原标题:付款刚刚完成,上市突然被暂停! 但是投资者说“赚了”,怎么了?

概要

[Thelistinghasjustbeensuspended!Butinvestorssay”earned”whathappened?】ThepaymentwascompletedlastweekandRishengConvertibleBondsunexpectedlyannouncedthesuspensionoflistingbutinvestorsfeltthattheyhadmadeaprofitWhy?

The payment was completed last week, and Risheng Convertible Bonds unexpectedly announced the suspension of listing, but investors felt that they had made a profit. Why?

original,Oriental Risen“Sudden braking” is because the company deducts non-recurring gains and lossesNet profitExpectedLoss60 million-140 million yuan, which may cause the issuer to failConvertible bondIssuance and listing conditions.

Due to the expected large loss of non-net profit,Oriental RisenThe limit fell on February 1st, and the decline continued on the 2nd.This led to Risheng convertible bondsConversionThe value has fallen below 60 and the suspension of the listing has allowed investors to avoid losses.

I just paid but have to withdraw

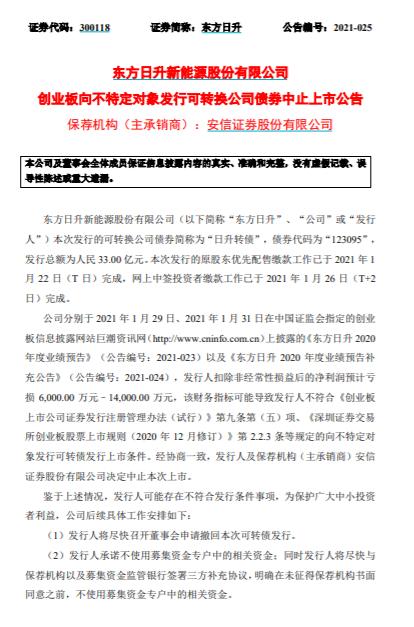

In the evening of February 1,Oriental RisenreleaseannouncementSaid that the listing of Risheng convertible bonds will be suspended. Risheng convertible bonds were issued on January 22, and payment was completed on January 26. The suspension of listing this time can be said to be a “sudden brake.”

The suspension of the listing was mainly due to the issuer’s expected large loss from non-net profits. On January 29 and January 31, Risen Orient successively disclosed thePerformance“Forecast” and “Supplementary Announcement of Oriental Risen’s 2020 Performance Forecast”, the company’s net profit after deducting non-recurring gains and losses (hereinafter referred to as “non-net profit”) is expected to lose 60 million to 140 million yuan.

Risen Energy stated that the financial indicators may cause the issuer to fail to comply with Article 9 (5) of the “Administrative Measures for the Registration and Management of Securities Issuance of Listed Companies on the Growth Enterprise Market (Trial)” and the “Regulations for the Listing of Stocks on the Growth Enterprise Market of Shenzhen Stock Exchange (2020). Revised in December)” Article 2.2.3 and other requirements for the issuance and listing of convertible bonds to unspecified targets. After consensus, the issuer and the sponsor (lead underwriter) Essence Securities Co., Ltd. decided to suspend the listing.

I’m in love with each other

From the issuance to the withdrawal of Risheng Convertible Bonds, investors who successfully subscribed for it can be said to have experienced a roller coaster journey.

The journey of an investor

Source: investor feed

Risen convertible bonds initial conversionpriceIt is 28.01 yuan. When issued on January 22, theshareholderFang Risheng’s latest closing price was 27.07 yuan, and the conversion value calculated on this basis was about 97 yuan. However, due to the attached conversion stock certificate, the price of the convertible bonds generally has a certain premium on the value of the converted shares, and some institutions have given an estimate of more than 120 yuan.

The scale of Risheng convertible bond issuance is 3.3 billion yuan, which can be counted as a “large-cap bond” in the convertible bond market. Due to the considerable income, investors are more active in purchasing, and the online winning rate is 0.013%.

On January 26, Risheng Convertible Bonds completed the online signing of investor payment.At that time, the announcement of large losses expected to deduct non-net profits had not been disclosed, and Risen Energy’s share price was relatively stable. Investors were waiting for the listing.Hit new incomeDrop the bag for safety.

On the evening of January 29, Risen Energy announced that it will deduct non-net profits and expect a large loss. Investors who have successfully subscribed have had a difficult weekend. On February 1, Oriental Risen really fell to the limit and closed at 19.29 yuan. The conversion value calculated by Risheng Convertible Bond fell to 69 yuan. In this case, it is a high probability event that a major break of the market is listed, and some investors have already “floated in their minds.”

On the evening of February 1, Risen Energy announced that it would suspend the issuance of convertible bonds, and stated that it would be added based on the subscription funds paid by investorsbankInterest on deposits in the same period was returned to investors. Investors said: “Fortunately, the refund.”

Source: stock bar

It is worth noting that the share placement ratio of this time exceeded 70%. If listed at the current conversion value, shareholders participating in the placement may lose more than 1 billion yuan.

Performance fell sharply in the fourth quarter, net loss exceeded 400 million yuan

Risen Orient’s net profit attributable to its parent in 2020 is expected to be 160 million to 240 million yuan, a decrease of 75.35% to 83.57% from the same period last year.

source:Company Announcement

Regarding the reasons for the decline in performance, the company stated that the company’s output of photovoltaic cells andproductThe realized sales revenue increased, but due to the dual impact of the increase in the price of the main raw and auxiliary materials upstream of the module and the decrease in the sales price of the module, the gross sales of photovoltaic products during the reporting periodinterest rateCompared with the same period last year, there was a decrease.

“Especially in the fourth quarter, the average grossinterest rateCompared with the previous three quarters, it decreased by about 13-15%, and the impact on operating profit was about 450 million-540 million yuan. “The announcement said.

The company also stated that during the reporting periodRMBImpact on the appreciation of the US dollar, the company’s foreign currencycurrencyExchange losses arising from conversion of sexual items, the amount of exchange losses included in financial expenses is about 90 million to 120 million yuan. The same period last year was the exchange gain, amounting to 119 million yuan.

And compared with the same period last year, the impact of non-recurring gains and losses on the company’s net profit increased.The impact of non-recurring gains and losses on the company’s net profit in the current period is about 300 million yuan, mainly due to the company’sTransactional financial assetsThe amount of income from changes in the fair value of the previous year’s non-recurring gains and losses on the company’s net profit amounted to 150 million yuan.

Combining the three quarterly reports of Risheng Oriental, in the first three quarters of 2020, the company achieved revenue of 10.83 billion yuan, a year-on-year increase of 10.8%; attributable net profit was 648 million yuan, a year-on-year decrease of 17.3%. Based on this calculation, in the fourth quarter of 2020, Risen Energy achieved revenue of 4.2 billion-6.2 billion yuan and a net loss of 410 million-490 million yuan.

Regarding the suspension of the convertible bond project, there are media reports that the relevant person in charge of the company has limited response and does not affect the progress of the non-raised investment part, but the progress of some projects involving fundraising cannot be ruled out slowing down.

Established in 1986, Risen Energy was listed on the Shenzhen Stock Exchange’s Growth Enterprise Market in September 2010. It is mainly engaged in the R&D, production and sales of photovoltaic cells and modules, and photovoltaic grid-connected power generation systems.As photovoltaicthemeStocks, Risen Orient’s share price has continued to rise for the past year.

source:Oriental wealth

The market value evaporated over 10 billion in 4 trading days

On the day of the suspension of the convertible bonds and the performance supplementary announcement, the letter of concern also followed. The company is required to list the unit sales price, sales volume, revenue, purchase unit price and cost ratio of main raw materials, gross profit margin, etc. of component products by quarter, and compare the market price changes of components and main raw materials, and the performance changes of comparable listed companies in the same industry during the same period Analyze the reasons and rationality of the sharp decline in performance in the fourth quarter.

The company is also required to supplement the type and amount of foreign currency held, and explain the specific circumstances of relevant exchange losses in combination with exchange rate changes, whether the company has established related risk prevention and control mechanisms and their effectiveness, and the types of transactional financial assets held by the company , The calculation process and basis of the amount and the fair value change income, and whether the relevant matters have performed the temporary information disclosure obligation in a timely manner.

At the same time, the company is required to explain the specific arrangements for the subsequent matters related to the suspension of the listing of the convertible bonds, the impact of the suspension of the listing on the company’s production and operation, financial status, etc. and the countermeasures to be taken, as well as self-examination of directors, supervisors, and senior executives, and shareholders above 5% In the case of buying and selling company stocks within one month before the announcement, whether there is any use of inside information for trading.

Affected by the decline in performance and the suspension of convertible bonds, on February 1, Risen Orient had a one-word down limit at the opening of the market. The down limit was not opened throughout the day, closing at 19.29 yuan per share, with a total market value of 17.4 billion yuan; February 2, as of noon closing , 15.56 yuan per share, a decrease of 19.34%, with a total market value of 14 billion yuan.

Compared with the closing price of 27.6 yuan per share on January 27, and the total market value of 24.868 billion yuan, the total market value has evaporated by nearly 10 billion yuan in just four trading days.

As of September 30, 2020, Risen Orient still has 51,000 shareholders and the top tenTradable shareholdersMedium, open call for participantsHSBC Jintrust FundPing AnfundAs well as private equity Gaoyi Assets products are listed.

Among them, the two funds of HSBC Jinxin Fund ranked second and eighth largest tradable stock holders of Risen Orient, and the two funds of Ping An Fund ranked fourth and seventh largest tradable shares of Risen Orient. Shareholder, Shanghai Gaoyi Asset Management Partnershipenterprise(Limited Partnership)-Gaoyi Linshan No. 1 Yuanwang Fund is the third largest shareholder of tradable shares of Risen Energy.

(Source: China Securities Journal)

(Editor in charge: DF064)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.