原标题:注意私募! 许多地方的证券监管局在一个月内发布了自检通知!

概要

[Privateplacementspayattention!Thesecuritiesregulatorybureausinmanyplacesissuednoticesforself-examinationwithinonemonth!】AftertheChinaSecuritiesRegulatoryCommissionissuedheavynewregulationsthesecuritiesregulatorybureausinShanghaiHebeiandotherplaceshaverecentlybeenvigorouslyissuednoticestoprivateequityintheirjurisdictionsrequiringprivateequityfundmanagerstolearnthe”RegulationsonStrengtheningtheSupervisionofPrivateEquityInvestmentFunds”Carryoutself-examinationandrectificationworkTheShanghaiarearequiressubmissionbeforeFebruary26andtheHebeiarearequiressubmissionbeforeFebruary28whichmeansthereisonemonthleft(ChinaFundNews)

After the China Securities Regulatory Commission issued heavy new regulations, the securities regulatory bureaus in Shanghai, Hebei and other places have recently been vigorously issuing notices to private placements in their jurisdictions, requiring private placementsfundManagers study the “Regulations on Strengthening the Supervision of Private Investment Funds”, and conduct self-examination and rectification work accordingly. The Shanghai area requires submission before February 26, and the Hebei area requires submission before February 28, which means there is one month left.

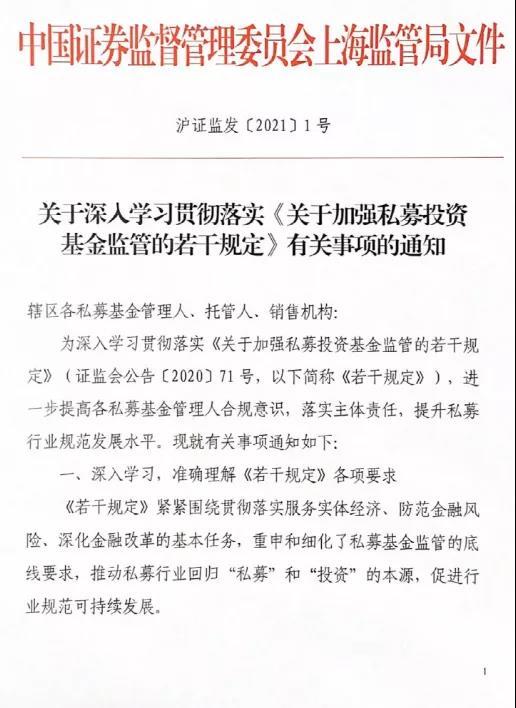

Shanghai Securities Regulatory Bureau notified private equity to conduct self-inspection and rectification in accordance with the new regulations

On January 25, the Shanghai Securities Regulatory Bureau issued the “Regarding in-depth study and implementation of the<关于加强私募投资基金监管的若干规定>“Notice on Relevant Matters” requires all private equity fund managers in the jurisdiction to earnestly do a good job of study, self-examination and related rectification.

This “Notice” is mainly to implement the new blockbuster regulations issued by the China Securities Regulatory Commission in early January-“Several Provisions on Strengthening the Supervision of Private Equity Investment Funds”, to further enhance the compliance awareness of various private equity fund managers and to enhance private equity Industry normsThe level of development。

The Shanghai Securities Regulatory Bureau requires all private equity companies to submit content including study and self-inspection rectification reports, self-inspection manuscripts, and the target is all private equity fund managers registered in Shanghai, and private equity funds that are to be newly established and moved in before February 28, 2021 The fund manager shall implement it by reference.The scale and number of private equity managers in Shanghai are the largest in the country. The fund manager looked at the latest data and registered private equity funds in Shanghai.Share4653.

Regarding time, the Shanghai Securities Regulatory Bureau stated that private equity managers, custodians, and sales organizations should report their learning, self-examination and rectification in writing before February 26, 2021, which means there is still one month left.

Let’s take a look at several requirements of the Shanghai Securities Regulatory Bureau for this notice.

First, in-depth study and accurate understanding of the requirements of the “Several Provisions”.

The Shanghai Securities Regulatory Bureau stated that the “Several Regulations” reiterated and refined the bottom line requirements of private equity fund supervision, promoted the return of the private equity industry to the origin of “private equity” and “investment”, and promoted the sustainable development of the industry.

The Shanghai Securities Regulatory Bureau requires that the first is to organize extensivelyPractitionersandRelated partyStudy the “Several Provisions”, private equity actual controllers, investors,ExecutiveswithKey positionPeople should take the initiative and take the lead in learning. The second is to fully understand the relevant system requirements of investors, increase publicity and education for investors, and actively popularize the various regulatory requirements of the “Several Provisions” to investors through online and offline methods such as official website and official WeChat account. The third is to combine the actual business development of the organization, use communication, discussion, case study and other methods to enrich the learning form, and solidify the learning effect through work practice.

Second, compare the self-examination to comprehensively sort out the compliance status of private equity institutions.

The Shanghai Securities Regulatory Bureau requires all private equity fund managers, custodians and sales institutions to compare the “Stock investmentFund Law, “Interim Measures for the Supervision and Administration of Private Investment Funds”, “Interim Provisions on the Operation and Management of Private Asset Management Business of Securities and Futures Institutions”, “Administrative Measures for the Suitability of Securities Futures Investors”, “Provisions on Strengthening the Supervision of Private Investment Funds” ”And other relevant laws and regulations of private equity funds, comprehensively carry out self-examination and sort out its own compliance status.

This self-inspection includes but is not limited to registration and filing, investor suitability, fundraising, risk control, compliance management, interestconflictPrevention, post-investment management and tracking, information disclosure,Related transactionAnd other aspects. On this basis, it is necessary to highlight the key points of the self-examination and compare the specific requirements of the “Several Provisions” one by one to ensure that everything is comprehensive and no self-examination dead ends.

Third, implement rectification and firmly keep to the bottom line of operation in compliance with laws and regulations.

The Shanghai Securities Regulatory Bureau emphasizes that all private equity fund managers, custodians, and sales institutions must earnestly perform their main responsibilities in accordance with the requirements of the “Certain Regulations”, firmly adhere to the bottom line of risks, strengthen the awareness of compliance, and analyze the causes and reflections of the problems found in the self-examination Countermeasures and perfect systems.

Among them, if a rectification time limit is set for violations, a rectification plan shall be formulated, rectification measures, deadlines and responsible personnel shall be clarified, and the rectification shall be completed in a timely manner; for violations that have broken the bottom line requirements, avoid fluke mentality and initiate self-examination and self-correction as soon as possible , Formulate detailed rectification plans and risk plans to effectively protect the legitimate rights and interests of investors;productIf it violates relevant investment regulations and cannot increase the scale, it is necessary to clarify the follow-up return plan and emergency response plan of the product.

Mr. Fund took a look. The contents of the self-examination manuscript of the “Regulations on Strengthening the Supervision of Private Investment Funds” include (1) qualified investors, (2) group operations, (3) fundraising, (4) Business restrictions, (5) compliance management, (6) related party transactions, (7) information disclosure.

First, whether qualified investors, such as by splitting and transferring private equity fund shares or their income (receiving) rights, or establishing multiple private equity funds for a single financing project, break through the qualified investor standards or investment in a disguised form The number of participants is limited.

Second, group operations, such as the same unit, individual holding or actual control of two or more private equity fund managers, is it reasonable and necessary to establish multiple private equity fund managers, and disclose each private equity fund fully, timely and accurately The division of labor for fund managers has established a sound compliance risk control system.

Third, fundraising, such as whether to raise funds from units or individuals other than qualified investors as stipulated in the “Private Equity Measures” or provide investors with multi-person pooling and fundingborrowLoans and other conveniences that meet the requirements of qualified investors; whether to entrust the layoutFund salesBusiness-qualified units or individuals are engaged in fund-raising activities; whether they are established for the purpose of engaging in fund-raising activities or in disguised formBranch。

Fourth, business restrictions, such as whether to directly or indirectly engage in private loans, guarantees,Factoring, Pawn, financial leasing, online loan information intermediary,Crowdfunding, Over-the-counter capital allocation and any other business that conflicts with or has nothing to do with the management of private equity funds (China Securities Regulatory CommissionUnless otherwise specified); private equity funds for the purpose of equity investment, in accordance withcontractAgreed to be votedenterpriseIf a loan is provided within one year, whether the due date of the loan or guarantee is later than the exit date of the equity investment, and whether the balance of the loan or guarantee exceeds 20% of the actual paid amount of the private equity fund.

Fifth, compliance management, such as whether to carry out or participate in fund pool business with rolling issuance, collective operation, maturity mismatch, separate pricing, etc.; whether to arbitrage private equity fund assets for direct or indirect investment For private equity fund managers, holdingsshareholder, Self-integration behaviors such as the actual controller and the enterprise or project actually controlled.

Sixth, related transactions, such as whether to engage in investment activities such as related transactions that damage the property of private equity funds or the interests of investors. Whether to establish a sound related party transaction management system, and regulate related party transaction pricing methods and transaction approval procedures.

Seventh, information disclosure, such as the registration information submitted andother informationWhether there are false records, misleading statements or major omissions in the materials, whether the information disclosure and reporting obligations are continuously fulfilled in accordance with regulations, and whether the submitted information materials are timely, accurate, truthful and complete.

The Hebei Securities Regulatory Bureau also issued a private equity self-examination notice

On January 15, the Hebei Securities Regulatory Bureau also issued the< span=“”>In the Notice on Strengthening the Supervision of Private Equity Investment Funds, private equity fund managers in the jurisdiction are required to actively conduct a comprehensive self-examination in accordance with the “ten must not” prohibitive requirements of the “Certain Provisions” and fill in the “Self-Inspection Form” to form a self-examination Report, and formulate a practical and feasible rectification plan, clarify the timetable, road map, and responsible persons, and do a good job of rectifying problems without compromise.

Regarding the time of self-examination, submit the “Self-inspection Form” and “Self-inspection Report” to the Securities Regulatory Bureau before February 28, 2021.

Mr. Fund took a look, and the self-examination report for this study looked like this.

Then there is the “Regulations” “Ten Must” self-inspection form, which contains 10 parts, including private equity fund business, equity structure, fundraising links, qualified investors, investment links, management links, registration and filing. For details, you can check the self-check sheet.

(Source: China Fund News)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.