原标题:“核弹级”深圳房地产市场大动作! 银行以官方参考价格发行贷款,首付30%变成50%?投机者真的哭了

概要

[Shenzhenpropertymarket”nuclearbomblevel”bigmove!Doesthebankmakea30%downpaymentforloansattheofficialreferencepricetobecome50%?】Inthefuturewhenbuyingahouse(second-handhouse)inShenzhenthedownpaymentratiomayincreaseina”disguised”mannerInthepasttwodaysfriendsintheShenzhenrealestatemarkethavebeenfranticThosewhowanttobuysellandintermediariesareeagerlypayingattentiontothesecond-handhousingtransactionreferencepricesissuedbyShenzhenandtheimpactofimplementation

In the future, when buying a house (second-hand house) in Shenzhen, the down payment ratio may increase in a “disguised” manner.

In the past two days, friends in the Shenzhen real estate market have been frantic. Those who want to buy, sell, and intermediaries are eagerly paying attention to the second-hand housing transaction reference prices issued by Shenzhen and the impact of implementation.

Latest news, most watchedbankLending,businessbankWill be based on transaction referencepriceGrant second-hand housing loans. At present, the listed prices of second-hand houses in Shenzhen are generally higher than the published reference prices for transactions. The media even reported that the reference price is equivalent to “30% off.”

Assuming a house sold for 10 million yuan, the reference price is 7 million yuan. If the original down payment is 30%, the loan can only be 4.9 million yuan (70%). The buyer actually needs to pay 5.1 million yuan, which is equivalent to a 50% down payment.

Expert of Shenzhen Housing and Urban-rural Development Bureau: The reference price is issued once a year

bankSecond-hand housing loans will be issued based on the reference price

The Shenzhen Special Zone Daily reported that on February 8, the Shenzhen Municipal Housing and Construction Bureau released the reference price of second-hand housing transactions, which caused widespread concern. How often does the second-hand housing transaction reference price be released? What are the impacts on citizens’ purchase of houses?

On the morning of February 9, the Ministry of Housing and Urban-Rural Developmentreal estateExpert, Shenzhenreal estatewithUrban ConstructionWang Feng, director of the Development Research Center, gave an in-depth interpretation of Shenzhen’s establishment of a second-hand housing transaction reference price release mechanism in an interview with reporters. Wang Feng revealed that the reference price of second-hand housing transactions in Shenzhen is released once a year in principle, and the mid-price listing price cannot exceed the reference price.commercial BankSecond-hand housing loans will be issued based on the transaction reference price.

“The Shenzhen Municipal Housing and Construction Bureau established a second-hand housing reference price release mechanism. It should be said that it is a pioneering work in China. It is for realizing that the house is used for living, not for speculation.Positioning, Implement stable land prices andHouse price, Stabilizing the expected control target plays a very important role. “Wang Feng said that in recent years, Shenzhen’s second-hand housing market has experienced relatively large fluctuations, and the price of second-hand housing has risen relatively quickly.National Bureau of StatisticsOf 70 large and medium-sized cities across the country announcedHouse price index, Shenzhen’s growth rate is 5%, while the second-hand housing growth rate is relatively large, reaching 12.9%, which is relatively high in the country.

Wang Feng said that in principle, the reference price of second-hand housing transactions in Shenzhen is released once a year, and may be released every six months when the market fluctuates.

Wang Feng revealed that in a survey of 3595 real estates in the city, it was found that most areas in eastern Shenzhen, such as Luohu, Longgang, Pingshan, Greenhouse, and Yantian districts, have basically the same reference price and transaction price. These real estates account for the entire city. 62% of the total number of real estates should be able to truly reflect the market transactions. However, there are still some areas, especially some hot spots in the west, such as Futian Xiangmihu area, Nanshan Houhai area, Baoan Baozhong area where the price of second-hand housing is much higher than the price of first-hand housing, and market irrationality is very prominent.

Shenzhen real estate media Nanfang Lou Shi summarized Wang Feng’s views into the following nine arguments:

1. The policy is a continuation of the 715 New Deal last year;

2. The reference price of second-hand housing is an important measure to stabilize housing prices;

3. This is the first time that the reference price of second-hand housing transactions has been released in China, which is conducive to increasing the transparency of second-hand housing transactions and guiding intermediaries to list rationally. Commercial banks need to use reference prices as an important basis for lending, which is conducive to reducing financial leverage;

4. Conducive to solving the problem of inverted second-hand housing prices;

5. Many people commented on the price two years ago, because everyone’s focus is on the hot spots. The reference price is based on the online signing price in the past year and is comprehensively determined through investigations of actual transactions and bank loans.

Among them, 62% of the real estate prices are basically the same as the online signing prices, 10% have not been sold in the past year or even two years, and 27% are the hot spots of Futian Baoan and Nanshan that everyone is paying attention to. The prices are obviously deviated from the reference prices and the prices are inflated. There is speculation and cannot reflect the reasonable level of the market;

6. There are recent reports that the average price of 90,000 second-hand houses in Shenzhen is seriously untrue. It is also based on the listed price, which seriously misleads the market and disrupts market expectations. Therefore, it is very meaningful for the government to announce the reference price in time;

7. The impact on the purchase of houses and residents, the transaction will decline in the short term, but the buyers and sellersGameStrengthened, no longer just strongSeller’s market, The bank will still use its own risk assessmentPricingLending, but financial institutions must also cooperate with the direction and guidelines of regulatory policies, too much deviation from the reference price will also be negotiated;

8. The reference price is adjusted once a year in principle, and will be adjusted according to the actual market conditions;

9. Since last year, especially this year, the government has continued to increase the supply of new houses, and new houses will be approved in batches this year. The ultimate goal is to protect the real demand for housing purchase.

Commercial banks will issue second-hand housing loans based on the transaction reference price

How big is the impact?

Let’s first take a look at how powerful the price discount is this time?

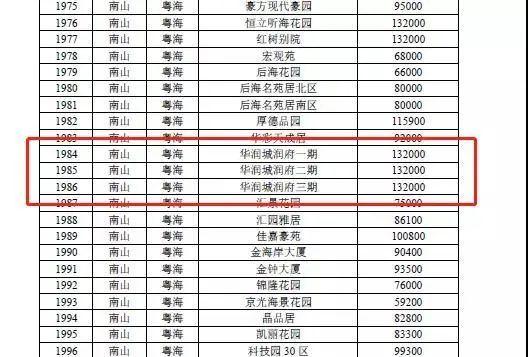

Take the most “famous” China Resources Dachong Run Mansion in the Shenzhen market as an example.Make new“Aroused national attention. The reporter found that the current listing price of second-hand houses in the first and second phases of Runfu has reached about 180,000 yuan per square meter, but the participation price released this time is only 132,000 yuan per square meter, which is equivalent to With a discount of 7.3%, based on an 80-square-meter apartment, the sale at the guide price is 3.84 million cheaper than the current market price.

For example, the Longguang Nine Dragon Terrace project in Guangming,shellThe most recent transaction was on January 23, 2021.unit priceIt is 82,895 yuan/square meter, and the official guide price is 51,900 yuan/square meter; another example, the Zhonghai Sunshine Rose Garden in Nanshan, the average transaction price is about 140,000 yuan/square meter, while the official guide price is 106,000 yuan Yuan/square meter.

If the bank’s appraised price system refers to the official guide price, what impact will it have?

For example, the actual transaction price of a Futian market is 10 million, the transaction reference price is 8 million, and the down payment is 50%. Originally, it could be loaned 5 million. The down payment should be 5 million. After the New Deal, only 4 million can be loaned. If you can’t raise the 1 million, you can only give up or buy a house with a lower total price. The demand was forced to decrease.

China Merchants SecuritieschiefAnalystTeacher Zhang Xia analyzed in the circle of friends that the price expectations of buyers and sellers are too high. If the actual down payment ratio is greatly increased if lending is based on the reference price, second-hand housing in Shenzhen will be frozen. .

Some netizens said that this is the real nuclear weapon.

For example, a real estate with a transaction price of 250,000 per square meter, the reference price of 110,000 6 is only less than half of the transaction price, so it is calculated by half. .

30% of the down payment places, can only lend 14 million, the actual down payment is 26 million, which is equivalent to a down payment of 65%;

For a 50% down payment, only 10 million can be loaned, and the actual down payment is 30 million, which is equivalent to 75%;

70% of the down payment quota, direct loans of 6 million, the actual down payment of 34 million, equivalent to 85%.

According to the analysis, the New Deal first depends on the extent to which it can be implemented. If it is not implemented, everything is useless. If the bank can fully cooperate and implement it, the influence will be very large.

Buyers: After the year, there will be a considerable number of buyers. Due to the greatly increased down payment and the expectation of the New Deal, they will fall into a wait-and-see mood, or switch to buying the East, and the effective demand will be forced to decrease;

Vendor: No surprises, I am still determined not to drop, betting that Shenzhen will always rise.

The final result is still a game, a game between buyers and sellers.

From the perspective of industry insiders, if the reference price of second-hand housing transactions has a greater impact on the banks’ appraisal prices, this policy will touch the foundation, dynamics and fundamental control measures. “If the assessed price is not higher than the official reference price, the leverage will drop a lot, the trend of skyrocketing everywhere will be changed, and Shenzhen will be sideways for a while.”

Shenzhenreal estateIntermediary Association:

When publishing house advertisements, reference prices should be used as an important basis and be published reasonably

Today, the Shenzhen Real Estate Intermediary Association issued a reminder: All real estate intermediaries and intermediaries should resolutely implement the second-hand housing transaction reference price release mechanism, proactively announce the requirements of the “Notice” to the owners, and urge them to reasonably adjust the entrusted listing prices; all real estate intermediaries , The intermediary personnel should use the reference price as an important basis when publishing housing advertisements online and offline, and publish them reasonably; for consulting on non-intermediary professional services such as financial mortgages other than the conclusive information of the house itself, real estate intermediaries shall not arbitrarily explain, committed to.

On the morning of the 9th, Shenzhen Real Estate Agency Association issued a reminder:

1. All real estate intermediaries and intermediaries shall resolutely implement the mechanism for issuing reference prices for second-hand housing transactions, proactively preach the requirements of the “Notice” to owners, and urge them to reasonably adjust the entrusted listing price.

2. All real estate intermediary agencies and intermediary personnel should use the reference price as an important basis and make reasonable announcements when publishing housing advertisements online and offline.Online channels include but are not limited toenterpriseOfficial website, mobile APP, WeChatpublicNumber, WeChat applet, subordinatePractitionersWeChat Moments etc.

3. Providing housing information release servicesthe InternetThe platform shall fulfill the responsibilities of advertising publishers in accordance with the law, check the compliance of the listing information release, and regularly verify and update. For the illegal release of housing information, necessary measures such as deleting (shielding) relevant information, suspending the release of housing information, etc. shall be taken in a timely manner, relevant records shall be kept, and relevant departments shall be reported.

4. Intermediaries should be fully familiar with the reference prices and relevant regulations of each real estate project, and provide consumers with accurate information. Real estate intermediary personnel shall not arbitrarily explain or promise the consultation of non-intermediary professional services such as related financial mortgages other than the conclusive information of the house itself.

Shenzhen Intermediary: Receive notifications for meetings

The listed price is not higher than the transaction reference price

According to media reports, many intermediariesthe companyThe meeting was urgently notified by relevant Shenzhen authorities,meetingThe main content is: from now on, all platforms of second-hand real estate brokerage companies, including websites, APPs, window advertisements, leaflets, companies or brokers’ various social media, cannot publish housing information higher than the transaction reference price ; Listings higher than the reference price can be transferred, and buyers must sign a risk notice.

Yesterday, an intermediary agency issued a notice, requiring that all online signing orders that have been traded must be placed within the same day to prevent other changes in the future.

The listing prices of major real estate intermediary platforms “disappear”

Earlier this morning, the reporter logged into the Lianjia.com APP and found that the listing price had disappeared and became “no data yet.”

shellNet, Leyoujia, Qfang.com and other platforms are also invisible.

(Article source: ChinafundNewspaper)

(Editor in charge: DF537)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.