概要

[Institutionsonthemarket:Arethereanysurprisesbeforetheholidaywhentwofactorshelpbankstocksrise?】BecausethebankisataturningpointinitsperformanceandsincethefourthquarteroflastyearinstitutionshavebeguntoincreasetheirholdingsSincethebeginningofthisweekthebankingsectorhascontinuedtostrengthenandtheindexhasrisenbymorethan6%Itisnowapproachinganewhighin2018

Jufeng Investment Advisor: Two factors helpbankWill there be surprises before the stock market rises?

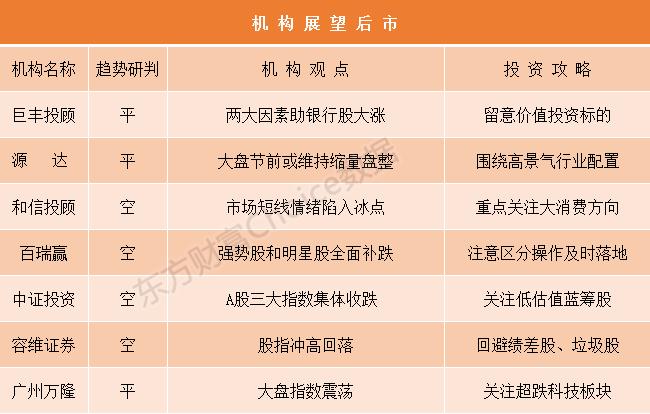

View: Since the fourth quarter of last year, market risk appetite has rebounded. With the accelerated recovery of economic fundamentals and reasonable abundance of liquidity, the logic of the market’s positive trend has not changed. After the upward structural shock, with the recovery of market sentiment and the improvement of the earning effect, the market is in full swing in the spring, and the market earning effect has begun. After the continuous upward movement, especially after the main rise of the three major indexes this year, as the margin of liquidity tightens, it is necessary to pay attention to the short-term suspension of the trend market, and consider appropriate adjustments and exchanges to lower the index and heavy stocks.

Today, the index opened higher and oscillated, continuing the trend of a slight rebound since February. On the disk, after a sharp bottoming out yesterday, market activity began to strengthen, individual stocks continued to perform, and some group stocks began to strengthen, and market sentiment was gradually picking up. At the same time, the weighting sector also performed, leading the index upward while stimulating new momentum in the market.

However, even if it rebounds, the market is still very fragmented, and in the differentiation, it may not be able to continue to perform.bankThe stock is none other than. Since this week,bankThe sector continued to strengthen, and the index has risen by more than 6%, and is now approaching a new high in 2018.And among the platesChina Merchants Bank、Ping An BankAnd many other stocks, stock prices are constantly hitting record highs.

According to past history, the overall performance of the big financial sector was eye-catching before the Spring Festival, but the differentiation this time was relatively large, especially the sharp decline of the securities sector, which formed a strong restraint on the market.But behind this performance, one is the recent trend of market liquidity margin tightening, and the other is mainlyPerformanceThe boost.Broker performanceThe substantial pre-increase is more certain, but the provision of impairment has caused concerns about performance. Banks are at a turning point in performance. At the same time, institutions have begun to increase their holdings since the fourth quarter of last year. This is the core factor for the upward trend of stock prices.

Apart from bank stocks, will there be other opportunities in the market before the Spring Festival? Will this scene of differentiation continue, and how should we operate it?

In fact, we proposed in January that the overall volatility in February will be the main one, and we recommend that the index should be lighter than individual stocks. This is mainly due to the Spring Festival effect and the main Shenglang in January. At present, despite the Spring Festival, the central bank’s rhythm is still relatively stable and not too loose. This is naturally not conducive to high-valued growth stocks without performance support. In other words, the recent poor performance of growth varieties is actually the core reason. In addition, it is not surprising that the performance sector, which is dominated by banks, continues to strengthen.

The same is true for funds. Based on the previous grouping, they are basically looking for new value depressions. At this time, some low-valued varieties have become their favorite objects. For example, since the fourth quarter of last year, institutions began to increase their holdings in banks. Today,real estateAlso performed and started to rebound, which also shows that before the holidayMain forceFunds will still be based on low valuation and performance tendencies. Of course, in the last few days before the holiday, the market’s trading enthusiasm will continue to be cold. At this time, some oversold stocks may have performance, but they only have short-term gaming opportunities. Specifically, we need to pay attention to changes in market liquidity after the holiday.

On the whole, under the support of the recovery cycle and fundamentals, the market’s mid-term positive trend remains unchanged. For the index, there is a high probability of a “golden pit” in this phased adjustment, but the sector and individual stocks need to be treated differently. In the adjustment process of the index, it is necessary to give due consideration to the moment of position swap. There is no need to deliberately reduce holdings, just exchange the target. Next, the market configuration may need to be slightly adjusted to cope with market changes, especially paying attention to low-end and low-value products. After all, with the economic recovery and accelerated recovery, the trend of valuation recovery is obvious and clear, but after many high-valued products have experienced the pull of funds, they can only rely on performance support at present, and if the performance and valuation are not very good Match, the room for continued upward movement is questionable. But on the contrary, many low-valuation and stagflation products still have room and motivation to repair. Obviously, funds will also seek new value targets. Banks and other varieties still need to pay more attention.

(Editor in charge: DF064)

Tip: The keyboard can also turn pages, try the “← →” key

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.