.

therefore,CITIC SecuritiesIt is believed that other non-standard Moutai in 2021 will also help report flexibility from the perspective of volume or price; and after Pfeiffer’s approval price stabilizes, the basis for price increase will be gradually consolidated. Therefore, we are firmly optimistic about the value of Maotai’s core assets, with the strongest support and flexibility, and maintain the company’s target price of 3,000 yuan in the next year.

CITIC SecuritiesIt is believed that the structural prosperity of the liquor sector remains unchanged, among which the leadingenterpriseBoth short and long logic, both volume and price rise, business growth is very sustainable and certain: On the one hand, the economy will pick up in 2021, liquor consumption will usher in a strong recovery, and the strong performance of the Spring Festival will also increase in 2021PerformanceCertainty; on the other hand, the “14th Five-Year” leading company has a clear & rational plan, hoping to achieve a high-certainty increase in volume and price, and a clear space. In the future, the core asset value of leading companies will be further highlighted, and short-term adjustments are opportunities for layout. It is recommended that long-term strategic deployment of liquor faucets is recommended.

Dongxing Securities: Can fall by up to 30%

apart fromCITIC Securities,Guotai JunanIt is also believed that the basic orientation of liquor constitutes a solid support, and the high growth and certainty of the first quarter report performance are prominent. Companies with performance support are expected to gradually stabilize their decline, and the sector will usher in differentiation. The phenomenon that stock prices are positive for fundamentals is expected to gradually disappear, and the allocation value of leading companies with outstanding performance will be highlighted.

but,Dongxing SecuritiesHowever, it is considered reasonable that the valuation of the liquor sector is 30-40 times, that is, the overall sector has a 10%-30% downside.

The agency stated that because 2017 is an important year for market style change, it will be the year 2017.food and drinkThe starting point for valuation reconstruction is to find the bottom of the valuation of the baijiu sector’s callback this round. In 2017, the overall valuation of the liquor sector reached 35 times, and the entire sector was returned to the mother net.profitThe growth rate was 44.92%. Comparing 2017 and the current valuation of the liquor sector, due to the rapid growth of profits, the overall PEG of the liquor sector in 2017 is less than 1, and the current PEG is between 1.5-2.5.

However, the current liquor companies’ netinterest rateThe level and ROE level have been greatly improved compared to 2017, and the profitability of the company has been greatly improved. In terms of valuation, it is believed that it can enjoy a higher PEG level. That is, the valuation can be based on the PEG1.5 times (central) level + certainty premium to determine the valuation of the liquor sector.Calculated according to this method, it is considered that the valuation of the liquor sector is 30-40 times as a reasonable valuation level, that is, the overall sector has a 10%-30% downside.

Ren Zeping: Suggest MoutaiThe foreign price is 100% higher than the domestic price!

Today, Ren Zeping, a well-known economist, posted an article on the content of a discussion with Maotai experts and consultants on WeChat.He mentioned in the article that Moutai is the most likely luxury that China will go to the world in the future.BrandOne, in the future, the price abroad can be considered twice that of the domestic one.

Regarding the development of Maotai and the concerns of all sectors of society and the capital market, Ren Zeping talked about the following points.

1. Always put quality Moutai first,food and drinkThe industry is unique, after allCommon peopleThe things at the entrance, so many big brands that were once the best, have fallen on this. Moutai has done a good job in this regard for a long time, and in the future it cannot relax and increase its anti-counterfeiting efforts.

2. All the controversies over Moutai in recent years, I think it is mainly MoutaiBrand PositioningThe question, whether to go high-endLuxuryRoute or cheap price limit route?This matter has been very awkward for a long time, in fact Moutaiquality+Culture is more suitable for taking the high-end route. With so many luxury goods abroad, can’t China produce one?Especially since 2012, private consumption has accounted for most of the proportion, and MoutaipriceEven setting new highs is the result of market choices. The market economy is the relationship between supply and demand, and prices are determined by supply and demand. Limiting prices is useless and unnecessary, and violates the laws of market economy.

3. With so many luxury brands in the West, can’t China produce one? Don’t we have this cultural confidence? Moutai is one of the most likely luxury brands in China to go global in the future, and the price in foreign countries can be considered twice that in China. China is the world’s largest buyer of luxury goods, but it does not have its own brand. Is that okay? Chinese people don’t drink Moutai. Do you encourage everyone to buy the foreign wine Macallan and whiskey?Not only Moutai should go high-end luxury goodsPositioning, China should have a few moreMain brandTo seize the global luxury goods market.

4. Moutai’s social responsibility should not be limited to making Moutai affordable to everyone. This is not in line with the laws of the market economy and is not realistic. It is reflected in tax payment and settlement.Employment, Poverty alleviation, support for local development, etc. As Guizhou’s second finance, Moutai’s contribution to local development over the years has actually been great.From an economic point of view, the price increase of Moutai can be understood as a kind of taxation, collecting taxes from the rich, and then feeding back the poverty alleviation and regional economic and social development, which is conducive to regulating income distribution.Common peopleIs it advantageous, isn’t it?

5. Ironwork has to be hard by itself. In view of external disputes, I think the most important thing for Maotai is to do a good job of itself, improve quality, and doCorporate Social Responsibility, To openly explain the brand positioning to the outside world.

(Source: China Fund News)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.