原标题:美国国债收益率能上涨多少?

概括

[HowmuchcanUSbondyieldsgoupwithoutfinishing?AnalystssaidthattheUS10-yearTreasurybondyieldisstillfarfromthelevelof192%beforetheepidemicwhichmeansthatitmaystillhaveroomforupside”Wethinkthe10-yearTreasurybondyieldwillbeabletobreakthroughthe2%markthisyear”

Recent U.S.National debtHigher yieldsmarketThe biggest focus of the market, although the yield rate has fallen this week, it is still at a relatively high level, and the market is expected to continue to rise.

U.S. 10-yearTreasury bond yieldIt broke through 1.6% at one time, but it dropped by 7 on Tuesday.Base point,United Statesfinancialunitauction58 billionU.S. dollarThe subscription multiple for the 3-year U.S. Treasury bill hit a new high since June 2018.

After the outbreak in the United States last year,MidlandChu started extremely loosecurrencypolicy,interest rateFell to a very low level.

becauseinterest rateExtremely low, extremely low last yearinterest rateU.S. Residential Houses in StateloanReached a record 4.3 trillion U.S. dollars,ReorganizationloanIt also reached a record high of 2.8 trillion U.S. dollars.

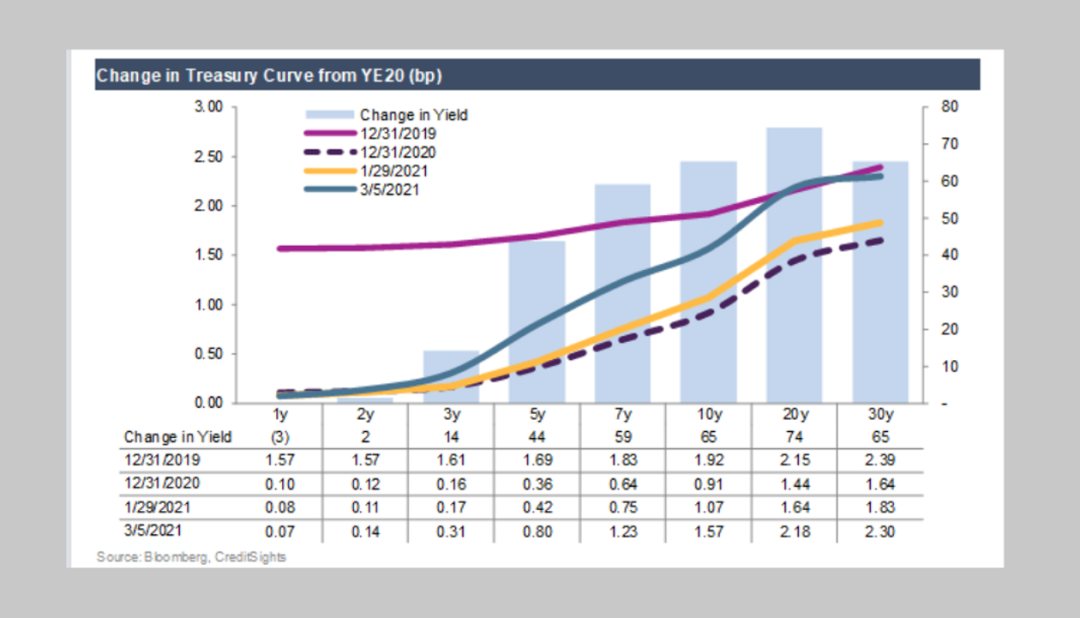

The US 30-year Treasury bond yield has risen by almost 65 basis points this year, approaching the level of the end of 2019. The U.S. 10-year Treasury bond yield has also risen by almost 68 basis points this year.

CreditSights AdvancedAnalystErin Lyons said that the US 10-year Treasury bond yield is still far from the 1.92% level before the epidemic, which means that it may have room for upside.

Chief of The Leuthold GroupinvestmentStrategist James Paulsen believes that currentlyBondMarketingInflation expectationsThat is, the 10-year break-even inflation rate is 2.25%, and there is still enough room for interest rates to rise.

“We think the 10-year Treasury bond yield will be able to break through the 2% mark this year.”

In this case, the market will pay more attentionMidlandWhether the reserve will take action, interest rate hikes may come sooner than previously expected.

Chief of Invescomarketing strategyTeacher Kristina Hooper said that if the yield on the 10-year U.S. Treasury goes up quickly,MidlandReserve will take action and affect market performance.

However, Hooper believes that inflation is unlikely to become a major problem because the United StatesEmploymentThe market is still weak, pluslongStructural issues, technological innovation issues, etc., US inflation will continue to be under pressure.

(Article Source: Golden Headlines)

(Editor in charge: DF537)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.