原标题:太棒了! 400亿美元的禁令不能阻止股票价格。 宁德时代再度增长了5%。 希尔豪斯半年赚了140亿。 这些股票也将达到禁令的顶峰。

概要

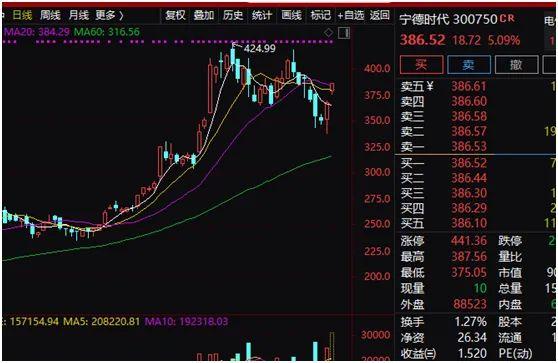

[Tooawesome!The40billionbancan’tstopthestockpriceNingdeTimesroseanother5%ThesestockswillalsoreachthepeakofthebanTheliftingofthebanwillgenerallyhaveashort-termimpactonthestockpriceoflistedcompaniesHowevertheNingdeeraistemporarilyaspecialcaseThebanonstockswithamarketvalueofmorethan40billionyuanwillbeliftedtomorrowOnthemorningofFebruary3thestockpriceofCATLdidnotseemtohaveanyimpactbutrose5%

Restricted sharesThe lifting of the ban will generally involve listingthe companyThe stock price will have a certain impact in the short term. but,Ningde eraIt is a special case for the time being.

Over 40 billionMarket valueTianliang stocks will be lifted tomorrow, in the morning of February 3rd,Ningde eraThe stock price did not seem to have any effect, but rose 5%.

More than 40 billion market value will be lifted soonNingde eraBut soared

On February 3, the stock price of CATL, which has a market value of about 900 billion yuan, was strong. As of the morning’s close, the stock price had risen 5%. For the company, it is currently facing a fixed increase in stocks of institutions with a market value of more than 40 billion yuan. The ban will be lifted soon.

According to the Ningde era on the evening of February 1announcement, Approved by the China Securities Regulatory Commission, the company’s set-up of additional shares to nine specific targets including Hillhouse Capital will be released on February 4, which is tomorrow.

According to the announcement, the 9 specific subjects mentioned aboveLifted stocksA total of 122 million shares, the above-mentioned shares account for 5.25% of the company’s total share capital. If calculated according to the closing price on the morning of February 3rd, the market value of the above-mentioned lifted shares is about 47 billion yuan.

It is worth noting that this is the CATL in July 2020Additional issuanceBank’s shares, which were not publicly issued at that timepriceIt is 161 yuan/share. Among them, Hillhouse Capital Management Co., Ltd. lifted 62.111 million shares. This means that Hillhouse Capital’s investment in the Ningde era alone has reached a floating profit of about 14 billion yuan within half a year. The total floating profit of the above nine specific objects is about 24 billion yuan.

According to the announcement, in addition to Hillhouse Capital, the remaining 8shareholderHonda Technologyindustry(China) Investment Co., Ltd.,Pacific OceanAssets, UBS AG, Beixin RuifengfundAnd many well-known institutions at home and abroad.

CATL has performed strongly in the past year of 2020. The stock price has actually increased by more than 230% after taking into account the dividend factor. However, after the above-mentioned fixed-income shareholders have invested in the shares, the stock price has continued to rise sharply. In general, the above-mentioned shareholders who participated in the fixed increase have more than doubled their floating profits in only half a year.

Ningde eramarketSeeking and investing big moves

According to the data, CATL is the world’s leading provider of power battery systems, focusing on the research and development, production and sales of power battery systems and energy storage systems for new energy vehicles, and is committed to providing first-class solutions for global new energy applications.Companies in battery materials, battery systems, battery recycling, etc.industryThe key areas of the chain have core technological advantages and sustainable R&D capabilities, forming a comprehensive and complete production service system.

As new energy vehicles have been widely sought after by the market in the past year, the Ningde era as an upstream manufacturer has also become a market darling.

In 2018 and 2019, Ningde era achieved return to motherNet profit3.387 billion yuan, 4.560 billion yuan. In the first three quarters of 2020, go to motherNet profitRecorded 3.357 billion yuan,YoYAn increase of 34.64%.

The Ningde era has also moved frequently recently.

Just last night, CATL announced that according to the company’s strategic development plan, in order to further promote the company’s production capacityclientTo meet demand, promote business development, and consolidate market position, the company’s holding subsidiary, Times FAW plans to invest in the construction of the expansion project of Times FAW’s power battery production line in Xiapu County, Ningde City, Fujian Province.Total investmentNo more thanRMB5 billion yuan. At the same time, the company plans to invest in the construction of a power and energy storage battery production base in Zhaoqing City, Guangdong Province, with a total project investment of no more than RMB 12 billion.

In this regard,Soochow SecuritiesAccording to the research point of view, due to the intensive launch of pure electrification platforms by major car companies, newproductThe cycle drove the explosion of demand for the toc end of electric vehicles. In the first year of global electrification, the expansion of Ningde era accelerated to meet the compound growth of 40%+ of power batteries in the next five years. After the company announced its 39 billion production plan in December, it announced its 29 billion expansion plan. According to the average investment of a single gwh expansion of 300 million yuan, this expansion corresponds to an additional 97gwh production capacity, and frequent expansions. expected.

These companies lifted the ban before the Spring Festival not smallHengli PetrochemicalThe scale of lifting the ban reaches 100 billion yuan

In addition to the Ningde era, some companies have recently lifted the ban on a large scale.

Preliminary data shows that before the Spring Festival in 2021,Hengli Petrochemical, Ningde era,ZTEThe market value of the lifted ban is above 10 billion yuan, of whichHengli PetrochemicalAccording to the current stock price lifted scale is around 100 billion yuan.

Industrial SecuritiesIt is believed that although the demand for funds may increase, A share fundssupplyIs also increasing simultaneously, globalinterest rateOn the downside, the value of equity allocation is prominent, residents, institutions, and foreign capital have formed three major living waters. The benign balance of supply and demand of stock market funds will greatly help A-shares to step out of the bull. The era of equity need not be overly pessimistic. Correspondingly, more attention is paid to the impact of lifting the ban on rhythm and structure.

(Source: Securities Times Net)

(Editor in charge: DF515)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.