原标题:什么操作? 这家上市农村商业银行的董事长刚刚“自掏腰包”以增加库存。 这与本条款有关吗?

概要

[Thechairmanofthislistedruralcommercialbankjustcameto”out-of-pocket”toincreasestockholdingsrelatedtothisclause?】OnJanuary24SunongBank(603323SH)announcedthatXuXiaojunthechairmanofthebankplanstousehisownfundstoincreasehisholdingsofthecompany’sAsharesbynolessthan2millionyuanthroughacentralizedbiddingtransactionBrokerageChinareportersnoticedthattherewasathree-yearstockpricestabilizationmechanismintheprospectuswhenSunongBankIPOAtpresentthebankhasbeenlistedforthreeyearsandasoftheendof2019therelevantarrangementshavepassedthecommitmentperiod(BrokerChina)

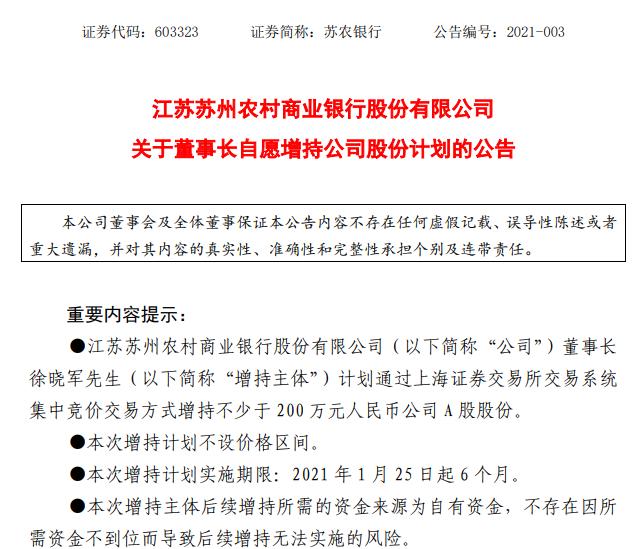

January 24,Sunong Bank(603323.SH)announcementSaid the bank’s chairman Xu Xiaojun plans to pass a centralized biddingmeans of transaction, With own funds to increase holdings of not less than 2 million yuanthe companyA shares.

BrokerageChinese reporters noticed,Sunong BankAt the time of the IPO, there was a three-year stock price stabilization mechanism in the prospectus. At present, the bank has been listed for three years, and as of the end of 2019, the relevant arrangements have passed the commitment period.

However, there is also the following paragraph in the bank’s prospectus: “The bank will require them to sign a letter of commitment before appointing new directors and senior managers in the future.GuaranteeIt fulfilled the commitments made by the directors and senior executives of the Bank to stabilize the stock price during the initial public offering and listing of the Bank, and required them to propose binding measures for unfulfilled commitments in accordance with the commitments made by the directors and senior executives of the Bank during the initial public offering and listing. “

Public information shows that Xu Xiaojun officially took office in September last yearSunong BankChairman.In this regard, close to SunongbankThe core person told the brokerage China reporter on the evening of January 24, “The relevant arrangements have passed the commitment period, so it has nothing to do with the terms. It is entirely a voluntary increase in personal holdings. It can be said that they understand the family status and see the future.”

The chairman plans to “pay out of his pocket” to increase his own holdingsbank

Sunonbank(603323.SH) announced today that Xu Xiaojun, chairman of the bank, plans to increase his holdings of the company’s A shares by no less than 2 million yuan through a centralized bidding transaction. The source of funds for the subsequent increase in holdings is its own funds. According to the announcement, “based on confidence in the company’s future development prospects and recognition of the company’s long-term investment value,” the increase in holdings decided to increase their holdings and voluntarily promised to lock up the above-mentioned holdings for three years from the date of purchase.

This time there is no increase planpriceThe period for the implementation of the share increase plan is 6 months from January 25, 2021. As of the close of January 22, Sunong Bank closed at 4.75 yuan per share. The reporter noted that as of the announcement, Xu Xiaojun, chairman of the bank, did not hold shares of Sunong Bank.

Sunong Bank had three years of relevant arrangements for the stock price stabilization mechanism during its IPO. However, so far, the bank has been listed for three years, but its prospectus contains the following paragraph: “Before appointing new directors and senior managers in the future, the bank will require them to sign a letter of undertaking to ensure that they will perform the first The directors and senior executives have made commitments to stabilize the stock price at the time of the public offering and listing, and they are required to put forward restraint measures for unfulfilled commitments in accordance with the commitments made by the directors and senior executives at the time of the Bank’s IPO.

At that time, the prospectus also stipulated that the bankshareholder,director,ExecutivesThe total amount of increased shares held in the stabilization mechanism shall be “not less than the after-tax salary and after-tax cash obtained from the Bank during the period from the beginning of the previous year to the date when the board of directors reviewed and approved the specific plan for stabilizing the stock price.Dividends15% of the total”.

Public information shows that Xu Xiaojun only became chairman of Sunong Bank in September last year. In September 2020, Sunong Bank successfully completed its reelection, and the sixth board of directorsmeetingAt the first meeting, Xu Xiaojun was elected as the new chairman and Zhuang Yingjie was appointed as the president.

However, a core person close to Sunong Bank told a brokerage China reporter on the evening of January 24, “The relevant arrangement has passed the commitment period, so it has nothing to do with the terms. It is entirely a voluntary increase in personal holdings. It can be said that they understand the family and see the future. period.”

The reporter noticed that in 2019, at leastBank of Zhengzhou、Yu Rural Commercial Bank、Jiangyin Bank, Sunong Bank,Hangzhou Bank、Bank of Wuxi、Shanghai Bank、Bank of Guiyang、Bank of Chengdu、Bank of Changsha、Bank of Nanjing、Zheshang Bank、Minsheng BankWaiting for 12 banks to disclose their shareholding increase plans and progress, but most of them started to increase their shareholdings due to the triggering of the stock price stability mechanism; among the entities participating in the increase of shareholdings, in addition to bank executives, most were local financial departments and state-ownedenterpriseWaiting for bank shareholders.

A new trend is that in the past two months, in the banking sector of Hong Kong stocks, such asZheshang Bank、Minsheng Bank、Postal Savings BankHong Kong stocks and others have all received institutional capital increase.The Hong Kong Stock Exchange revealed that on January 15, Li Lu, the founder of Himalaya Capital, increased his holdings.Postal Savings BankH shares, this is after his increase in holdings on December 19, 2020Postal Savings BankAfter the H-shares, it has increased its position again, so far Himalaya Capital has held a total ofPostal Savings Bank6.42% of the total share capital of H shares has aroused widespread market concern.

Listed bankPerformanceExpress News predicts positive revenue growth and differentiation is increasing

Affected by positive news such as the recovery of the performance of many banks, the banking sector has recently ushered in a warm winter in the secondary market.The China Securities Bank Index has risen by more than 7% this year. Several stock banks and top city commercial banks have all received individual stocks.Northward capitalContinuous inflow.

As of January 24, incomplete statistics, there are at least 3 joint-stock banks, 2 city commercial banks, and 4 rural commercial banks that have released 2020 performance reports, althoughOperating incomeThe growth rate has diverged, and the whole yearNet profitBoth achieved positive growth and continued to improve asset quality.

Specifically, the annualNet profitIndicators,China Merchants BankIt recorded 97.342 billion yuan, an increase of 4.82% year-on-year,Industrial BankWas 66.626 billion yuan, a year-on-year increase of 1.15%,Everbright BankIt was 37.824 billion yuan, a year-on-year increase of 1.26%;Shanghai Bank20.885 billion yuan, an increase of 2.89% year-on-year,Bank of JiangsuAchieved 15.06 billion yuan, a year-on-year increase of 3.06%;Bank of WuxiIt was 1.312 billion yuan, an increase of 4.96% year-on-year,Jiangyin BankAchieved 1.057 billion yuan, a year-on-year increase of 4.34%, and Sunong Bank’s 956 million yuan, a year-on-year increase of 4.71%.Zhangjiagang BranchAchieved a net profit of 1.01 billion yuan, a year-on-year increase of 4.93%.

In terms of operating income, the eight banks achieved positive year-on-year growth, but their growth rates were clearly differentiated.among themBank of Jiangsu、Industrial Bank、Bank of WuxiObtained double-digit year-on-year growth rates of 15.68%, 12.04% and 10.06% respectively.China Merchants Bank、Everbright Bank, Sunong Bank,Shanghai Bank、Zhangjiagang BranchIncreases were 7.71%, 7.32%, 4.85%, 1.90% and 8.43% respectively.

After the epidemic ushered in a turning point in performance, the asset quality of many banks continued to improve.Judging from the disclosure situation, the NPL ratios of the seven banks have all declined compared with the end of 2019.Industrial Bank、Everbright Bank, Bank of Wuxi dropped by more than 0.1 percentage point, down 0.29, 0.18, and 0.11 percentage points to 1.25%, 1.38%, and 1.10% respectively.Bank of JiangsuThe NPL rate at the end of 2020 is the best level since 2015,Jiangyin BankThe non-performing rate achieved four consecutive years of decline.

CICCinResearch reportPointed out that the current macroeconomic recovery trend is clear,CreditStrong demand, superimposedcreditConditions converge, loan pricing is expected to stabilize and rise, and it is expected that the financial statements of commercial banks in 2021 will be more real and healthy.

Zhongtai SecuritiesDai Zhifeng, director of the Institute and head of the financial group, believes that 70% of the on-balance sheet risksCreditIn terms of state-owned enterprises, infrastructure, and real estate; in terms of existing risks, the manufacturing, wholesale and retail industry loan risks have been systematically cleared from 2014 to 2017; the incremental risks of problems are controllable, retail credit has experienced the test of the epidemic, and the proportion of small and micro businesses ReachPledgeMainly. From the perspective of the fundamentals of the banking sector, the burden of the bank’s asset quality stock is digested, and the stability is better than expected.

(Source: Brokerage China)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.