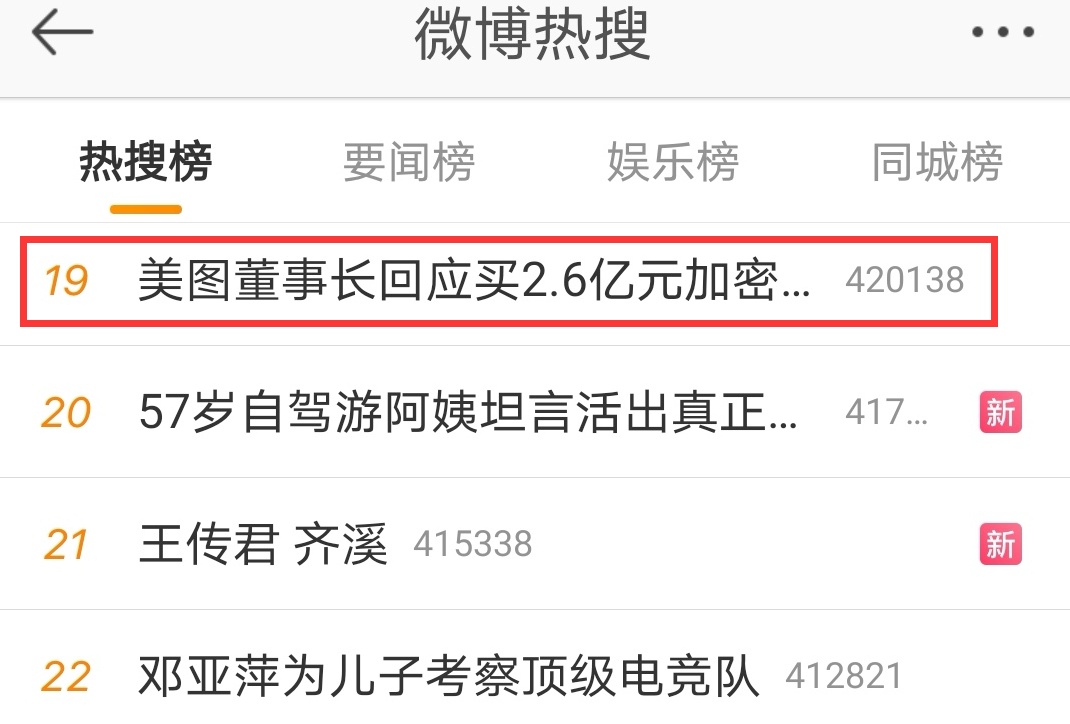

原标题:7年巨亏121亿元,却花2.6亿元购买比特币和以太币,美图在下棋吗?股价short花一现

概括

[7yearsofhugelossof121billionyuanbutspending260millionyuantobuybitcoinethereumMituisplaying?】OnMarch8MeitutheparentcompanyofMeituXiuxiuaHongKong-listedcompanylistedonWeibobecausethecompanyannouncedinahighprofilethatithadpurchased40millionUSdollarsinEtherandBitcoinwhichisapproximatelyRMB260millionyuan

Meitu wants to enter the blockchain? !

On March 8, Meitu Xiuxiu’s motherthe company——Hong Kong stock listed companyMeituBoardedWeiboHot search, because the company announced in a high profile that it had purchased 40 million US dollars ofEthereumAnd Bitcoin, aboutRenminbi260 million yuan.

Subsequently,MeituChairman Cai Wensheng posted in the circle of friends,MeituContinue to lay out the blockchain.Cai Wensheng said: “Someone must be the first to eat crabs. This should be regarded as the first Hong Kong listed company to purchase BTC figures.currencyWell, it can be regarded as the world’s first listed company to use ETH as a currency value reserve. “

Stimulated by the above news, on the morning of March 8, Meitu’s stock price opened sharply 14% higher. However, the release time of Meitu’s “blockbuster news” seems a bit untimely. The same day as Hong Kong stocks opened up and down, Hong Kong’s Hang Seng Index closed down 1.92%, and the Hang Seng Technology Index plummeted 6.4%. Meitu’s stock price finally closed down 6.27%, with a daily amplitude of more than 22%.

Meitu high-profile announced 260 million yuan “buy currency”

On the evening of March 7, Meitu released on the Hong Kong Stock ExchangeannouncementAccording to the report, the group purchased 15,000 Ethereum and 379 Bitcoin (BTC) in open market transactions on March 5. The total consideration of these two cryptocurrencies is approximately US$22.1 million and US$17.9 million, respectively. The total is 40 million US dollars (about 260 million yuan).

Based on the above data, it can be calculated that the average price of Meitu to buy Ethereum is 1,473 US dollars/piece, which is approximately RMB 9,500/piece; the average price of Bitcoin purchases is 47,200 US dollars/piece, which is approximately RMB 300,000/piece. Pieces.As ofBrokerageAccording to a Chinese reporter, the latest quotation of Ethereum is $1,733.02 per coin, and the latest quotation of Bitcoin is $50,300 per coin. This means that Meitu’s investments in Ethereum and Bitcoin have floating profits of approximately 17.65% and 6.57%, respectively. The floating profits are US$3.9 million and US$1.1756 million respectively. The total floating profits are US$5.0756 million, or approximately RMB 3311. Ten thousand yuan.

Meitu stated that these purchases were made in accordance with a cryptocurrency investment plan previously approved by the company’s board of directors. According to this, the group can purchase cryptocurrencies with a net value of no more than 100 million U.S. dollars. The source of funds is the company’s existing cash reserves (but Not the remaining money from the company’s initial public offering).

Meitu stated in the announcement that the board of directors believes that cryptocurrencies have enough room for appreciation, and at this time, by allocating part of its cash reserves to cryptocurrencies, it can be used for fund management to diversify the risk of holding cash (due to the global central bank Significant increase in fund managementcurrency supplyAnd the resulting depreciation pressure). In addition, the board of directors believes that this can show investors and stakeholders the group’s ambition and determination to accept technological innovation, so as to prepare for entering the blockchain industry.

Chairman Cai Wensheng: Someone must be the first to eat crabs

Soon after the announcement, Meitu’s chairman Cai Wensheng posted in Moments that Meitu continued to lay out the blockchain and purchased ETH and BTC digital currencies as a value reserve for the long-term development of the blockchain strategy.

Cai Wensheng also said, “Someone must be the first to eat the crab. This should be regarded as the first Hong Kong listed company to purchase BTC digital currency, and it can also be regarded as the world’s first listed company to use ETH as a currency value reserve.”

However, many netizens did not buy Bitcoin and other cryptocurrencies by Meitu. Some netizens said bluntly, “If you want to make money, just say it. If you really want to be optimistic about the digital currency, you should research and develop it yourself. Why do you buy it?”TeslaBuy 30,000, Meitu buys 50,000, the speculation company” believes that Meitu’s purchase of bitcoin is pure speculation.

Some netizens asked, “Buy a few bitcoins even if you enter the blockchain?” Some netizens said: “The virtual currency represented by bitcoin is the purest bubble in history.” Other netizens joked: “So what is the chairman? I have money. Wouldn’t it be okay to spend some money on renting an office space? Last time I went to Meitu for an interview, the staff’s desk was so crowded, half of the interviewmeetingThe room is occupied again. “

Another netizen said frankly: “I used to have an indifferent attitude towards virtual currencies, but now I am really disgusted. Because of virtual currencies, a large number of people follow the trend and flood into the mines, resulting in a serious premium for graphics cards. Or ordinary users.”

Lost 12.1 billion in 7 years and wants to diversify the layout of medical beauty and e-commerce live broadcast

MitoFoundedIn October 2008, it has Meitu Xiuxiu, Beauty Camera, BeautyPlus and short video community Meipai. In December 2016, Meitu made an IPO in Hong Kong with an issue price of HK$8.5.

The company’s share price rose to a maximum of 23.05 Hong Kong dollars in March 2017, but then fell in shock. In December 2019, Meitu’s stock price dropped to HK$1.32.In February of this year, Meitu had a continuous rise, with the highest increase of 198% in the range, and the stock price touched 4.5 Hong Kong dollars, but it has recently fallen back.New crotchThe price is reported at HK$2.54 and the market value is HK$11 billion.

Data shows that from 2013 to 2019, Meitu has accumulatedLoss12.126 billion yuan.Specifically, from 2013 to 2015, MeituNet profitThe losses were 25.81 million yuan, 1.77 billion yuan and 2.22 billion yuan respectively. From 2016 to 2019, the company’s net profit lost 6.261 billion yuan, 197 million yuan, 1.255 billion yuan and 397 million yuan, respectively. In the first half of 2020, the company achieved total revenue of 558 million yuan, a year-on-year increase of 20.1%, and a net loss of 16 million yuan. It is worth noting that the company generated an adjusted net profit of RMB 24.94 million attributable to the parent, achieving a half-year profit.

As of the first half of 2020, Meitu’s total monthly active users reached 295 million, an increase of 4.6% from December 2019. Among them, the number of monthly active users of Meitu Xiuxiu increased by 4.2% to 121 million. The average daily usage time reached 15.4 minutes, an increase of 13.2% compared to the second half of 2019. The number of monthly active users of Beauty Camera was 65.96 million yuan, a decrease of 1.3% from December 2019; the monthly active users of BeautyPlus increased by 18.1% to 78.09 million.

From the perspective of income structure, online advertising is still the main source of income for Meitu. In the first half of 2020, Meitu’s online advertising revenue reached 318.5 million yuan, a year-on-year decrease of 12.1%, accounting for approximately 57.14% of total revenue.

At the same time, in the first half of 2020, Meitu’s non-advertising business revenue has increased significantly, and its proportion has increased from 21.9% in the same period last year to 42.86%.

Among them, advanced subscription services and in-app purchase business revenue reached 84.128 million yuan, a year-on-year increase of 209.2%, and the proportion increased from 5.9% to 15.1%;the InternetThe revenue of value-added services increased by 37.3% to 21.34 million yuan, accounting for an increase from 3.3% to 3.8%; other revenue increased by 126.2% to 133.5 million yuan, accounting for an increase from 12.7% to 24%.

MitoExecutivesZeng said that in addition to doing a good job of existing business in China, Meitu will also expand in the fields of cosmetics and medical beauty. In addition, e-commerce live broadcast is another diversified track that Meitu is looking at. Meitu previously stated in its financial report that several e-commerce live broadcast tests were conducted in the first half of 2020, and more tests will be conducted in the second half of the year.Meitu believes that as more and more users buy beauty through live broadcastproduct, This service will complement its strategy well.

TeslaAnnounced the purchase of 9.76 billion bitcoins, but the stock price fell by 30%

In the context of global easing, the expectations of Bitcoin’s “digital gold” and “anti-inflation” have been further strengthened, and more and more listed companies are buying cryptocurrencies as part of their capital management.

On February 8 this year,TeslaIn a document submitted to the U.S. Securities and Exchange Commission, it was disclosed that the company had bought 1.5 billion U.S. dollars (approximately RMB 9.762 billion) worth of Bitcoin, and the news directly led to BitcoinpriceSoaring all the way, hitting a maximum of 58,300 US dollars per piece. Recently, the price of Bitcoin has fluctuated violently, with the lowest hitting $43,000 per coin, while the latest offer was $50,300 per coin. According to estimates, Tesla’s cost of buying Bitcoin is less than US$35,000. As of now, it has a floating profit of 43.7%, and the floating profit amounts to US$656 million. For the full year of last year, Tesla’s net profit was US$721 million.

However, since Musk announced on February 8 that he had invested 1.5 billion US dollars to buy bitcoin, Tesla’s stock price has fallen all the way. So far, it has fallen by 30%, and its market value has shrunk by more than 250 billion US dollars. The latest market value is 5739. One hundred million U.S. dollars. In 2020, Tesla’s share price has risen astonishingly, with an increase of more than 743% during the year.

NasdaqThe listed company MicroStrategy (Wei Ce Investment) purchased 425 million U.S. dollars of Bitcoin in August last year, and in the week of February 24 this year, it purchased 19,452 Bitcoins again for 1,026 million U.S. dollars. As of March 5, the number of bitcoins held by the company has increased to 91,064 at a total consideration of US$2.2 billion and an average price of approximately US$24,119 per coin. At present, the value of Bitcoin held by the company is close to 4.6 billion U.S. dollars, which is more than double the floating profit. The company’s stock price has also continued to pull back recently, falling more than 52% since its peak.

Bitcoin is extremely controversial, Munger: I never buy Bitcoin

Currently, in the financial industry, the debate surrounding Bitcoin is quite fierce.

Catherine Wood, the founder of Ark Investments, known as “Female Buffett,” has made a judgment: Bitcoin has the potential to reach trillions of dollars in market value. According to the grand vision of Ark Investment in 2021, if all the constituent companies in the S&P 500 allocate 1% of their cash to Bitcoin, the price of Bitcoin may rise by about $40,000; if these companies allocate 10% of their cash Configure Bitcoin, then the price of the cryptocurrency will increase by $400,000 accordingly.

U.S. investmentbankCitigroupup to dateResearch reportIt is pointed out that the recent large-scale acquisitions of Bitcoin by companies such as Tesla and MasterCard have stimulated the huge potential of Bitcoin. Bitcoin, the world’s largest cryptocurrency, is at a historical deciding moment. It is now at a “critical point”, either becoming the currency of choice for international transactions or facing a “speculative implosion.”

Critics believe that Bitcoin is a quasi-pyramid scam that damages the environment, and has no practical use other than funding illegal activities.For them, Bitcoin is low at bestinterest rateThe tip of the iceberg triggered by speculation.

U.S. Treasury Secretary Janet Yellen warned that Bitcoin is apublicAll pose a danger. She said: “I don’t think Bitcoin can be widely used as a transaction mechanism. To some extent, I am worried that it will usually be used for illegal financing. Trading with it is an extremely inefficient way to process transactions. It needs to consume an astonishing amount of power.”

President of the European Central BankChristina LagardeIt is even more bombarding that Bitcoin is a “highly speculative asset” that has been used in the past to engage in some interesting businesses and some “interesting” and completely condemned money laundering activities.

“Stock God” Buffett’s old partner, 97-year-old Charlie Munger, recently expressed a negative attitude towards Bitcoin. “I don’t think Bitcoin will eventually become the world’sexchangeThe medium is too unstable to be a good medium of exchange. In fact, it is an artificial substitute for gold. I never buy gold, so I never buy Bitcoin. “Munger suggested that investors should treat Bitcoin like him.

(Source: Brokerage China)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.