原始标题:在牛年,将近80%的个人股票上涨了,三倍翻了一番! 各种“毛”资产暴跌了3.4万亿,这才是真正的A股? 市场前景操作指南在这里…

概括

[IntheYearoftheOxnearly80%ofindividualstocksrosethreetimesanddoubled!Allkindsof”Mao”collapsed34trillionwhichistherealA-share?】RecentlyifyoujustlookatBaotuanstocksandthebroadermarketindexyouwillmistakenlythinkthatabearmarketiscomingHoweverdon’tbefooledbytheappearanceoftheindexDatashowthatmorethan80%ofindividualstocksroseaftertheholiday(BrokerChina)

Has A shares entered a bear market? The data may not be what you think…

In the near future, if you just look at Baotuan stocks andMarket index, You will mistakenly think that the bear market is coming. However, don’t be fooled by the appearance of the index. Data show that more than 80% of individual stocks rose after the holiday.

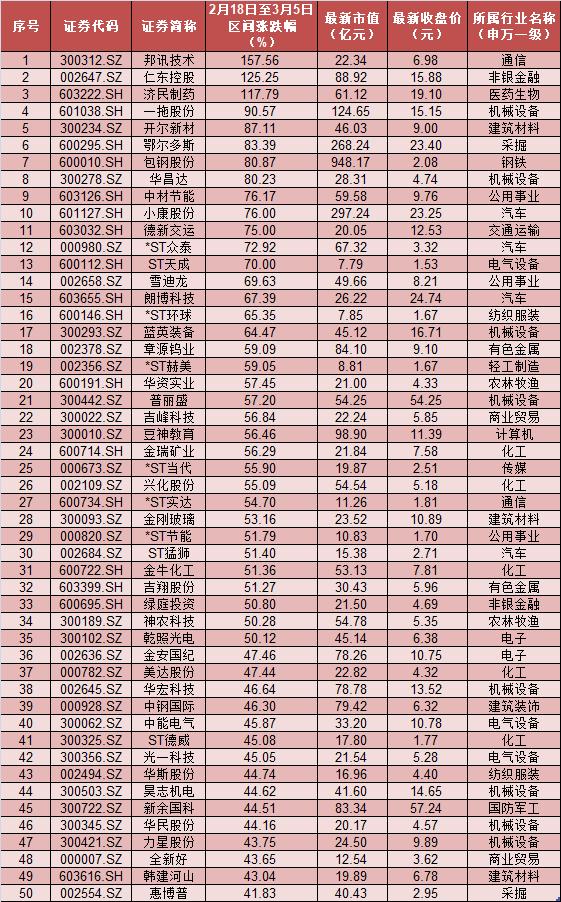

The data shows that 1,600 stocks rose by more than 10%, and 123 stocks rose by more than 30%. Among the top 100 stocks, 94 stocks have a total market value of less than 10 billion, accounting for 94%. From the perspective of the increase, three more doubled!Bangxun Technology、Rendong Holdings、Jimin PharmaceuticalThe increases were 157.56%, 125.25%, and 117.79% respectively.

Before the holiday, “Crash“Rising style” became the hottest stock review on the Internet; after the festival, everything turned upside down, and the “Carnival style plunge” became the hottest stock review.

With sudden changes in the market, you will find that there are fewer and fewer Christians calling “Kun Kun” recently, and discussions on the topic of “Cai Kun” are increasing day by day.

The A-share market has changed!There are fewer and fewer Christians shouting “Kun Kun”

In just one Spring Festival, the A-share market has changed.

After the festival, withKweichow Moutai、Ningde era、Aier OphthalmologyThe leading group stocks continued to fall, and these big-eyed blue-chip heavyweights dragged downGrowth Enterprise Market IndexThe Shenzhen Component Index fell nearly 16%, and the Shenzhen Component Index fell nearly 10%.Shanghai IndexFell 4%. If you just look at the appearance of Baotuan stocks and large-cap indexes, you will mistake it for a bear market.

However, if you carefully scan the 4,023 stocks in the entire market (excluding stocks that have been suspended from listing, and the number of times that have been listed within half a year,New crotch), you will be surprised to find that after the holiday, there were 3286 stocks that rose, only 729 stocks fell, and 8 stocks were flat. This means that 81.7% of individual stocks are on the rise after the holiday.

Statistics show that from the average rise and fall of 4,023 stocks, the stocks rose by an average of 7.9% after the holiday. In terms of market value, Baotuan stocks fell the most, with an average drop of 8.28% in the listed value of 100 billion, and a market value of 50-100 billion. The following stocks have gained an average of 11.07%.

On the other hand, before the holiday (January 1 to February 10, 2021), although the market index was in a bull market, the Shanghai Composite Index rose 5.24% and the Shenzhen Component Index rose 10.31%.Start a businessThe board index rose by 15.09%. However, more than 3,000 stocks fell during this period, accounting for as much as 75%.

Therefore, the “crash rise” has become the hottest stock comment on the Internet before the holiday. Its origin is: various liquors, medical, new energy leaders, various “mao”,fundBao Tuan, soaring all the way, the others are falling. It was during this time that the “Kun Kun” of Shigekura Baijiu was dominated by the Christians and went out of the circle. Netizens chanted the slogan “Kunkun bravely fly, iKun will stay with you forever”.

But after the festival, everything turned around, and the “carnival plunge” became the hottest stock comment on the Internet.

From February 18th to March 5th, more than 3,200 stocks rose in the Shanghai and Shenzhen stock markets, accounting for 81.7%, and nearly 1,600 stocks rose more than 10%. During this period, there were only 729 stocks that fell, and only 95 stocks that really crashed (a drop of more than 20%). Group stocks such as liquor, photovoltaics, and medical services became the hardest hit areas of the plunge.Tongce MedicalFell 39%, “eye mao”Aier OphthalmologyFell 31%,Kweichow MoutaiFell 21%,WuliangyeIt fell by 22%. As a result, you will find that there are fewer and fewer Christians who call “Kun Kun”, and the discussion on the topic of “Cai Kun” is increasing day by day, and “Kun Kun” has also become “Cai Xukun.”

After the holiday, more than 80% of individual stocks rose, and stocks with small market capitalization went crazy

After the holiday (February 18 to March 5), the three major A-share indexes seem to have fallen staggeringly, but from the perspective of individual stocks, it will be much better after the year. Among the 4,023 A-share stocks (excluding temporarily listed stocks and sub-new stocks listed within six months), 3,286 stocks rose (average increase of 11.78%), accounting for as high as 81.7%. Only 729 stocks fell, and 8 stocks were flat.

Among the 3286 rising stocks, the number of small and medium-cap stocks (with a total market value of less than 50 billion yuan) is as high as 3186, accounting for 96.9%; there are 645 stocks with a market value between 10 billion and 500, accounting for 19.6%; There are 2,541 stocks with a market value of less than 10 billion, accounting for 77.3%.

From the perspective of gains, the top 10 stocks with post-holiday gains areBangxun Technology、Rendong Holdings、Jimin Pharmaceutical、YTO shares、Kaier New Materials、Ordos、Baotou Steel、Huachangda、Sinoma Energy Conservation、Well-off shares, The increase was 157.56%, 125.25%, 117.79%, 90.57%, 87.11%, 83.39%, 80.87%, 80.23%, 76.17%, 76.00%.

Among them, 6 of the top 10 stocks have a market value of less than 10 billion yuan.The biggest increaseBangxun Technology, The total market value is only 2.2 billion yuan; the second largest increaseRendong Holdings, The latest market value of 8.892 billion yuan, the stock recorded 7 daily limit in the past 8 trading days; the third largest increaseJimin Pharmaceutical, The latest market value is 6.1 billion yuan, and the stock has gained 6 daily limit in the past 10 trading days.

The top 50 list of A-share gains after the holiday

Statistics show that after the holiday, nearly 1,600 stocks rose more than 10%, 392 stocks rose more than 20%, and 123 stocks rose more than 30%. Among the top 100 stocks with post-holiday gains, 94 stocks have a total market value of less than 10 billion, accounting for 94%. There are 72 stocks with a total market value of less than 5 billion, accounting for 72%; 49 stocks with a total market value of less than 3 billion, accounting for 49%. This means that the vast majority of stocks with the highest gains after the holiday are stocks with small market capitalization.

Guosheng Securities pointed out that since the beginning of the New Year, the market has experienced very strong ups and downs, and Baotuan stocks have fallen one after another.Valuation adjustmentDuring the period, high-valued stocks continued to move downwards, and low-valued blue-chip stocks were favored by incremental funds.Recent market incrementCash flowSigns of entering the small and medium market capitalization of blue chips are obvious, and focus on operationsNon-ferrous metals, Chemical, clean energy, machinery manufacturing and other industries.

The big ticket collapsed, 32 companies have a market value of 100 billionthe companyA drop of more than 20%

In the A-share market, large tickets have always been a magnet, and institutions are keen to invest in them. With more and more institutions buying, the stock price of large tickets has naturally risen. However, when the organization’s grouping behavior reaches its extreme and the valuation of heavy stocks reaches its limit, once the market wind changes, highly convergent positions will easily lead to transaction crowding, forming a stampede, and causing related stocks to fall sharply. The sharp drop in stock prices will also cause losses to the fund’s net value, leading to redemptions by some citizens, and the fund being forced to sell some stocks, forming a negative cycle.

Statistics show that since February 18, there are 95 stocks that have fallen by more than 20% in A shares. Among them, there are 32 companies with a market value of over 100 billion, accounting for 33.68%, and most of them are institutional stocks.Among the above 32 companies with a market capitalization of 100 billion yuan, the pharmaceutical stocks are the most, with 7 companies, namelyMindray Medical、WuXi AppTec、Aier Ophthalmology、Pien Tze Huang、Yunnan Baiyao、Tigermed、Wantai Bio.Liquor stocks are followed by 5 companies, namelyKweichow Moutai、Wuliangye、Luzhou Laojiao、Yanghe shares、Shanxi Fenjiu, The decline was 20.79%, 22.22%, 30.77%, 21.37%, 29.93%. Since the Year of the Ox, the above-mentioned 32 companies with a market value of 100 billion yuan have lost 3.4 trillion yuan.

List of 100 billion market capitalization stocks that have fallen by more than 20% after the holiday

How to operate in the future?Institutions: sink the target to 10 billion-50 billion market capitalization company

A year later, the sharp decline of institutional holdings became the main reason for the decline of the three major A-share indexes. A considerable part of this round of decline was caused by the rise in U.S. bond yields.As the anchor of global risk assets-10-year U.S.National debtThe yield exceeded the market threshold of 1.5% overnight on February 25, and even exceeded 1.6% during the session.At the beginning of this year, this value was less than 1%, and it soared by more than 50 in just 2 months.Base point, The increase was as high as 60%, exceeding market expectations, making financial markets with historically high valuations more vulnerable.

On the evening of March 3, Beijing time, the U.S. 5-year P&L inflation rate rose by 2.5%, a record high since 2008. The 10-year U.S. Treasury once rose by nearly 1.5%.On the evening of March 5th, Beijing time, 10-year period in the United StatesTreasury bond yieldIt rose to 1.62%, exceeding the high since February 25.Although recentlyMidlandThe Chu has repeatedly downplayed inflation concerns, but the market believes that the worst inflation in 50 years is about to come. Some organizations have roughly simulated it according to the DCF model. The 10-year U.S. debt has risen from 1% to 1.5%, and the average valuation of the entire market should be reduced by 20-30%.

Guotai JunanIt is believed that as inflation expectations continue to heat up, U.S. debtinterest rateThe upward certainty is very strong, and the difference lies in the upward rhythm and short-term upward potential.But regardless of the rhythm and space, withinterest rateThe consensus on the upside is getting stronger and stronger, highinterest rateIt is a sharp edge to pierce the asset bubble, and the turbulence in the global financial market may intensify. However, although the current liquidity tightening is not expected to cause systemic risks to A shares, it will still trigger certain structural risks. Under the influence of this, the old group stocks will gradually withdraw from the field of vision.

Guotai JunanSaid that for some time in the past, A-shares have pushed the valuations of leading stocks in the technology, pharmaceutical and consumer sectors to their historical extremes under the grouping of institutions. Of course, in this respect, these group stocks have a certain premium, but it is more driven by liquidity. In the future, as the liquidity margin tightens, the core focus of the market will shift from the original liquidity drive to the profit drive, which will continue to suppress the valuation of the old group stocks. When there is a correction in the old Baotuan stocks, institutions will again continue to select and form new Baotuan stocks based on the matching degree of earnings and valuation.Currently worldwideRaw materialsThe long-end logic of the cycle leader benefits from the resonance of economic growth at home and abroad and the replenishment of inventories in Europe and the United States, while the near-end logic benefits from industrial productspriceRising, with higher odds and winning rate, will become a new group stock.

Galaxy Securities pointed out that from the perspective of the price/performance ratio of stocks and bonds, rising interest rates will cause the stock market valuation to be under pressure.Performance. Although the current general environment will not lead to the complete collapse of market confidence, increased volatility is inevitable. Therefore, it is recommended to focus on fundamental advantages and valuation attractiveness when configuring.

Tianfeng SecuritiesIt is believed that as the inflection point of global liquidity is expected to gradually approach, for large market capitalization companies (above 50 billion), the subsequent volatility will increase with a high probability, and the space for their excess returns will continue to be compressed.For small companies with a market value of less than 10 billion, the capital and currentcreditThe continued decline in the cycle is not conducive to the overall increase in the valuation of these small-cap companies. Therefore, the style configuration needs to be balanced. It is more reasonable to sink the target to a company with a market value of 10-50 billion.

In terms of configuration,Tianfeng SecuritiesSuggested attention: 1) Top-down perspective: Give priority to mid-market value companies in high-quality tracks with industry beta attributes, including production line equipment, military upstream, new energy (vehicles), raw materials and parts (non-ferrous metals) that follow the global production cycle , Chemical, Machinery, etc.)); 2) Bottom-up perspective: Choose companies with alpha attributes. This type of company requires continuous verification of annual and quarterly performance data.

(Article Source:BrokerageChina)

(Editor in charge: DF506)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.