原标题:炸锅! 美国散户投资者在华尔街被包围和镇压,敢于“拔掉网线,删除代码,然后关闭服务器”!股价暴跌了八倍

概要

[Fryer!AmericanretailinvestorshavebeenencircledandsuppressedonWallStreetdareto”unplugthenetworkcabledeletethecodeandshutdowntheserver”!】ThestoryofWallStreet’sbloodbathbyretailinvestorsinUSstockswillcontinuetonightbutwhatIneverexpectedis!WallStreetunpluggedthenetworkcableandclearedthestockcode!AccordingtoreportsAmericanonlinebrokerageRobinhoodhasclosedthestocktradingofGameStation(GME)AMCCinemas(AMC)andNokia(NOK)AccordingtosomeusersontheRedditforumandTwitterthestocksofAMCGMEandNokiacannotbefoundonRobinhoodwhichmeanstheycannotbetraded(ChinaFundNews)

US stock retail investors bloodbathWall StreetThe story continues tonight, but what I never expected is!Wall Street unplugged the network cable and took the stockCodeCleared!

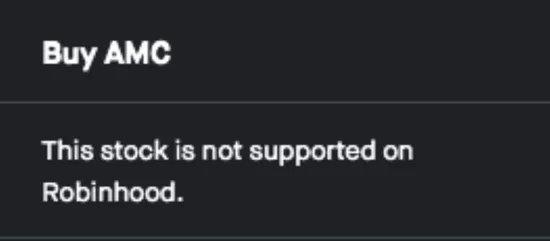

AMC and GME stocks are currently unavailable for trading on Robinhood

According to reports, AOLBrokerageRobinhood is closedGame station(GME) 、AMC Cinemas(AMC) andNokia(NOK) stock trading.

According to some users on Reddit forums and Twitter, AMC, GME and Robinhood cannot be found on Robinhood.NokiaThe stock is no longer available for trading.

Recently, stocks that have been shorted a lot, such as GME, AMC andNokiaWait, the stock price has soared. Among them, AMC rose by more than 300% on Wednesday, and GME also rose by 130%.

Analysts said this may be because retail traders tried to create a short squeeze in these stocks. These stocks have high short positions, so squeeze or force short covering positions, which quickly pushes up stock prices.

Driven by the madness of retail investors, multipleOnline trading platformThere was downtime, and Robinhood became the number one financial app on the iPhone. Currently, Robinhood is the most popular stock trading platform for US retail investors.

A-share netizens were shocked!

In addition, Futu Holdings said that due to upstream restrictions, GME and AMC stocks have been banned from opening positions (closed positions are not affected), and many domestic brokerages have also banned the opening transactions of some such stocks. Affected by such stocks, upstream trading channels are congested, and some orders have stalled. It is recommended to participate cautiously.

Interactive BrokersSaid that due to the consideration of abnormal market fluctuations, the option transactions of AMC, BB, EXPR, GME and KOSS will be liquidated.In addition, the stock longPositionNeed 100%GuaranteeGold, short stock positions require 300%Margin, Until further notice.Interactive BrokersIt is one of the world’s largest online brokerage firms, and its policies have indicator significance.

Game stationStock price volatility

Fuse is triggered multiple times

On the evening of the 28th, after the US stock market opened,Game stationThe stock price plunged by 24% at one time, and then rose rapidly. During the period, the circuit breaker was triggered many times, and the highest rose to 482.85 US dollars per share, an increase of nearly 40%, and then quickly dived, long and shortGameQuite intense. According to market news, Game Station once became the largest constituent stock of the Russell 2000 Index (market value).

As of press time, the game station has temporarily stopped for the 8th time in intraday trading, and the decline has expanded to 31%. It had risen by more than 35% before.

The same trend also occurs inAMC Cinemason. As of press time, AMC has plunged nearly 60%.

It soared over 300% in the last trading day. According to our understanding,AMC CinemasIs a movie screening under the Wanda Groupthe company, Is also the largest theater chain in the United States. Previously, various bad news in the context of the new crown epidemic caused AMC theaters’ share prices to be hit. The bankruptcy alert of AMC Cinemas was lifted this week. Driven by the enthusiasm of retail investors, the company’s stock price has risen sharply for three consecutive days.

CitiAnalystInvestors are warned that due to the recent surge in Game Station, someETFFacing distortions, the company’s greater influence has changed the composition of the ETF and may force the latter to make “temporary rebalancing and strategic adjustments”.The sharp volatility of the game station in the past month “has increased its visibility in various ETFs. Whether it is a long-term transaction or a hedge transaction, it highlights that these ETF users should be aware of the game station’spriceBehavior can have a huge impact on their positions. “Citigroup also warned to “pay special attention to ETFs with combined leverage.”

Retail base camp is end: Discord platform decided to remove Wallstreetbets server

In the afternoon of the 28th, it was reported that Discord announced on Wednesday that they had banned the r/WallStreetBets server because it had repeatedly violated the platform’s anti-hate speech policy.

A Discord spokesperson told the media: “Due to repeated occurrences of content that violates community guidelines, including hate speech, glorified violence, and dissemination of misinformation, the WallStreetBets server has been secured by us.teamConcerned for a while. In the past few months, we have issued multiple warnings to the service administrator. Today, we decided to remove the server and its owner from Discord because they continue to allow hateful and discriminatory content after receiving multiple warnings. “

Previously, the r/WallStreetBets community on Reddit has intensified the huge volatility of the stock market in the past few days by boosting the stock prices of GameStop, AMC Theaters and Nokia.

Although the r/WallStreetBets community was born on Reddit, its members have established a “server” on the group chat platform Discord, where members can discuss stock trading plans.

The managers of the Reddit community criticized Discord’s move. On Wednesday, they posted on Reddit: “Success also brought us torture. Our Discord server was the first victim. Everyone knows that if a place gathers 250,000 people, then someone here will say Something unbearable. But the room itself is good, and the people who run it are excellent people. Discord spilled dirty water on us. This is very unethical.”

But Discord said that their decision to remove the server has nothing to do with the trading activities discussed by the group. A Discord spokesperson said: “It should be noted that we did not ban this server for financial fraud related to GameStop or other stocks. Discord welcomes all kinds of individuals.Financial managementDiscussion, from investment clubs and daytimeTraders, To college students and professional financial advisors. We are monitoring this situation, and if there are allegations of illegal activities, we will cooperate with the authorities according to the specific circumstances. “

The trading activities carried out by the WallStreetBets community have, to a large extent, caused serious damage to traditional Wall Street institutions. GameStop short positions alone have suffered more than $5 billion in position losses.

The volatility of the stock market also made the White House say that it is “monitoring the situation.”

White House Press Secretary Jen Psaki said at a press conference: “Our team, economic team, including Treasury Secretary Janet Yellen and others, are monitoring this situation. This is a good reminder, but the stock market is not the only measure of economic health. It does not reflect the situation of middle-class and working-class families.”

U.S. stocks retail account representative perfect angers Wall Street

On the morning of the 28th,Bank of Communications InternationalReleased by Hong Hao, Managing Director and Head of Research DepartmentWeiboReposted, introduced the representative of U.S. stocks retail investors and social capital company CEO Chamath Palihapitiya, the host of CNBC, and gave a wonderful response to lead the U.S. retail investors to buy the game station (code GME). The following isWeiboRepost the full text:

Today’s climax comes from CNBC’s invitation to Chamath to launch a discussion on TV. (If you don’t know Chamath, you have to check it out on Wiki. This era is definitely no longer the era of Buffett, but belongs to people like Musk and Chamath. Whether you agree or not, a new generation of Young people think so).Because Chamath has many fans and he is stillTwitterShe took the lead in buying GME, so she was invited to TV as a retail representative. CNBC hopes to torture Chamath with morals, and to get rid of the arrogance of this group of rebels.

I think no matter how good the text is, it can’t describe the wonderfulness of the CNBC host on TV by Chamath. I hope that qualified readers will finish the 20-minute interview. Let me summarize it a little bit, but my summary is far from restoring the wonderful things.

1. The reason for the surge in GME’s stock price is that this stock was shorted by institutions by 140%. Why can it be 40% more? If it weren’t for Wall Street institutions to use tools that retail investors can’t use every day, how could they be caught by retail investors 40% more? perfect.

2. Many of the research levels on the forum are related to hedgingfundThe level of research is quite (I also agree with this), why can’t retail investors buy and sell based on these research?

3. Quantitative funds on Wall Street (indicating the Renaissance) do not look at the fundamentals for trading at all. Why can they not be blamed if they do not look at the fundamentals, and retail investors will be blamed if they do not look at the fundamentals? perfect.

4. FromTeslaLooking at the history of stock prices, all hedge funds are wrong and all retail investors are right. Why must hedge funds be better than retail investors? perfect.

5. Hedge funds are only open to large investors but not to retail investors. Now retail investors are not satisfied with making money. Why should they restrict retail investors? Still perfect.

I thought it was a moral torture of retail investors, but in the end it turned into a soul-quest of the establishment! wonderful.

Chamath also made it very clear that market neutral funds can get leverage of $10 billion from brokerage firms with a principal of $1 billion. These are advantages that retail investors do not have.Wall Street is relying on secrets, relying on a good dinner, relying on each other’s shoulders, comemonopolyInvestment market. The discussion on the forum is very transparent, these are things Wall Street should learn.

Looking back at the epic retail battle against Wall Street

It all starts with the game retailer Gamestop. Gamestop (game station), referred to as GME.

Many people in the United States grew up buying game discs at game stations. Before Christmas, the parents lined up and went home with games. It was very memorable and atmosphere. But now that the technology is advanced and everyone is connected to the Internet, fewer and fewer people will go to physical stores to buy physical games. In the past few years, most people have not been optimistic about game stations. The stock price dropped from 28 in 2016 to more than 3 yuan at the end of 19th. Last year, Game Station became the stock with the most short-selling stocks in US stocks. FactSet’s data shows that the net short position of the game station game station is 138% of the stock circulation.

And just as the game station was forced to go bankrupt and faced with delisting, netizens on the American forum reddit saw these short institutions with strong positions, and some people began to encourage everyone to buy the game station’s stocks and options.

WallStreetBets, this is a redditPartition, Similar to Chinese stocks, referred to as WSB in the market, many of the above-mentioned stocks that have skyrocketed recently have been seriously shorted, so they are also called “WSB concept stocks.”

On Tuesday, the company’s stock closed up 92.71% to $147.98.Closed on Wednesday, it rose 133.13% again, the mostNew crotchThe price is 344.99 US dollars. On January 12, its closing price was only $19.95, which was more than 16 times higher in just 10 trading days.

According to data from S3 Partners, as of Tuesday, the game station’s short positionsLossMore than 5 billion U.S. dollars (about 32.3 billionRMB), including losses of US$917 million and US$1.6 billion on Monday and Friday.

Gabe Plotkin, fund manager of the US tens of billions of hedge fund Melvin Capital, told CNBC on Wednesday that after experiencing huge losses, the company has cleared its short position in Game Station on Tuesday afternoon. Plotkin also clarified market rumors about the imminent liquidation of Melvin Capital, saying that the speculation that the company will file for bankruptcy is wrong. Melvin Capital’s specific loss in short-selling against game stations is currently unknown.

(Source: China Fund News)

(Editor in charge: DF380)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.