原标题:易方达还有另一个限制零售的“零售账户基础”,但东方红瑞苑却愿意购买50亿元! Kemin:增加仓库还是假装死了?

概括

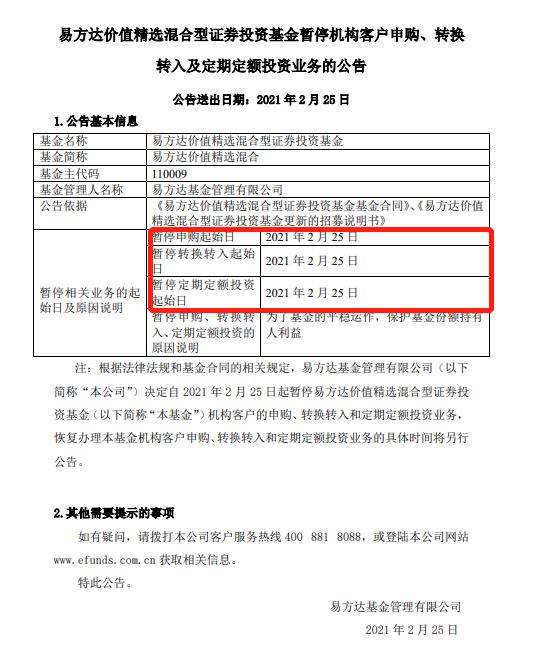

[EFundhasanother”retailaccountbase”thatactivelyrestrictsthepurchaseofDongfanghongbutisopentopurchase!Addingtoastorehouseorpretendingtodie?】WhilebeingridiculedbytheChristiansanotherfundunderEFundopenedanactivepurchaserestrictionThisafternoonEFundValueSelectionissuedanannouncementstatingthatthesubscriptiontransferandregularfixed-amountinvestmentofinstitutionalcustomerswillbesuspendedfromthe25th(InterfaceNews)

Received on the 24thHong Kong stocksA-shares and Hong Kong stocks both fell sharply due to the impact of increased stamp duty on stock transactions.Especially the big increase in the previous periodMarket valueBaotuan stocks were among the top decliners, while small-cap stocks performed relatively well.

After being ridiculed by the Christians for “declining mothers do not recognize”, another one under Yi FangdafundActive purchase restriction is activated.This afternoon, E Fund Value Selection was releasedannouncement, Said the agency will be suspended from the 25thclientSubscription, transfer-in and regular quotainvestment。

The data shows that the fund’s currentmanagerFor Ge Qiushi, as of the end of 2020, the scale is 3.569 billion yuan. The 2020 semi-annual report shows that the fund’s individual investors accounted for 99.56%, and institutions accounted for 0.44%.

The Fund’s quarterly report shows that the top ten heavyweight stocks areChina Free(601888)、Kweichow Moutai(600519)、Wuliangye(000858)、Midea Group(000333)、Luzhou Laojiao(000568)、Ping An Bank(000001)、China Merchants Bank(600036)、Zhongmi Holdings(300470)、Rongsheng Petrochemical(002493)、Shinwasei(002001).Since February 19, theFund unitNet worth has experienced three consecutive declines. Among them, the 19th fell 0.35%, the 22nd fell 2.11%, and the 23rd fell 0.24%.

Yesterday afternoon, Zhang KunmanagementE Fund’s small and medium-sized caps suddenly announced a big dealDividends, And will suspend subscription, transfer and transfer from the 24thFixed investment。

Statistics found that not only the small and medium-sized caps managed by Zhang Kun were closed to welcome customers, but the Hongde Fund, which was managed by Wu Chuanyan, also announced the suspension of large-amount purchases, transfers and scheduled investments of more than 5,000 yuan from the 22nd.

On the day before the Spring Festival, Zhu Shaoxing’s Fu Guo Tianhui Selected Growth also controlled the amount of subscription, fixed investment, and conversion to 10,000 yuan per day.

Well-known fund managers’ high-performance funds have successively restricted purchases. Does this convey the currentmarketOf pessimism?

In this regard, some insiders said, “As the fund goes out of the circle, and during the Spring FestivalYear-end awardsAfter the issuance of the Chinese New Year, many equity funds attracted more funds to purchase, resulting in a rapid growth in the size of the fund.Restricting large purchases is to protect the originalHolderinterest. “

Some fund managers closed their doors to thank customers, and some funds quietly opened their doors to attract money. Taking Dongfanghong Asset Management as an example, after Dongfanghong Qidong raised 14 billion yuan a day on February 19, Dongfanghong Ruiyuan quietly opened a subscription on the 24th, with a raised limit of 5 billion yuan. Statistics from the channel show that as of 14:00, omnichannel has raised 4.4 billion and is expected to start the placement.

The market continues to weaken, how to interpret the market outlook?The interface news reporter learned that there are alreadyAnalystRecommend investors to lowerPosition, Pay attention to defense.

Liu Yang, senior strategist of Boshi’s macro strategy department, said that this round of adjustment is universal in the world, with high valuation of domestic weighted stocks and overseas shares.Technology stocksAll have seen various degrees of decline, and the long-term overseas US debtinterest rateThe unexpected rebound may be the fuse, but it is mostly caused by the relatively extreme mid- and long-term price performance indicators of A shares.interest rateThe volatility-sensitive stage.

Following the confirmation of the policies of the two sessions, whether it iscurrency+tightcredit“Policy combination, or “stable currency + tight credit” combination, the direction of tight credit is unquestionable, market expectations should not be optimistic; at the current position, we recommend continuously reducing positions and putting defense first.

In specific sectors, Liu Yang said that he continues to be optimistic about the pro-cyclical non-ferrous metals and chemicals.From a medium-term perspective, the “tight currency + tight credit” phase of the chemical/nonferrous/liquor trades will benefit from inflation.bank/ Liquor and white electricity are both directions that need attention. Among them, the liquor sector is undergoing adjustments, and you can consider buying at appropriate timing.

(Article source: Interface News)

(Editor in charge: DF075)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.