原标题:高涨,美国小盘股大大跑赢机构股! A股小盘股指数仍在下跌。 中美股市风格应该互换吗? SPAC的狂潮愈演愈烈,美国股市掀起了一波上市浪潮

概括

[RisinghighUSsmall-capstocksoutperformedinstitutionalstocksbyalargemargin!ShouldChineseandAmericanstockmarketstylesbeswapped?AftertheoutbreakofthenewcrownepidemicUSstockshavebecomemoreandmorelikeA-sharesbeforeThetrendofUSstockinstitutionsholdinggroupstockshassignificantlyunderperformedsmall-capstocksandevenretailinvestorsholdinggroupstockshavemadeinstitutionshelpless

Sino-US stock market styleexchange?

A-shares are mostly retail investors, who previously preferred smallMarket valuethe company,along withfundRise to A sharesPricingThe gradual control of the right to speak has formed a vigorous market for institutional holdings. The trend of A-share beautification is becoming more and more obvious, and all kinds of funds are pouring into institutional holdings.

However, U.S. stocks after the outbreak of the new crown epidemic have become more and more like A-shares before.The trend of U.S. stock institutions’ Baotuan stocks underperformed the small-cap stocks by a large margin. There has even been a phenomenon that retail investors are frustrated by trading stocks.

Institutional stocks: A-shares rose strongly, while US stocks were flat

Entering 2021,Global stock marketUshered in a good start. According to important global stock market data,Hang Seng Index,Shenzhen Component Index、NasdaqThe index rose the most during the year, rising 10.8%, 10.3% and 9.37% respectively.The overall performance of A-shares in the global stock markets is at the top, and the performance of A-share institutional stocks is particularly outstanding.

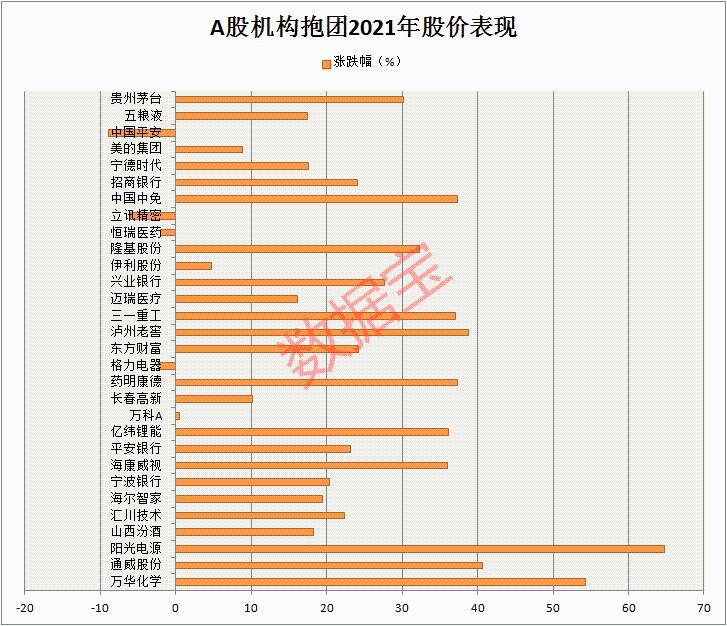

According to the statistics of Securities Times·Databao, at the end of 2020, the performance of the top 30 stocks of the fund group during the year, 30 stocks rose an average of 22.68%, of whichSungrow、Wanhua Chemical、Tongwei shares、China Free、Sany Heavy IndustrywithKweichow MoutaiEleven stocks rose more than 30%;SungrowThe increase was the first, with a cumulative increase of 64.76% this year, onlyHengrui Medicine、Gree Electric、Luxshare PrecisionwithPing An of ChinaThe stock price has fallen.The share price performance of institutional Baotuan shares far exceeds that of A sharesMarket index。

For U.S. stocks, the statistics of Databao show thatThe top 30 stocks of institutional holdings rose by an average of 3.43% during the year, only outperforming Dow JonesindustryThe index’s 2.78% is less than the S&P 500’s 4.76% andNasdaq9.37% of the index.Of the 30 stocks, onlyIntel、Exxon Mobil,Google,AbbottPharmaceutical,JPMorganwithMicrosoftThe company’s cumulative increase during the year exceeded 10%,IntelThe cumulative increase was 24.82%, the largest increase.

Comparing A-share institutional holdings and U.S. institutional holdings, DataPro found that the companies listed on the US stocks are more stable, with most of them in the market capitalization. A-share listed companies have greater changes in each disclosure quarter, and A-share institutional holdings have grown. The sex is better.

Small-cap stocks: US stocks performed dazzlingly, A shares fluctuated downward

U.S. stock institutions underwent poor performance, while small-cap stocks performed very well.The Russell 2000 Index is a market capitalization indicator representing small and medium-sized stocks in the market. The total market capitalization of 2000 companies is only 3.5 trillion US dollars, which is lessappleCompany andMicrosoftThe total market value of the two companies of the company (a total of US$4.12 trillion).The Russell 2000 Index performed exceptionally dazzling after the year, with a cumulative increase of 15.93%, which is close to the 18.36% increase for the entire year of last year, and it has significantly outperformed the major US stock indexes.

Among the constituent stocks of Russell 2000, 49 shares have doubled since the beginning of the year.Although some companies with outstanding share price performance are considered to have excellent growth, the overall uncertainty is large. Most of them are unprofitable and small market capitalization companies. From the perspective of rolling price-earnings ratio, only Weice Investment, CLEAN ENERGY FUELS, and SILVERGATE CAPITAL, safety container andLescom PharmaceuticalsPositive, others areLoss。Novavax PharmaceuticalsAnd EXP WORLD are the only two companies with a market capitalization of over US$10 billion.

A very small number of A-share stocks rose in a group, leading to a sharp rise in the index, while for most A-share companies, the decline accelerated.The CSI 1000 Index is composed of 1,000 small and liquid stocks. The average market value and market value of its constituent stocksMedianCompared with small and medium board,Growth Enterprise Market IndexAll are smaller, which can comprehensively reflect the overall situation of small-cap companies in the Shanghai and Shenzhen stock markets.Data show that the China Securities Index has continued to fluctuate and fall since August last year, and it will accelerate its decline in 2021, with a cumulative decline of 5.16% during the year, significantly underperforming the broader market index.If the A-share stocks with poor liquidity are counted, their performance will only be worse.

The SPAC frenzy intensified,Become an investor

In the US stock market, the SPAC frenzy has intensified. On February 12 alone, there were 28 application documents, a record high.In less than one and a half months, the SPAC fundraising scale in 2021 has exceeded half of last year’s historical peak.

SPAC, the blank check company, also known as the special purpose acquisition company, is aMutual FundWait for the main body to raise funds to form an “emptyShell company“, the promoter listed it on the U.S. stock exchange. This “shell company” only has cash. After listing, the main task is to find a non-listed company with high growth prospects to merge with it, so that it can obtain financing and go public. It was already a listed company before the merger, so the new company does not need to go through other cumbersome IPO procedures, and it is relatively easy to directly become an exchange listed company.

Simply put, SPAC is the same as the traditional “IPO listing” and “borrowShell listing” is different,By building shells first, raising funds, and then proceedingM&A, And finally make the target of merger and acquisition become a listed company.

According to public data from data company SPAC Research, on February 12, more than 20 investor groups traded in US securitiesCommitteeSubmitted 28 blank cheque company application reports. Since 2021, there have been 144 SPACs in the U.S. stock market, with a fundraising scale of US$45.7 billion, an increase of more than 50% from the historical high of US$82 billion in 2020.

The increase of US stock SPACs has provided a shortcut for other companies to go public. This model is increasingly favored by investors, and it is also related to the concept of speculation by retail investors to a certain extent. This method has also brought richness to investors. income.Such asVirgin Galactic, Spotify, PalantirWait for the leaderenterpriseAre listed in the SPAC way,Jia Yueting’s FF car (Faraday Future) is also reported to be listed on the SPAC.

U.S. market liquidity is the main reason

The difference in the stock price performance of US stock institutions and small-cap stocks, the emergence of retail investors holding group and short-selling investors, and the intensification of the SPAC frenzy, which demonstrates the enthusiasm and speculation concept of retail investors in the secondary market of US stocks.MidlandReserve loosecurrencyPolicies have resulted in sufficient market liquidity, providing an objective basis for the popularity of these phenomena.

At the end of JanuaryMidlandReserve interestmeetingon,MidlandChu said that monetary policy will be relatively stable, ultra-lowinterest rateWill remain unchanged, the scale of quantitative easing will be relatively stable, and fiscal policy will be more proactive. The new Finance Minister Yellen will promote the progress of fiscal policy.Do not rule out a fiscal stimulus of more than 2 trillion yuan.

(Article source: data treasure)

(Editor in charge: DF078)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.