原标题:超过3500只股票下跌了1000亿美元,白马直接崩溃了! 原因在这里? 茅台逆市上涨5.44%

概要

[Over3500stocksfellby100billionandthewhitehorsecrasheddirectly!Thereasonishere?MoutaibuckedthemarketInearlytradingonFebruary4thethreemajorA-shareindexescollectivelymademistakesTheShanghaiCompositeIndexfellbelow3500pointsandtheChiNextIndexfellbelow3200pointsAsofthenoonclosetheShanghaiCompositeIndexShenzhenComponentIndexandChiNextIndexfell102%144%and123%respectivelyOver3500stocksintheA-sharemarketfellinthemorningandonly521stocksrose

It’s the moment when the liquor is really fragrant!

In early trading on February 4, the three major A-share indexes collectively went wrong.The Shanghai Composite IndexFell below 3500 points,Growth Enterprise Market IndexIt fell below 3200 points. As of the noon close, the Shanghai Stock Exchange Index,Shenzhen Component Index、Start a businessThe board index fell 1.02%, 1.44% and 1.23% respectively. Over 3,500 stocks in the A-share market fell in the morning, and only 521 stocks rose.

Northbound funds today in early tradingNet inflowA shares, butShanghai Stock ConnectwithShenzhen Stock ConnectCash flowThere are disagreements. The data shows that as of the close of the afternoon, the net inflow of northbound funds was 3.131 billion yuan, of which the net inflow of Shanghai Stock Connect funds was 0 billion yuan and the net inflow of Shenzhen Stock Connect funds was 3.131 billion yuan.

In the near future, expectations of tighter liquidity have raised market concerns. In the morning of February 4, the central bankannouncementSaid that in order to maintain stable liquidity before the Spring Festival, the peoplebankTointerest rateThe bidding method carried out a 14-day reverse of 100 billion yuanRepurchaseoperating. On that day, 100 billion yuan of the central bank’s reverse repurchase expired, completely hedging the amount of maturity.

CITIC SecuritiesIt is believed that, with reference to the policy setting and the risk of repeated epidemics, the probability of ample liquidity turning too quickly is extremely low, and the market liquidity is expected to reconsolidate in February.

At the beginning of the early trading on February 4, the trend of technology stocks was sluggish, with a market value of over 120 billion yuan.Yonyou NetworkThe opening flash crashed, and the intraday limit was reached. Some stockholders ridiculed “Xunfei squatted after yongyou squat?”

In contrast, liquor stocks rose sharply today.Kweichow MoutaiThe intraday rose more than 6%, setting a record high of 2330.00 yuan. Is it time for white wine to smell delicious again?

Another 100 billion market capitalization technology stocks crash

FollowingIFlytekAfter the flash crash in the end of February 3, shortly after the opening of the early trading on February 4, another 100 billion market capitalization technology stocks crashed. Some stockholders ridiculed “Xunfei squatted after yongyou squat?”

Yonyou NetworkAfter opening flat in the morning on the 4th, it fell rapidly, hitting the limit for about half an hour at the opening, and then fluctuating within a narrow range near the limit, and the decline narrowed slightly near the midday. As of the midday close,Yonyou NetworkIt fell 7.02% to 38.68 yuan, and the latest total market value was 126.5 billion yuan.

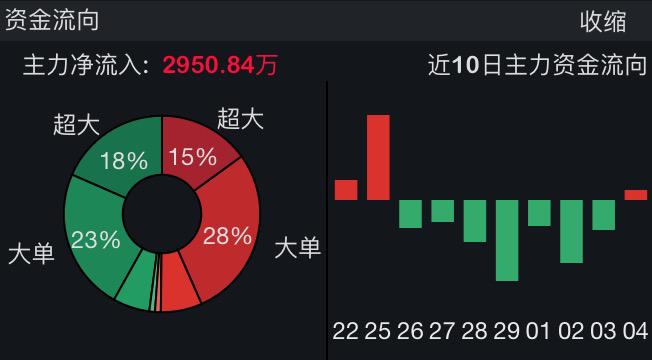

But it’s worth noting that while UFIDA’s network fell,Main forceFunds are flowing in quietly. As of midday’s close, the main funds had a half-day net inflow of 29,508,400 yuan into UFIDA, and the main funds had been net outflows for 7 consecutive trading days.

UFIDA’s main capital flow recently

According to data, UFIDA’s technology is limitedthe companyforenterpriseandPublic organizationProvide digital and intelligent services. In the classification of Shenwan’s first-level industry sector, it belongs to the computer industry sector.

It is worth noting that in early trading on the 4th, the overall trend of technology stocks was sluggish. In Shenwan’s first-level industry sector, as of the close of trading, the communications and computer sectors have fallen by more than 3% in half a day, and the electronics sector has fallen by more than 2%.

Extending the time period, the computer and communications sectors have oscillated and adjusted back for nearly half a year, and the electronics sector has continued to fall after rising to a recent high on January 21.

When will technology stocks usher in a full rebound?

Tianhong FundThe technology team believes that after more than half a year of adjustment, some high-quality technology stock companies with solid fundamentals have reached a relatively reasonable valuation range. In 2021, investment in technology stocks will be concerned.artificial intelligence, Cloud computing, intelligent networked cars and other investment opportunities.

Tianfeng SecuritiesSaid that technology stocks have the opportunity to rebound, mainly depends onPerformance。

Kweichow MoutaiBreak through 2300 yuan

While technology stocks are in a downturn, liquor stocks have taken advantage of the trend to rise.Kweichow MoutaiBreak through 2300 yuan during the session. Today’s morning market was accurately predicted by stockholders. Some stockholders posted in the early morning of February 4th: “Big A technology fell across the board, is it time for liquor to be really fragrant again?”

Let’s look at the performance of liquor stocks today. According to data, in the Chinese industry, the liquor sector rose 3.01% at midday, the largest increase.

Among individual stocks,Huangtai WineryStrong daily limit after opening.Old white dry wineThe intraday rose to 9.68%, approaching the daily limit, and rose 5.52% at the midday close.

Kweichow Moutai broke through 2,300 yuan in intraday trading, rising to a maximum of 2330.00 yuan, a record high; it rose 5.44% to 2309.01 yuan at noon closing; the latest total market value was 2.9 trillion yuan. The main funds flowed substantially into Kweichow Moutai in early trading today. As of midday’s close, the half-day net inflow to Kweichow Moutai was 1.737 billion yuan.

On the news, in addition to dealers, Moutai has extended its sales policy to supermarkets and e-commerce channels. February 3, for the regulation of supermarkets and e-commercePromotionKweichow Moutai Sales Co., Ltd. requires all newly developed online and offline merchants not to set thresholds based on promotional conditions such as points and consumption amount, and restrict some consumers from snapping up Feitian Moutai. The buffer period is only 2-3 days.

According to Bohai Securities, from the monthly data, a batch of high-end liquorpriceAccelerate the upward trend, and other data trends are basically the same as before. At the beginning of the year, the liquor sector was repeatedly disturbed by local epidemics, but from the perspective of actual payment collection and dynamic sales, it is still operating in the business cycle. As a procyclical variety of optional consumption, liquor performance will continue to improve from the previous month, the industry’s natural attributes will still exist, and demand will continue to be confirmed. It is recommended to select high-end liquor with higher certainty, and continue to pay attention to the sub-high-end dynamic sales.

Grasp high-quality stocks in volatile market

From yesterday’s rare earths to today’s liquors, the A-share sector is still moving rapidly. Looking ahead,BrokerageIt is expected that the market may fluctuate slightly in the short-term, and the stocks that have supportive performance are grasped in the volatile market.

Zheshang SecuritiesSaid that looking forward to February, the overall index is expected to fluctuate, with structural opportunities dominated. From the time dimension of February, focus on structural switching, focusing on three clues.First, low-level procyclical varieties with improved fundamentals, represented by clues to global epidemic restoration, including airports, airlines, hotels, etc.; second, the financial report disclosure period entered in February, focusing on the varieties of performance turning points.bankAnd national defense equipment as the representative; third, focusing on the financial report, pay attention to the breakdown structure opportunities of performance exceeding expectations.

CITIC SecuritiesIt is believed that considering that the annual report forecast has just been disclosed, A shares are facing the calibration of performance and valuation, and it is recommended to pay attention to the varieties that are expected to continue to exceed expectations in the 2020 annual report and the first quarter of 2021.

(Source: China Securities Journal)

(Editor in charge: DF515)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.