原始标题:巴菲特的重仓股曝光!这位小型技术领导者已受到100多家机构的调查,其中透露了与特斯拉合作等重磅信息

概括

[Buffett’sheavystocksexposed!Thesmalltechnologyleaderhasbeeninvestigatedbymorethan100institutionsandrevealedheavyinformationsuchascooperationwithTeslaOntheeveningofFebruary27thBeijingtimeBuffettannouncedtheannualopenlettertoshareholdersontheBerkshireHathawaywebsiteDatashowthatBerkshireHathaway’soperatingprofitinthefourthquarteroflastyearwas502billionUSdollarsayear-on-yearincreaseof14%Thecashreservesattheendof2020are1383billionUSdollarsThefinancialreportshowsthatasofDecember312020BerkshireHathawayannouncedthatthetoptenpositionsattheendofthefourthquarteroflastyearwereApple(marketvalueofUS$1204billion)BankofAmerica(marketvalueofUS$313billion)andCoca-Cola((MarketvalueofUS$219billion)AmericanExpress(marketvalueofUS$183billion)VerizonCommunications(marketvalueofUS$86billion)Moody’s(marketvalueofUS$716billion)UnitedBankofAmerica(marketvalueofUS$69billion)BYD(marketvalueofUS$5897billion))Chevron(marketvalueofUS$4096billion)CharterCommunications(marketvalueofUS$345billion)(SecuritiesTimes)

After the holidayInstitutional researchThere are more than 60 stocks,Jerry sharesbecomeResearchThe stock with the largest number of institutions.

On the evening of February 27th, Beijing time, Buffett at Berkshire Hathawaythe companyThe official website announces the annualshareholderopen letter. Data show that Berkshire Hathaway’s operating profit in the fourth quarter of last year was 5.02 billion US dollars, a year-on-year increase of 14%. The cash reserves at the end of 2020 are 138.3 billion U.S. dollars.

The financial report shows that as of December 31, 2020, Berkshire Hathaway announced that the top ten positions at the end of the fourth quarter of last year wereapple(Market value of 120.4 billion U.S. dollars),Bank of America(Market value of 31.3 billion U.S. dollars),Coca Cola(Market value of 21.9 billion U.S. dollars),American Express(Market value of $18.3 billion), Verizon Communications (market value of $8.6 billion),Moody(Market value 7.16 billion U.S. dollars),United Statesbank(Market value of US$6.9 billion),BYD(Market value of 5.897 billion U.S. dollars),Chevron(Market value of 4.096 billion US dollars), Charter Communications (market value of 3.45 billion US dollars).

Buffett investedBYDIs Hong Kong stocks, notBYDA shares.Twelve years ago, Buffett’s Berkshire Hathaway, when BYD’s stock price was at a low point at the end of 2008, sold 8 Hong Kong dollars per share, or about 1 US dollarspriceInvested in BYD’s Hong Kong stocksBYD shares230 million US dollars, accounting for 10% of the company’s shares. The cost of US$230 million, compared to the market value of BYD at the end of the fourth quarter of last year, is US$5.897 billion, which also means that Buffett’s Berkshire Hathaway has earned more than 24 times the benefits of BYD!

Some well-known institutions disclose their positions

In addition to Buffett, since the New Year, Hillhouse Capital and the Norwegian Governmentfund, Jinglin Assets and other well-known investment institutions announced their positions at the end of 2020.

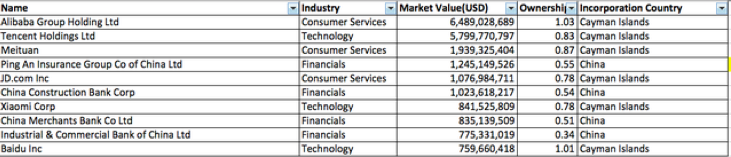

On February 25, the positions of the Norwegian government’s global pension fund, the world’s largest sovereign fund, were fully exposed.As of the end of 2020, the fund’s holdings include 742 Chinese companies, of which the largest holdings areAlibaba.It’s not the largest A-share stockKweichow Moutai, ButPing An of China。

Compared with the end of 2019, the market value of the Norwegian government’s global pension fund Chinese stock investment rose from 236.1 billion yuan to 320.5 billion yuan in 2020.

The fund’s top three major holdings in Chinese stocks are:Alibaba、Tencent Holdings, Meituan, the market value of its positions are 42.5 billion yuan, 38 billion yuan, and 12.7 billion yuanAlibabawithTencent HoldingsIt also ranks among the top 20 largest stocks in the Norwegian government’s global pension fund.And the largest A-share stock isPing An of China, The market value of positions held is 8.2 billion yuan;Kweichow MoutaiThe market value of the position is about 4.2 billion yuan.

Compared with the end of 2019, the Norwegian Government’s Global Pension Fund has increased positions in many Chinese companies, includingWei LaiAutomobile, Xiaomi Group,JingdongGroup etc.

Earlier, Hillhouse submitted to the US Securities and Exchange Commission (SEC) about the position of US stocks at the end of the fourth quarter of 2020.

Pinduoduo、BeiGene、Jingdong、IQIYI、Taibang Bio、BilibiliEtc. has always been a company held by Hillhouse for a long time, and the perfect diary of the listing in the fourth quarter of last year,MINISOProjects invested by Hillhouse’s primary market also appeared on Hillhouse’s fourth quarter position list.

In the fourth quarter of last year, Hillhouse Capital increased its holdings by 9 companies and added 19 companies. among them,PinduoduoHillhouse increased its holdings by 23,000 shares, the number of shares rose to 10.23 million shares, and the stock market value was as high as US$1.818 billion (approximatelyRMB11.7 billion yuan), becoming Hillhouse’s largest heavyweight stock (PositionAccounted for 14.45%).

6 shares were investigated by hundreds of institutions

According to the statistics of Securities Times and Databao, there are more than 60 stocks investigated by institutions after the holiday.In terms of the types of research institutions, post-holiday securities companies have the most extensive surveys, surveying more than 50 companies, that is, over 80% of listed companies have surveyBrokerageparticipate.

Jerry sharesBecome the stock with the largest number of research institutions after the holiday.The data shows that a total of 172 institutions have investigated the company, including 47fund company, 21 securities companies, 19 private equity, 15InsuranceCompany etc.In the survey minutes, some organizations asked whether the company’s business was in line withOil priceRelated?If oil prices go down again, will it seriously affect the company?Performance?

The company stated that the current main business of the company is oil and gas equipment manufacturing and technical services, maintenance and transformation and trade parts sales, environmental protection services, etc. The relationship between overseas business and oil price is relatively close, while the relationship between domestic business and oil price is relatively low. Despite the plunge in international oil prices in 2020, driven by the national energy security strategy, increasing oil and gas resources reserves and production has brought opportunities. Domestic crude oil production increased by about 1.6% year-on-year, natural gas production increased by 9.8%, and shale gas production increased by 30%. The above has a positive impact on the company’s business. The National Energy Administration held the 2021 shale oil exploration and development promotion meeting, which clearly included the strengthening of shale oil development in the “14th Five-Year” development plan, which also promotes the company’s business.In recent years the companyproductWith the increase in sales lines, the brand awareness of products overseas continues to increase, and the resistance to falling oil prices has been greatly improved. And according to the current judgments of mainstream domestic and foreign research institutions, as the epidemic improves this year, international oil prices will not fluctuate sharply like last year, and the industry’s prosperity will pick up.

Jerry sharesSome time ago, the stock price once hit a record high, but after the holiday there was a big callback, adjusted from above 57 yuan to the latest 42.5 yuan, a sharp drop of nearly 27%.

Other stocks investigated by more institutions includeHengyi Petrochemical、Robust medical、Lianchuang Electronics、Pumen TechnologyEtc., have been investigated by more than 100 institutions. among them,Lianchuang ElectronicsObtained surveys from 106 institutions.In the survey minutes, the company introduced that the company has beenTeslaContinue to provide car lens, which is the second levelsupplier, Some lenses are the main supplier, and we are cooperating with the development of a variety of lenses for future upgrades. End of 2020TeslaThe lens is being upgraded, the DMS surveillance lens is in fixed-point cooperation, and the upgraded product is already in mass production and shipment. Three advanced assisted driving safety (ADAS) lenses have been co-operated.versusTeslaThe joint development reflects the company’s leading position in optical vehicle lenses.

In the questioning session, some organizations asked, the logic of the growth of equity incentives from 2021 to 2023?

The company said,Company systemThe restricted stock incentive plan is to further establish and improve the company’s effective incentive mechanism, fully mobilize the enthusiasm of the company’s management and core employees, effectively combine the interests of shareholders, the company and employees, and make all parties concerned about the company. Long-term development.From the perspective of the goal of equity incentives, the growth of the entire main business comes from the growth of the optical business.industryRevenue from 2021 to 2023 will be 2.6 billion yuan, 4.5 billion yuan, and 6 billion yuan respectively. The source of confidence is mainly from the company’s market prospects and comprehensive consideration of orders in hand. The company will do its best to seek development and strive to achieve its goals.

Some organizations asked whether Tesla’s progress was affected by unit price or share? The company said it will increase its share in 2021.Other new energy vehicles haveConfidentiality agreement, It is not convenient to disclose.

Lianchuang ElectronicsIt is a small leader in A-share technology with a current market value of over 10 billion yuan. In the context of the recent general adjustment of A-shares, the stock has performed relatively defensively, with a cumulative decline of 2.7% this week, which is far stronger than the performance of major indexes.

These companies’ annual reports have high expectations and low valuations

Data treasure statistics show that among the listed companies surveyed by institutions after the holiday, according to last year’s annual report, express report, and performance forecast, the median net profit,Jixin Technology、Jinggong Steel Structure、Robust medical、Keshun shares、Hegang ResourcesThe net profit of other stocks last year increased by more than 30% year-on-year and the converted price-earnings ratio was less than 20 times. In terms of net profit growth,Robust medicalThe expected increase is 568%-623%, and the net profit range reaches 3.65 billion yuan to 3.95 billion yuan. From the perspective of price-to-earnings ratios, the above-mentioned five stock markets are all at 15 to 19 times earnings.

The A-share market plummeted this week.The Shanghai Composite IndexFell more than 5%,Shenzhen Component IndexFell more than 8%, the small and medium board index fell more than 9%,Growth Enterprise Market IndexFell more than 11%.

Sort out and find out, remove timesNew crotchAfter the impact, this week’s institutional research stocks fell over 1% on average this week, outperforming the broader market.The biggest increase isHuachang Chemical, The cumulative increase this week has exceeded 25%.Other stocks with larger gains includePumen Technology、Hongya CNC、Hyde ControlAnd so on, the cumulative increase has exceeded 10%. (Data treasure Chen Jiannan)

(Source: Securities Times)

(Editor in charge: DF532)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.