原标题:以前的“跌停限制王”已经在8天的时间内变成了7天的涨停,而对于大量亏损的股票,最近还有25天的涨停! 表现不佳的股票再次被妖魔化了吗?交易所已经开始关注

概括

[Theformer”limitdownking”hastransformedintoan8day7dailylimit!Therearemorehugelossstocksrecently25stockswithpoordailylimitperformanceanddemon?Afterthecollapseoftheorganizationgroup”poor-performingstocks”and”junkstocks”andotherproblematiccompanieshavebeentransformedandturnedintosweetpastriesinthetwocitiesThesecondarymarketshowsthatRendongHoldings(002647)theformer”limit-loweringking”recentlyturnedaroundandusheredinan8-day7-daylimit;thehugelossof*STZotyehasalsostageda12-daydailylimitandithasbeentradingsinceJanuary11Therewere25dailylimitsin34tradingdaysandtheweirdtrendalsoattractedtheattentionoftheShenzhenStockExchange(OfficialWeiboofeCompany)

After the organization’s group collapsed, “poor performance stocks”, “Junk stocks“And other issuesthe company, After a sudden change, it turned out to be a sweet pastry in the two cities, and they have staged a wave of daily limit.

The secondary market shows that the former “limit-limit king”Rendong Holdings(002647) Recently turned around, ushered in 8 days 7 daily limit; huge amountLossof*ST ZhongtaiIt also staged a daily limit for 12 consecutive days, and there were 25 daily limits in 34 trading days since January 11. The weird trend has also attracted the attention of the Shenzhen Stock Exchange.

ST plate “monstery” struck

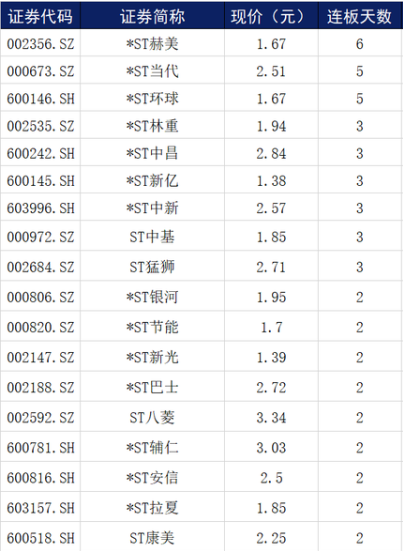

After the collapse of the organization’s “Baotuan”, the “monstery” of the ST sector in the two cities prevailed. On March 5th, as many as 40 stocks in the ST sector have a daily limit, of which*ST Hemei(002356) 6 connecting plates,*ST contemporary(000673) with*ST Universal(600146) 5-connected board.

According to statistics, as of March 5,Share192 ST shares announced for the whole yearPerformanceForecast and performance forecast types show that there are 83 pre-profit companies, 59 pre-loss companies, and 33 loss-reducing companies.

To previewNet profitStatistics for the upper limit, throughout the yearNet profitThe highest is*ST Pegasus(002210), is expected to achieve netprofitThe upper limit is 9.505 billion yuan, followed by*ST Liyuan(002501)、ST Yongtai(600157), the annual net profit ceilings are estimated to be 4.90 billion yuan and 4.805 billion yuan respectively.

Among ST companies whose performance is expected to lose, the one with the most expected loss is*ST HNA(600221), the estimated minimum loss for the year is 58 billion yuan, followed byST Kangmei(600518)、*ST Anxin(600816), the estimated losses are 14.85 billion yuan and 6.9 billion yuan respectively.

The secondary market shows that since February this year, the ST sector has shown a continuous upward trend, and the overall sector rebounded more than 12% from the low point in early February.Among them, bankruptcy has been submitted to the courtReorganizationof*ST Zhongtai(000980), the increase since February is nearly 80%, and it even staged 12 consecutive boards.

Among the ST stocks with pre-earnings, the best performers during the year were ST Fenda (002681), ST Dongke (000727) andST huge(601258), these three stocks all rose more than 20% this year.

“The King of Limits” is once again a god

Not only is the ST sector crazy, but stocks that have experienced flash crashes in 2020, such asRendong Holdings、Jimin Pharmaceutical、Rambo Technology、Good home、Huazi IndustryAnd so on. Recently, the daily limit has been staged one after another, and some stocks have consecutive daily limit.WhereRendong HoldingsThe most eye-catching.

After the opening of the market on March 5, Rendong Holdings was still trending strong, surpassing the daily limit in just 10 minutes. Although there were several subsequent bombings, the funds were closed back in the afternoon.Cover sheetThe volume reached more than 50,000 hands, and the trading volume exceeded 2.1 billion. As of the closing, Rendong Holdings closed at 15.88 yuan, with a total market value of 8.89 billion.

This is also the seventh daily limit that Rendong Holdings has harvested in the past eight trading days. It is worth noting that the stock has continued to rise sharply since February 24, with seven daily limit gains in 8 trading days, with a cumulative increase of 102.55%.

After market on March 5LonghubangData shows that an institution’s seats bought 27.97 million yuan and sold 47.49 million yuan, a total net sale of about 20 million yuan.The other seats are all seats in the sales department. The securities sales department of Ningbo Sangtian Road, Guosheng Securities Co., Ltd., which bought the most, bought 32.57 million yuan and sold the mostCaitong SecuritiesShaoxing Shangyu Jiangyang Road Securities Sales Department sold 28.39 million yuan.

However, for Rendong Holdings’ daily turnover of over 2.1 billion yuan, hot moneyGameThe signs are obvious.

With such a rising trend, Rendong Holdings seems to have forgotten the “slaughter” three months ago, 14 tragedies with the lower limit, setting a record for consecutive lower limit stocks that year, and Rendong Holdings has also become the “limit king”. , “The strongest meat grinder in history”.

To Rendong,*ST ZhongtaiWait for key monitoring

Rendong Holdings’ main business is third-party payment,Factoring、supply chainWaiting for business. In terms of performance, Rendong Holdings’ performance has not seen a fundamental improvement.

On January 29 this year, Rendong Holdings released a performance forecast, which is expected to belong to a listed company in 2020shareholderofNet loss280 million-430 million yuan, from profit to loss.Rendong Holdings explained that the main reason for the changes in performance was the provisionGoodwillImpairment provision。

Because of the continuous daily limit, Rendong Holdings recently released a total of three abnormal fluctuationsannouncement, There is no information that should be disclosed but not disclosed.In addition, Rendong Holdings also disclosed that due to stock price fluctuations, the expiration of the two financing businesses, and potentialPledgeThe impact of default disposal risk, controlling shareholder Beijing Rendonginformation TechnologySome shares of the company held by the limited company and the person acting in concert with Rendong (Tianjin) Technology Co., Ltd. may be subject to the risk of forced liquidation.In addition, Rendong Holdings disclosed that among the debts in arrears, the company has repaid 80 million yuan and paidIndustrial BankApply for loan renewal.

However, even after three announcements of changes were disclosed, Rendong Holdings was still hyped by hot money. After the close of trading on March 5, the Shenzhen Stock Exchange issued an inquiry letter requesting the company to explain whether there are six matters that should be disclosed, including undisclosed major matters.

Coincidentally. The debt-ridden, huge loss *ST Zotye also received an inquiry letter from the Shenzhen Stock Exchange on March 3 after performing 12 consecutive games.

In addition, news from the Shenzhen Stock Exchange showed that from March 1 to March 5, the Shenzhen Stock Exchange took self-regulatory measures against 38 abnormal securities trading activities, involving abnormal trading situations such as intraday pushes and false declarations; “Rendong Holdings”, “*ST Zotye” and “CDB 2009” and “CDB 2008” with abnormal daily gains continued to conduct key monitoring and timely supervisory measures; a total of 26 major issues of listed companies were carried out. Check and report to the China Securities Regulatory Commission for clues to 3 suspected violations of laws and regulations.

Related reports:

Shenzhen Stock Exchange: This week, Rendong Holdings and *ST Zhongtai continued to focus on monitoring the abnormal gains for multiple consecutive days

(Article source: e company official micro)

(Editor in charge: DF150)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.