原标题:深夜! 证券监督管理委员会采取了行动,另一位A股实际控制人已提交调查! 股价暴跌了80%…网民:看到极限了吗?

概括

[Suddenlylateatnight!TheSecuritiesRegulatoryCommissionshotanotherA-shareactualcontrollerwhowasfiledforinvestigation!Thestockpriceplummetedby80%】ThestockpricehasfallenagainandagainandKaoshareshavesufferedamajorbearish!JustnowKaoalistedcompanyinJiangsuGardensannouncedthattheactualcontrollerofthecompanywassuspectedofinsidertradingandtheChinaSecuritiesRegulatoryCommissiondecidedtofileaninvestigationAsoftheendofthethirdquarterof2020thenumberofshareholdersofKaoshareswas15500(ChinaFundNews)

The stock price has fallen repeatedly,Kao sharesGreat bad news again!

Just now, Jiangsu Gardens went publicthe companyKao sharesannouncement, The company’s actual controller was suspected of insider trading, and the China Securities Regulatory Commission decided to file an investigation. As of the end of the third quarter of 2020,Kao sharesshareholderThe number of households is 15,500.

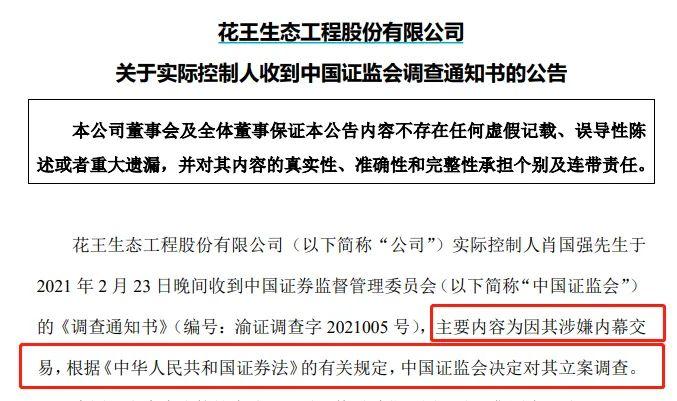

Kao shares disclosure of actual controller under investigation

On the evening of February 25, Kao announced that the companyActual controlXiao Guoqiang received the investigation notice from the China Securities Regulatory Commission. Because he was suspected of insider trading, the China Securities Regulatory Commission decided to open an investigation.

Kao said that this investigation is an investigation of Xiao Guoqiang’s personal investigation. He did not hold any position in the company and will not adversely affect the company’s daily production and operation. The company’s management, business and financial status are normal.

The announcement stated that Xiao Guoqiang did not directly hold the company’s shares, he indirectly held the company’s shares through the Kao Group, and did not belong to the company’s controlling shareholder and shareholders holding more than 5% of the shares.This investigation will not cause the company’s controlling shareholder Kao Group toAssignment by agreementViolation of relevant laws and regulations.

The latest data shows that Kao Group (Kao International Construction Group) holds 39.87% of Kao shares.

Netizen: See you there?

Suddenly under investigation, among the stocks of Kao shares, some netizens even expressed that they would like to see three lower limits, and some netizens said they did not want to hold any more shares.

Major shareholders just sold off

It is worth noting that Xiao Guoqiang controls Kao shares through the Kao Group, which is the controlling shareholder (major shareholder) of Kao shares. Last week, Kao shares just announced that Kao Group had carried out a reduction operation.

Kao issued an announcement on the evening of February 18, 2021, stating that from November 17, 2020 to February 16, 2021, the Kao Group will bidmeans of transactionCumulatively reduced the company’s holdings by 2,000,000 shares, accounting forTotal equityOf 0.60%.

The stock price has fallen by more than 80%

Kao shares were listed on the Shanghai Stock Exchange in August 2016. Basically, the market was at its peak at the beginning of the market, and it has risen all the way. In November 2016, it reached 28.47 yuan (previously).Restoration), and then the stock price continued to fall. The latest closing price was 5.35 yuan.Market valueOnly 17.96 yuan left.

The stock price fell more than 80% after the high.

PerformanceSharp decline

The stock price continues to decline, behind which Kao shares have repeatedly plummeted. Since 2018, Kao’s performance has repeatedly declined. In 2017 there were 171 millionNet profit, Which directly reached 99.93 million yuan in 2018, and continues to drop in 2019.

In the notice at the end of January this year, Kao expects to achieve theNet profitFrom RMB 0 million to RMB 30 million, a decrease of RMB 67,393,300 compared with the same period of the previous year, to RMB 97,393,300, which continued to drop significantly.

The controlling shareholder’s debt default shares are frozen: or affectedEquity transfer

In November 2020, it was announced that Kao Group intends to transfer its 73 million shares of the company to Huzhou Hip HinginvestmentDevelopment Co., Ltd. (referred to as “Huzhou Xiexing Investment”), and involves the company’s non-public issuance of A shares and other related matters.

If this transaction is finally reached, it will result in changes in the company’s controlling shareholder and actual controller. Huzhou Xiexing Investment is an important investment entity and investment and financing platform controlled by the Huzhou State-owned Assets Supervision and Administration Commission.

However, even if it wanted to sell state-owned assets, the Kao Group defaulted on its debt and its shares were frozen, which may affect the transfer of shares.

It was announced in December 2020 that 50.873 million shares of the company held by the Kao Group were frozen. The cumulative number of shares frozen in the Kao Group is 133,643,300 shares, accounting for 100% of the shares held by it and 39.81% of the company’s total share capital. The freezing of company shares held by the Kao Group may delay the implementation of this transaction.

The announcement stated that as of now (December 17, 2020), the Kao GroupShare833 million yuan in debt is overdue, of which 458 million yuan is stockPledgeborrow375 million yuan is involved in litigation debts.Kao Group does not exist yet has not expiredenterpriseBond, Did not proceedcreditRating.

However, as of February 5 this year, Kao shares announced that as of the disclosure date of this announcement, the Kao Group holds 133.643 million shares of the company, accounting for 39.81% of the company’s total share capital; after this time the freeze is lifted, the remaining number of frozen shares is 59,898,800 shares, and the number of shares that have not been frozen is 73,745,500 shares.

(Article source: ChinafundNewspaper)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.