概括

[Organizationisalsowondering!Thenetinflowofmorethan10billionfundsfellmoreandmorebuyingbutnotrising!What’sgoingoninthissector?】ThemarketcontinuedtoreboundtodayandthestockindexmaintainedanarrowrangeoffluctuationsIntermsofETFstwonewETFswerelistednamelytheLeagueofNationsSecurityCSIAll-IndexSecuritiesCompanyETFandPingAnCSIAnimalHusbandryETFAsofthecloseofthemarkettheyfellrespectively025%andanincreaseof02%

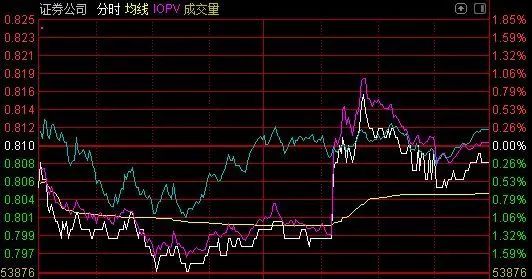

marketToday’s rebound in the market continues, and the stock index maintains a narrow range of volatility.ETFOn the other hand, two new ETFs are ushered in the listing, which is the full index of the League of Nations Security and China Securities.Securitiesthe companyThe ETF and Ping An CSI Animal Husbandry ETF had fallen by 0.25% and rose by 0.2% respectively as of the close.

It is worth noting that since March, the ETFs that track the China Securities Livestock Index have been listed together, and three of them have appeared in just a few days; and the trackingsecurities companyThe number of ETFs in the index has reached 9 and the competition is very fierce!

Over ten billionfundsInfluxBrokerage

The League of Nations Security China Securities refers to the securities company ETF listed today for tradingCodeIt is 159848, and the market is referred to as a securities company.

The securities company’s current listing and tradingfundThe share is 314 million, as of March 5, 2021,Fund assetsIn combinationstockIt accounts for 5.8% of the total assets of the fund.

Among the top ten heavyweight stocks,Guotai JunanThe largest percentage of net worth, at 1.15%; from the perspective of the recent three-month rise and fall, the top ten heavyweight stocks collectively closed down, of whichGuolian SecuritieswithThe Pacific OceanThe cumulative decline was 32.74% and 12.34% respectively.

The tracking target of the securities company is the CSI All-Index Securities Company Index (index code: 399975). The index is based on June 30, 2007, and 1,000 points are used as the base date.Base pointAs of March 11, the latest closing price was 794.68 points, and the index has fallen by 10.76% in the past three months.

CSI All Index Securities Company Index Trends in Recent 3 Month

Public information shows that the CSI All Index Securities Company Index selects the securities company industry stocks in the sample stocks of the CSI All Index to reflect the overall performance of the industry stocks.

It is worth noting that although the securities company index has continued to adjust in the past three months, the number of ETFs tracking the securities company index in the two cities has been increasing, reaching nine, and the competition is very fierce!

Over-the-counter funds have continued to enter the market. Since the beginning of the year, in addition to the securities companies listed today (159848), the shares of the other 8 related ETFs have increased. Among them, the share of securities firms ETF (512000) has increased the most, an increase of 5.63 billion. Secondly, the securities ETF (512880) increased by 2.978 billion shares.

By intervalDealPrice calculation, year-to-date brokerage ETF (512000), securities ETF (512880) and securities ETF fund (512900), respectivelyNet inflowFunds were 6.232 billion yuan, 3.446 billion yuan and 1.143 billion yuan, and the total net inflows exceeded 10 billion yuan.

In terms of scale, the top ranked securities ETF (512880) and securities firm ETF (512000) are currently 36.765 billion yuan and 25.5 billion yuan, while the five bottom-ranked firms are all less than 800 million yuan in size. serious.

9 ETFs that track the securities company index

Regarding the current trend of the securities sector, some brokerage firms said that the registration system is the corecapitalMarket reform is the core factor that will promote the valuation of securities firms for a long time to come. Securities companies act ascapital markethighqualityThe important engine of development will continue to move towards marketization, specialization, and internationalization, and the industry will improvelongThe trend remains unchanged.However, the recent correction in the secondary market has been significant, and the securities sector has been greatly affected. It is recommendedinvestmentThose who remain cautious.

ETFs that track the China Securities Livestock Index get listed together

The Ping An CSI Livestock Breeding ETF was listed today with a trading code of 516760, and the on-site abbreviation is the breeding ETF.

The breeding ETF is listed and traded this timeFund share225 million shares. As of March 5, 2021, the proportion of stocks in the fund’s asset portfolio to the total assets of the fund is 14.22%.

Among the top ten heavyweight stocks,Muyuan shares、Haida GroupIt accounts for more than 2% of net worth; from the perspective of the rise and fall in the past three months, among the top ten heavyweight stocks, 4 stocks rose and 6 stocks fell, of whichMuyuan shares、Haida GroupThey have risen by 45.4% and 23.37% respectively, showing good performance, whileTiankang BiologicalwithZhengbang TechnologyThey have fallen by 9.6% and 7.25% respectively.

The tracking target of the breeding ETF is the China Securities Livestock Breeding Index (index code: 930707). The index is based on December 31, 2011, and is based on 1,000 points. As of March 11, the latest closing price was 3601.48 points, nearly The index fell 0.05% in three months.

Public information shows that the CSI Livestock Breeding Index from Shanghai and ShenzhenA crotchThe stocks of listed companies involved in livestock and poultry feed, livestock and poultry medicine, and livestock and poultry breeding are selected as sample stocks to reflect the overall performance of the stocks of listed companies related to livestock breeding.

It is worth noting that since March, ETFs tracking the China Securities Livestock Breeding Index have been listed together. Three of them have appeared in just a few days. Currently, the largest is the breeding ETF (159865), with a share of 473 million shares and a scale of 448 million yuan. .

However, the shares of the two ETFs listed a few days ago have been reduced since they were listed. The shares of the breeding ETF (159865) and the livestock ETF (159867) have decreased by 40 million and 48.5 million respectively since their listing.

3 ETFs tracking CSI Livestock

(Source: Daily Economic News)

(Editor in charge: DF142)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.