原标题:大老板部署银行股票? 整个行业逆市上涨并支撑了市场,许多银行股票创下了新高!该组织赚了数百亿

概要

[Bigguysdeploybankstocks?ThisinstitutionhasmadetensofbillionsofdollarsagainstthemarketWhilethebankingsectorinthecapitalmarketisgainingmomentumasawholeinvestmentbankingstockshave“exited”andsome“entered”OntheeveningofFebruary3theBankofNingboannouncedthattheYoungorGroup’splantoreduceitsholdingsinthebankhadbeenimplementedwithatotalof296millionsharesreducedAtpresentYoungorholdsabout500millionsharesofBankofNingbo(includingtwodividends)andthefloatingprofitoftheremainingsharesisabout17billionyuan(deductingthecostofinvestment)InadditionYoungorhasreceivednearly2billionyuan(taxincluded)incashdividendsfromBankofNingboAtthesametimesincetheendoflastyearinvestmentcirclesincludingXieZhiyuLinYuanLiLuandotherinvestmentcirclesandinstitutionalfundshaveincreasedpositionsorinvestigatedbanksseveraltimes(BrokerChina)

On February 4, the market dived,bankStocks bucked the market and rose to support the market.Bank of WuxiIt hit the daily limit for a while,Postal Savings Bank、Ping An Bank、China Merchants Bank、Industrial Bank、Bank of NingbowithHangzhou BankWait manybankShares rose, and some stock prices even hit record highs.

capital marketbankWhen the sector is gaining momentum as a whole, investment banking stocks have “exited” and some have “entered”.

In the evening of February 3,Bank of NingboThe announcement shows,YoungorThe group’s reduction plan for the bank has been implemented, with a total of 296 million shares reduced.BrokerageChinese reporter flipping throughYoungor、Bank of NingboFinancial reports over the years, a comprehensive review of its buying and selling timing, and costs found:

Through two rounds of reductions in 2011-2013 and the second half of 2020,YoungorA total of 10.54 billion yuan of share transfer income was obtained. After deducting a rough estimate of the cost of equity, an investment income of about 7 billion yuan has been realized; at present, Youngor holds about 500 million shares of Bank of Ningbo (including twoDividendsBonus shares), the floating profit of the remaining holdings is around 17 billion yuan (deducting the cost of ownership). In addition, Youngor has received nearly 2 billion yuan (tax included) in cash dividends from Bank of Ningbo.

At the same time, since the end of last year, investment circles including Xie Zhiyu, Lin Yuan, Li Lu and other investment circles and institutional funds have increased their positions orResearchbank.

Youngor’s “speculation” in Bank of Ningbo made tens of billions

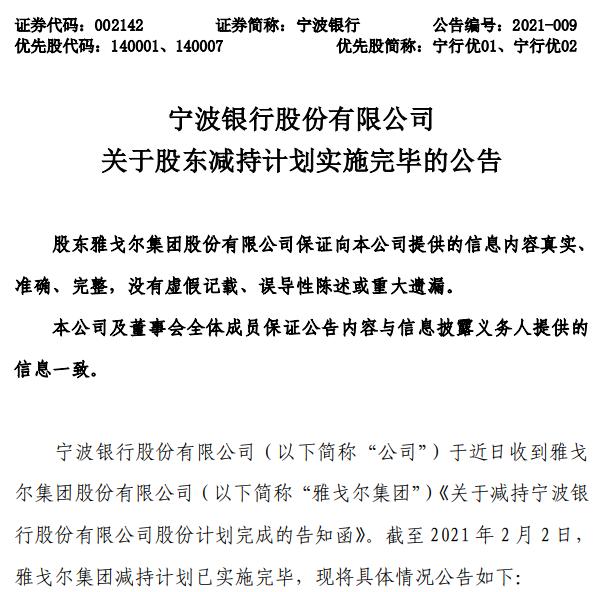

On the evening of February 3, Bank of Ningbo issued an announcement stating that as of February 2, 2021, the Youngor Group’s shareholding reduction plan has been implemented, with a total of 296 million shares reduced, accounting for 4.94% of the total share capital of Bank of Ningbo.

After the reduction, the Youngor Group still holds 8.32% of the shares of Ningbo Bank.

A review of Youngor’s investment in Bank of Ningbo found that the investment began in 2004, when Bank of Ningbo had not changed its name, and its full name was “Ningbo Commercial Bank”.

This year, Youngor first invested in the acquisition of a small amount of shares in the bank, and then quickly invested 155.6 million yuan to participate in the bank’s capital increase.After the capital increase was completed, Youngor already held 162 million shares of Bank of Ningbo, accounting for 9% of the total equity of Bank of Ningbo at that time, and tied for the second largestshareholder。

In 2005, Youngor acquired 17 million shares of Ningbo Commercial Bank from Ningbo Samsung Group at a price of 1.15 yuan per share, increasing the number of shares held to 179 million shares. This also constitutes all the shares held by Youngor before the bank’s listing.

In October 2010, Bank of Ningbo, which has been listed for three years, completed a large-scale fixed increase. Youngor took the opportunity to purchase 70.5 million shares again at a cost of 807 million yuan.

However, from the third quarter of 2011 to the second quarter of 2013, Youngor completed the first round of reduction of its holdings in Bank of Ningbo, with a total size of 53.8 million shares, all of which were held before the listing of the bank. Youngor’s annual report disclosed that this round of reductions involved a total of approximately 540 million yuan in transaction funds and obtained investment income of 484 million yuan.

Starting from the fourth quarter of 2013, Youngor turned to a large-scale increase in Bank of Ningbo. The main increase in holdings includes: increase of 95.65 million shares in the fourth quarter of the year, 63.83 million shares in the first three quarters of 2014, 23.85 million shares in the full year of 2015, 2.52 million shares in the first quarter of 2016, September 2017 to In November, it increased its holdings of 77.81 million shares, increased its holdings of about 127 million shares in 2018, and increased its holdings of 2.14 million shares in the first quarter of 2019.

According to the comprehensive calculation of Youngor’s annual reports over the years, the company increased its holdings of approximately 392 million shares of Bank of Ningbo in the secondary market from 2013 to 2019, at a cost of 5.232 billion yuan. In addition, Bank of Ningbo also issued bonus shares in 2015 and 2017, and Youngor received 72.21 million shares and 136 million shares respectively.

By the end of March 2019, Youngor’s holdings in Bank of Ningbo had reached 796.4 million shares and remained unchanged. Comprehensive calculations, the total cost of Youngor’s investment in Bank of Ningbo is approximately 6.221 billion yuan.

In August 2020, Youngor began its second round of reduction of Bank of Ningbo.According to Youngor’s announcement, from the beginning of August to the beginning of December, the company sold 296.5 million shares of Bank of Ningbo, with a transaction amount exceeding 10 billion yuan.Net profit2.646 billion yuan.

In conjunction with the announcement of Bank of Ningbo, the shares of Bank of Ningbo that Youngor has reduced mainly include two parts:

The first is the shares held by Youngor before the listing of Bank of Ningbo (the remaining 125.2 million shares before the reduction), and the shares obtained by participating in the bank’s fixed increase in 2010 (the remaining 70.5 million shares before the reduction).In this round of reduction, Youngor reduced its shareholding by approximately 86.954 million shares in total and obtainedEquity transferRevenue 2.911 billion yuan.

Second, since the fourth quarter of 2013, Youngor has reduced its holdings of Ningbo Bank’s shares in the secondary market (about 392 million shares remain before the reduction). In this round of reductions, Youngor reduced its holdings by nearly 210 million shares in total, and obtained 7.089 billion yuan in equity transfer income.

According to the data, through the two rounds of shareholding reductions in 2011-2013 and the second half of 2020, Youngor obtained a total of 10.54 billion yuan in share transfer income. After deducting a rough estimate of the cost of equity, it has realized about 7 billion yuan in investment income (non-net profit). In addition, Youngor has received nearly 2 billion yuan (tax included) in cash dividends from Bank of Ningbo.

Up to now, the number of Bank of Ningbo shares held by Youngor has fallen to about 500 million shares (including two dividends), and the latest market value is about 20.66 billion yuan. After deducting the cost of the shares, a rough calculation shows that the floating profit of the remaining shares is 17 billion yuan. about.

After the market on February 4, the stock price of Bank of Ningbo closed at 41.32 yuan, a record high for individual stocks

Bank stocks have a warm winter, these bigwigs secretly make arrangements

From the performance of the industry’s secondary market, the banking sector seems to usher in a “warm winter” market.

On February 4, the market dived, and bank stocks bucked the market and rose to support the market.Bank of WuxiOnce hit the daily limit,Postal Savings Bank、Bank of Chengdu, Bank of Ningbo,Hangzhou BankWaiting for many bank stocks to strengthen.Ping An Bank、China Merchants Bank、Industrial Bank, Bank of Ningbo,Hangzhou BankAfter reaching a new high on February 3, the stock price rose again.

According to the data,Main forceFunds have continued to increase positions in bank stocks in the past five days, and 14 stocks won the main forceNet inflowOver 100 million yuan. Among them, as of February 3 after the market,Industrial BankThe net inflow of more than 700 million yuan topped the list. February 4th, the bankETFThe trading volume was 5,929,600 hands, and the trading volume was 742 million yuan, an intraday increase of more than 2%.

At the close on February 4, the share prices of 37 listed banks rose more and fell less on that day

When the industry’s secondary market is booming, some people “leave” and some “enter”.

The Hong Kong Stock Exchange revealed that on January 15, Li Lu, the founder of Himalaya Capital and a disciple of Buffett, increased his holdings.Postal Savings BankH shares, this is after the increase of Li Lu’s holdings on December 19, 2020Postal Savings BankAfter the H-shares, it has increased its position again. So far, Himalaya Capital has held a total ofPostal Savings Bank6.42% of the total share capital of H shares.

Open positionPostal Savings BankAfter H shares, on January 27, including Himalaya Capital,China Securities, Guosheng Financial,China Universal FundHuatai Baoxingfund, Yangtze River Pension, etc.Institutional researchUpBank of Wuxi. In the intraday on February 4, Bank of Wuxi led the rise of bank stocks, and the intraday share price once rose by the limit.

Before that, looking through the investor activity records of listed banks, you will find that in October and November 2020, Li Lu’s Himalaya Capital conducted two surveysPing An Bank, Understand the bank’s strategic direction, business strategy, impact of the epidemic, future sustainability, retail transformation and upgrading plans and other issues.

At the beginning of this year, bank stocks also attracted the attention of many investment institutions and star fund managers.

In January of this year, Xie Zhiyu, a public offering fund, substantially increased its positions in Industrial Bank, and Industrial Bank has also recently entered the top ten heavyweight stocks of Xingquan Herun. In the second quarter of 2020,Hualin SecuritiesThe self-operated account bought a large amount of Bank of Wuxi and entered the top five shareholders of tradable shares of Bank of Wuxi.

In addition, Lin Yuan, a well-known private equity investor, also bought banks through funds.Penghua China Securities Bank, listed in January this yearIndex fund(LOF) According to the announcement, the Linyuan Investment No. 133 private equityStock investmentThe fund holds 23.45 million shares, accounting for as high as 1.71%.

It’s also worth noting that since October last year, the Hong Kong stocks and banks, except for Postal Savings Bank, such asZheshang Bank、Minsheng BankHong Kong stocks, etc. have all gained holdings of investment institutions and insurance capital.Among them, Centennial Life will begin to build positions in mid-2020Zheshang Bank, Successively bought in the A-share and H-share marketsZheshang BankShares.

“The current valuation of the banking sector is at a historically low level, with both offensive and defensive capabilities. It is expected that in 2021, the asset quality of the entire banking sector will be stable, and the liquidity and credit environment will be better than expected.” For warehouse bank H shares, on the one hand, H shares have relatively low valuations and high dividends. On the other hand, they are also related to the long-term stability of insurance capital’s focus on investment income. Investment opportunities in banking stocks have attracted attention,Institutional positionsThe improvement reflects the gradual tilt of market funds to the banking sector with high certainty or growth logic.

CICCResearch reportJudging, the market at the end of January this yearinterest rateFaster tightening, economic growth, inflation, asset price trends, financial risks and other factors affect the trend of China’s monetary policy. The recent policy actions that have led to the tightening of capital margins do not mean that monetary policy will be tightened systematically.interest rateIt may be in a state of range fluctuation; at the same time, the policy pursuit of multi-objective balance is good for banks in 2021Performancewhich performed.

Brokerage China reporters do not complete statistics. As of now, a total of 17 listed banks have released 2020 performance bulletins, and Ping An Bank disclosed the 2020 annual report.From the perspective of performance or performance bulletin data, although the revenue growth rate of various banks has diverged, from the perspective of net profit performance, exceptShanghai Pudong Development BankIn addition to a slight year-on-year drop of 0.99% in net profit, 16 banks achieved positive growth in their annual net profit.

(Source: Brokerage China)

(Editor in charge: DF380)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.