原标题:7天6板! “黑马”还是“恶魔猫”? 净利润猛增12倍,股价飞涨! 还能部署哪些“性能牛”? 21股涨幅超过10倍

概要

[6boardsin7days!”DarkHorse”or”DemonCat”?Netprofitsoared12timeswhatother”performancecattle”canbedeployed?】Theexplosiveperformancehasbecomeaboosterforthecompany’sstockpriceOnJanuary202021thecompanyissuedaperformanceforecastThenetprofitattributabletoshareholdersofthelistedcompanyin2020afterdeductingnon-recurringgainsandlossesis245millionto275millionyuanwhichisexpectedtoincreaseby224millionto245millionyuancomparedwiththesameperiodofthepreviousyear254millionyuananincreaseof1067%to1210%year-on-year(BrokerChina)

Open on January 25,Shaanxi Black CatThe straight-line closing daily limit was reported at 7.01 yuan, an increase of 10.05%. As of January 25,Shaanxi Black CatHas scored 6 boards in 7 days.

explosivePerformanceBecome a booster for the company’s stock price. On January 20, 2021, the company released a performance forecast, which will belong to a listed company in 2020shareholderDeduction of non-recurring gains and lossesNet profitFrom 245 million yuan to 275 million yuan, compared with the same period last year, it is expected to increase by 224 million yuan to 254 million yuan, an increase of 1067% to 1210% year-on-year.

As of January 25, among A-share listed companies that have issued performance forecasts and express reports, 354 companies have achieved a performance growth rate of more than 100%, of which 21 companies have a performance growth ceiling of more than 10 times. Market analysis pointed out that from 2017 to 2020 from New Year’s Day to the Spring Festival, the concept of pre-increment outperformed all A, and the midfield was restless in the spring, focusing on the direction of performance pre-increase in the cost-effective industry.

Performance boosts stock price flying

January 20,Shaanxi Black CatThe 2020 performance forecast is released. The estimated net profit for 2020 is about 250 million to 280 million yuan, an increase of 823.0% to 933.0% year-on-year. The net profit attributable to shareholders of listed companies in 2020 after deducting non-recurring gains and losses will be 245 million to 2.75 Compared with the same period last year, it is expected to increase from 224 million to 254 million yuan, an increase of 1067% to 1,210% year-on-year.

Company explanation, 2020 company ownerproductCoke woolinterest rateAn increase of about 5 percentage points year-on-year, net profit increased.

Since 2019MarketpriceDue to the reasons for the suspension of production and maintenance of the methanol branch and the non-formal production of subsidiaries Xinfeng Technology, Heimao Chemical, and Heimao Energy, the net profit in 2019 was low, only 27.096 million yuan. Therefore, the company’s net profit in 2020 will increase significantly year-on-year .

In addition, 2020Company investmentRevenue increased significantly by approximately 90 million yuan year-on-year.

It is worth noting that before the disclosure of the performance forecast, the company’s stock price has risen rapidly. In the 4 trading days from January 15 to January 20, the company’s stock price continued to rise by the limit.

On the evening of January 20, the company disclosed its performance forecast. On January 21, the company’s stock price reached the one-character board daily limit. On the 22nd, the company’s stock price rose and fell, rising by more than 6% that day, and the intraday amplitude reached 10%. On the 25th, the company’s stock price once again hit the upper limit.

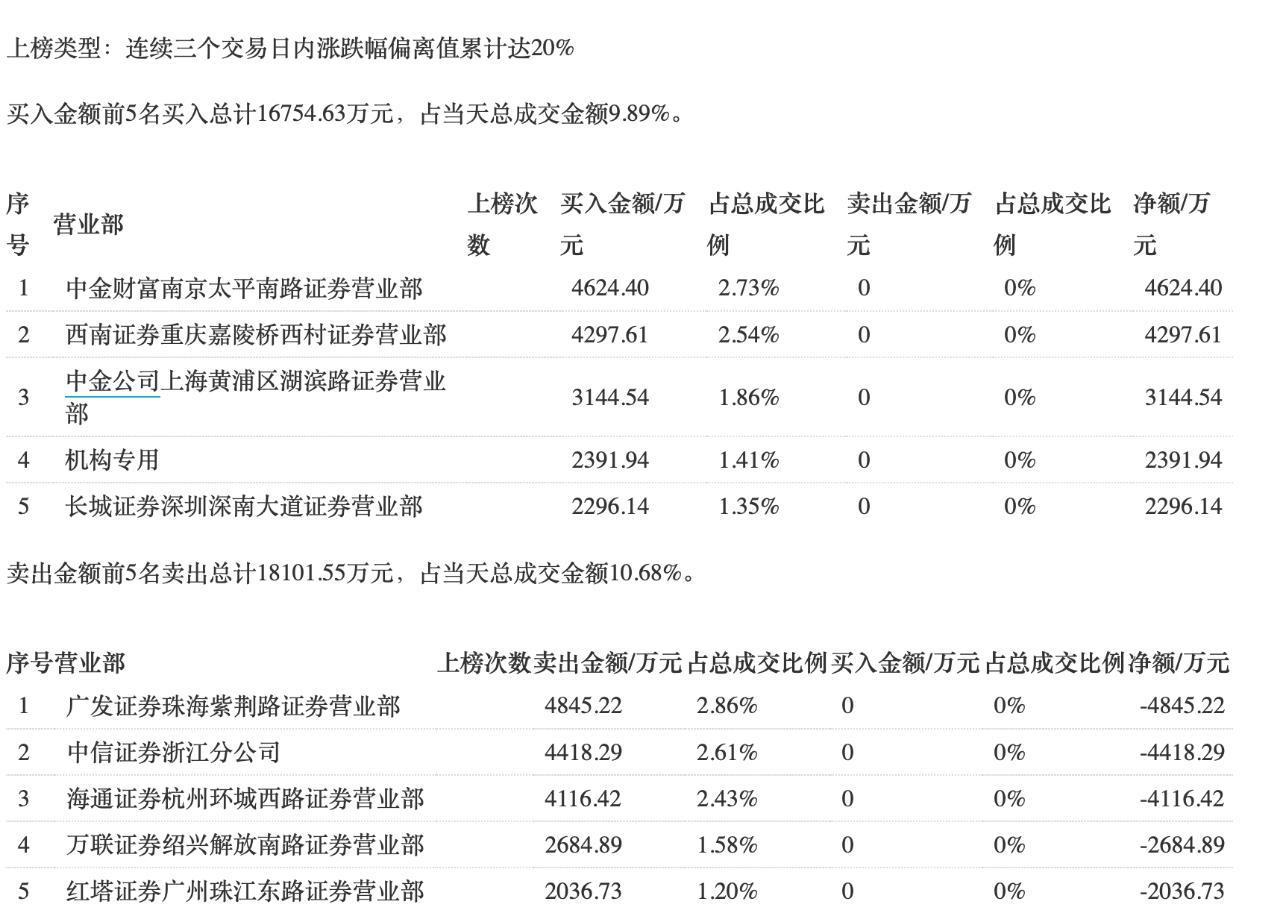

Shaanxi black catLonghubangThere is no shortage of hot money on the board. Data show that in the three trading days before January 22, the famous hot money seat CICC Fortune Nanjing Taiping Road Securities Business Department bought a total of 46.244 million yuan. In addition,Southwest SecuritiesChongqing Jialing West Bridge Sales Department also bought more than 40 million yuan. In addition, Wanlian Securities Shaoxing South Jiefang Road Sales Department and other seats were also seen on the Dragon Tiger List.

Some institutions are still optimistic about the follow-up performance flexibility of Shaanxi Black Cat.Essence Securities January 21stResearch reportIt is pointed out that the company is expected to fully benefit from the improvement of the coke industry’s prosperity.The dilemma of low concentration and substantial overcapacity in the coke industry has been gradually resolved with the help of the industry’s capacity reduction.Capacity utilizationIt has been upgraded to a higher level, and capacity reduction is still ongoing.In the context of high actual capacity utilization, cokesupplyThe price increase brought about by the contraction is more elastic, and the price of coke is expected to rise.

With the continuous implementation of capacity reduction in the coke industry, the industry’s supply and demand pattern will change from a previous surplus to a net shortage. It is expected that after 2021,industryWith the increase in concentration, the two major problems that plague the industry are expected to be fully resolved, the industry’s prosperity is restored, and sustained profitability is expected.

According to Jiao Lian Information, the 14th round of price increases for coke started this week, with a cumulative increase of 900 yuan/ton.Low inventory on the demand side, demand resumes after the Spring Festival, and new construction on the supply sideCapacity releaseAgainst the background of the shortage, it is expected that coke prices will still have room to rise after the Spring Festival, which is expected to bring greater performance flexibility to the company.

354 companies doubled their performance, 21 companies increased by more than 10 times

Now is the period of intensive disclosure of performance forecasts. The performance of some listed companies is also quite gratifying. As of January 25, among the listed companies that have issued performance forecasts and performance bulletins, 354 companies have predicted that the 2020 performance growth ceiling will exceed 100%. Among them, the performance growth ceiling of 21 companies exceeded 10 times.

Shengxiang BioWith a performance growth of more than 70 times, it currently ranks first on the list. The company expects that the net profit attributable to the owners of the parent company in 2020 will increase by 251.78 million yuan to 276.678 million yuan compared with the same period last year (statutory disclosure data), an increase of 6375% to 7008% year-on-year.

The company is one of the stocks benefiting from the epidemic.In the performance forecast, the company stated that during the reporting period, the company actively responded to the global fight against the new crown epidemic, developed corresponding epidemic prevention and control products in a relatively short period of time, and simultaneously equipped professional after-sales and technical support teams to provide customers in a timely and effective manner. Provide a full range of services to better meet the needs of the global market, and further the company’s new crown nucleic acid detection reagents, nucleic acid detection equipment, related consumables, etc.Product salesSignificant growth. At the same time, the company’s instrument sales and installed capacity growth further drove the company’s incremental sales of all reagents. In 2020, the company will ship 6,122 instruments in total. Therefore, the foregoing situation has had a positive impact on the company’s 2020 annual performance.

Another big bull stock that has benefited from the epidemic isIntech Medical.. January 24,Intech MedicalThe 2020 annual performance forecast is released. The company expects to achieve net profit attributable to shareholders of listed companies from 6.8 billion to 7.3 billion yuan, a year-on-year increase of 3713.45% to 3993.85%.

Regarding the reasons for the changes in performance, the company said that during the reporting period, due to the impact of the new crown epidemic, the global demand for disposable protective gloves has surged, and the company’s disposable protective gloves have seen a significant increase in the price of products, which has caused sales revenue and grossinterest rateBoth are greatly improved.

Since last year,Intech MedicalThe stock price continues to rise. For the full year of 2020, the company’s share price rose 913%. Since 2021, the company’s stock price has risen by 72%, and the company’s market value has exceeded 100 billion.

In addition, among the stocks whose performance is expected to increase by more than 10 times year-on-year, there are alsoDaan Gene、Oriental Bio、Zhijiang Bio、Zhende MedicalAnd other biomedical stocks.

In addition to the epidemic benefit stocks, resource stocks are anotherMain force. Among the stocks whose performance is expected to increase more than 10 times year-on-year,Godsend materials、Hanrui CobaltThey are all well-known big bull stocks.

Everbright SecuritiesA research report on January 24 pointed out that looking forward to the market outlook, A shares will usher in the intensive disclosure period of annual report performance forecasts. Investors can actively pay attention to the industry profit trend reflected in the annual report performance forecast, and those profits continue to improve or continue to be profitable. Industries that maintain high growth are expected to continue to be favored by funds in the future.

In terms of configuration, it is recommended to grasp the following three main lines of investment:

1. The recovery of the global economy and loose liquidity have pushed up the prices of resource products. It is recommended to pay attentionNon-ferrous metals, Petroleum and Petrochemical;

2. Domestic consumption continues to pick up, and they are optimistic about cars driven by their own electrification cycle and home appliances that benefit from overseas exports;

3. Pay attention to the investment opportunities in the 2020 annual report performance forecast, such as TMT with high short-term performance growth, and new energy and military sectors with high long-term performance.

“A-share funds have moved from the early stage of the group’s food and beverage/electrical Xinzhong to the direction of cost-effectiveness and performance catalytic resonance. The social financial inflection point is further confirmed, and the M1 growth inflection point is to be confirmed, butcreditThere are still 6-12 months after the cycle highcurrencyIt is sinking, and the enthusiasm for residential capital moving and foreign investment is not low, the micro liquidity is significantly better than the macro, and the stock market is not short of “water.” The industry may show that “water” flows towards the cost-effectiveness. The concept of pre-increasing from New Year’s Day to the Spring Festival from 2017 to 2020 outperforms all A, focusing on the direction of performance pre-increasing in the cost-effective industry. “Huatai SecuritiesStrategyAnalystZhang Xinyuan pointed out.

(Article Source:BrokerageChina)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.