原标题:不仅仅是减少社会保障! 这位资本老板突然清算了宁波银行,赚了3300%的巨额利润,利润超过60亿! 超过1000亿的大头牛存量减少了700亿,这是什么信号?

概要

[Morethanjustsocialsecurityreduction!ThecapitalbosssuddenlyliquidatedthebankofNingboandmorethan100billionbigbullstockswerereducedby70billionInthepasttwoyearsseveralmajortrackssuchascoreassetsembracingthefutureconsumptionmedicinenewenergyandtechnologyhaveemergedinlargenumbersThestockpricesoftensofbillionsandhundredsofbillionsofgiantscontinuetoreachnewhighsandthenumberofhundredsofbillionsofmarketvaluegiantscontinuestoincreaseHoweverinthiswealthyharvestseasontherehavebeenconstantcorestockswithlargemarketcapitalizationsandnewsthatmorethan5%ofmajorshareholdersandexecutiveshavereducedtheirholdingsandsoldthem(ChinaFundNews)

this weekend,Social securityfundThe news of the reduction of Bank of China’s H shares has attracted investors’ attention.

According to the latest information from the Hong Kong Stock Exchange, the National Council for Social Security Fund reduced its holdings of 59.867 million shares on the floor on February 2.Bank of ChinaH shares, cash out more than 159 million Hong Kong dollars.After the reduction is completed, the social security fund will hold as the “beneficial owner”Bank of ChinaThe number of H shares dropped to 5.808 billion, holdingBank of ChinaThe proportion of H shares also fell to 6.94%.The interim report shows that as of the end of June 2020, the social security fund holdsBank of ChinaThe number of H shares reached 6.685 billion.

This means that since the second half of last year, the Social Security Fund has reduced its holdings of approximately 877 million shares of the bank. Based on the average transaction price in the range, the total cash amount is approximately HK$2.3 billion.

In fact, not only social security funds, but with the birth of tens of billions of bull stocks and hundreds of billions of giants, theshareholderWe have also ushered in the harvest season!

In the past two years, core assets, embracing the future, several major tracks such as consumption, medicine, new energy, and technology have emerged in large numbers.However, in this wealthy harvest season, there are constantly large market capitalization core stocks, and more than 5% major shareholders andExecutivesSo importantShareholder reductionNews of the sell-off.

As of the end of 2018, there were only 59 stocks with a market value of more than 100 billion yuan. By the latest close on February 5, 2021, the number of stocks with a market value of more than 100 billion yuan reached 136. Excluding the stocks listed since 2019, there are 121; that is, In two years, the giants with a market value of 100 billion yuan have doubled.

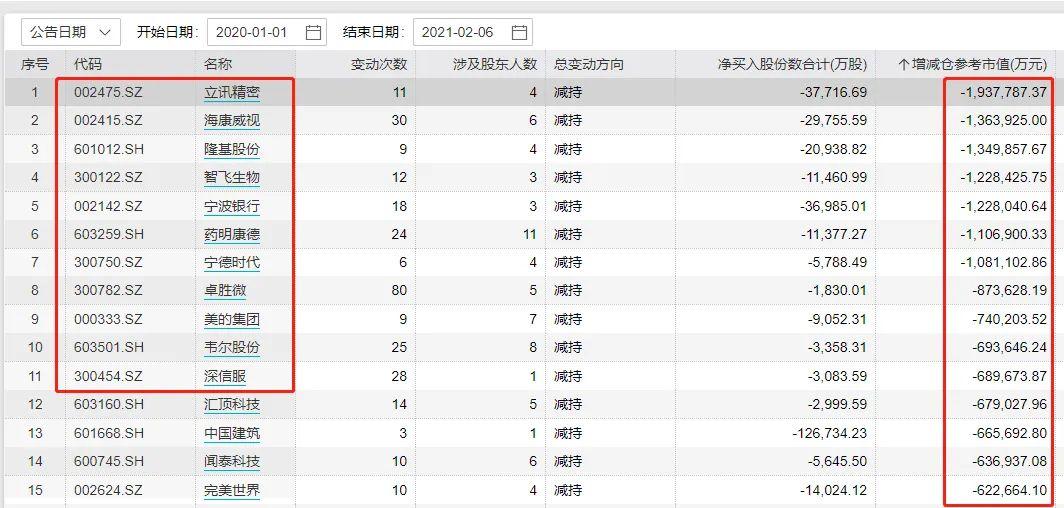

Let’s take a look at the overall situation. In the past year or so (since 2020), there have beenLuxshare Precision、Hikvision、Longji shares、Zhifei、Bank of Ningbo、WuXi AppTec、Ningde eraThe major shareholders reduced their holdings by more than 10 billion yuan. These stocks are big bull stocks in the past two years, with a market value of hundreds of billions or even close to one trillion;Luxshare PrecisionIt was reduced by important shareholders up to 19.4 billion yuan.

And with the shares just sold to Hillhouse Capital,Longji sharesAll important shareholders have sold as much as 29.3 billion yuan since 2020, and the stock has risen more than 7 times since 2019.

In addition,Zhuo Shengwei、Midea Group、Weir shares、Convinced、WingtechThey are also giants with a market value of hundreds of billions. The big bull stocks in the past two years have been sold by important shareholders.

Let’s take a look one by one:

5 times big bull stocksLuxshare Precision:

Controlling shareholders, actual controllers, etc. cash in nearly 20 billion

On February 4, Luxshare Precisionannouncement, The controlling shareholder Luxshare Co., Ltd. and its concerted actors, one of the actual controllers of Luxshare Precision, and vice chairman Wang Laisheng, passed on February 3, 2021Large transactionsSystem reductionthe companyThere are 140 million shares in total, accounting for 2% of the company’s total share capital.The announcement stated that the reduced funds will be mainly used for otherindustryInvestment and partial repayment of Luxshare LimitedbankborrowFund requirements

The data shows that the transaction price of these 2% (2 transactions) of block transactions was 51.11 yuan, and the amount of cash set was 7.337 billion yuan. But before again, in the past year or so, important shareholders such as controlling shareholders, one of the actual controllers, executives and spouses have cashed out 12 billion yuan, and important shareholders have reduced their holdings by as much as 19.4 billion yuan since 2020.

Although Luxshare Precision has recently recovered its share price, its latest closing price is 49.52 yuan, with a market value of 346.5 billion yuan. And since 2019, the stock has risen by as much as 5 times. At the end of 2018, two years ago, the market value of Luxshare Precision was less than 60 billion yuan.

At a high stock price in October 2020, Luxshare Precision’s market value was once close to 450 billion yuan.

560 billion giants:

The most cattle investor Gong Hongjia sells over 10 billion

HikvisionIt is also a big bull stock, and there is also a well-known private equity Feng Liu among shareholdersproduct, However, Gong Hongjia, known as the best investor since 2020, has soldHikvisionOver ten billion. Gong Hongjia is not an ordinary shareholder. He is the founding shareholder of Hikvision and the vice chairman of Hikvision. He still holds more than 10% of the shares and holds a stock market value of more than 50 billion yuan.

The general manager and executive deputy general manager of Hikvision also recently reduced their holdings in January this year. In the past year or so, six major shareholders have reduced their holdings 30 times, with a market value of 13.6 billion yuan.

Since 2019, Hikvision’s stock price has risen by as much as 144%, with the latest closing price of 59.64 yuan and a market value of 557.2 billion yuan.

Photovoltaic leader Longji has soared more than 7 times in 2 years:

Important shareholders just sold 6% of their shares for 15.8 billion

After major shareholders sold 13.5 billion yuan in the past year, the photovoltaic leaderLongji sharesImportant shareholders have just transferred 6% of their shares to well-known private equity Hillhouse Capital, with a transfer amount of 15.8 billion yuan.

On the evening of February 5, Longji shares announced that the company’s shareholder Li Chunan and Hillhouse Capital signed a share transfer agreement on December 19, 2020. Li Chunan intends to transfer 6% of the company’s total share capital to Hillhouse Capital through an agreement transfer. On February 5, 2021, the company received a notice from both parties to the agreement that the transfer and registration procedures for the agreement to transfer shares were completed on February 4, 2021.

Li Chunan transferred 226 million shares of the company this time, accounting for 6.00% of the total share capital of the listed company; each share of the transaction was transferredpriceIt is 70 yuan, and the total transaction consideration is 15.841 billion yuan.At present, Longi shares the mostNew crotchThe price is 114.62 yuan, and the market value is 432.3 billion yuan. Hillhouse Capital has a floating profit of 63.74%, and the floating profit amount is as high as 10 billion yuan.

It’s worth noting that the stock price keeps going up and the well-knownPublic offeringFund manager Xie Zhiyu reduced Longji shares. Among the top ten heavy stocks of Xingquan Herun in January managed by Xie Zhiyu, the photovoltaic leader Longji shares have already withdrawn, and Xie Zhiyu has reduced its holdings.

ZhifeiNew high:

Actual controllers and important shareholders sold more than 10 billion

February 5,ZhifeiThe stock price soared 6.12% and hit a record high, closing at 195.97 yuan, with a market value of 313.6 billion yuan. Since 2019, Zhifei Biotech’s share price has risen by as much as 419%, which is also a big bull stock.

However, since 2020, the actual controllers and important shareholders of Zhifei Biological have greatly reduced their holdings by 12.3 billion yuan. As of January 8 this year, Wu Guanjiang, an important shareholder, was still reducing its holdings, and just two months ago, in November 2020, the company’s controlling shareholder and actual controller Jiang Rensheng was also reducing its holdings.

“Most cattlebankshare”Bank of NingboNew high:YoungorCash out another 10 billion

Chairman: It’s better to invest in clothing for 30 years

The strongest stock price since 2019bankshare,Bank of NingboThe stock price soared 181%. On February 5 this year, the stock price soared by 4.07%, another record high, with a market value of 258.3 billion yuan.

The stock price keeps hitting new highs, but important shareholders have repeatedly reduced their holdings. In February of this year, the announcement of shareholders’ reductions was still ongoing.Shanshan shares、YoungorThe group has recently reduced its holdings. Since 2020, important shareholders have reduced their holdings by more than 12 billion yuan.

The latest announcement again shows,August 3, 2020 ~ February 2, 2021,YoungorA total of 296 million shares of Bank of Ningbo were reduced, with an average price of 33.73 yuan, and a total of 10 billion yuan in cash. After the reduction, the Youngor Group still holds 8.32% of the shares of Bank of Ningbo and is the third largest shareholder of Bank of Ningbo.

Youngor previously released 2020PerformanceThe forecast shows,Company investmentBusiness realizationNet profit4.470 billion yuan, while the net profit of the fashion apparel segment during the same period was only 1.01 billion yuan. Statistics show that in 22 years, investment income from stocks and other investment has contributed about 40 billion yuan in profits to Younger.

No wonder the chairman of Youngor said: “I have been making garments for more than 30 years, and the profits have been accumulated bit by bit. But the investment is different, and I can make 30 years of manufacturing money at once!”

For this reason, some netizens joked that who is going to make it?

In addition, 2020WuXi AppTec、Ningde eraWas also reduced by important shareholders by more than 10 billion yuan,Zhuo ShengweiWas reduced by 8.7 billion yuan,Midea GroupIt was also reduced by 7.4 billion yuan.

Capital tycoon has invested more than 20 years: Ningbo Bank made 33 times the liquidation

The stock price of Bank of Ningbo keeps rising, and Zheng Yonggang, a capital magnate who has invested more than 20 years, can’t sit still.Shanshan sharesLiquidated the investment in Ningbo Bank.

In the evening of February 5th,Shanshan sharesAccording to the announcement, since January 6th, the company has conducted centralized bidding through the Shenzhen Stock Exchangemeans of transactionSold 8,708,800 shares of Bank of Ningbo, with a turnover of approximately 340 million yuan.After the sale, Shanshan shares no longer hold shares in Bank of Ningbo.

Shanshan shares are an important stock of lithium batteries, with the latest market value of 25.3 billion yuan.

As one of the earliest shareholders of Bank of Ningbo, the cost of Shanshan shares in Bank of Ningbo was less than 182 million yuan.From the first reduction in holdings at the end of 2014 to the current clearance, Shanshan has realized a cumulative reduction of approximately 5.4 billion yuan in gains (before tax) and cashDividendsThe income (before tax) exceeds 650 million yuan,The total return on investment exceeds 33 times.Total investment income reached 6.05 billion yuan。

In addition, the subsidiary of Shanshan Co., Ltd. will invest 400 million yuan in 2020 to participate in the capital increase and share expansion of Bank of Ningbo through a single asset management plan, and the sale has been completed, and the accumulated investment income is about 220 million yuan.

As early as 1993, Zheng Yonggang, who dug the first pot of gold, chose to apply to the local regulatory authority for the establishment of Ningbo Shanshan CitycreditThis is part of the predecessor of Bank of Ningbo. The annual report of Shanshan shares shows that before Bank of Ningbo was listed in 2007, Shanshan held a total of 179 million shares of the bank, and the investment cost was less than 182 million yuan.In addition, the company did not participate in the orientation launched by Bank of Ningbo in 2010Additional issuance。

(Source: China Fund News)

(Editor in charge: DF358)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.