原标题:措手不及! 在连续三个董事会下跌之后,这只A股突然发生了什么?

概要

[Caughtoffguard!WhathappenedtotheA-sharethatsuddenlydroppedafterthethirdconsecutiveboard?IntheearlytradingofJanuary22DadonghaiA(000613SZ)whichhadbeendailylimitforthreeconsecutivedayssuddenlyopened671%lowerandthenloweredthelimitfortenminutesAsofthenoonclosethestockwasreportedat443yuanpershareandthelatestmarketvaluewas135billionyuanSuddenlydroppedtoalimitafterthreeconsecutivegamesfromheaventohellSowhathappenedtothiscompany?(ChinaFundNews)

In the beginning of 2021, various “monster stocks” emerged one after another, and suddenly fell to the limit after another three consecutive shares.

In the morning of January 22, the daily limit had been three consecutive days beforeDadonghai A(000613.SZ) suddenly opened 6.71% lower, and then dropped to a limit for ten minutes. As of the noon closing, the stock was reported at 4.43 yuan per share, and the latest market value was 1.35 billion yuan.

Suddenly dropped to a limit after three consecutive games, from heaven to hell.Then thisthe companyWhat happened?

Last year’s revenue was less than 100 million

Sound the delisting alarm

In fact, the “fuse” that led to today’s opening limit was the two last nightannouncement。

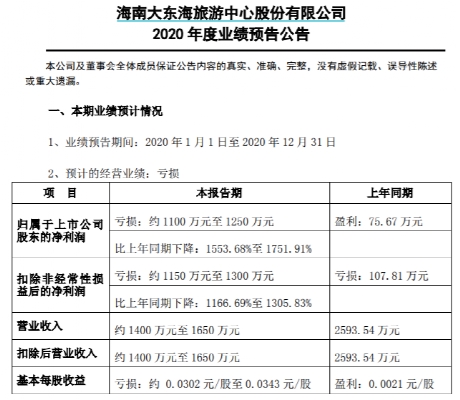

In the evening of January 21,Dadonghai AReleased the “2020PerformanceAdvance notice.The announcement showed that the company was deeply affected by the new coronavirus pneumonia epidemic and other reasons.Main business incomeCompared with the same period of the previous year, it decreased significantly.It is expected that the company will be from January 1, 2020 to December 31, 2020Operating incomeAbout 14 million to 16.5 million yuan,Net profitLoss11 million to 12.5 million yuan.

In 2019, which was not affected by any sudden “black swan” factors, the company’s annual operating income was only 25 million yuan, and the net profit was only 756,700 yuan.

As its financial data touched on the newly revised “Shenzhen Stock Exchange Stock Listing Rules” this year, the company also issued the “Risk Warning Announcement on the Possible Delisting Risk Warning of the Company’s Stocks” last night.

According to Article 14.3.1 of the New Exchange Delisting Regulations: “The latestaccountingAnnual auditedNet profitIs negative and operating income is less than 100 million yuan, or the latest one after retrospective restatementFiscal yearNet profit is negative and operating income is less than 100 million yuan”,Dadonghai AAfter the audited 2020 annual report is disclosed, the company’s stock will be subject to a “delisting risk warning.”

However, as long as the new delisting regulations were announced, Dadonghai Aborrow“The operating income and loss of 9.086 million yuan in the first three quarters of this year and net profit of 9.1085 million yuan” are included in the ranks of potential “hat people”.

Mediocre fundamentals

Three consecutive boards rely on “horse racing concept”

It is understood that the main business of Dadonghai A is hotel accommodation and catering services. The hotel is located in the central area of Dadonghaijing District, Sanya City, Hainan Province. Affected by the new crown pneumonia epidemic, the tourism and tourism service industries continued to suffer, and the company’s operations fell sharply.The company is currently addingbig hotelThe transformation and construction of infrastructure facilities, increase the expansion of the domestic tourist market, and strive to improve business competitiveness after the epidemic.

From a fundamental point of view, despite the company’s netprofitableIt was in a state of loss for the second time. The total amount lost more and earned less, but the operation was relatively stable, and there was no “roller coaster” performance that surged and plummeted.

In the secondary market, the current share price of Dadonghai A has fallen from a high of 18.76 yuan per share in 2015 to about 4 yuan. Although it is not as good as the historical location of less than 1 yuan in 2005, the stock price has fallen by more than 60% in the past five years.The latest data shows that as of the end of the third quarter of 2020, the companyshareholderThe number is 38,600, but there is nofund、Insurance, Land Stock Connect and other institutional investors hold shares.

So why the sudden and continuous skyrocketing is due to a big news three days ago.

In the afternoon of January 19,Hainan RuizeAn official micro-message from, detonated the long-silent horse racing section.

This Tuesday,Hainan RuizeA post on the official WeChat account stated that the China Speed Horse Racing Competition Rules Revision Seminar was held inHainan RuizegroupmeetingThe meeting was held at the conference, and the meeting fully discussed and revised the Chinese speed horse racing rules, and reached a preliminary consensus. After the rule revision is confirmed, it will be promulgated as soon as possible and will be implemented on a trial basis in 2021. At the same time, China Speed Horse Racing Technical Standards and China Speed Horse Racing Competition Rules will be promulgated at the same time.

Although Hainan Ruize withdrew the manuscript after the market, the information was reprinted by the media and immediately caused a market move. In the afternoon of that day, horse racing concept stocks rose sharply. As of the close of the day, Hainan Ruize and Dadonghai A had their daily limit,Luo Niu ShanSoared 6.35% to close at 9.04 yuan.

It is worth noting that as of now,Luo Niu ShanAnd its subordinatesWholly-owned subsidiaryHainan Ya’anju Property Service Co., Ltd. holds a total of 72,091,800 A shares of Dadonghai, accounting for 19.80% of the company’s total share capital, and is the company’s largest shareholder since 2010.But strangely, Hainan Ruize andLuo Niu ShanThe two horse racing concept stocks rose rapidly only on January 19 when market sentiment was ignited, and then returned to calm. Only Dadonghai A continued its strong daily limit in the next two trading days and won the third consecutive board.

Dadonghai A also responded to the continuous daily limit of the company’s stock in a timely manner. On the two nights of January 20 and 21, it continuously issued an announcement of abnormal stock trading fluctuations, saying that the company had conducted a self-examination and that the company’s current operating conditions are normal and internal and external The environment has not changed significantly.At the same time, after a written verification with the company’s largest shareholder Luo Niushan, Luo Niushan does not affect the company’s stock trading.priceThere is no significant information that should be disclosed but has not been disclosed for major events with abnormal fluctuations.

Hot money hype is too fierce

Small and medium retail investors are wary of following the trend and speculating

Sure enough, after the detonation of the “horse racing concept”, hot money arrived.

From January 18th to 20th, Dadonghai A has accumulated a 20% deviation from the value of fluctuations in three consecutive trading days.

After-hoursLonghubangLook,Caitong SecuritiesCo., Ltd. Hangzhou Qingchun Road Securities Sales Department, China International Capital Corporation ShanghaiBranch officeas well asZhongtai SecuritiesThe Shenzhen Branch of the Co., Ltd. also appeared in the seller’s buyer’s seat.

among themCaitong SecuritiesThe securities business department of Hangzhou Qingchun Road Co., Ltd. bought Dadonghai A for RMB 4.4138 million and sold RMB 3.133 million during the same period; China International Capital Corporation Shanghai Branch bought RMB 2.8370 million and sold RMB 3.2166 million. ;Zhongtai SecuritiesThe Shenzhen Branch of the Co., Ltd. bought 3,990,500 yuan and sold 2,179,400 yuan.

In addition, the institution is the largest “short position” of Dadonghai A, with the highest selling amount, with a total of 3.3414 million yuan sold from January 18th to 20th.

Recently, the hot money speculation in the market has intensified. There were 10 boards in 10 days.Yibin Paper, There are 4 boards in 4 days, and the stock price doubles directlyNew crotchRiyueming.In addition, the recent market speculation for oversold stocks has recently hit the 5 limit and 3 limit respectively.Good home、Oriental fashionThere are also “ghosts” with hot money behind them.

In this regard, some market participants said that small market capitalization stocks with poor performance can easily become hot money targets.

Take Dadonghai A as an example, fromcompany achievementsFrom a point of view, the company’s fundamentals are flat, and its net profit has suffered multiple losses in the past ten years. From the secondary market, the small market value of Dadonghai’s A market is small, and the market value after the recent three daily limits is only 1.8 billion yuan. The intraday stock price has reached its lowest point in the past 7 years, and it is not surprising that it has been targeted by hot money.

Market participants also reminded them to be wary of the “drumming and spreading flowers” of hot money. Started by the big hot money players to start the speculation, the big money raises the stock price, and attracts small and medium retail speculators who follow the trend. People always take a fluke and think that some people will be stupid. They will not be the last to follow, but the ultimate follower , They are mostly retail investors.

Just like at this moment, some investors refer to the stock price trend of Dadonghai A on January 20 and firmly believe that today the company may step out of the ground and stage a Jedi comeback.[Click to enter Dadonghai A]

(来源:《中国基金报》)

(负责人:DF358)

郑重声明:Oriental Fortune.com发布此信息的目的是传播更多信息,而与该立场无关。