原标题:牛年首笔个人公开募股基金获得批准,“中国商人”退伍军人举足轻重。 化工“泰坦”计划能否掘金A股亲周期性市场?

概括

[ThefirstpersonalpublicofferingfundintheYearoftheOxwasapprovedforthepro-cyclicalmarketoftheNuggets’A-sharesforthechemical”Titan”?】WiththerecentnewsthatXingheFundwasapprovedbytheChinaSecuritiesRegulatoryCommissiontheindustryonceagainexpressedconcernaboutthe“individual”publicofferingDuetodifferencesinpersonalinvestmentstylestheproductperformanceof“individual”publicofferingshasfluctuatedItisalsooftencriticizedbytheoutsideworldHoweverreportersfromthecoreshareholdersofXingheFundfoundthatWangFengonceworkedasafundmanagerforChinaBusinessFundintheprocyclicalindustriessuchaschemicalandnon-ferrousmetalswhichwillalsobringaboutthenextIPOfundraisingandinvestmentMoreimagination(DailyEconomicNews)

With the recent prosperityfundThe news of the approval of the China Securities Regulatory Commission spread, and the industry once again expressedPublic offeringExpressed concern about his style of play. Due to differences in personal investment styles, the “personal line”Raised fundsofproductPerformanceHot and cold is often criticized by the outside world, but the core of Xinghe FundshareholderThe Chinese reporter found that Wang Feng had beenChinese Business FundShi Shigekura, chemical, non-ferrous metals and other procyclical industries as a performing fund manager will also bring more imagination to the next fund raising and investment.

It is reported that two of the three major individual shareholders of Xinghe Fund are veterans of the Chinese Business Fund. According to the requirements of the China Securities Regulatory Commission, within 6 months after obtaining the industrial and commercial securities and futures business license, the first one should be issued.Public fund products, The current approval stage is still before the official public offering license is obtained.

Public fundraising adds “personal department”fund company

Compared to funds around 2018the companyThe upsurge for the establishment of Xinghe Funds has slowed down significantly after 2019. In particular, the number of approved “individual” public offering funds has been rare in the past year. The news that Xinghe Fund was approved by the China Securities Regulatory Commission has once again triggered the industry’s criticism of “individuals”. Department’s discussion on public funds.

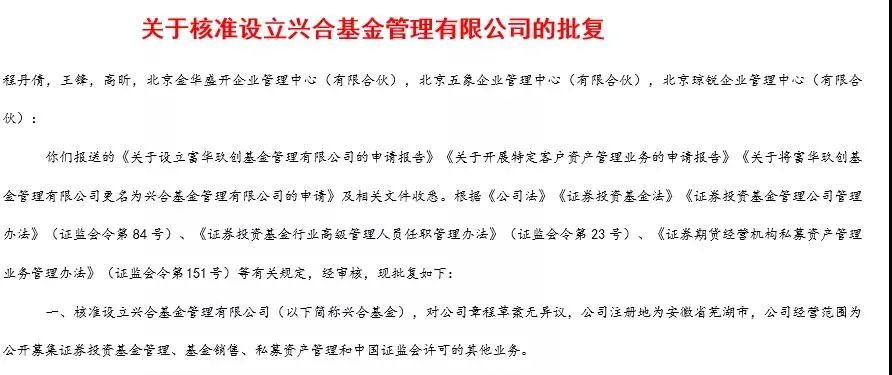

A few days ago, the China Securities Regulatory Commission issued the “Approval on the Approval of the Establishment of Xinghe Fund Management Co., Ltd.”. The reply showed that the approved registered capital of Xinghe Fund Management Co., Ltd. was 100 million yuan.RenminbiIn the approved shareholding structure, individual shareholders such as Cheng Danqian, Wang Feng, and Gao Xin accounted for 89% of the total capital contribution. The remaining three institutional shareholders are Beijing Jinhua BloomingenterpriseManagement Center (limitedpartnership), Beijing Five ElephantsBusiness managementCenter (Limited Partnership) and Beijing Qiong Rui Enterprise Management Center (Limited Partnership).

Source: Screenshot of the CSRC website

Note: Xinghe Fund approved equity institutions Source: Screenshot of the CSRC website

It is worth noting that among individual shareholders, Cheng Danqian has the highest proportion of capital contribution, with a capital contribution of 48 million yuan accounting for 48% of the capital contribution, and the actual controllers of the three institutional shareholders also point to Cheng Danqian. Taking Beijing Wuxiang Enterprise Management Center (Limited Partnership) as an example, Qixinbao statistics show that Wang Feng and Gao Xin each subscribed to contribute 1.98 million yuan, holding 49.5% of the shares, and the actual controller is Cheng Danqian.

The other two shareholding institutions also maintain the same shareholding ratio in the shareholding details, only differing in the scale of subscribed capital contributions. It can be seen that the Xinghe Fund is another “personal” public fund company initiated and established by Cheng Danqian, Wang Feng, and Gao Xin.

According to relevant laws and regulations, all shareholders need to complete the establishment of Xinghe Fund within 6 months from the date of this approval, pay in full, elect directors and supervisors, and hire senior management personnel. The approval was issued by the China Securities Regulatory Commission on February 25 this year, and it is expected that the relevant tasks and requirements will be completed before the end of August this year.

From the perspective of personal resume, Cheng Danqian previously served as the chief inspector of Huashang Fund. During her tenure, Huashang Fund set a good story in 2010. Equity products such as the company’s Huashang Prosperity Growth and Huashang Alpha led similar products for a long time at that time; Feng Ze served as a fund manager in the first fund of the Chinese Merchants Fund, the Chinese Merchants Leading Enterprise, for two and a half years after its establishment in 2007. Statistics show that his job return was 13.84%, and his annualized return was 5.12% ahead of the time.CSI 300Annualized -1.34% level.

In addition to the above-mentioned former “Chinese businessmen” public offerings, Qixinbao statistics show that Gao Xin has been the legal representative and president of China Economic and Trade Asset Management Co., Ltd. since July 2009.Worked at China Economic and Trade Asset Management Co., Ltd. and Renzhong Economic and Trade Ronghui No. 1BondPrivate equityStock investmentFund investment manager, statistics show that the product currently has an annualized return of 6.15%, ranking 27th among 148 products of its kind.

Risk control and investment ability test weak market Nuggets fineness

It is not difficult to see from the background of Xinghe Fund’s shareholders that the foundingteamHas long-term capital market investment and compliance experience, and whether the team has professional background and industry resources also affects the company’s future development, especially for new fund companies in the current environment, where risk control and investment capabilities test weak markets Golden condition.

According to the approval requirements of the China Securities Regulatory Commission, Xinghe Fund shall, after obtaining the business license issued by the administrative department for industry and commerce, obtain the securities and futures business license from the China Securities Regulatory Commission, and within 6 months from the date of obtaining the securities and futures business license, Public fund products should be issued.

A person in the investment community told reporters that for newly established public fund companies, the Administration for Industry and Commerce must obtain approval before registering the license information with the words “fund management”, and then the Administration for Industry and Commerce can register and obtain the license information. To the public offering fund license, that is to say, Xinghe Fund is still making relevant preparations before obtaining the public offering license.

However, industry insiders say that approval is the most difficult step, and obtaining a license is a matter of procedural time. However, for this reason, the timing of the first fund product is directly affected by the time window for the first fund product. However, from the “individual” fund company In terms of investment ability, successful cases in the past require the right time and place.

“Different fromBrokerageIt is the team battle advantage of public funds in investment research and risk control, and the ability of individual public funds is relatively limited. “The above-mentioned investors said frankly that the well-known Ruiyuan Fund and Zhonggeng Fund in the industry have formed a match in the short term due to the personal appeal of star fund managers, but the difference in personal investment styles has also caused the performance of the company’s products to be on different main lines. The gap in the market quickly opened up. Although Qiu Dongrong, a subsidiary of China Geng Fund’s low-valuation strategy, is understandable, it does miss the photovoltaic and new energy market in 2020.

From the current shareholder sequence of Xinghe Fund, Wang Feng and Gao Xin are both actual players, but the number of fund management related to Wang Feng in public information is only one of the leading Chinese companies, which is a partial stock.Hybrid fundGao Xin has only managed one product of China Economic and Trade Ronghui No. 1, and he prefers a bond strategy. Next, whether the two will be responsible for the two main lines of company equity and fixed income investment needs to be observed, but in terms of their respective performance levels, they are still a certain distance from the industry leader.

Want to catch up with the investment opportunities in the chemical and non-ferrous market?

However, when A-shares experienced a continuous sharp decline in 2008, Wang Feng once said in a media interview that the decline caused the stocks of some outstanding companiespriceBeing underestimated, their value will eventually be re-recognized by the market in the future, and it also brings structural opportunities. Therefore, it is not worthy of pessimism and panic.

The reporter found that in the two and a half years of Wang Feng’s duties, he was particularly enamored of stock selection in the chemical and non-ferrous industries. Although it was similar to the A-share strategy in the pro-cyclical market at that time, he had to say that the current A The investment trend of stocks is expected to resonate with Wang Feng’s investment.

Quarterly report holdings of leading Chinese companies (Quarterly Report 2007)

Positions held in the quarterly reports of leading Chinese companies (2008 Quarterly Report)

Statistics show that in 2007, the allocation ratio of Chinese business leaders to the industrial sector reached 31.09%, exceeding the average of 17.77% in the same category; the allocation ratio of energy category reached 7.46%, which was the same as the average of 7.37% in the industry. In heavy stocks,Yuntianhua、Taiyuan Heavy Industry、SinopecAnd other chemical stocks have long been ranked among the top ten heavyweight stocks for a long time,YuntianhuaFrom the third quarterly report of 2007 to the third quarterly report of 2008, it maintained the sequence of the largest heavy stocks.

Although Wang Feng’s list of heavy stocks has changed since the 2008 Quarterly Report, from an industry perspective, it is still a pro-cyclical chemical industry.Non-ferrous metalsTransition, and increased the configuration of mechanical equipment,Baobian ElectricIn the four quarters of 2008, it became the fund’s number one holding stock.

Wang Feng’s style of stock selection can be seen that the focus on pro-cyclical product layout is the main line, and he has repeatedly made it clear that he is confident in the improvement of corporate performance in pro-cyclical conditions, especially when the market index returns to a reasonable range, some resource stocks Will usher in the beginning of value revaluation.

(Source: Daily Economic News)

(Editor in charge: DF506)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.