原标题:大幅增加后,大股东突然决定减少持股量! 这个……

概要

[Afterthebigincreasethemajorshareholderssuddenlydecidedtoreducetheirholdings!】Bottomingoutandreboundingfor5consecutivedailylimitsXiangheIndustrialcanbecalleda”littledemonstock”inthenearfuture(ShanghaiSecuritiesNews)

Bottomed out and rebounded for 5 consecutive daily limits,Xianghe IndustryIt can be called the “little demon stock” in the near future, but the stock price has just broken through the previous platform.shareholderBut it directly throws out a large-scale reduction plan.

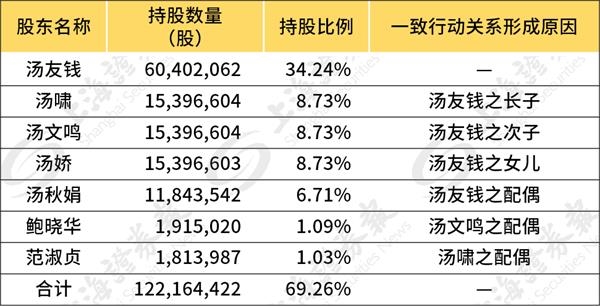

Xianghe IndustryReleased on the evening of January 20announcement,Controlling shareholderTang Youqian and its persons acting in concert Tang Xiao, Tang Wenming, Tang Jiao, Tang Qiujuan, Fan Shuzhen, and Bao Xiaohua plan to reduce their total holdings of no more than 10.584 million shares from February 18 to August 17, accounting forTotal equityOf 6%. Among them, the centralized bidding reduction does not exceed 2%.Large transactionsThe reduction will not exceed 4%.

Affected by this news,Xianghe IndustryIt fell sharply in early trading on January 21.

Coincidentally,Julong TechnologyAfter the recent surge, major shareholders also reduced their holdings with a high profile.

January 21,Julong TechnologyAccording to the announcement, Liu Jun passed the centralized bidding and bulk bidding from September 10, 2020 to January 20, 2021.means of transactionCumulative reductionthe companyThere are 9,624,465 shares, accounting for 2.29% of the company’s total share capital.

After the transaction, Liu Jun and his son Liu Xiang still hold approximately 134 million shares of the company, accounting for 33.19% of the company’s total share capital.

In addition, Liu Jun and Liu Xiang plan to reduce their holdings by no more than 25.2 million shares of the company, that is, no more than 6% of the company’s total share capital.

The stock price rose sharply, and the family reduced its holdings

Judging from Xianghe Industrial’s share reduction list, the Tang Youqian family is basically the one who plans to reduce holdings.

Xianghe Industrial NearFuturesThe price performance is quite interesting-after a four-month volatility, the stock price suddenly bottomed out and rebounded without a trace of hesitation. The price rose for 5 consecutive trading days.

In response, Xianghe Industrial stated that after the company’s self-examination and written consultations with the company’s controlling shareholders andActual controlAs of the date of this announcement, the company’s operations are normal and there are no major issues that should be disclosed but not disclosed.

Frequent good news in the past few months

In fact, in the four months when the stock price fluctuated downward, Xianghe Industrial frequently released positive news.

On September 29, 2020, Xianghe Industry announcedWholly-owned subsidiarySign daily operationscontract, The amount involved is 25,353,900 yuan.

On October 14, 2020, Xianghe Industry disclosed the status of the recently signed contracts, with a total amount of 53.247 million yuan.

On November 27, 2020, Xianghe Industry announcedUtility model patents。

In this process, Xianghe Industry continuesRepurchaseShares, as of December 31, 2020, the company has accumulatedRepurchaseThere are 3,388,500 shares, accounting for 1.92% of the company’s total share capital,Deallowestprice13.517 yuan/share, the highest transaction price 16.060 yuan/share, the total amount of funds paid isRMB50,012,200 yuan (excluding transaction costs).

It’s just that the continued positive hasn’t brought significantimprove, And even continued to fall. Until the company did not release a favorable announcement, the stock price suddenly exerted force and continued its daily limit.

Hot money appearedLonghubang

Who is leading the sharp trend of Xianghe Industry? The answer is simple, hot money.

Statistics show that Xianghe Industrial has frequently seen hot money on the Dragon and Tiger list recently. E.g,Guotai JunanThe business department of Securities Xianju Jiufangxiang bought 2,754,200 yuan from the 14th to the 15th, and sold 3,564,900 yuan from the 19th to the 20th.

It should be noted that this is not the first time that Xianghe Industrial has soared. Just in July 2020, the company’s share price doubled within a month, but it soon fell to the limit and returned to the starting point.

What’s interesting is that there were alsoGuotai JunanSecurities Xianju Jiufangxiang Business Department.

However, at that timeGuotai JunanSecurities Xianju Jiufangxiang Business Department is notMain force, But the famous Zhengzhou Gang.

Julong TechnologyAlso staged a similar scene

In addition to Xianghe Industrial, after the stock price of Julong Technology rose sharply, major shareholders also announced a reduction in their holdings.

On January 21, Julong issued an announcement stating that on January 21, 2021, the company received the “Notice Letter” issued by Liu Jun and Liu Xiang, shareholders holding more than 5% of the shares, informing them that the time for the previous share reduction plan has expired. Plans to reduce shares in the future. According to the announcement, Liu Jun is the father of Liu Xiang.

From September 10, 2020 to January 20, 2021, Liu Jun passed centralized bidding andLarge transactionsThe method accumulatively reduced the company’s holdings of 9.624465 shares, accounting for 2.29% of the company’s total share capital; Liu Xiang did not reduce the company’s shares. Liu Jun and Liu Xiang still hold about 134 million shares of the company in total, accounting for 33.19% of the company’s total share capital.

In addition, Liu Jun and Liu Xiang plan to reduce their holdings by no more than 25.2 million shares of the company, that is, no more than 6% of the company’s total share capital. Among them, the reduction of holdings through centralized bidding will be carried out within 6 months after 15 trading days from the date of the announcement of the reduction plan; the reduction of holdings through block transactions will be carried out from the date of the announcement of the reduction plan3 6 months after the trading day.

(Source: Shanghai Securities News)

(Editor in charge: DF515)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.