原标题:500ETF证券贷款多次激增,而做空时的“控股集团”却暂停了机构? 这是事实!

概要

[500ETFsecuritieslendingsurgedmanytimesandtheinstitutionsweresuspendedwhile”holdingtogether”whileshorting?Hereisthetruth!】TheindustryclearlystatedthattheabovespeculationisnotaccurateFirstofall500ETFsecuritieslendinginvestorsaremainlyindividualinvestorsandquantitativeprivateequitySecondlysecuritieslendingisnotentirelyashort-sellingbehaviorbutalsoaformoflong-shortbalanceItisreportedthatoneofthemainreasonsforthestrongsellingdemandfor500ETFsecuritiesisthattheCSI500stockindexfutureshasalong-termdiscountandthecostofshortsellingthroughstockindexfuturesishigherthanthecostofsellingsecurities(ShanghaiSecuritiesNews)

RecentmarketIncreased shock, 500ETFSecurities lending surged, and China CSI 500ETF repeatedly reminded securities lendingTransaction risk,Caused widespread concern.

There is even speculation that the 500ETF hit the trading suspension threshold because the institution “holds a group” while shorting.

In this regard, industry insiders made it clear that the above speculation is not accurate. First of all, 500ETF securities lending investors are mainly individual investors and quantitative private equity.Secondly, securities lending is not entirely a short-selling behavior, it is alsoLong and shortBalanced expression.It is reported that one of the main reasons for the strong demand for 500ETF securities lending and selling is the long-term discount of CSI 500 stock index futures and short selling through stock index futures.costHigher than the selling cost of securities lending.

Fund announcementRepeatedly remind the risk of securities lending transactions

In the past half month, the China Securities CSI 500 ETF has repeatedly prompted the risks of securities lending transactions.

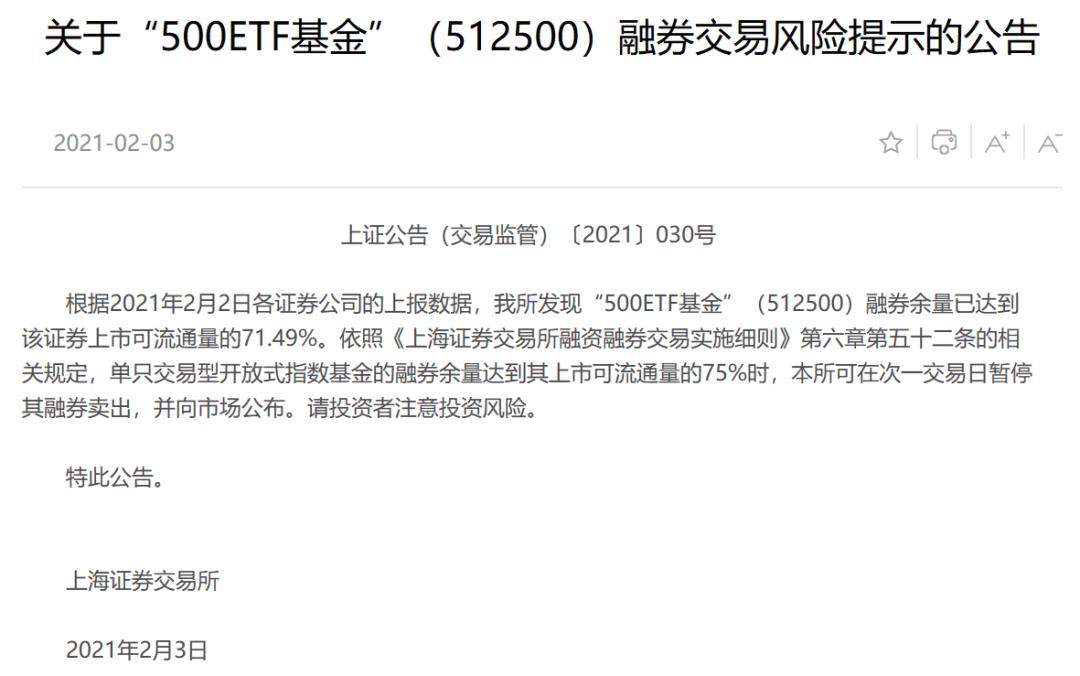

On February 3, the Shanghai Stock Exchange issued a risk warning on the China Securities 500ETF securities trading.announcementShow, according to securitiesthe companyAccording to the reported data, the margin of the China Securities and Exchange 500 ETF on February 2 reached 71.49% of the marketable liquidity of the securities.In accordance with relevant regulations, single-trading open indexfundWhen the margin of securities lending reaches 75% of its listed liquidity, its securities lending and selling can be suspended on the next trading day and announced to the market.

In fact, before this, due to the large margin of securities lending, the China Securities CSI 500 ETF had suspended securities lending and selling.

According to the announcement, according to the data reported by various securities companies on January 25, 2021, the margin of China Securities 500ETF securities trading has reached 75% of the liquidity of the securities listed. In accordance with relevant regulations, the securities lending and selling of the underlying securities were suspended from January 26.

It was not until February 1 that the securities lending and selling of the China Securities CSI 500ETF was resumed. According to the announcement, since January 29, the margin of China Securities 500ETF’s securities lending has been lower than 70% of the listed securities. In accordance with relevant regulations, the securities lending and selling of the underlying securities will be resumed from February 1.

From the historical performance point of view, the Shenzhen Stock Exchange CSI 500 ETF has also suspended securities lending and selling before. At that time, the rules of the Shenzhen Stock Exchange imposed a 25% limit on the suspension of ETF selling. However, at the end of last year, the Shenzhen Stock Exchange revised its rules and raised the threshold for suspension of securities lending to 75%.

From a historical point of view, on January 26 this year, the Shanghai Stock Exchange suspended the 500ETF (512,500) securities selling, and the Shenzhen Stock Exchange suspended the “500ETF” securities selling twice on September 16, 2020 and December 23, 2020. , None have an impact on the market.

In fact, due to the guarantee of the relevant mechanism, there will be no risk of “shortage” in 50ETF securities lending.According to the “Shanghai Stock ExchangeMargin tradingAccording to the relevant provisions of Article 52 of Chapter VI of the Trading Implementation Rules, when the margin of a single trading open-end index fund reaches 75% of its listed liquidity, the exchange may suspend its trading on the next trading day. Securities lending and selling.

Securities lending is not simply shorting

There is speculation in the market that the 500ETF has reached the trading suspension threshold because the institution “holds groups” while shorting.

In fact, according to reporters, 500ETF securities lending investors are mainly individual investors and quantitative private equity, so the above speculation is not accurate.

One from ShanghaiBrokerageAnalystSaid that, compared with the past hedging through stock index futures, single securities trading or ETF funds have gradually become the mainstream short-selling method in the market.

It is reported that the proportion of 500ETF securities lending has gradually increased, mainly as a result of the expansion of the quantitative scale of private equity and the increase in demand for hedging targets; secondly, there is also market risk accumulation and reductionlongReasons for exposure, institutions need to dynamically adjust long and short positionsPositionTo deal with unknown risks in the market and reduceproductThe risk of net worth fluctuations.

A quantitative private equity individual in South China also confirmed that many private equity is aimed at absolute returns, and needs to dynamically adjust the balance of positions, and use different financial instruments to hedge while doing multiple stocks.Product risk。

Since most of the targets of CSI 500 are mid-cap stocks, there are large excess returns and it is easier to obtain alpha returns. According to statistics, there are currently 4178 stocks in Shanghai and Shenzhen, among which,China Securities 500 IndexCheng shares are all A-sharesMarket valueThe top 301-800 stocks are relatively large in scale.PerformanceRelatively good stock representatives have gained 20% in the past year, which is significantly better than CSI 1000 (up 10%). Therefore, some index-enhanced,Market neutral strategy, Flexible configuration strategy and other private equity funds use securities lending CSI 500ETF for hedging.

From the perspective of investment efficiency, the private equity source also said that one of the main reasons for the strong demand for 500ETF short-selling is that the long-term discount of CSI 500 stock index futures is higher than the cost of short-selling through stock index futures.

Industry insiders have judged that if this phenomenon improves, the margin of securities lending of each 500ETF may continue to climb. However, if the CSI 500 stock index futures discounts converge, there is a high probability that the margin amount of each 500ETF will decrease.

In addition, due to the extremely low scale of securities lending, industry insiders believe that it has little impact on the market.Up to now, the total size of all 500 ETFs is 51.5 billion yuan, and the China Securities 500 IndexConstituent stocksThe total market value has reached 11 trillion yuan; of which, the China Securities 500ETF has a total scale of 3.363 billion yuan and a securities lending balance of 2.248 billion yuan. Therefore, the balance of China Securities 500ETF securities lending accounts for only 0.02% of the underlying assets, which is difficult to have a substantial impact on the underlying assets.

(Source: Shanghai Securities News)

(Editor in charge: DF150)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.