原标题:23分钟内售罄! 这些天仍然有人在抢钱,这是怎么回事?

概括

[Soldoutin23minutes!What’sgoingonwithpeoplerushingforfundsthesedays?】SincetheYearoftheOxmarketvolatilityhasincreasedmarkedlywithmanyprivateequityproductsatthetensofbillionslevelfallingbymorethan10%lastweekUnexpectedlyinsuchavolatilemarkettherearestillsometensofbillionsofprivateequityproductssoughtafter(ShanghaiSecuritiesNews)

Since the Year of the Ox,marketThe volatility has increased significantly, and there are many tens of billions of private equityproductLast week it fell more than 10%. Unexpectedly, in such a volatile market, there are still some tens of billions of private equity products sought after.

It is reported that on March 1, YuzhongOriBoInitiateOf a newfundThe subscription was officially opened, and it was quickly sold out in just 23 minutes, with a raised scale of nearly 300 million yuan. The total amount of recent products raised by a tens of billions of private equity in Beijing also exceeded 5 billion yuan.

Half is sea water and half is flame. It is worth noting thatPublic offeringThe issuance has recently cooled down. Not only has the number of sold-out funds decreased in one day, but also new funds have extended the fundraising period.

Why are some private equity products still popular?Industry insiders bluntly said that when the market just started to adjust, due to private equityPositionMore flexible,investmentInstead, they will be more inclined to buy private equity funds, but if the market continues to weaken or volatility continues to increase, public and private equity offerings may cool down significantly.

Ten billion-level private placement is still hot

On March 2, tens of billions of private placementsOriBo WeChat issued a “Thank You Letter” stating that on March 1, from ChinaOri“Central Europe Ruibo Core Selected Private EquityStock investmentThe fund” is officially open for subscription, and it has been sold out in just 23 minutes.jobsSuccessfully completed.

CEIBS Chairman Wu Weizhi published an article on Monday, saying that in the absence of sudden major changes in the future, the probability of this round of bull market has not yet fully ended.Although some industries are related tothe companyThe bull market may have been completed, but there are still a lot to be found in the market.Investment goodsKind. And compared to all major types of assets, the group of high-quality companies with reasonable valuations is still the most attractive asset. In addition, the fact that the bull market is not over does not mean that the market will not adjust. The adjustment and cooling of the short- and medium-term market is a good thing for the market to get out of the bull market.

According to industry insiders, the scale of the new products established by China Europe Ruibo is nearly 300 million yuan, and many other old products are still open normally. “If you look at Wu Weizhi’s statement, the current adjustments will make the new fund more open. positive”.

In addition, a tens of billions private equity firm in Beijing recently sold closed-period products in multiple channels, and the total raised funds have exceeded 5 billion yuan.According to a market source in the private equity market: “The period from January to March of each year belongs toFund issuanceDuring the opening stage of the channel, the schedule of the channel is very precious. You need to make an appointment a year in advance. So now several channel time points are gathered together, and it is not deliberately arranged. There are still several channels that have not ended and ended. It will be sealed afterwards. “

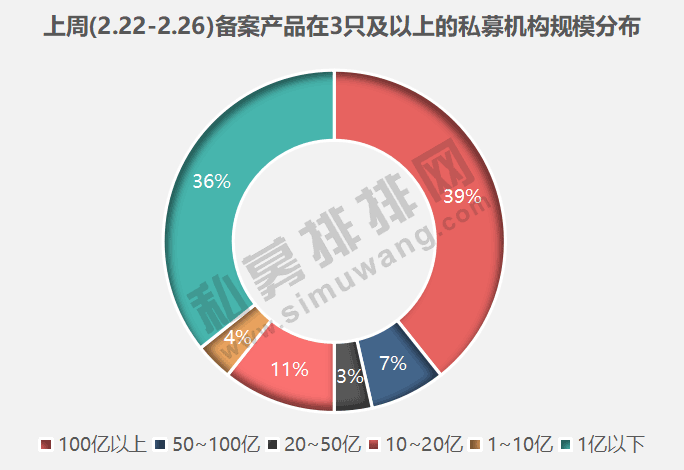

Private equity ranking data shows that from the perspective of the number of filings, tens of billions of private equity is still the number of filing funds last week.Main forceMilitary”, 11 private equity funds with tens of billions of value in a single week are 3 or more.

Significant adjustments in the net value of private equity products

The general public-private equity fund’s explosion is mainly due to the money-making effect of the fund, but from the recent tens of billions of private equityPerformanceIn terms of performance, this is not the case.

Data from third-party platforms shows that the net worth of a number of tens of billions of private placements last week (2.19-2.26) has undergone substantial adjustments. For example, many products of Qushi Asset have fallen by more than 10%, many products of Oriental Harbor have fallen by more than 14% last week, and many products of Linyuan Investment have fallen by more than 17%.

“In fact, there is a certain degree of lag in capital. A few days before the market adjustment, individual investors could not make money, so they would switch to funds. Moreover, the money-making effect of funds increased significantly last year.Bargain huntingIn the past week, there have been no obvious signs of a cooling down in the issuance, but the capital entering the market is still relatively active. In addition, tens of billions of private equity is more inclined to issue three-year closed products. From a medium to long-term perspective, it is a relatively good time to enter the market now. “A private equity funder in Shanghai said.

Issuance or will gradually cool down

Today, the market once again fell into a sharp adjustment. As of the close, the Shanghai Composite Index had fallen by more than 2%.Growth Enterprise Market IndexIt fell nearly 5%.

In this regard, many industry insiders bluntly said that subsequent private placements may cool down significantly.

“Investors buying funds are mainly due to the money-making effect. Today’s market adjustment means that many tens of billions of private equity will also perform ugly this week. The sharp decline for two consecutive weeks will cause many individual investors to have risk aversion. ,oldclientIt may also be necessary to preserve the income. In addition, as far as I know, many private equity executives now have a small marginLighten up, But still stick to those with higher certainty and did not retreat. Therefore, the net value of some products will fluctuate greatly, and the pace of investors entering the market will naturally slow down. “The above-mentioned Beijing tens of billions of private equity market sources revealed.

From the data point of view, public offerings have cooled down. Not only did the number of funds sold out in one day dwindle rapidly, this week there was also a postponement of the raising of new funds.

However, from a longer-term perspective, a number of tens of billions of private equity is still quite confident in the A-share market.

For example, Xingshi Investment believes that for the whole year, there are still many investment opportunities that can participate in 2021, the economy continues to recover, and the profitability of listed companies is obvious.improve, The direction of strong earnings growth and reasonable valuation will be the focus of attention, as long asenterpriseIf profit is supported, there is no fear of changes in liquidity.

Founding of the above-mentioned Beijing tens of billions of private equitypartnershipPeople also bluntly said: “Recently, they will not reduce their positions significantly, and they are still optimistic about the more certain targets. After the sharp decline in some assets, they will be more attractive.”

(Source: Shanghai Securities News)

(Editor in charge: DF075)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.