原标题:大动作! 4万亿外国巨人将如何在中国申请公开发行许可证?监管正在加速开放进程

概括

[Bigaction!Howwillthe4trillionforeigngiantsapplyforpublicofferinglicensesinChina?】OnthefirsttradingdayaftertheLunarNewYearanotherforeignassetmanagementinstitutionsubmittedanapplicationforadomesticpublicfundlicenseOnFebruary182021SchroderInvestmentManagementCoLtdsubmittedthe”ApprovalfortheEstablishmentofPublicFundManagementCompanies”andtheapplicationmaterialswerereceivedonthesamedayAsofJune302020thetotalassetvalueofSchroderGroupworldwidereachedapproximately42trillionyuan(BrokerChina)

Frequently boarded “hot search”fundThe industry is so lively, foreign giants grab the domestic marketPublic offeringThe track is right!

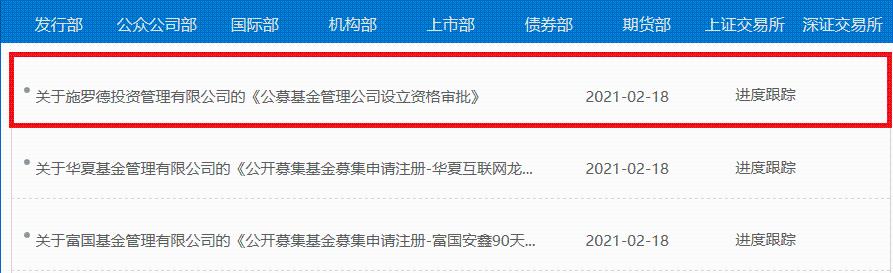

On the first trading day after the Lunar New Year, another foreign asset management institution submits domesticRaised fundsLicense application. February 18, 2021Schroder InvestmentThe Management Co., Ltd. submitted the “Examination and Approval of Qualifications for the Establishment of Public Fund Management Companies”, and the application materials were received on the same day. As of June 30, 2020, the total asset value of Schroder Group worldwide reached approximately 4.2 trillion yuan.

Since April 1, 2020, the restrictions on the proportion of foreign shares held by financial institutions have been officially lifted.On that day, the two major U.S. asset management giantsBlackRockBoth Lubomai and Lubomai have submitted public offering license applications to the China Securities Regulatory Commission in the name of their subsidiaries.BlackRockIt was approved in less than 5 months.

The entry of foreign giants will bring mature professional and diversified investment strategies and management models to domestic investors. However, competition in domestic public offerings has become fierce, and the 28th effect has become increasingly prominent. Whether foreign public offerings are “mules or horses”, Whether it will shake the existing competitive landscape is not yet known.

Public fund market is expected to add foreign “recruits”

The Schroder Group was established in 1804 and is an asset management organization headquartered in the United Kingdom. It was established in 1959 inLondon Stock ExchangeListed.As of June 30, 2020, the Schroder Group’s global assets totaled US$649.6 billion (equivalent toRMBAbout 4.2 trillion), investment areas include stocks,Bond, Multi-asset, alternative assets andreal estateWait.

At the press conference of the China Securities Regulatory Commission held on February 5 this year, the spokesperson of the China Securities Regulatory Commission Gao Li said that it will continue to strengthen the market buyer power, further optimize the fund registration system, and enhance equity funds.productofsupplyAnd service quality, support more high-quality asset management institutions to apply for public offering licenses.

In fact, the Schroder Group has a long history of domestic public offering tracks.Founded in 2005Bank of Communications Schroder FundIs the first batch in Chinabankbackgroundfund companyNoichi,shareholderforBank of Communications、Schroder InvestmentManagement Co., Ltd. and China International Marine Containers (Group) Co., Ltd. hold 65%, 30%, and 5%, respectively, with a registered capital of 200 million yuan.

According to Tianxiang data, if the profit scale of its funds is viewed, the Bank of Communications Schroder Fund will rank among its 130 products with a profit of 57.951 billion in 2020.bankIt ranks first, 11 in the industry, and the top five are E Fund, China Huitianfu, GF, China, and Fortune, all of which have a net profit of over 90 billion.

Obviously, Schroder Group is not satisfied with only participating in domestic public offering funds, but hopes to obtain another public offering license by way of wholly-owned holding.

As early as November 2018,Schroder InvestmentGroup Chief Executive Peter Harrison made it clear at the Global Media Conference that the Chinese market will become a key area for Schroder’s strategic growth. He believes that the A-share market is the second largest stock market in the world, with high liquidity and extremely high retail participation. These characteristics give investment institutions the opportunity to obtain greater alpha returns in China.

Schroder InvestmentZhang Lan, general manager of Management (Shanghai) Co., Ltd., once said that China is the top priority in Schroder’s global strategy.Schroder InvestmentCommitted to introducing more excellent strategies into mainland China, providing tailor-made investment solutions and long-term stable returns for increasingly mature mainland investors.

Supervision and timely feedback on foreign investment applications for public offering licenses

On April 1, 2020, the first day that domestic financial institutions lifted foreign shareholding restrictions, asset management giantsBlackRockBlackRock Financial Management Company and Neuberger Berman Investment Advisers LLC respectively submitted public offering license applications with Lubomai.

Both parties received the supplementary notice on April 9th last year. After BlackRock submitted the supplementary materials on July 31st, the establishment application was accepted by the CSRC on the same day and formally approved on August 21st.

Neuberger Berman Investment Advisers LLC needs to apply for global non-linked ordinary accountsInsuranceThe statistical caliber of the scale of asset management, as well as the four issues related to the asset management business of Lubomai Group and Lubomai Investment Consulting Co., Ltd. are among the top in the world, supplementary explanation, demonstration or feedback.

May 9, 2020FidelityInternational also submitted a public offering license application. According to the regulatory information publicity,FidelityThe fund received “SupplementaryFidelityThe scale, product types, etc. of public funds, pension funds, charity funds, endowment funds, etc., managed by Asian subsidiaries in the past three yearsPerformancePerformance, etc. and Fidelity International in the past 3 yearsStock investmentThe scale of fund management and public offering of securities investment funds. “, “Of the 6 proposed directors of Fidelity Fund, only one (and an independent director) is of Chinese nationality, and none of the 6 have any experience in the domestic securities and fund industry. It is necessary to demonstrate whether the relevant personnel are familiar with domestic laws and regulations and whether they have the ability of directors to perform their duties. ”And 8 other feedbacks.

On November 19, 2020, AllianceBernstein Fund Management Co., Ltd. received a supplementary notice one week after submitting the application for public offering qualifications. AllianceBernstein’s public offering has also become another symbol of overseas investment management giants’ deployment in China.

In addition to directly applying for public offering fund licenses, there are also foreign capitals seeking to gain control by increasing their shareholding in joint venture companies, such asChina Investment JP Morgan FundIt is expected to become the first domestic joint venture company to be converted into a wholly foreign-owned public offering fund. Its foreign shareholder is Morgan Asset Management (JPMorganSubsidiary asset management company).According to Shanghai Union on August 24, 2020propertyInformation released by the exchange, Shanghai InternationalTrustCo., Ltd. intends to transfer 49% of the equity held by China International Fund Management Co., Ltd.price7 billion yuan. If the transaction is successfully completed, CIMC will be wholly-owned by JPMorgan Asset Management and become a wholly foreign-owned public fund management company.

Morgan StanleyThere is also a breakthrough in the equity change of Huaxin Fund.ShanghaiHuaxin sharesLimited company this monthannouncement,Wholly-owned subsidiaryHuaxin Securities intends to transfer and holdMorgan StanleyHuaxin Securities andMorgan Stanley36% equity of Huaxin Fund. This equity transfer is equivalent to Huaxin Securities “emptying” the equity of the fund company, and the foreign shareholder Morgan Stanley will most likely take over.

For domestic and foreign investment management giants to grab the public offering track,Zheshang FundChairman Xiao Feng once saidBrokerageChinese reporters said that foreign public offerings and domestic public offerings have their own strengths. “After further opening up, foreign-funded institutions can come to China to design products and serve Chinese customers. They have tried it in the investment field. What they have to do now is the market and respond to customer needs. How do they serve Chinese customers? How to satisfy China What customers need? What products are you designing? What methods are used to talk to them? What channels are used? The impact may be just these, there is no such thing as they will be more competitive than local Chinese fund companies.”

Xiao Feng believes that what foreign public fund companies need more is to learn from local public fund companies. “We obviously know local customers better than them. So first they must learn. If they copy their overseas models in China, they must If you fail, you can make this assertion. Secondly, we should welcome them. They also have hundreds of years of experience in the world. We should learn from them to optimize our service to customers, but I don’t think it will produce much Shock.”

(Source: Brokerage China)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.