原标题:“一个兄弟”进入游戏! 中信的30亿资产管理子公司即将推出! 需要申请公开发售资格吗? 有哪些障碍?

概括

[“BrotherOne”entersthegame!CITIC’s3billionassetmanagementsubsidiarywillbelaunchedsoon!Needtoapplyforpublicofferingqualifications?】UndertheinfluenceofthenewregulationsonassetmanagementassetmanagementofsecuritiescompanieshaveestablishedassetmanagementsubsidiariesoneafteranotherstrivingtobecomearegulararmyinthepublicofferingtrackCITICSecuritiesannouncedontheeveningofFebruary22thatthecompany’sboardofdirectorsagreedtoinvestnomorethan3billionyuantoestablishawholly-ownedsubsidiaryCITICSecuritiesAssetManagementCoLtdThismoveistobettergraspthedevelopmentopportunitiesoftheassetmanagementindustry(BrokerChina)

Under the new regulations on asset management,BrokerageAsset management have set up asset managementthe companyAnd strive to bePublic offeringThe regular army on the track.

CITIC SecuritiesIn the evening of February 22announcementShow that the company’s board of directors agreed to invest no more than 3 billion yuan to establishWholly-owned subsidiaryCITIC SecuritiesAsset Management Co., Ltd., this move is to better grasp the development opportunities of the asset management industry.

Brokerage China reporter learned that after CITIC Asset Management changed to an asset management subsidiary, it can better serve its original institutional clients on the one hand; on the other hand, it intends to enter the public offering market and apply for a public offering license.

Currently, there are 19 asset management subsidiaries in the securities industry.CITIC SecuritiesIn general, there may be some unique obstacles.First, due to the restrictions of “one participation, one control”, CITIC Asset Management’s application for a public offering license is uncertain; second,CITIC SecuritiesAs the only brokerage in the industrySocial securityfundDomestic investment managers and the onlyenterpriseFor annuity fund investment managers, whether these two business qualifications can be transferred to a subsidiary still requires the approval of multiple regulatory authorities.

But what is certain is that it is an unstoppable trend for brokerage asset management to enter the public offering track.

1.4 trillion CITIC Asset Management plans to establish an asset management subsidiary

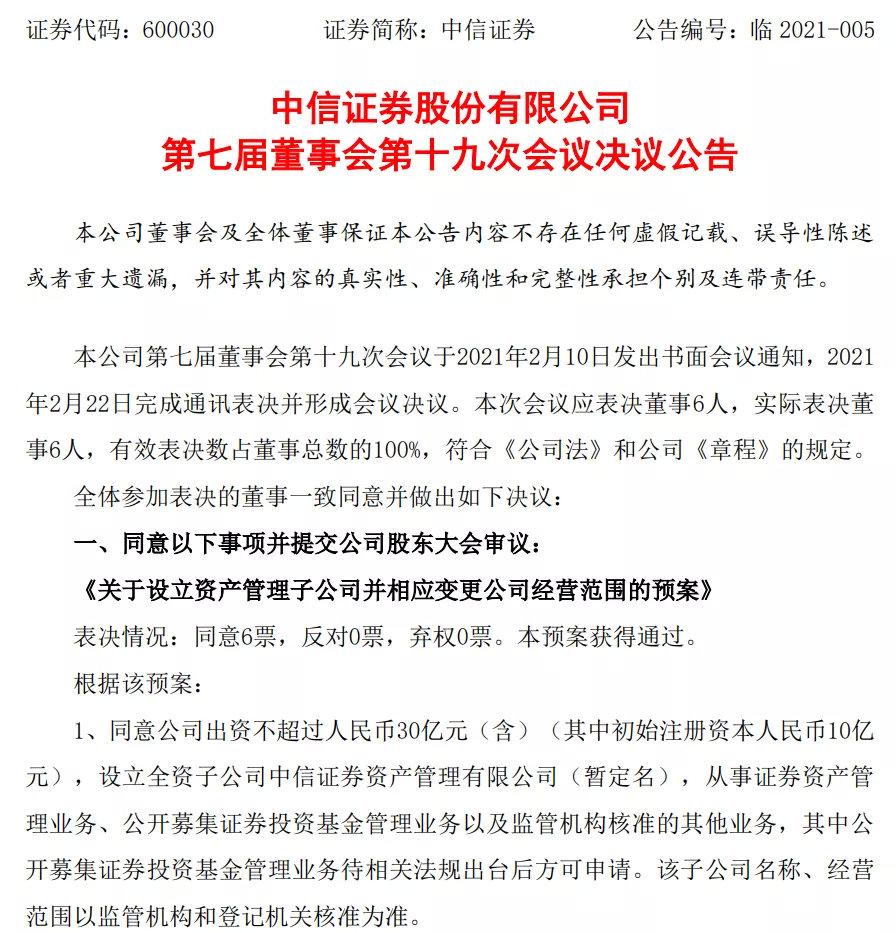

In the evening of February 22,CITIC SecuritiesThe disclosure announcement stated that the company’s board of directorsmeetingDeliberated and passed the “Preplan on Establishing Asset Management Subsidiaries and Changing the Company’s Business Scope accordingly.” According to the plan,CITIC SecuritiesAgreed to contribute no more than 3 billion yuan (inclusive) (of which the initial registered capitalRMB1 billion yuan), the establishment of a wholly-owned subsidiary CITIC Securities Asset Management Co., Ltd. (tentative name) to engage in securities asset management business and public offeringsStock investmentFund management business and other businesses approved by regulatory agencies, including publicly offered securities investment fund management business, can only apply after the promulgation of relevant regulations.

Why set up an asset management subsidiary? The board of directors of CITIC Securities stated that in order to better grasp the development opportunities of the asset management industry, expand the depth and breadth of the asset management business, and expand and strengthen the asset management business.

The announcement showed that the asset managementCompany establishmentLater, it will inherit the securities asset management business of CITIC Securities. CITIC Securities’ asset management business has always been arrogant in the industry. CITIC Securities’s 2020 semi-annual report shows that by the end of the reporting period, CITIC Securities’ assets under management totaled 1.42 trillion yuan, including collective asset management plans, single asset management plans, and special asset management plans. RMB 169.858 billion, RMB 1,253,858 and 103 million, of which RMB 857.524 billion was actively managed. Under the new asset management regulations, the company’s private asset management business (excluding social security funds, basic pensions,company annuity, Occupational Annuity Business, Big Collectionproduct, Aggregate pension products, asset securitization products) have a market share of 12.87%, ranking first in the industry.

In November 2020, the third quarter data released by the China Securities Investment Fund Industry Association showed that the average monthly management scale of CITIC Asset Management was 1.1 trillion yuan, ranking first; of which the active management scale was 613.856 billion yuan, and the active management scale accounted for about 56 %.

The aforementioned plan also shows that CITIC Securities will provide the subsidiary with a net capital guarantee commitment of no more than RMB 7 billion (inclusive) based on the risk control indicators of the subsidiary;FoundedFrom the date on which its capital status can continue to meet the requirements of the regulatory authorities; the management management is authorized to go through relevant procedures in accordance with the regulatory requirements according to actual needs.

Intends to apply for a public offering license

Brokerage China reporter learned that after CITIC Asset Management becomes an asset management subsidiary, on the one hand, it can better serve its original institutional customers; on the other hand, it will enter the public offering market and apply for a public offering license.

New asset management regulations are profoundly changing the landscape of big asset management. Beginning in the second half of 2018, various brokerage asset management companies have begun to transform the public offering of large-scale products. Cutting into the public offering track is becoming the main strategy of various brokerage asset management, and industry competition is becoming increasingly fierce.

In this context, the development strategy of CITIC Asset Management is also changing: from 2011 to 2015, the strategy of CITIC Asset Management is to base itself on the organization and expand the platform; from 2015 to 2017, it will be based on the organization and take into account retail; 2018 Years later, the strategy has become an organization based on larger retail.

Since August 2019, the regulator officially issued the first batch of large-scale transformation approvals, CITIC Asset Management has issued 7 large-scale “participation products”, with a total fundraising scale of over 40 billion yuan, and many products have become popular in the market. , Has become a new force that stirs up public fundraising.For example, on January 21 this year, CITIC Securities’ 7th large collection of “participating” products-“CITIC Securities Selected Return Two-year Holding Period”HybridThe collective asset management plan raised 6.7 billion yuan on the day of its second launch.

For brokerage asset management, there is still a serious problem after product transformation, that is, the issue of public offering licenses to be solved. There is a three-year transition period from the date of approval by the China Securities Regulatory Commission for reforming products due to public offerings, after which it can be extended, but this does not cure the problem. The fundamental way to achieve public offerings is to obtain public offering qualifications.

However, CITIC Securities already has a holdingfund companyChina Asset Management, Limited by the “one participation, one control” policy, CITIC Asset Management has been unable to apply for a public offering license.

It is understood that since at least the beginning of 2019, supervision has been discussing and revising the “one participation, one control” policy. On July 31, 2020, the China Securities Regulatory Commission publicly solicited opinions on the “Measures for the Supervision and Management of Publicly Offered Securities Investment Fund Managers (Draft for Solicitation of Comments)”. The draft of the opinion clearly proposed that the restrictions on “one participation and one control” should be appropriately relaxed, allowing the same entity to simultaneously Control a fund company and a public offering licensed institution.

The relaxation of regulatory policies is in line with the overall guidance of the regulation to relax the proportion of foreign shareholding and enhance the overall strength of domestic public offerings. This may also be a major motivation for CITIC Securities to apply for an asset management subsidiary at this time.

Business transfer faces potential obstacles

In addition to the “one participation, one control” policy, as far as CITIC Securities is concerned, applying for an asset management subsidiary also faces some unique obstacles.

According to a public introduction on the official website of CITIC Securities, CITIC Securities is the only company in the industry that has both corporate annuity investment managers, domestic investment managers of social security funds,InsuranceCapital entrusted investment management qualification, basic pensionInsuranceA brokerage asset management institution qualified as a fund investment manager.

Among them, CITIC Securities is the onlyEnterprise Annuity FundOne of the brokers qualified as investment managers (the other isCICC), and at the same time, it is the only domestic investment manager of a social security fund for securities firms. These two business qualifications are both honors that CITIC Securities has obtained, and whether the business can be transferred is a major obstacle for CITIC Securities to establish an asset management subsidiary.

Brokerage China reporter has recently learned that the qualification of annuity fund investment manager is more likely to be transferred to a subsidiary. However, the qualification of the National Social Security Fund’s domestic investment manager may require a transition period.

A related person told reporters that there are indeed some obstacles to the establishment of an asset management subsidiary by CITIC Securities and the application for a public offering license, but the preliminary actions (the company’s board of directors andshareholderIf it is not done, it will be impossible to know whether the supervision will be approved. At present, the process of applying for an asset management subsidiary by a brokerage company takes two to three years. From the perspective of the future development trend of the public offering industry, it is necessary to start preparations now.

There are 19 asset management subsidiaries in the industry

Currently, there are 19 asset management subsidiaries in the securities industry. Since the implementation of the new asset management regulations, the supervision has approved a total of 3 asset management subsidiaries, namely Anxin Asset Management, Debon Asset Management, and Tianfeng Asset Management.

In addition, there are brokerage firms that are applying for asset management subsidiaries. October 2020,Shen Wan HongyuanAnnounced the proposed establishment of an asset management subsidiary.

A brokerage asset management company recently obtained a public offering license. On January 25, 2021, Monarch Asset Management was approved for public offering business qualification.Became the first approved by the China Securities Regulatory Commission after the amendments to the “Administrative Measures for Securities Investment Fund Management Companies”Raised fundsThe business-qualified brokerage is an asset management company.

Undoubtedly, the new asset management regulations are superimposed on the public offering industry to shine in the future, and securities companies place more emphasis on the development of asset management business.

(Source: Brokerage China)

(Editor in charge: DF380)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.