原标题:控股股东涉嫌违反法律,信用调查的第一部分是“黑天鹅”! 阿里巴巴等巨头加持,微信可喜科技创新板?

概要

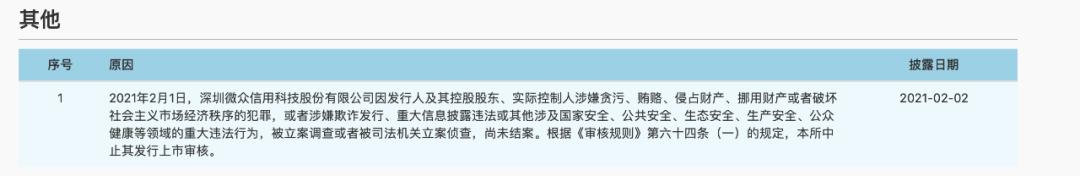

[Thecontrollingshareholderwassuspectedofillegalcreditinvestigationandthefirstsharewas”blackswan”!WeChatKebroDreamScienceInnovationBoard?】OntheeveningofFebruary2theShanghaiStockExchangedisclosedthatShenzhenWeizhongCreditTechnologyCoLtdwassuspectedofcorruptionbriberypropertyembezzlementmisappropriationofpropertyordisruptingtheorderofthesocialistmarketeconomyduetotheissueranditscontrollingshareholderandactualcontrollerorSuspectedoffraudulentissuancemajorinformationdisclosureviolationsorothermajorviolationsinvolvingnationalsecuritypublicsafetyecologicalsafetyproductionsafetypublichealthetchavebeenfiledforinvestigationorbyjudicialorgansforinvestigationandthecasehasnotyetbeenclosedInaccordancewiththerelevantprovisionsoftheAuditRulestheShanghaiStockExchangesuspendsitsissuanceandlistingreview

WeChat, which aims to sprint the first share of domestic credit information technology, has encountered a major setback on its way to go public.

On the evening of February 2, the Shanghai Stock Exchange disclosed that Shenzhen WeizhongcreditTechnology Co., Ltd. due to issuer and its holdingshareholder, The actual controller is suspected of corruption, bribery, embezzlement of property, misappropriation of property, or crimes of disrupting the order of the socialist market economy, or suspected of fraudulent issuance, major information disclosure violations, or other matters involving national security, public safety, ecological safety, production safety, and public health Major violations in other fields have been filed for investigation or by judicial organs for investigation, and the case has not yet been closed. In accordance with the relevant provisions of the Audit Rules, the Shanghai Stock Exchange suspends its issuance and listing review.

Aim to sprint the first stock of domestic credit information technology

Weizhongxinke has not yet been listed, and the claim that the first share of domestic credit information technology is circulating in the market.

The prospectus shows that Weizhongxinke, as a credit technology service provider, mainly provides credit information technology, risk decision-making, credit technology integration, etc.productand service.The company is mainlybankProvided by industry financial institutionsCreditUnder the sceneenterpriseCredit report, credit risk decision-making system, credit integration solutions and other credit technology products and services, helpbankCreate pure credit, online, automated, batch, and intelligent credit products for small, medium and micro enterprises.At the same time, WeChat Branch is stillbankClient provides businessTrading floorUnder the sceneEnterprise CertificationCredit technology products such as products and transaction verification products.

In terms of business scope, the main partners of Weizhongxinke are banks. Weixinke disclosed that as of the end of the first half of 2020, the company’s main partners include 6 major state-owned banks, 9 joint-stock commercial banks, 12 private banks and 32 city commercial banks. At the end of the first half of the year, the company generated 15,721,300 credit reports for 5,696,500 small, medium and micro enterprises.

According to the Weixinke prospectus, from 2017 to 2019, the company’sOperating incomeThey were 32,231,200 yuan, 69,353,400 yuan, and 154 million yuan, respectively, with a year-on-year growth rate of 115.17% and 122.40% respectively, maintaining a relatively rapid growth rate;Net profitThey were 6.7426 million yuan, -791.6 million yuan, and 51,341,400 yuan respectively.

However, the prospectus shows that Weizhongxinke’s main business and policy changes are highly related. Tax-related data is an important basis for the company’s credit evaluation of small, medium and micro enterprises.WeChat Branch used to be the “Silver Taxinteractive“Participants and operation and maintenance parties of the “platform” directly provide banks with credit evaluation services based on tax-related data through the “Bank-Tax Interactive” platform.

In 2019, the State Administration of Taxation issued the “Notice on Deepening and Standardizing the “Interaction between Banks and Taxes””, which the industry calls “Circular 113”.

The promulgation of “Circular 113” requires the direct connection of bank and tax data. WeChat will no longer provide customers with credit information technology services through the “Bank and Tax Interactive” platform. The company loses the convenience of providing services based on the “Bank and Tax Interactive” platform Advantages of sex and tax-related data collection. In the long run, “Circular 113” and other “Bank-Tax Interaction” related policies may pose greater risks to WeChat’s business model, market competition pattern and customer continuity.

In terms of business model, “Circular 113” requires direct tax data connection and desensitive push of tax data. The original non-direct connection mode of corporate tax-related information transmission is gradually transformed into a direct connection mode. There is a risk that the bank cannot collect tax data or even obtain tax data, or the company cannot adapt to changes in customer demand brought about by the change in data transmission mode.

At the same time, “Circular 113” does not specify the specific scope and standards of data desensitization. Due to the implementation of “Circular 113” data desensitization requirements by bank customers, the quality of the credit evaluation service provided by the company cannot meet the customer’s business. Requirements, and even affect the normal business development.

From the perspective of market competition, Weixinke has lost the advantage of providing services directly to banks through the “Bank-Tax Interactive” platform under the direct connection mode. Weixinke continues to face credit bureaus, financial technology companies, and large companies. Competition between data technology companies and other technology companies. At the same time, as competition in the industry intensifies, the business model and core technology of WeChat Branch may be imitated, chased, or even replaced by competitors, which may lead to a decrease in the company’s business needs and a decline in customer stickiness.

Weizhongxinke stated in the prospectus that if the above situation occurs or the continuous development and change of the “bank-tax interaction” policy causes changes in the company’s business environment, it may have an adverse impact on the company’s business operations, financial conditions and operating results. Thus affecting the company’s ability to continue operations.

However, before the suspension of the review, although the supervision paid attention to the major changes in the business environment of Weizhongxinke, it did not hinder its listing. On December 7, 2020, WeChat Branch went smoothlyScience and Technology Innovation BoardOne moment. Regrettably, Weizhongxinke’s listing review finally pressed the “pause button” before submitting for registration.

Many celebrity shareholders buy shares

Weizhong Technology has already made a statement in the financial market.The company has gone through 5 rounds of financing since its establishment. Investors include well-known institutions such as IDG Capital and Bosera Capital, Tencent, Ali, etc.the InternetGiants also haunt the company’s shareholder register. The prospectus shows that Weizhongxinke’s latest valuation has reached 2.5 billion yuan.

Bosera Capital entered in July 2017. In order to introduce external investors, Zhongrun Sifang and Gongqingcheng Guojun, controlled by the actual controller, provided external investors Hengqin Guoren, Hairun No. 5, Bosera Part of the capital contribution was transferred on the 1st.

In April 2018, WeChat Branch conductedEquity transferIn addition to the first capital increase, Wejinke invested 4.5 million yuan to become one of the company’s shareholders. Wejinke’s full name is Weizhong Financial Technology Group Co., Ltd., and Tencent Chairman Ma Huateng is suspected to be the actual controller of Wejinke. However, only one year later, Wejinke transferred all of the equity it held in Wezhongxinke.

In August 2018, Weixinke introduced Yunxin Venture Capital as a strategic investor.priceAcquired a 26% stake in Weizhongxinke and became the company’s second largest shareholder. Yunxin Venture Capital is a wholly-owned subsidiary of Alibaba’s Ant Company.In subsequent rounds of financing, WeChat Branch also introduced Haitong InnovationStock investmentLimited company and other shareholders.

The entry of capital such as the Ali department has brought not only funds to WeChat, but also development resources. The prospectus shows that Alibaba has always been the core customer of WeChat Branch.

Weixinke disclosed in the prospectus that the company has many related-party transactions, among which the related-party sales in the recurring related-party transactions are mainly related sales to Chongqing Wantang. In 2018, 2019 and the first quarter of 2020, the company sent Chongqing Wantang to Chongqing Wantang. The sales amount of 223,400 yuan, 31,815,500 yuan and 8,276,400 yuan, respectively, accounted for 0.32%, 20.63% and 27.26% of the company’s operating income.The proportion of connected transactions between Weizhongxinke and Chongqing Wantang remained at a relatively high level, and there is a possibility of further increase in the amount of connected transactions.PerformanceHave a certain impact.

Chongqing Wantang’s full name is Re-Wantanginformation TechnologyLimited company, which is exactlyAnt GroupA wholly-owned subsidiary.In addition, during the reporting period, Weizhongxinke made 8 related party fundsBorrow, The cumulative amount involved is 2.56 million yuan, the total amount of related leases is 903,800 yuan, and the total amount of costs and expenses paid by the related parties and Weizhongxinke is 2.039 million yuan.

After the suspension of the review, is there any chance for Weizhongxinke to be listed?

According to the relevant rules of the Science and Technology Innovation Board listing review, after the suspension of the review is eliminated, the Shanghai Stock Exchange will resume the review of the issuer’s issuance and listing after the review and confirmation.

After the review is resumed, the review time limit will continue to be calculated from the day when the review is resumed.However, the issuer adjusts its financial reporting period to one or moreGo to meetingIn the calculation year, the review time limit shall be recalculated from the day when the review is resumed.

However, if there are major defects in the content of the application documents for issuance and listing, which will seriously affect the understanding of investors and the review of the Shanghai Stock Exchange, the issuer withdraws the application for issuance and listing orSponsorCircumstances such as withdrawal of sponsorship, the Shanghai Stock Exchange will terminate the issuance review.

(Article Source:BrokerageChina)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.