原标题:DR007的开盘价提高了,引导首都中心上扬? 【华创固定收益|周冠南团队】

概要

[DR007’sopeningquotationincreasedtoguidethecapitalcenterupward?】OnFebruary4theopeningpriceofDR007wentupby12BPto232%ItwasanincreaseinthecasethatthereverserepurchaseoperationinterestratehasnotbeenadjustedIthasnotoccurredafter2019andisworthyofattention;theadjustmentrangeisnotanintegerandDR001opensThequotationhasnotbeenincreasedsimultaneouslyanditisnecessarytoverifywhethertheincreaseistemporary

Report introduction

1. The opening quotation of DR007 is raised, so beware of whether the central bank has guiding fundspriceUpward intention

On February 4, the opening price of DR007 rose by 12BP to 2.32%, which is an inverseRepurchaseoperatinginterest rateThe increase in the unadjusted situation has not occurred after 2019 and is worthy of attention; the adjustment range is non-integer, and the opening quotation of DR001 has not been increased simultaneously. It is necessary to verify whether the increase is temporary in the future.

At the same time, the central bank restarted the 14D reverse on ThursdayRepurchaseThe operation, the opening of the new year’s liquidity investment, whether it is a pre-holiday routine operation, or whether it actively guides the central bank to raise the overall cost of funds investment remains to be verified.Generally, the 14D operation before the holiday should be maintained for a period of time, which can alleviate the problem of concentrated expiration of 7D funds after the holiday, or smooth the fluctuation of funds. What needs to be observed is whether the central bank continues to carry out 14D reverse repurchase after the holiday. To determine whether it is similar to the August 2016 “short lock and long lock”.

Special attention should be paid to whether the central bank has the intention of actively guiding the upward movement of capital prices.The current main contradiction is that the central bank withdrew from the easing of liquidity after the Yongmei Incident, but the way it withdrew is puzzling. The degree of capital tightening at the end of January is very rare in the tightening of capital after 2019. It seems that the policy The intention is not limited to the management of unanimously loose expectations in the financial market, and the simple management of expectations will not be so urgent and intense.Therefore, we need to pay more attention to whether the central bank is demanding more substantial tightening. The main risk of capital is whether the capital price center will continue to be higher than the policy.interest raterun.

2. In the medium term, pay attentioncurrencyPolicy expectations management andreal estateRegulatedinteractive

From the overall policy perspective, we need to pay attention to whether there is any structuralCreditOverheating phenomenon, pay attention to the management of monetary policy expectations andreal estateRegulatory interaction.

First, there is structureCreditThe possibility of overheating.Major cities in Januaryreal estateSales growth has risen sharply, which means that real estate-related loan growth may exceed expectations, that is, structural credit overheating. Historically, the central bank’s tolerance for credit overheating is low, which is the “sensitive nerve” of monetary policy. From this perspective, it may be understandable that the central bank is making such an urgent and drastic policy change.

Second, if the central bank takes real estate regulation as its expected management purpose, it means that the timing and magnitude of policy tightening may exceed expectations.If the central bank’s policy is aimed at real estate, rather than confined to reversing the excessive easing expectations of the financial market, the policy tightening will be longer and longer, because from financial market expectations to societypublicThe expected reversal takes longer and requires tools with stronger signal meaning.The current fundamentals are still in the process of repairing, the external environment is still unclear, and there is no policy yetinterest rateConditions for raising interest rates. In this case, we should be more careful about the central bank’s intention to actively guide the price of funds, and use liquidity control tools to enhance the price center of funds.

Specifically, the central bank was cautious in its operations before the holiday and needed to beware of the risk of capital tightening under the pressure of cash withdrawal; cash backflow after the holiday, the funding gap is not pressured, the two sessions are approaching, and the central bank should be wary of “should be loose or not loose”. When it comes to capital prices, it is expected that it will be difficult for the capital price center to return to 2.2%, and the volatility center may be above the policy interest rate.

Risk warning: inter-section liquidity remains tight

text

1. The opening quotation of DR007 is raised to guide the capital center upward?

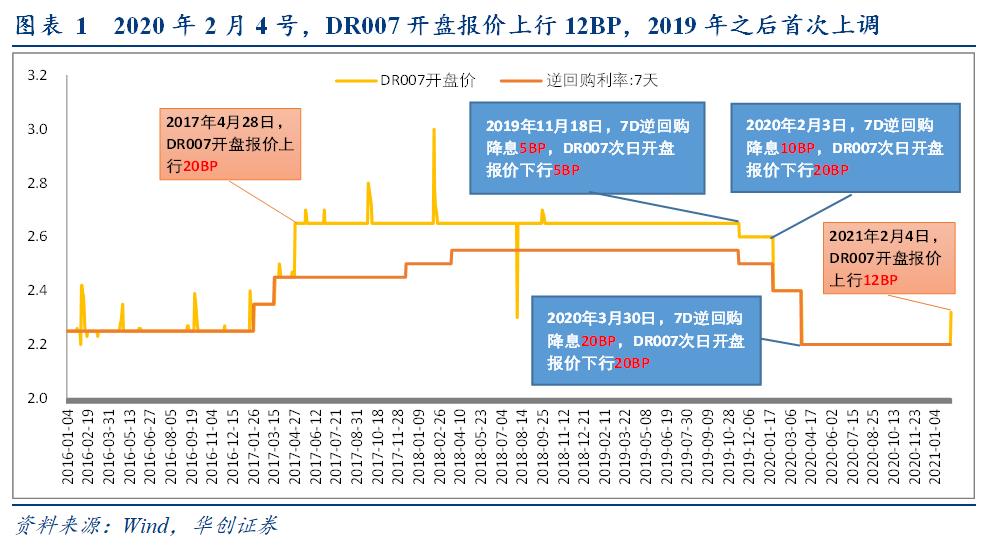

On February 4, the opening quotation of DR007 rose by 12BP to 2.32%, which was the first increase in the opening quotation since 2019.Judging from the historical changes in the opening quotation of DR007, the relationship with the policy interest rate is stable. Generally, the opening quotation is adjusted the next day after the reverse repo operation interest rate is adjusted; after 2019, the adjustment range of the three downward adjustments is slightly different from the policy interest rate. On November 18, 2019 and March 30, 2020, the 7D reverse repurchase operation interest rate was lowered by 5BP and 20BP, respectively, and the opening quotation of DR007 on the next day was adjusted by the same amount; February 3, 2020, in order to hedge the impact of the epidemic, reverse repurchase rate cuts 10BP, the opening quotation of DR007 was reduced by 20BP the next day, so that the opening quotation of DR007 and the 7D reverse repo operation interest rate remained at the same level. Therefore, the DR007 quotation this time is an increase under the condition that the reverse repurchase operation interest rate has not been adjusted. It has not occurred after 2019 and is worthy of attention.

The adjustment range is not an integer, and the opening quotation of DR001 has not been increased simultaneously. It is necessary to verify whether the increase is temporary in the future.Before 2019, there was a temporary increase in the quotation of DR007 on a certain trading day, and the quotation on the next day returned to its original level; generally, the long-term adjustment of the opening quotation of DR007, the adjustment range is an integer mark, on Thursday only 12BP is increased, and the adjustment range is not an integer; The opening quotation of DR001 on Thursday has not been adjusted simultaneously; therefore, it remains to be seen whether the subsequent opening quotation of DR007 will maintain the level of Thursday.

At the same time, on Thursday, the central bank restarted the 14D reverse repurchase operation and started the liquidity placement for the new year. Whether it is a pre-holiday routine operation or whether it actively guides the central bank to increase the overall cost of funds invested remains to be verified.Recalling the operating rules of 14D reverse repurchase, the central bank restarted 14D reverse repurchase in August 2016 and started the operation of “locking short and increasing long”. In 2017, 14D reverse repurchase operations were frequent and became daily operations; the overall operation scale in 2018 was obvious Decline, but there are still many time windows for operation; after 2019, 14D reverse repurchase operations are generally before the Spring Festival and inter-seasonal points, and there are fewer operations at other times; the central bank restarted 14D reverse repurchase in August 2020, triggering the market” “Shortening and lengthening” concerns, but the 14D release window did not last long; this time the 14D reverse repurchase came too late, and the 7D funds on Thursday can already be cross-section. Therefore, the current 14D and 7D funds are invested, and there is no deadline. Differences, the market has concerns that the central bank will actively guide the price of market funds upward.From a follow-up point of view, the general 14D operation before the holiday should be maintained for a period of time, which can alleviate the problem of the concentrated expiration of 7D funds after the holiday, or play a role in smoothing the fluctuation of funds. It needs to be observed whether the central bank continues to carry out the 14D reverse after the holiday. Repurchase placement to determine whether it is similar to the August 2016 “lock short and long length”.

On the whole, we need to be especially careful about whether the central bank has the intention of actively guiding the upward trend of market capital prices.Whether it is the guidance of major banks’ financing prices or the upward adjustment of the opening quotation of DR007, the central bank’s initiative to guide the capital price upward movement has not been solid, but it means more and more; in the central economythe workmeetingAfter determining the policy tone of macro-control focusing on “stability”, the central bank’s policy level has significantly reduced the discussion of policy withdrawal, but the monetary policy is still in a state of “discretionary choice”. The current main contradiction is that the central bank withdrew from the easing of liquidity after the Yongmei Incident, but the way to withdraw is puzzling. The degree of capital tightening at the end of January is very rare in the tightening of capital after 2019. It seems that the policy The intention is not limited to the management of unanimously loose expectations in the financial market, and the simple management of expectations will not be so urgent and intense. Therefore, we need to pay more attention to whether the central bank is demanding more substantial tightening. The main risk of capital is whether the capital price center will continue to operate above the policy interest rate.

2. In the medium term, focus on the interaction between the management of monetary policy expectations and the regulation of real estate

Since the beginning of the year, reports of housing loan shortages in major cities have surged.supplyTightening or increasing demand, the specific reasons have yet to be verified. From mid-January to the present, the media reported that Shanghai, Guangzhou, Shenzhen and other first-tier cities have experienced a shortage of personal mortgage loan lines. However, the central bank issued a housing loan concentration management document at the beginning of the year.bankPersonal mortgage loan business is restricted, and real estate sales in first-tier cities are relatively strong, so it is impossible to verify whether the shortage of credit lines is controlled by the head office or caused by the surge in demand.

From the overall policy perspective, it is necessary to pay attention to whether there is a phenomenon of structural credit overheating, and to pay attention to the interaction between the management of monetary policy expectations and the coordination of real estate regulation.

First, there is the possibility of overheating of structured credit.30 large and medium-sized cities in JanuaryProductRoom sales area single monthYoYThe growth rate is as high as 64.9%. Historically, the single-month year-on-year growth rate of commercial housing sales area is consistent with the single-month year-on-year growth rate of households’ medium and long-term consumer loans. Based on this, January can be judged.New creditThe performance of personal real estate loans may exceed expectations; at the same time,industryThe sector’s prosperity has been maintained in the near future, and the rising demand for financing has continued for some time after earnings have improved.enterpriseMedium- and long-term credit continued to increase year-on-year; from the perspective of the proportion of residential medium- and long-term loans in new credit, it remained stable in January of the previous year. If this proportion is used to estimate the total amount of new credit in January, whether housing loans will occur The increase in quotas and other types of loan quotas determines the increase in the current monthCredit scaleWhether it exceeds expectations. Therefore, the growth rate of real estate sales in major cities in January has risen sharply, which means that the growth rate of real estate-related loans may exceed expectations, that is, structural credit overheating. Historically, the central bank’s tolerance for credit overheating is low, which is due to monetary policy. From this perspective, it is understandable that the central bank’s urgent and drastic policy turn.

Second, if the central bank takes real estate regulation as its expected management purpose, it means that the timing and magnitude of policy tightening may exceed expectations.Recently, the regulatory policies of local and real estate management departments have been issued one after another. The Ministry of Housing and Urban-Rural Development went to Shanghai and Shenzhen.Research, Shenzhen and Shanghai respectively issued documents on sales-related policies such as mortgages, and direct real estate regulation has been significantly tightened; in real estate regulation, the central bank, in addition to the management of related real estate fields required by macro-prudential requirements, also often uses anticipatory management to restrain the public The expectation of easing monetary policy is in line with real estate regulation. Obviously, if the central bank’s policy intent is aimed at real estate, rather than being limited to reversing the expectation of excessive easing in the financial market, the extent and duration of policy tightening will be longer, because the financial market expects It will take longer to reverse the expectations of the general public, and tools with stronger signal significance are also needed. However, the current fundamentals are still in the process of repairing, the external environment is still unclear, and the conditions for policy interest rate hikes are not yet available. In this case, we should beware of the central bank’s intention to actively guide market capital prices and use liquidity control tools to improve Capital price center.

Specifically, the central bank was cautious in its operations before the holiday and needed to beware of the risk of capital tightening under the pressure of cash withdrawal; cash flow back after the holiday, the funding gap is not pressured, the two sessions are approaching, and the central bank needs to beware of “should be loose or not loose”. When it comes to capital prices, it is expected that it will be difficult for the capital price center to return to 2.2%, and the volatility center may be above the policy interest rate.

(Source: Huachuang Securities)

(Editor in charge: DF358)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.